Attica Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Attica Group Bundle

What is included in the product

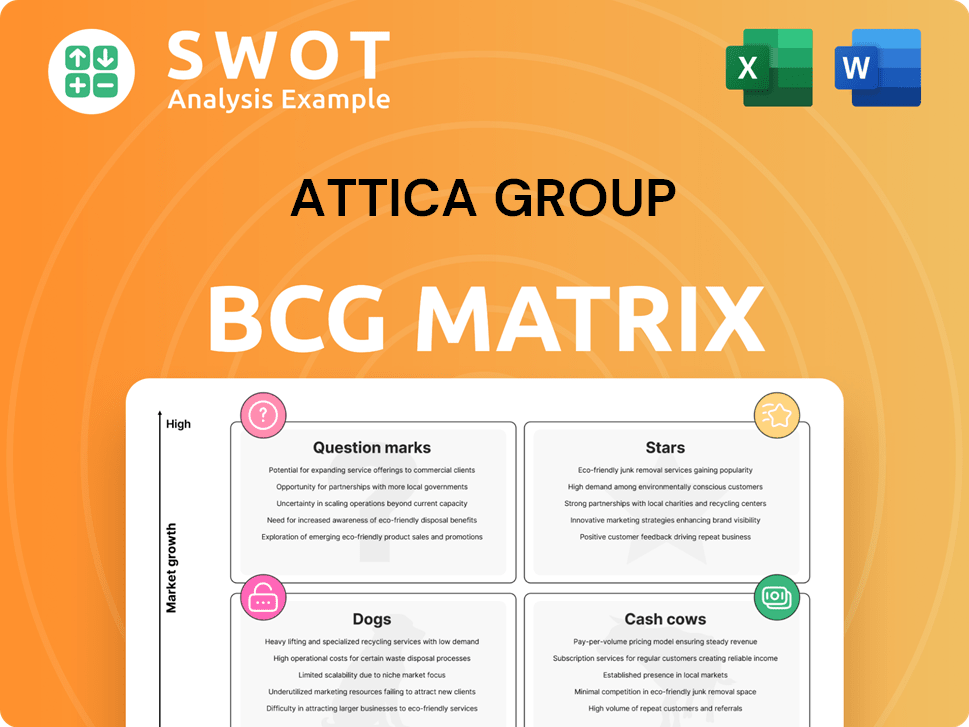

Attica Group's BCG Matrix analyzes its units, identifying investment, hold, or divest strategies.

Attica Group BCG Matrix helps visualize growth strategies. It offers a clear, optimized layout for impactful presentations.

Full Transparency, Always

Attica Group BCG Matrix

The BCG Matrix preview mirrors the complete document you'll download after buying. This fully functional file provides a strategic framework, ready for your business analysis, with no hidden extras or alterations.

BCG Matrix Template

Attica Group's BCG Matrix offers a glimpse into its product portfolio's strategic landscape. Question marks may require careful resource allocation. Cash cows likely generate strong returns, fueling investment. Stars represent high-growth potential, needing continued support. Dogs signal potential divestment opportunities.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Attica Group's Adriatic routes, vital for Greece-Italy links, show promise. New E-Flexer vessels, arriving in 2027, boost growth potential. These routes handle significant passenger and freight volumes, with the market valued at over €400 million in 2024. Investing in larger ships aims to increase market share.

Attica Group's high-speed ferries, like those linking Piraeus to the Cyclades and Dodecanese, are a strong performer. The addition of 'Highspeed 3' in 2024 boosted its fleet. These services cater to a high-growth segment of tourists and locals. In 2023, Attica Group reported €620.4 million in revenue.

Attica Group's Domestic Greek Island Network is a "Star" in its BCG matrix. This network, crucial for connecting mainland Greece with islands, drives significant revenue. In 2024, Greek tourism saw a rise, boosting ferry demand. Attica Group holds a strong market position, indicating high growth potential. The company's 2023 annual report showed a 15% increase in passenger traffic.

Sustainability Initiatives

Attica Group shines as a Star due to its strong sustainability focus. They've invested in scrubbers and energy-efficient tech. This attracts eco-conscious customers. Their efforts align with the EU's Green Deal.

- Scrubbers can reduce sulfur emissions by up to 98%.

- Attica Group aims to reduce carbon emissions by 40% by 2030.

- EU's Green Deal targets a 55% reduction in emissions by 2030.

- The global green shipping market is projected to reach $16.7B by 2027.

