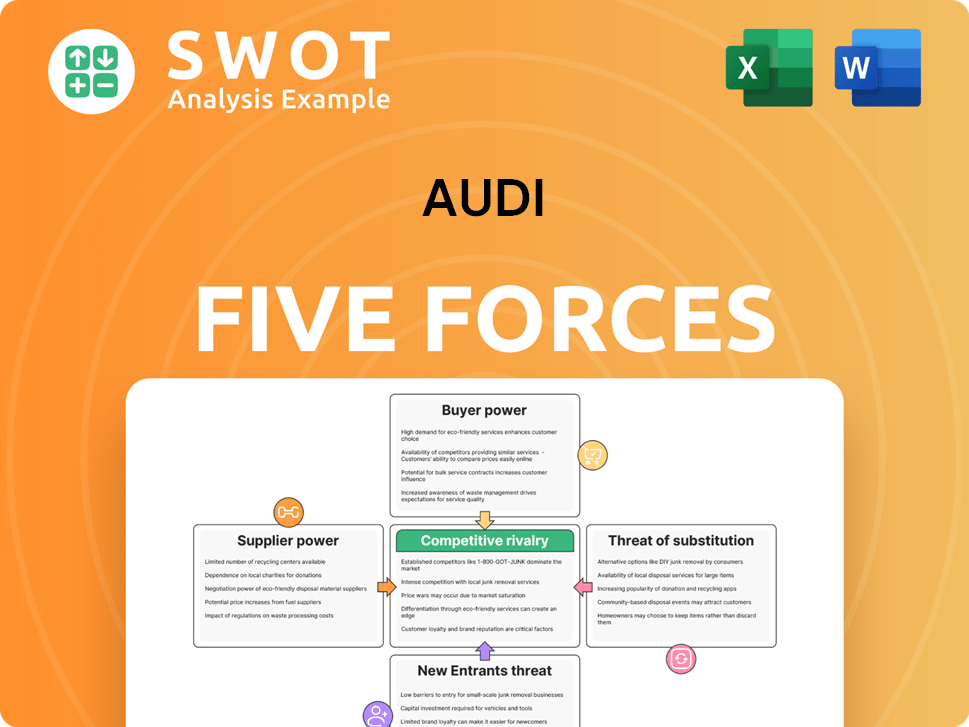

AUDI Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AUDI Bundle

What is included in the product

Analyzes Audi's competitive position by evaluating industry rivals, suppliers, buyers, and new entrants.

Customize pressure levels, so you instantly understand market dynamics.

Full Version Awaits

AUDI Porter's Five Forces Analysis

This is the complete AUDI Porter's Five Forces analysis you'll receive. The preview presents the exact, fully detailed document you'll download immediately after purchase.

Porter's Five Forces Analysis Template

AUDI navigates a competitive automotive landscape. Its success hinges on managing supplier power, with technology a key factor. Buyer power is significant due to diverse choices. The threat of new entrants, especially EVs, is rising. Competitive rivalry among premium brands is intense. Finally, substitute products like ride-sharing present a challenge.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore AUDI’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Audi sources components from a vast network of suppliers. The concentration among these suppliers, particularly for specialized parts like electronics or premium materials, influences their bargaining power. For instance, if a few firms control a key technology, they can exert pressure on pricing. In 2024, the automotive industry faced supply chain disruptions impacting production costs.

Switching suppliers can be costly and time-consuming for Audi. If changing suppliers requires significant modifications to production processes, suppliers gain bargaining power. The more unique and essential a supplier's product, the higher the switching costs. For instance, in 2024, the global automotive parts market was valued at over $1.5 trillion.

Suppliers of unique components, like advanced EV battery tech, hold significant power. These suppliers can dictate prices and terms due to limited alternatives. In 2024, the global EV battery market was valued at over $60 billion, highlighting the influence of these specialized suppliers. The scarcity of these inputs strengthens their bargaining position.

Impact on Quality

The quality of supplied components directly affects Audi's vehicle performance and brand image. Suppliers of vital parts, such as engines and safety systems, hold considerable power. Defects can harm Audi's reputation and raise warranty expenses. For example, in 2024, Audi spent approximately $1.2 billion on quality-related issues.

