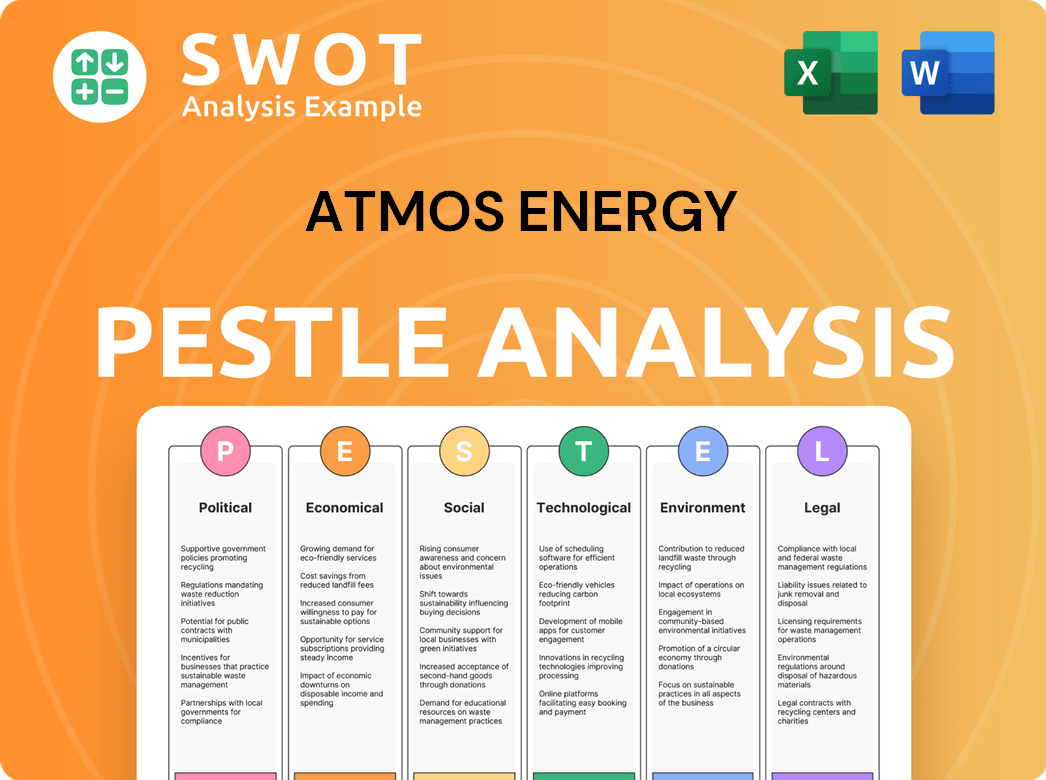

Atmos Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atmos Energy Bundle

What is included in the product

Uncovers how PESTLE factors affect Atmos Energy: Political, Economic, Social, Tech, Env, & Legal.

Helps pinpoint critical challenges by condensing the PESTLE findings into key action items.

Preview Before You Purchase

Atmos Energy PESTLE Analysis

The preview showcases the complete Atmos Energy PESTLE Analysis. The document's layout and content you see is the same upon purchase.

PESTLE Analysis Template

Our PESTLE analysis dives deep into Atmos Energy's external environment. We explore the political landscape, regulatory changes, and social trends impacting their operations. Examine economic factors, technological advancements, and legal frameworks shaping the company. Identify environmental considerations, including sustainability and climate change impacts. Equip yourself with crucial insights to anticipate challenges and seize opportunities. Download the complete analysis now for strategic foresight.

Political factors

Atmos Energy faces impacts from federal, state, and local regulations. Energy policies and environmental standards affect operations and pricing. In 2024, the U.S. government increased scrutiny on methane emissions. This impacts gas utilities like Atmos. Policy shifts towards renewables present both challenges and chances.