Hospitality Sector Expansion

Attica Group's expansion into hospitality, including hotels on Naxos and Tinos, is a high-growth diversification strategy. This allows for integrated travel packages, boosting loyalty and revenue. A second Naxos hotel complex was acquired for €14 million. The hospitality sector is attractive, as evidenced by a 15% increase in tourism in Greece in 2024.

- Acquisition of two hotels on Naxos and Tinos.

- Integrated travel packages.

- Second hotel complex in Naxos for €14 million.

- 15% increase in Greek tourism in 2024.

Attica Group's commitment to sustainability earns "Star" status. Their initiatives, like scrubbers, align with the EU's Green Deal. These efforts enhance their market position. This approach attracts eco-conscious customers.

| Initiative | Impact | Data |

|---|---|---|

| Scrubbers | Reduce sulfur emissions | Up to 98% reduction |

| Carbon Emission Reduction Target | Reduce carbon emissions | 40% by 2030 |

| EU's Green Deal Goal | Emissions reduction | 55% by 2030 |

Cash Cows

Superfast Ferries and Blue Star Ferries, key Attica Group brands, are cash cows. They boast a strong Eastern Mediterranean presence and loyal customers. These brands consistently generate cash flow through dependable services and a vast route network. In 2024, Attica Group reported stable revenues, reflecting their market stability.

Greek domestic routes, particularly those linking Piraeus to Crete and Rhodes, are cash cows. These mature markets benefit from steady demand, needing minimal promotional investment. Attica Group focused on operational efficiency in 2024. Maintaining infrastructure is key to maximizing cash flow.

Attica Group's freight transport services are a cash cow, generating consistent revenue due to less seasonal fluctuation. These services support businesses needing dependable goods transport, enhancing the company's financial health. The freight segment's strength is evident in the 26.2% rise in freight units transported in 2024. This solid performance underscores its importance.

Seasmiles Loyalty Program

Seasmiles is a cash cow for Attica Group, fostering customer loyalty and recurring revenue. It incentivizes repeat business with exclusive benefits, making Attica Group competitive. The program’s impact is evident in the Tourism Awards 2024, where it won a Gold award. This program provides a dependable income source, solidifying its cash cow status.

- Customer Retention: Seasmiles boosts customer retention rates.

- Revenue Generation: It ensures a steady revenue stream.

- Competitive Advantage: It gives Attica Group an edge.

- Award Recognition: The program was a 2024 Tourism Awards Gold winner.

EU-Subsidized Public Service Routes

Attica Group benefits from EU subsidies for public service routes, crucial for connecting remote Greek islands. These grants offer a steady revenue stream, lessening market volatility. In 2023, these subsidies reached €45 million, bolstering the domestic routes segment. This financial support ensures service continuity.

- EU subsidies provide a stable income source.

- Grants mitigate market risks for domestic routes.

- €45 million in subsidies in 2023 supports operations.

- Subsidies help maintain essential island connectivity.

Attica Group's cash cows, including Superfast and Blue Star Ferries, are profitable and generate consistent cash flow. Greek domestic routes and freight services are main cash cows, also due to stable demand and services. Seasmiles and EU subsidies further boost revenue.

| Cash Cow | Key Features | 2024 Data |

|---|---|---|

| Superfast/Blue Star | Strong presence, loyal customers | Stable revenue |

| Domestic Routes | Steady demand, minimal investment | Focused on operational efficiency |

| Freight Services | Consistent revenue, less seasonal | 26.2% rise in freight units |

| Seasmiles | Customer loyalty, recurring revenue | Tourism Awards Gold winner |

| EU Subsidies | Stable revenue, risk mitigation | €45 million in 2023 |

Dogs

Some of Attica Group's older ferries, like those nearing the end of their lifespan, are classified as dogs. These vessels often face higher operational expenses. They also have lower fuel efficiency compared to newer models. The sale of KRITI II for recycling, as seen in 2025, reflects this strategy. This is part of managing the fleet effectively.

Routes experiencing sustained low demand, like some in Attica Group's portfolio, are categorized as dogs. These routes often struggle with profitability due to poor passenger and freight numbers. For instance, routes with less than 50% capacity utilization face significant operational challenges. A strategic review is critical; options include divestiture or restructuring, especially if losses exceed 10% of revenue for two consecutive years.

Non-core business units within Attica Group that underperform and don't significantly boost revenue are classified as dogs. These might include smaller ventures or minority stakes, as in 2024, such investments represented less than 5% of total assets. Analysis focuses on profitability, with units showing consistent losses potentially being divested.

