Aussie Broadband PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aussie Broadband Bundle

What is included in the product

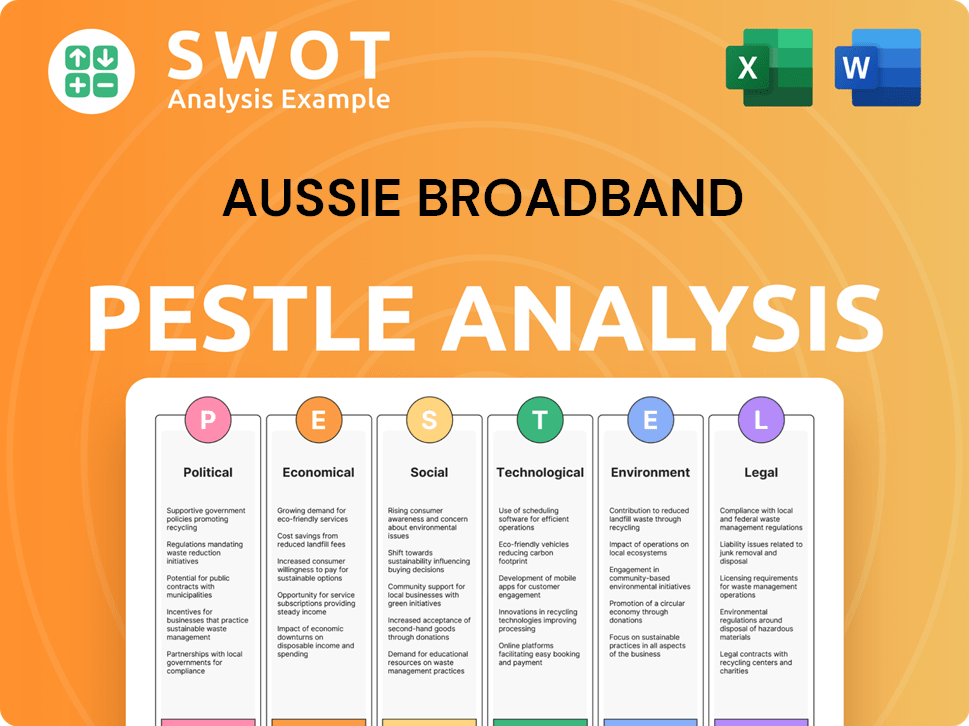

Unpacks external macro-factors impacting Aussie Broadband, covering political, economic, social, tech, environmental & legal aspects.

Helps support discussions on external risk and market positioning during planning sessions.

Preview Before You Purchase

Aussie Broadband PESTLE Analysis

The preview reflects the complete Aussie Broadband PESTLE Analysis you’ll receive.

This file includes detailed Political, Economic, Social, Technological, Legal, & Environmental factors.

It’s fully formatted & ready for immediate download.

All data presented is identical to the purchased version.

No changes—get started right away!

PESTLE Analysis Template

Navigate Aussie Broadband’s landscape with our PESTLE Analysis. Uncover how political stability, economic trends, and technological advancements impact their strategies. Social factors and environmental regulations are also covered. Grasp legal constraints and the opportunities they offer. Buy the full version for expert insights. Get it now!

Political factors

Aussie Broadband operates within Australia's heavily regulated telecommunications sector. The ACMA and ACCC enforce competition and consumer protection. Regulatory shifts can drastically affect the company. For example, the government's 2024 review of the Universal Service Obligation could reshape funding for regional services.

NBN Co, a government-owned wholesale broadband provider, significantly influences Aussie Broadband's operations. Policy decisions on NBN's pricing and infrastructure directly affect Aussie Broadband's costs. In 2024, NBN Co's revenue reached $5.5 billion, showcasing its market dominance. Changes to NBN's regulatory framework can alter Aussie Broadband's profitability and service offerings.