Atmos Energy's earnings are significantly influenced by rate cases and regulatory approvals. State utility commissions oversee the rates Atmos Energy charges customers. In 2024, Atmos Energy actively pursued rate adjustments across its service territories. For instance, in 2024, Atmos Energy's rate base grew by approximately $1.5 billion. The regulatory outcomes directly affect the company's financial performance.

Government backing for natural gas is crucial for Atmos Energy. Policies supporting pipelines and storage boost its prospects. However, the shift away from fossil fuels poses challenges. The U.S. Energy Information Administration projects natural gas consumption to remain significant through 2050. Political shifts could impact this.

Energy Security Policies

Energy security policies significantly impact the natural gas sector, influencing companies like Atmos Energy. Government efforts to ensure a reliable energy supply infrastructure directly support Atmos Energy's operations. These initiatives often involve investments in pipelines and storage. Such policies aim to stabilize energy prices and availability for consumers.

- In 2024, the U.S. natural gas production reached a record high of 104.3 billion cubic feet per day.

- The U.S. Energy Information Administration (EIA) forecasts continued growth in natural gas consumption through 2050.

- Government investments in natural gas infrastructure totaled $15 billion in 2023.

Local Government Relations

Atmos Energy's success hinges on strong local government ties. These relationships facilitate permit acquisition and compliance with local regulations. Effective communication helps in addressing community concerns about projects and operations. Positive relations can streamline project approvals and minimize delays. For instance, in 2024, Atmos Energy invested over $1.5 billion in system upgrades, requiring seamless local government cooperation.

- Permit Acquisition

- Ordinance Compliance

- Community Relations

- Project Approvals

Atmos Energy navigates complex political landscapes, influenced by regulations at every level. Government policies drive energy strategies, shaping infrastructure investments and emission standards. Strong government relations are crucial, streamlining project approvals and ensuring compliance with evolving standards.

| Aspect | Details | Impact |

|---|---|---|

| Regulatory Scrutiny | Increased focus on methane emissions | Higher compliance costs, operational adjustments |

| Rate Cases | State utility commissions set rates | Direct financial performance impact |

| Infrastructure Support | Government backing for pipelines and storage | Enhances company prospects |

Economic factors

Atmos Energy's supply costs are directly tied to natural gas prices, which have seen fluctuations. For instance, in 2024, natural gas spot prices at the Henry Hub experienced volatility, ranging from approximately $1.50 to $3.00 per MMBtu. These price swings can affect customer bills. Demand might be influenced by price changes.

Atmos Energy's capital expenditures are substantial, with a focus on upgrading infrastructure for safety and reliability. These investments are critical for growth, supported by regulatory cost recovery mechanisms. In 2024, Atmos planned $2.2 billion in capital spending. Accessing capital markets is crucial to fund these projects. Atmos Energy's investments are expected to drive long-term value.

Atmos Energy's financial performance is closely tied to the economic vitality of its service areas. Areas experiencing industrial expansion and population growth usually show increased demand for natural gas. For instance, in 2024, regions with significant development saw a rise in customer connections, boosting gas consumption and revenue. This is expected to continue in 2025.

Inflation and Interest Rates

Inflation can drive up Atmos Energy's operational costs, including materials and labor needed for infrastructure. Higher interest rates, influenced by inflation, will increase borrowing costs for capital projects. For instance, the U.S. inflation rate was 3.5% as of March 2024. These economic shifts could affect Atmos Energy's profitability and investment strategies. The Federal Reserve held its benchmark interest rate steady in May 2024, reflecting efforts to manage inflation.

- Inflation Rate (March 2024): 3.5%

- Federal Reserve Interest Rate (May 2024): Steady

Customer Affordability

Customer affordability is a crucial economic factor for Atmos Energy. Rising natural gas prices can strain customer budgets, affecting residential and commercial clients. Increased costs, driven by commodity prices or rate changes, may lead to payment difficulties and bad debt. For instance, in 2024, natural gas prices saw fluctuations impacting consumer bills across the U.S.

- Residential natural gas prices averaged $11.36 per thousand cubic feet in January 2024.

