Atos Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atos Bundle

What is included in the product

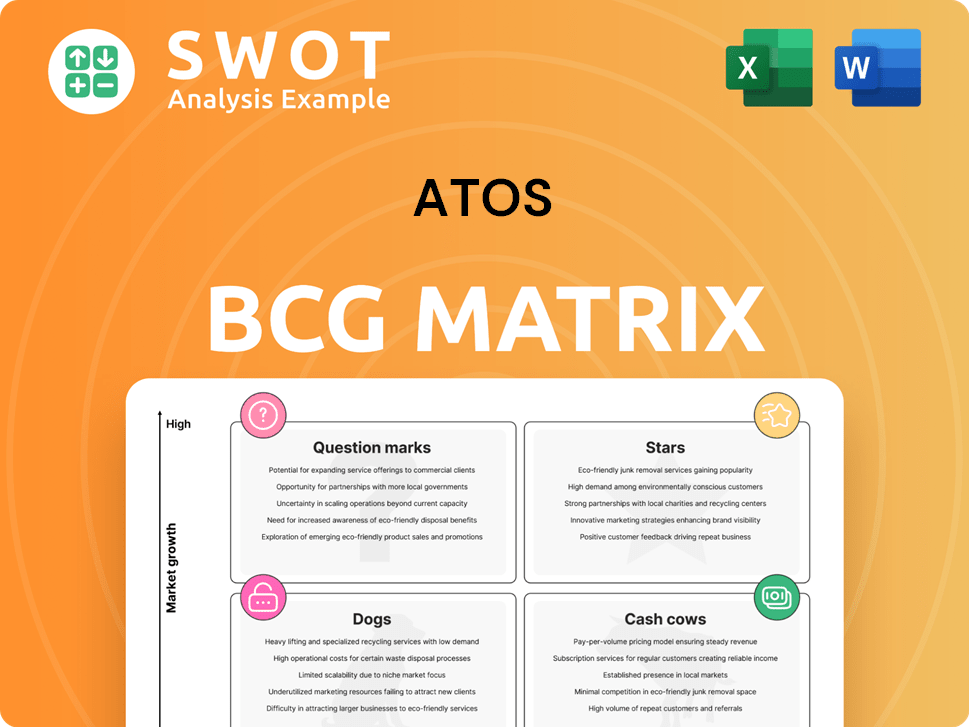

Strategic overview using the BCG Matrix to analyze Atos' business units.

Clearly visualize business unit performance with a one-page matrix.

Delivered as Shown

Atos BCG Matrix

The preview shows the complete BCG Matrix report you receive upon purchase. This isn't a sample; it’s the fully editable, download-ready version for strategic insights.

BCG Matrix Template

Here's a glimpse into Atos's strategic landscape using the BCG Matrix. See how its products are categorized: Stars, Cash Cows, Dogs, and Question Marks. The matrix offers a snapshot of market share vs. growth rate.

This preview highlights key placements, but there's so much more. Get the full BCG Matrix report to unlock detailed quadrant analysis and actionable strategic guidance.

Stars

Atos' cybersecurity solutions are positioned as a Star in its BCG Matrix, reflecting its strong market presence, especially in Europe. The cybersecurity market's growth, fueled by rising cyber threats, bolsters this status. Atos' focus on cybersecurity as a key growth and innovation area further supports this classification. In 2024, the global cybersecurity market is projected to reach $212.6 billion.

Atos's cloud services are a Star in the BCG Matrix, reflecting high growth and market share. The cloud computing market is projected to hit $1.6T by 2025, growing at 14.9% CAGR. Atos saw a 7% YoY revenue increase, driven by cloud services. This growth highlights Atos's strong position in a booming market.

Atos holds a significant position in High-Performance Computing (HPC), especially within Europe. The need for HPC is fueled by research and complex applications. In 2024, Atos secured HPC upgrade contracts, showing its commitment. Investment in HPC contracts has been a focus area for Atos; in 2023, the company's HPC revenues were approximately €1.2 billion.

Digital Transformation Projects

Atos prioritizes digital transformation, helping clients integrate technology into their operations. In 2022, Atos invested roughly €160 million in R&D. The company aims for digital services to make up 50% of its revenue by 2024. Atos focuses on sustainability and innovation across healthcare, finance, and the public sector.

- Digital transformation is a core focus for Atos, aiding clients with tech integration.

- R&D investment was about €160 million in 2022.