The Australian government focuses on boosting competition in telecommunications. This is crucial for Aussie Broadband, which competes with major firms. Policies address fair play and ownership concentration, impacting its market position. The ACCC keeps a close eye on competition in telecom services. In 2024, the ACCC reported ongoing scrutiny of market practices.

Telecommunications-Specific Legislation

The Australian telecommunications sector is heavily regulated by specific legislation. Key laws include the Telecommunications Act 1997 and the Competition and Consumer Act 2010, which govern licensing, consumer protection, and infrastructure access. Amendments to these acts, like those seen in 2024 regarding cybersecurity, can significantly impact companies. These legal changes introduce new compliance requirements or open new market prospects for providers like Aussie Broadband.

Regional Connectivity Initiatives

Government programs boosting regional telecom services offer Aussie Broadband chances and hurdles. These initiatives could broaden the customer pool, but also add rules and partnerships affecting how they set up and spend. For instance, the Australian government has committed $3.5 billion to improve regional connectivity through the Mobile Black Spot Program and other initiatives as of early 2024. This funding supports infrastructure upgrades and service expansions, potentially benefiting Aussie Broadband.

- $3.5 billion government commitment to regional connectivity.

- Mobile Black Spot Program and other initiatives.

- Potential for increased customer base in regional areas.

- Need to comply with program requirements.

Aussie Broadband faces impacts from Australia's telecom policies. The government's focus on competition affects its market position, monitored by the ACCC, with recent scrutiny reported in 2024. Government programs, like the $3.5 billion regional connectivity commitment, present opportunities and challenges. Legislative changes, such as 2024 cybersecurity amendments, introduce new compliance or market prospects.

| Political Factor | Impact on Aussie Broadband | Data/Example (2024/2025) |

|---|---|---|

| Regulation of Telecom Sector | Compliance costs and market access | 2024: ACMA and ACCC enforcement; review of Universal Service Obligation |

| NBN Co's Influence | Pricing, infrastructure, and competition | 2024: NBN Co's revenue reached $5.5 billion; ongoing policy adjustments |

| Government Initiatives | Funding, partnerships, and market reach | Early 2024: $3.5B for regional connectivity; Mobile Black Spot Program |

Economic factors

The Australian economic climate and cost of living significantly affect consumer behavior in the telecom sector. High inflation and rising living costs can lead consumers to cut back on non-essential services, potentially impacting Aussie Broadband's ARPU and subscriber growth. In early 2024, inflation remained a concern, with the CPI at 3.6% in the March quarter, influencing consumer spending patterns. This economic pressure could drive demand for more budget-friendly telecom plans.

As a retail service provider, Aussie Broadband faces direct impacts from NBN Co's wholesale costs. In 2024, NBN Co's pricing adjustments affected providers' margins. Aussie Broadband's cost of goods sold is heavily influenced by these wholesale charges. This shapes their ability to offer competitive retail prices in the market. Their financials reflect these cost dynamics.

Labor shortages in the Australian telecommunications sector, as of early 2024, are a significant concern, potentially inflating operational costs. The Australian Bureau of Statistics indicated a 3.7% rise in wage costs in the information media and telecommunications sector in the year to December 2023. These shortages could hinder Aussie Broadband's infrastructure deployment and service delivery capabilities. Furthermore, the cost of skilled labor is rising with specialized roles like network engineers and cybersecurity experts being in high demand.

Global Economic Conditions

Global economic trends indirectly affect Aussie Broadband. High inflation and rising capital costs can increase infrastructure investment expenses. These conditions also influence equipment costs and the overall economic climate. For instance, in early 2024, global inflation remained a concern, impacting borrowing costs.

- Inflation rates are still above central bank targets in many countries.

- Interest rate hikes by central banks have increased the cost of capital.

- Supply chain issues continue to impact equipment costs.