- Atmos Energy's rate adjustments directly influence customer bills, reflecting commodity costs.

- Customer payment challenges can affect Atmos Energy's revenue and financial stability.

Atmos Energy's costs fluctuate with natural gas prices; in 2024, prices swung between $1.50-$3.00/MMBtu impacting customer bills. Capital spending, like the planned $2.2 billion in 2024, relies on economic factors, especially interest rates affected by inflation (3.5% in March 2024). Customer affordability is crucial; rising gas prices strain budgets, with residential averages at $11.36 per thousand cubic feet in January 2024.

| Economic Factor | Impact | Data (2024) |

|---|---|---|

| Natural Gas Prices | Cost of Sales, Customer Bills | $1.50-$3.00/MMBtu spot price range |

| Capital Spending | Infrastructure Upgrades, Debt Costs | $2.2 Billion Planned |

| Inflation (March) | Operating, Borrowing Costs | 3.5% |

| Residential Gas Price (Jan) | Customer Affordability | $11.36/Mcf |

Sociological factors

Public perception of natural gas significantly influences Atmos Energy. Trust in utility companies is crucial; safety incidents erode this trust. Environmental concerns increase scrutiny; for example, in 2024, pipeline incidents led to public outcry. Negative perceptions can hinder expansion plans and affect stock value; in 2024, Atmos's stock experienced fluctuations tied to safety reports.

Atmos Energy actively engages in community support through charitable contributions and employee volunteer programs, strengthening its social standing. In 2024, Atmos Energy invested over $1.5 million in community programs. These efforts include initiatives like Project Share, which helps vulnerable customers. Such programs enhance the company's reputation and foster positive community relationships, reflecting a commitment to corporate social responsibility.

Atmos Energy relies on a skilled workforce and a robust safety culture. Labor availability, training programs, and employee well-being are vital. In 2024, Atmos invested $20 million in safety initiatives. Employee safety incidents decreased by 15% due to these efforts.

Demographic Trends in Service Areas

Demographic shifts significantly affect Atmos Energy. Population changes and household sizes directly influence natural gas demand. For example, the U.S. Census Bureau projects continued population growth in many Southern states where Atmos operates. Understanding these trends is crucial for strategic planning. This impacts service needs and infrastructure investments.

- U.S. population growth is projected to be concentrated in the South and West.

- Household size trends affect gas consumption patterns.

- Aging populations may lead to changes in energy usage.

- Immigration patterns also affect demand.

Customer Expectations for Service and Reliability

Societal norms heavily influence how customers perceive the reliability and quality of natural gas services. Atmos Energy must consistently meet these expectations to ensure customer satisfaction and loyalty. For instance, in 2024, the American Customer Satisfaction Index (ACSI) score for utilities, which includes gas, was around 77 out of 100, indicating a high standard. Any failures in service directly impact customer trust and brand reputation.

- ACSI score of 77 reflects high customer expectations.

- Reliability is crucial for maintaining positive customer relationships.

- Service failures can severely damage customer trust.

Public perception greatly affects Atmos Energy, with safety incidents potentially damaging trust. Community involvement through charitable efforts strengthens the company’s image; in 2024, over $1.5M invested. Customer satisfaction, reflected by high ACSI scores, demands reliable service. Demographic shifts impact demand.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Public Trust | Key to Operations | 2024 Stock Fluctuations Tied to Safety. |

| Community Relations | Enhances Reputation | $1.5M in Community Programs. |

| Customer Satisfaction | Maintain Loyalty | ACSI Score of 77. |

Technological factors

Atmos Energy heavily relies on technology for pipeline safety. This includes advanced inspection tools and leak detection systems. Modernization efforts boost efficiency. In 2024, Atmos invested heavily in these technologies. These investments reflect a commitment to safety.

Atmos Energy leverages data analytics and smart grid tech to enhance its natural gas network. This approach optimizes operations and predicts potential issues. Specifically, it aims to improve service reliability across its service areas. In 2024, Atmos invested $1.6 billion in system upgrades.