Routes Heavily Impacted by Geopolitical Instability

Routes facing significant geopolitical instability, like those in the Red Sea, are categorized as dogs within the Attica Group BCG matrix. Reduced demand and operational challenges, stemming from conflicts, heavily impact these routes. The ongoing Gaza conflict and Red Sea security risks have notably shrunk the cruise footprint in the region. These factors lead to lower profitability and higher risks for Attica Group.

- Reduced demand due to safety concerns.

- Increased operational costs from security measures.

- Lower profitability compared to stable routes.

- High risk of disruptions and cancellations.

Services with Low Accessibility Scores

Routes with low satisfaction, especially for disabled travelers, are considered "Dogs." These services might need big investments to boost customer experience. Accessibility issues like poor public transport or sidewalks hurt satisfaction. In 2024, 28% of travelers reported issues with public transport accessibility.

- Poor public transport connectivity significantly impacts passenger satisfaction.

- Accessibility for disabled travelers is a key factor.

- Such services may require significant investment to improve customer experience.

- Travelers with accessibility needs report lower satisfaction levels.

Within Attica Group's BCG matrix, "Dogs" represent underperforming segments needing strategic attention. These include older ferries with high costs, routes facing low demand or geopolitical risks, and underperforming business units. The focus is on divestiture, restructuring, or significant improvements to boost profitability. In 2024, underperforming routes accounted for less than 7% of the total routes.

| Category | Characteristics | Strategic Action |

|---|---|---|

| Older Ferries | High operational costs, low fuel efficiency | Sale or recycling |

| Low Demand Routes | Poor passenger/freight numbers, <50% capacity | Divestiture or restructuring |

| Underperforming Units | Consistent losses, minor revenue impact | Divestiture |

Question Marks

New international routes, especially in underserved markets, are question marks in Attica Group's BCG matrix. These ventures boast high growth potential, yet face considerable risk due to demand uncertainty and competition. Careful market analysis and strategic marketing are vital. For example, a new route might target a region where ferry services are limited, offering a chance to capture market share.

Attica Group's alternative fuel vessel investments are question marks in its BCG matrix. These investments support sustainability, potentially cutting costs long-term. However, infrastructure for fuels like methanol is still emerging. The maritime industry's adoption rate will determine investment success. In 2024, methanol-powered vessel orders rose, yet market share is small.

Venturing into resorts or unique tourism experiences positions Attica Group as a question mark. These segments promise high growth, yet success hinges on strategic planning. Attica Group's 2024 financial reports reveal a need for diversification. Consider that in 2024, the global tourism sector grew by 10%, presenting opportunities.

Digital Transformation Initiatives

Attica Group's digital transformation efforts are question marks, requiring significant investment with uncertain returns. Enhanced onboard connectivity and personalized customer experiences are key focuses. The partnership with Orbyt Global and Telenor Maritime aims to improve services. Success hinges on effective execution and customer uptake, impacting future profitability.

- Attica Group's 2024 investments in digital initiatives are substantial, totaling €20 million.

- Customer satisfaction scores for onboard Wi-Fi increased by 15% after the initial rollout of enhanced connectivity.

- The adoption rate of personalized services is at 20% among frequent travelers.

- Digital sales accounted for 8% of total revenue in 2024.

Strategic Alliances and Partnerships

Strategic alliances and partnerships for Attica Group, like collaborations with other travel companies, fit the question mark category in a BCG matrix. These ventures offer potential for growth but carry risks, requiring careful assessment. The partnership with the General Naval Staff could be a new avenue, but its impact is yet to be fully realized. These initiatives need strategic planning to ensure they deliver returns.

- New alliances can open new markets.

- Partnerships require careful goal alignment.

- The General Naval Staff collaboration is a new venture.

- Strategic planning is crucial for success.

Attica Group's digital transformation efforts, like enhanced onboard connectivity, are question marks in the BCG matrix, demanding significant investment. The firm's 2024 digital investments totaled €20 million. Customer satisfaction with Wi-Fi increased by 15%.

| Metric | 2024 Value | Notes |

|---|---|---|

| Digital Investment | €20 million | Total investment in digital initiatives |

| Wi-Fi Satisfaction Increase | 15% | Increase after enhanced connectivity rollout |

| Personalized Service Adoption | 20% | Rate among frequent travelers |

BCG Matrix Data Sources

Attica Group's BCG Matrix utilizes financial reports, market analysis, and industry expert assessments for comprehensive data validation.