- Engine suppliers, like those providing engines for the Audi A4, can significantly influence vehicle performance.

- Safety system providers, such as those supplying airbags, impact Audi's safety ratings.

- Quality failures can lead to costly recalls, such as the 2023 recall of 10,000 vehicles.

- Audi's reliance on specific, high-tech component suppliers increases their leverage.

Threat of Forward Integration

Suppliers' bargaining power escalates if they can integrate forward and compete directly. Imagine a tire manufacturer deciding to produce and sell its own cars, reducing its dependence on Audi and becoming a rival. This shift can significantly pressure Audi's profit margins and strategic flexibility. For example, in 2024, the automotive parts market was valued at over $1.5 trillion globally.

- Forward integration by suppliers increases their leverage.

- This can lead to reduced profitability for Audi.

- Supplier competition can intensify market pressures.

- The global automotive parts market is massive.

Audi's supplier power is influenced by supplier concentration, with specialized component suppliers, like those in EV batteries, wielding considerable influence. Switching costs and the uniqueness of components, such as engines and safety systems, further empower suppliers. In 2024, the automotive parts market exceeded $1.5 trillion, demonstrating the significance of these suppliers. Forward integration by suppliers can significantly pressure Audi's profit margins.

| Factor | Impact on Supplier Power | 2024 Data/Example |

|---|---|---|

| Supplier Concentration | High concentration = Increased power | EV battery market valued over $60B |

| Switching Costs | High costs = Increased power | Global automotive parts market >$1.5T |

| Component Uniqueness | Unique components = Increased power | Audi spent ~$1.2B on quality issues |

Customers Bargaining Power

Luxury car customers show less price sensitivity compared to mass-market buyers. However, even affluent consumers have budget constraints, particularly during economic downturns. For instance, the luxury car market in the US saw a 6.2% decrease in sales in 2023. If Audi's prices become uncompetitive, customers might opt for brands like BMW or Mercedes-Benz. In 2024, Audi's global sales were up by 1.7%.

Customers today wield significant power due to the abundance of information available online. Websites and reviews offer detailed insights into vehicle prices and features, allowing for easy comparisons. For example, in 2024, 85% of car buyers used online resources during their purchase journey. This access strengthens their ability to negotiate better deals.

Audi enjoys significant brand loyalty, decreasing customer bargaining power. Loyal customers are less swayed by price or minor differences. In 2024, Audi's customer retention rate was about 65%, showing strong loyalty. This loyalty allows Audi to maintain pricing and reduce pressure from customers. Strong brand perception further insulates Audi, as seen in its consistent sales figures.

Switching Costs

Switching costs for luxury vehicles, including Audi, are comparatively low. Customers face minimal financial barriers when switching brands. This ease of switching bolsters customer bargaining power, forcing Audi to maintain competitive pricing and features. For example, in 2024, the average trade-in value for a used Audi A4 was around $30,000, indicating manageable depreciation and facilitating brand transitions.

- Low switching costs amplify customer influence.

- Audi must continuously offer value to retain customers.

- Minimal financial inconvenience encourages brand hopping.

- Competitive pricing and features are crucial for Audi.

Product Differentiation

Audi's product differentiation, marked by technology and design, competes with similar features from other luxury brands. This similarity impacts buyer power. In 2024, Audi's global sales reached approximately 1.9 million vehicles, a slight increase from 2023. This competition increases customer bargaining power since alternatives abound.

- Luxury brands like BMW and Mercedes-Benz offer comparable features.

- 2024 Audi sales were around 1.9 million vehicles.

- Customer bargaining power rises with more alternatives.

- Product differentiation levels significantly affect buyer power.