Technological advancements in renewable natural gas (RNG) and hydrogen production are gaining momentum. These alternative energy sources are in the early stages of widespread use, but their potential is significant. For instance, in 2024, the RNG market saw investments exceeding $1 billion. Hydrogen production, though nascent, is projected to grow, with analysts forecasting a 15% annual growth rate through 2025.

Cybersecurity Threats and Infrastructure Protection

Cybersecurity threats are a significant technological factor for Atmos Energy. Protecting critical infrastructure from cyberattacks is a growing concern. Investing in robust cybersecurity measures is essential for reliable operations. The energy sector faces increasing cyber threats, with attacks rising by 20% in 2024. Atmos Energy must allocate substantial resources to cybersecurity.

- Cybersecurity spending in the energy sector is projected to reach $10 billion by 2025.

- Ransomware attacks on energy companies increased by 30% in the first half of 2024.

- Atmos Energy's cybersecurity budget increased by 15% in 2024.

Efficiency Enhancements in Operations

Technological advancements are pivotal for Atmos Energy's operational efficiency. Innovations in compression and metering technologies enhance natural gas transmission and distribution. These improvements lead to significant cost savings and a reduced environmental footprint. For instance, smart grids and digital monitoring systems optimize pipeline management. Atmos Energy's focus on tech is reflected in its capital expenditures, with approximately $1.6 billion allocated for infrastructure improvements in fiscal year 2024.

- Smart grids and digital monitoring systems optimize pipeline management.

- Atmos Energy allocated about $1.6 billion for infrastructure in fiscal year 2024.

Atmos Energy's tech investments center on pipeline safety, smart grids, and renewables like RNG. Cybersecurity spending in the energy sector is projected to reach $10 billion by 2025. Infrastructure improvements got roughly $1.6 billion in 2024.

| Technology Area | 2024 Investment | Impact |

|---|---|---|

| Pipeline Safety | Significant | Enhanced safety, leak detection |

| Smart Grids | $1.6B in infrastructure upgrades | Optimized operations, reliability |

| Cybersecurity | Budget increased 15% | Protect critical infrastructure |

Legal factors

Atmos Energy is subject to stringent pipeline safety regulations at both federal and state levels. Non-compliance can lead to hefty fines, with penalties potentially reaching millions of dollars. For instance, in 2024, the Pipeline and Hazardous Materials Safety Administration (PHMSA) issued over \$20 million in penalties for safety violations across the industry. Staying compliant is critical for operational continuity and financial health.

Rate case rulings are often contested legally. Parties may appeal decisions, affecting rate implementation. This legal process creates uncertainty for Atmos Energy. For instance, in 2024, several rate cases saw legal challenges. These challenges can delay or alter approved rate adjustments, impacting revenue projections.

Atmos Energy must adhere to stringent environmental laws. This includes regulations on air emissions, water quality, and waste management. Methane emission regulations are critical for natural gas companies. Non-compliance can lead to significant financial penalties. The EPA has increased scrutiny, with potential fines reaching millions.

Land Use and Eminent Domain Laws

Atmos Energy's operations are significantly impacted by land use and eminent domain laws, particularly for pipeline projects. These legal frameworks govern land acquisition and usage, crucial for infrastructure like pipelines. The company must adhere to federal, state, and local regulations to obtain permits and rights-of-way. In 2024, Atmos Energy invested heavily in pipeline integrity and expansion, requiring careful navigation of these legal processes.

- Eminent domain allows the company to acquire land for public use, but this can lead to legal challenges.

- Permitting processes vary by location, adding complexity to project timelines.

- Compliance costs are a significant factor in project budgets.

- Legal disputes can delay or halt projects, impacting financial performance.

Contractual Agreements and Legal Disputes

Atmos Energy's operations hinge on contractual agreements for natural gas. These include supply, transportation, and various services. Legal disputes stemming from these contracts can impact finances and operations. In 2024, the company faced legal challenges related to pipeline safety and regulatory compliance, impacting its financial outlook.