Competition and Pricing Pressure

The Australian broadband market is highly competitive, with major players like Telstra and smaller providers vying for customers, leading to pricing pressure. Aussie Broadband faces the challenge of balancing competitive pricing to attract and retain customers while managing profitability. This includes navigating wholesale costs and intense market competition. For instance, in 2024, the average monthly broadband cost in Australia was around $75.00, reflecting the competitive environment.

- Telstra and Optus hold significant market share, intensifying competition.

- Aussie Broadband must innovate to differentiate and justify its pricing.

- Wholesale costs and infrastructure investments influence pricing strategies.

Economic factors heavily shape Aussie Broadband's performance, especially with rising living costs impacting consumer spending. Inflation, at 3.6% in early 2024, influences spending habits. Additionally, labor shortages, coupled with competition, pressure costs. Market dynamics and global trends further influence its financial outcomes.

| Factor | Impact | Data (Early 2024) |

|---|---|---|

| Inflation | Reduced consumer spending | CPI: 3.6% |

| Labor Shortages | Increased operational costs | Wage rise: 3.7% (Dec 2023) |

| Competition | Pricing pressures | Avg. Broadband cost: ~$75/month |

Sociological factors

Internet usage is booming, with over 90% of Australians online as of early 2024. This surge fuels demand for faster, more reliable broadband. Streaming, remote work, and online education are key drivers, pushing consumers to seek superior internet services. Aussie Broadband benefits directly from this trend, as evidenced by its growing subscriber base and revenue figures in 2024.

Digital inclusion is vital, especially in rural Australia. In 2023, the Australian Digital Inclusion Index showed disparities, with rural areas lagging. Aussie Broadband's efforts to extend its services and address affordability are crucial. For instance, in 2024, the company invested heavily to improve services in underserved areas.

Australian consumers prioritize excellent customer service and dependable network performance. Aussie Broadband's strong reputation is a key differentiator. In 2024, 85% of Australian consumers cited customer service as a critical factor in their telecom choices. This focus reflects a significant sociological influence on consumer decisions. Aussie Broadband's customer satisfaction score was 88% in Q1 2024.

Work-from-Home Trends

The surge in remote work significantly affects Aussie Broadband. Reliable home internet is now crucial for many Australians, boosting demand for faster, more dependable services. This shift influences the types of plans and services consumers seek. In 2024, over 40% of Australian employees worked from home at least some of the time, highlighting this trend.

- Increased demand for higher-speed internet plans.

- Greater emphasis on service reliability and customer support.

- Potential for increased market competition.

Social Media and Online Activity

The surge in social media use and online activities, such as streaming and e-commerce, fuels the need for dependable internet and data. These digital behaviors influence how consumers use and value internet services. Australians spend an average of 6 hours and 17 minutes online daily, highlighting the significance of constant connectivity. This demand is further driven by the growing popularity of online shopping, with e-commerce sales in Australia reaching $54.7 billion in 2023.

- 6+ hours daily online use.

- E-commerce sales reached $54.7B in 2023.

Australians are increasingly reliant on the internet, driving demand for reliable, fast broadband. Remote work and online activities heavily influence internet needs, affecting service choices. Customer service is crucial, with high expectations. Aussie Broadband aligns with these trends.

| Sociological Factor | Impact on Aussie Broadband | Data/Statistics (2024/2025) |

|---|---|---|

| Internet Usage | Increased demand for high-speed plans. | 90%+ Australians online; 6+ hrs daily online; E-commerce sales hit $54.7B (2023). |

| Digital Inclusion | Opportunities to expand services, especially in underserved areas. | Investments in rural areas in 2024 to address the digital divide. |

| Customer Service | Enhances brand reputation, supports subscriber growth. | 85% of Aussies cite customer service as vital, Aussie Broadband’s customer satisfaction score 88% (Q1 2024). |

Technological factors

The NBN's tech evolution, including FTTP and HFC upgrades, directly affects Aussie Broadband's service offerings. In 2024, NBN Co aimed to have 8.5 million premises ready for FTTP. These upgrades boost speeds and service quality, vital for competitiveness. Aussie Broadband must adapt to these changes to maintain its market position. The company's revenue was $795.2 million in FY24.