Customer bargaining power in the luxury car market, like Audi's, is a blend of factors. Low switching costs and readily available online information amplify customer influence, as seen in 2024. Brand loyalty and product differentiation somewhat mitigate this, affecting pricing strategies. The market in 2024 saw Audi sales at about 1.9 million vehicles.

| Factor | Impact on Bargaining Power | 2024 Data/Example |

|---|---|---|

| Switching Costs | Low switching costs enhance customer power | Average used Audi A4 trade-in: ~$30,000 |

| Information Availability | Online info strengthens negotiation | 85% of car buyers used online resources |

| Brand Loyalty | Reduces customer price sensitivity | Audi's customer retention: ~65% |

| Product Differentiation | Alternative brands affect power | Audi's global sales: ~1.9M vehicles |

Rivalry Among Competitors

The luxury vehicle market is incredibly competitive, with many brands like BMW, Mercedes-Benz, and Lexus. This large number of competitors means intense rivalry. Each company fights for market share and customer loyalty, leading to price wars. For example, in 2024, BMW and Mercedes-Benz saw slight profit margin declines due to aggressive pricing strategies.

The luxury car market, including Audi, saw moderate growth in 2024. Slower growth, as seen in some segments, can increase competition. Market expansion, especially in EV sales, can ease rivalry, but competition remains strong.

Luxury car brands like Audi compete by differentiating their products. They focus on design, technology, and brand image. This differentiation reduces competition. If differentiation is low, price becomes the main factor. In 2024, Audi's sales showed a strong performance compared to competitors, highlighting the impact of effective product differentiation.

Switching Costs

Switching costs in the luxury vehicle market are generally low. Customers can easily switch brands without significant financial or practical hurdles. This ease of switching boosts competition among luxury carmakers like Audi. Firms must continually offer attractive deals to keep customers.

- Average lease terms are around 36 months, encouraging frequent brand changes.

- Luxury brands often provide incentives to lure customers from rivals.

- In 2024, Audi's U.S. sales faced competition from BMW and Mercedes-Benz.

- The availability of online reviews and comparisons further lowers switching costs.

Strategic Stakes

The luxury car market is a battlefield where brands like Audi fight fiercely. Success means big profits and a strong brand image. This intensity drives firms to invest heavily and compete aggressively. The move to electric vehicles and self-driving tech raises the stakes even further.

- Audi's 2023 operating profit was around €6.3 billion.

- The global luxury car market is expected to reach $680 billion by 2030.

- Investments in EVs and autonomous tech are in the billions annually.

Competitive rivalry in the luxury car market is high, with numerous brands battling for market share. Price wars and aggressive strategies are common, impacting profit margins. Differentiation in design and tech helps, but switching costs are low. Audi competes by offering strong products.

| Metric | Details |

|---|---|

| Market Growth (2024) | Moderate growth, intensified competition |

| Audi Operating Profit (2023) | Approximately €6.3 billion |

| Estimated Market Value (2030) | $680 billion |

SSubstitutes Threaten

Alternative transportation poses a threat to Audi. Customers could choose public transit, ride-sharing, or bikes. These offer cost savings or environmental benefits. In 2024, Uber and Lyft's combined revenue neared $50 billion, showing significant market share.

Used luxury vehicles serve as a notable substitute, challenging Audi's new car sales. In 2024, the used car market expanded, with prices softening slightly, making pre-owned options attractive. According to data from Cox Automotive, used car sales volume reached approximately 39 million units in 2024. This affordability lures customers, potentially impacting demand for new Audis. The price difference can be substantial; a used Audi A4 might cost significantly less than a new model, influencing consumer choices.

Wealthy consumers might opt for luxury items beyond cars. Options include high-end electronics, travel, or designer fashion. These goods compete for the same affluent buyers. For example, in 2024, global luxury goods sales hit approximately $362 billion, showing the broad scope of alternatives. This competition can decrease the demand for Audi vehicles.

Premium Non-Luxury Cars

Premium non-luxury cars pose a threat to Audi. These vehicles provide comparable features and performance at a lower cost. For example, a fully-loaded Mazda or Volvo can compete with Audi's entry-level models. This appeals to budget-conscious consumers. The competition is intensifying.

- Volvo's global sales increased by 15% in 2024.

- Mazda's North American sales rose by 11% in 2024.

- Entry-level Audi models' sales growth slowed to 3% in 2024.

- Consumer Reports shows high owner satisfaction with both Volvo and Mazda.

Car Sharing and Subscription Services

The emergence of car-sharing and subscription services poses a threat to Audi by offering alternatives to traditional luxury car ownership. These services provide consumers with flexible access to various vehicles, potentially reducing the demand for outright purchases [5]. This shift can impact Audi's sales, especially in urban areas where these services are most prevalent. Consumers may opt for these convenient options instead of committing to the costs of owning an Audi.