- Contract disputes can lead to significant litigation costs.

- Regulatory changes can affect contract terms and profitability.

- Compliance failures may result in penalties and reputational damage.

- The company allocates resources for legal and compliance matters.

Atmos Energy faces hefty penalties for non-compliance with pipeline safety rules; PHMSA issued over \$20 million in penalties across the industry in 2024. Legal battles frequently challenge rate rulings, affecting implementation timelines and revenue. Environmental regulations, especially methane emission standards, carry the risk of major fines from the EPA, and can range into millions of dollars.

| Legal Aspect | Impact | Financial Implication (2024/2025) |

|---|---|---|

| Pipeline Safety | Non-compliance | Penalties: Millions of dollars (e.g., PHMSA penalties) |

| Rate Case Appeals | Implementation delays | Revenue uncertainty; potential loss |

| Environmental Laws | Methane emissions; others | Fines from EPA, compliance costs |

Environmental factors

Atmos Energy prioritizes reducing methane emissions from its operations, a crucial environmental goal. This commitment aligns with growing concerns about greenhouse gases and climate change. The company has set specific targets to decrease these emissions. In 2024, natural gas utilities emitted ~0.4% of all U.S. methane emissions. Atmos's initiatives reflect industry-wide efforts to minimize environmental impact.

Climate change poses risks to Atmos Energy. Changing weather patterns and extreme events can influence gas demand and disrupt infrastructure. The company must adapt its operations. For example, in 2024, extreme weather caused $15 million in damages. Adaptation includes reinforcing pipelines.

New projects and upgrades at Atmos Energy need environmental permits. This involves environmental reviews to get approvals. In 2024, the EPA issued 30% more permits than in 2023. Navigating the process minimizes environmental harm. For example, Atmos's 2024 spending on environmental compliance was $150 million.

Land and Habitat Protection

Atmos Energy's projects must consider land use and habitat protection during pipeline routing and construction. This involves minimizing disruption to sensitive ecosystems, a key environmental responsibility. In 2024, the company likely faced scrutiny regarding habitat preservation during expansion projects. The company's commitment to environmental stewardship is reflected in its compliance efforts.

- Pipeline projects can affect wetlands and forests.

- Mitigation strategies may include habitat restoration.

- Environmental impact assessments are crucial.

- Compliance with regulations is essential.

Water Usage and Conservation

Atmos Energy's operations involve water usage, making water conservation an important environmental factor. The company is likely to face increasing scrutiny and regulations regarding water use. Effective water management is crucial for environmental stewardship and operational sustainability. Water-efficient practices can mitigate risks and improve public perception. For example, in 2024, the U.S. natural gas industry used approximately 1.5 billion gallons of water.

- Water use is an environmental concern for natural gas operations.

- Water-efficient practices are part of environmental stewardship.

- Expect increased scrutiny and regulations.

- Water management is key for sustainability.

Atmos Energy focuses on lowering methane emissions, a key environmental objective, especially with the natural gas industry emitting around 0.4% of all U.S. methane in 2024. Climate change and extreme weather events affect gas demand and can disrupt infrastructure; adaptation includes reinforcing pipelines after the 2024 damage of $15 million due to severe weather. Environmental factors include environmental permits, land use, habitat protection during projects, and water conservation.

| Environmental Factor | Impact | 2024/2025 Data |

|---|---|---|

| Methane Emissions | Regulatory Pressure | Natural gas utilities accounted for ~0.4% of all U.S. methane emissions. |

| Climate Change | Infrastructure Damage | Extreme weather caused $15 million in damages in 2024. |

| Water Usage | Environmental Impact | The U.S. natural gas industry used ~1.5 billion gallons in 2024. |

PESTLE Analysis Data Sources

The analysis relies on official government data, industry publications, and reports from economic and environmental agencies.