The evolution of 5G, satellite internet, and IoT presents both opportunities and challenges for Aussie Broadband. 5G's expansion could drive demand for faster, more reliable connectivity. Satellite internet might offer alternatives in underserved areas, potentially impacting fixed broadband. IoT's growth increases the need for robust, widespread connectivity, benefiting companies like Aussie Broadband. In 2024, 5G coverage reached 95% of the Australian population, and satellite internet is expanding.

The surge in data consumption, fueled by streaming and gaming, demands continuous network enhancements. Aussie Broadband must invest in infrastructure to handle rising data loads and ensure quality service. In 2024, data usage in Australia grew by 30%, prompting significant network upgrades.

Cybersecurity and Network Resilience

Cybersecurity is paramount as Aussie Broadband's operations heavily rely on digital infrastructure. Threats like data breaches and cyberattacks necessitate robust security measures to protect customer data and maintain operational integrity. Network resilience is crucial; Aussie Broadband must ensure its network can withstand disruptions, offering consistent service.

- Aussie Broadband invested $1.6 million in cybersecurity in FY23.

- The company reported a 99.9% network uptime.

- Cybersecurity incidents increased by 23% in 2024.

Technological Innovation in Service Delivery

Technological innovation is reshaping service delivery for Aussie Broadband. Advancements in software-based networks, automation, and AI are key. These technologies boost efficiency and improve customer experience. New services are also enabled by these advancements. For instance, the global AI in telecom market is expected to reach $11.2 billion by 2025.

- AI-powered network management tools are increasingly used to optimize network performance, as seen with companies like Nokia and Ericsson.

- Automation reduces operational costs by up to 30% in some telecom companies.

- The adoption of 5G technology is driving innovation in service delivery.

Aussie Broadband navigates evolving NBN tech, including FTTP expansions impacting service offerings, while also addressing challenges posed by 5G, satellite internet, and IoT. Cybersecurity, network resilience, and infrastructure upgrades are crucial due to increasing data consumption. Innovation via software-based networks, automation, and AI is critical.

| Aspect | Details | Impact |

|---|---|---|

| NBN Tech | FTTP/HFC upgrades; $795.2M FY24 revenue | Boosts speeds, competitiveness; needs adaptation. |

| 5G/Satellite/IoT | 95% 5G coverage; satellite expansion | Demand for faster connectivity; network changes. |

| Data Consumption | 30% data usage growth in 2024 | Requires infrastructure investment. |

Legal factors

Aussie Broadband is subject to Australian telecommunications laws. These laws cover licensing, competition, and consumer rights. The company must adhere to the Telecommunications Act 1997 and related regulations. In 2024, the Australian Communications and Media Authority (ACMA) reported over 7 million complaints about telco services.

Aussie Broadband must comply with Australian Consumer Law, ensuring fair practices. This includes transparent advertising and contracts, crucial for customer trust. They are also subject to specific telecommunications regulations. In 2024, the Australian Communications and Media Authority (ACMA) received over 14,000 complaints about telcos.

Aussie Broadband faces legal obligations regarding privacy and data retention, crucial for its services. Compliance with the Privacy Act 1988 is essential to protect customer data. This includes data handling, storage, and security practices. Data retention laws might mandate keeping certain customer data for specific periods. Failure to comply could result in hefty fines and reputational damage.

Competition and Anti-competitive Conduct Rules

The legal landscape for Aussie Broadband involves stringent competition and anti-competitive conduct regulations. These rules, overseen by the Australian Competition and Consumer Commission (ACCC), are designed to foster fair market practices within the telecommunications industry. Aussie Broadband must comply with these regulations to avoid penalties and maintain its operational license. Breaching these rules can lead to significant fines and reputational damage.