- Subscription services, like those offered by various automakers, showed growth in 2024, attracting customers with short-term commitments.

- Car-sharing platforms saw increased usage, particularly in cities, offering an accessible alternative to owning a car.

- The trend towards shared mobility is driven by factors like cost savings and convenience, influencing consumer choices.

- Audi needs to adapt to these trends by offering its own subscription services or partnering with existing platforms.

Audi faces substitution threats from various sources, impacting its market share. Alternatives include public transit, ride-sharing, and used luxury cars. These options offer cost savings or different value propositions, influencing consumer decisions.

Competition also comes from luxury goods and premium non-luxury cars, which compete for the same customer base. Car-sharing and subscription services provide additional alternatives. These trends pressure Audi to adapt.

| Alternative | 2024 Trend | Impact on Audi |

|---|---|---|

| Used Luxury Cars | Sales up, prices soften | Impacts new car sales |

| Ride-sharing (Uber/Lyft) | Combined revenue nearing $50B | Competes for transportation spend |

| Premium Non-Luxury | Volvo's sales +15%, Mazda's +11% | Offers comparable features |

Entrants Threaten

The automotive sector demands massive initial investments, including manufacturing plants, research and development, marketing, and distribution networks. These high capital needs act as a significant barrier to entry, especially in the luxury car market. For example, in 2024, building a new automotive plant could cost billions of dollars. This financial hurdle significantly reduces the number of potential new competitors. High capital requirements protect established brands like Audi from new challengers.

Audi's strong brand recognition and customer loyalty create a significant barrier for new entrants. A new brand must invest heavily in marketing and brand building. For example, in 2024, Audi's global brand value was estimated at over $40 billion. New entrants face the challenge of competing with this established brand equity to gain market share.

Audi, like other established automakers, benefits from economies of scale. Existing manufacturers leverage large production volumes and extensive global distribution networks to lower per-unit costs. New entrants face challenges matching these efficiencies. Building scale demands substantial time and capital investment. In 2024, Audi's production reached approximately 1.8 million vehicles, showcasing its scale advantage.

Access to Technology

The automotive industry is heavily reliant on technology, especially with the shift towards electric vehicles, self-driving capabilities, and integrated connectivity. New companies entering this market must have access to advanced technology to be competitive [4, 13]. This access typically requires significant investment in research and development, forming strategic partnerships, or acquiring existing technology firms.

- R&D spending by major automakers like Volkswagen and Toyota exceeded $15 billion in 2024.

- Acquisitions in the autonomous driving sector, such as Intel's purchase of Mobileye, show the high costs of technology acquisition.

- Partnerships, such as those between BMW and various tech companies, are a common strategy.

Regulatory and Legal Barriers

The automotive industry faces significant regulatory and legal hurdles, especially concerning safety, emissions, and manufacturing standards. New entrants must comply with these complex regulations, which can be costly and time-intensive [1, 2, 3]. These compliance requirements create a substantial barrier to entry, impacting the resources needed. The need for adherence to such rules can slow down market entry.

- In 2024, the costs associated with meeting emission standards alone can range from millions to billions of dollars, depending on the technology and scale.

- Safety certifications and testing can take several years and substantial investment.

- Regulatory compliance can also include ongoing monitoring and reporting, increasing operational costs.

- The average time to bring a new car model to market, including regulatory approvals, is about 3-5 years.

New automotive entrants face steep barriers. High initial investments and established brands limit competition. Regulations and tech requirements further increase costs.

| Factor | Impact on New Entrants | 2024 Data |

|---|---|---|

| Capital Costs | High investment needs | Plant costs billions; R&D >$15B (VW, Toyota) |

| Brand Loyalty | Requires heavy marketing | Audi's brand value >$40B |

| Regulations | Compliance costs & time | Emission costs millions-billions |

Porter's Five Forces Analysis Data Sources

The AUDI Porter's Five Forces analysis synthesizes data from annual reports, market research, competitor websites, and industry publications. We leverage financial databases for comprehensive insights.