- The goal is for digital services to represent half of total revenue by 2024.

- Atos targets diverse sectors, including healthcare and finance.

AI and Machine Learning

Atos positions its AI and Machine Learning services as a "Star" within its BCG matrix. The company is deeply engaged in AI and cloud computing, projecting substantial growth in these areas. By 2030, Atos aims to be a leader, using AI/ML to boost customer interactions and internal processes. The tailored solutions are expected to increase customer engagement, projecting a 12% growth in this sector.

- AI market is expected to reach $1.8 trillion by 2030.

- Atos aims for a significant market share in the AI and cloud sectors.

- Customer engagement initiatives are key.

- Operational process improvements are crucial.

Atos leverages AI and ML as a Star, with ambitions in AI and cloud. Customer engagement is boosted, aiming for 12% sector growth. By 2030, the AI market should reach $1.8T, supporting Atos's goals.

| Aspect | Details |

|---|---|

| Market Focus | AI/ML, Cloud Computing |

| Growth Target | 12% Customer Engagement |

| Market Size (2030) | $1.8 Trillion (AI) |

Cash Cows

Atos' managed services, like those with long-term contracts, can be cash cows. These offer consistent revenue with minimal new investment. However, the sector faces difficulties. In 2024, Atos' revenue was impacted by these challenges, highlighting the need to focus on high-performing areas. For example, the digital transformation services grew 3% in the first half of 2024.

Atos' legacy IT infrastructure services, though declining, still offer consistent cash flow. These services benefit from existing contracts and a stable client base. However, the market is mature, requiring minimal investment. Efficient management is key to maximizing profitability. In 2024, Atos aimed to streamline these services to boost margins, as per financial reports.

In geographic markets where Atos has a robust presence, certain services act as cash cows, generating steady revenue. These markets, like parts of Europe, offer stable income with less need for rapid growth. Focusing on operational efficiency is crucial in these areas to maximize profits. In 2024, Atos reported strong performance in several European regions, indicating continued cash flow. This strategic focus on established markets has proven vital for Atos.

Long-Term Government Contracts

Atos has historically relied on long-term government contracts, offering predictable revenue. These contracts, once won, provide a steady income flow over several years. Effective management and service delivery are key to ensuring these contracts remain profitable. In 2024, Atos secured a $200 million contract extension with the French government for IT services.

- Revenue Stability: These contracts provide a stable income stream.

- Contract Duration: Contracts often span multiple years, offering long-term revenue visibility.

- Profitability: Efficient operations are crucial for maintaining profitability.

- Market Data: As of Q3 2024, government contracts accounted for 35% of Atos's revenue.

Cybersecurity for Critical Infrastructure

Atos' cybersecurity services for critical infrastructure could be a cash cow, given the steady demand and essential nature of these services. The sector faces increasing regulatory scrutiny and cyber threats, driving consistent need for robust security solutions. This translates to recurring revenue with manageable investment for Atos. In 2024, the global cybersecurity market for critical infrastructure was valued at approximately $20 billion, with projections showing continued growth.

- Steady demand due to essential security needs.

- Recurring revenue from critical infrastructure clients.

- Manageable investment relative to revenue potential.

- Compliance with evolving regulations.

Cash cows for Atos include stable revenue streams with minimal investment. Managed services with long-term contracts exemplify this, offering consistent profits. Cybersecurity for critical infrastructure also fits, given steady demand. Legacy IT services and specific geographic markets further contribute to cash flow stability.

| Characteristic | Description | Financial Impact (2024) |

|---|---|---|

| Revenue Stability | Consistent income, predictable cash flow. | Managed Services: 3% growth in Q2 2024. |

| Investment Needs | Low capital expenditure requirements. | Legacy IT: Streamlining improved margins. |

| Market Focus | Mature markets, strong client base. | Cybersecurity: $20B market, growing. |

Dogs

Atos has been strategically scaling back its Business Process Outsourcing (BPO) operations within the UK. The Q1 2025 financial results highlighted a revenue decrease across its divisions. Tech Foundations saw a 17.5% decline, primarily due to the reduction in BPO activities in the UK. This strategic shift positions BPO in the UK as a "Dog" in the Atos portfolio, characterized by low growth and market share.

Atos' Tech Foundations segment, a key part of its business, is currently facing headwinds. In 2024, this segment saw a revenue decline of 4.1%, indicating challenges. This decrease stemmed from lower resource utilization and reduced volume. These factors collectively impacted Tech Foundations' overall performance.

Atos shuttered its 'computing as a service' due to low profitability. This move signifies the service as a Dog in the BCG matrix. Dogs have weak market share and growth. By exiting, Atos can allocate resources to better opportunities. In 2024, Atos's revenue was impacted by strategic shifts.

Declining Digital Activities

Atos's digital activities have declined significantly, primarily due to contract terminations and reduced scopes, plus market weakness in key regions. This double-digit decrease signals underperforming areas within the digital segment. The company faces a critical decision: invest heavily to revitalize these activities or divest them to cut losses. For 2024, Atos reported a revenue decrease in its Digital Transformation segment.

- Digital activities are underperforming.

- Contract terminations and reductions are key drivers.

- Market softness in North America, the UK & Ireland, and Southern Europe is a factor.

- Significant investment or divestiture is likely.

Underperforming Contracts

Atos faces challenges with underperforming contracts, leading to financial strain. These contracts, for which Atos has allocated provisions, fail to meet profitability expectations. Such situations consume valuable resources without delivering significant profits, aligning with the 'Dog' category. Resolving these issues is key for Atos to improve its financial standing. In 2024, Atos reported a significant decrease in operating margin due to these issues.

- Provisioning for underperforming contracts directly impacts profitability.

- Resource allocation is inefficient due to these low-yield contracts.

- Atos needs to restructure or exit these contracts to improve financial health.

- In 2024, Atos's operating margin declined due to these contracts.

The "Dogs" in Atos’s portfolio, like BPO in the UK, exhibit low growth and market share, impacting overall revenue. Tech Foundations and digital activities faced declines in 2024 due to reduced contracts and market weakness. Underperforming contracts further strain profitability, requiring strategic exits or restructuring for financial improvement.

| Segment | 2024 Revenue Change | Key Driver |

|---|---|---|

| Tech Foundations | -4.1% | Lower resource utilization |

| Digital Transformation | Decreased | Contract terminations |

| Underperforming Contracts | Impacted margin | Low profitability |

Question Marks

Atos's foray into new AI solutions places it in the "Question Marks" quadrant of the BCG matrix. These solutions, like AI-powered cybersecurity tools, show high growth potential, yet currently hold a small market share. For instance, the AI market is projected to reach $200 billion by 2025. Success hinges on strategic investments. Atos needs to ensure market adoption to gain market share.

Specific digital transformation services at Atos, like AI-driven solutions or quantum computing applications, fit into the question marks category. These services show promise for high growth but demand considerable investment to establish a market presence. Atos must rigorously assess the viability of these offerings. For example, Atos's investments in AI increased by 15% in 2024.

Atos aims to broaden its global reach by entering new markets in Asia and North America. Despite the high growth potential, Atos currently holds a low market share in these regions. Strategic investments and partnerships will be crucial for success. In 2024, Atos's revenue was approximately €10.5 billion.

Decarbonization Services and Products

Atos positions its decarbonization services and products as a Question Mark in its BCG Matrix. This reflects high growth potential in sustainability, a key area for many businesses. The market share is still emerging, indicating the need for strategic investment and development. For example, the global green technology and sustainability market was valued at $36.6 billion in 2023, with projections to reach $74.7 billion by 2028.

- High growth potential in the sustainability sector.

- Market share is still developing.

- Requires strategic investment.

- Atos is committed to decarbonized digital solutions.

Quantum Computing Initiatives

Atos is channeling resources into quantum computing, an emerging technology. Despite its potential, Atos's current market share in this area is modest. Substantial investment and development are essential to elevate its position. The quantum computing market is projected to reach $125 billion by 2030.

- Atos is investing in quantum computing.

- Market share is currently low.

- Significant development is needed.

- Quantum computing market is projected to reach $125 billion by 2030.

Atos's offerings in AI, digital transformation, and quantum computing are categorized as "Question Marks". These ventures show high growth potential but have a small market share initially. Strategic investments are critical for Atos to gain a stronger market position. Data shows that Atos's AI investments increased by 15% in 2024.

| Category | Description | 2024 Data |

|---|---|---|

| AI Solutions | High growth, low market share | AI investment +15% |

| Digital Services | Need substantial investment | Revenue: €10.5B |

| Quantum Computing | Emerging tech, modest share | Market to $125B (2030) |

BCG Matrix Data Sources

Atos BCG Matrix leverages diverse sources: financial statements, market research, and expert analysis for strategic precision.