- The ACCC has taken action against several telcos for misleading conduct, with penalties reaching millions of dollars in 2024.

- Aussie Broadband reported revenue of $798.1 million in FY24, a 16% increase year-on-year.

- The company's net profit after tax (NPAT) was $13.8 million in FY24.

Mandatory Reporting and Compliance

Aussie Broadband must comply with mandatory reporting and regulations set by the ACMA and ACCC. These bodies oversee telecommunications in Australia. The company must report on service quality and consumer complaints. Non-compliance can lead to significant penalties and legal issues.

- ACMA's compliance framework includes audits and investigations.

- In 2024, the ACCC reported over 40,000 complaints about internet services.

- Aussie Broadband's adherence to these laws is crucial for its operational license.

Aussie Broadband faces rigorous legal obligations including adherence to the Telecommunications Act 1997 and consumer laws. In 2024, ACMA received thousands of complaints against telcos, highlighting the need for compliance. Failure to adhere to regulations can result in fines and reputational harm.

| Legal Area | Regulation | Impact on Aussie Broadband |

|---|---|---|

| Competition | ACCC oversight | Compliance to avoid penalties |

| Consumer Rights | Australian Consumer Law | Transparent practices, customer trust |

| Data Privacy | Privacy Act 1988 | Secure data, avoid fines |

Environmental factors

Australia's climate is changing, with more extreme weather events. Increased floods and bushfires threaten Aussie Broadband's infrastructure. The company must ensure its network can withstand these environmental challenges. In 2024, the cost of natural disasters reached $6.5 billion in Australia, highlighting the financial impact of climate change.

The telecommunications sector, including Aussie Broadband, is energy-intensive due to network infrastructure and data centers. There's growing pressure to cut carbon footprints, potentially through regulations. In 2024, the industry saw increased scrutiny regarding sustainability. Aussie Broadband might need to invest in energy-efficient tech to comply, impacting costs.

Aussie Broadband faces environmental challenges from e-waste due to the disposal of electronic equipment. Sustainable practices for equipment lifecycle management and waste reduction are crucial. The global e-waste volume reached 53.6 million metric tons in 2019. Australia generated 507,000 tonnes of e-waste in 2020-2021.

Environmental Regulations and Reporting

Aussie Broadband needs to consider the evolving landscape of environmental regulations. There's a growing emphasis on sustainability, which might bring in new rules about environmental impact reporting. This could mean Aussie Broadband has to disclose its climate-related data. The Australian government is increasing focus on environmental sustainability, which could lead to more stringent regulations.

- In 2024, Australia's emissions reduction target is at least 43% below 2005 levels by 2030.

- Companies may face mandatory climate-related disclosures.

Community Concerns about Infrastructure Deployment

Community concerns regarding Aussie Broadband's infrastructure deployment, including towers and cabling, are relevant environmental factors. Visual impact and health perceptions can influence public sentiment and project approvals. Addressing these concerns and adhering to environmental planning regulations are crucial for successful deployments. These regulations often mandate environmental impact assessments.

- In 2024, the Australian Communications and Media Authority (ACMA) reported that 98% of Australians had access to mobile broadband, highlighting the pervasive nature of telecommunications infrastructure.

- A 2023 study by the University of Melbourne found that community opposition to infrastructure projects, including telecommunications, increased by 15% compared to 2020.

- Environmental impact assessments can cost between $50,000 and $500,000 per project, depending on complexity.

Aussie Broadband confronts environmental challenges from climate change, including extreme weather events, such as bushfires, costing the Australian economy $6.5 billion in 2024. Sustainability is a growing concern, with increased scrutiny and the potential for new regulations to reduce the company’s carbon footprint. E-waste management, community opposition, and impact assessments will also affect the company's operations, due to growing regulatory and public focus on these matters.

| Environmental Factor | Impact on Aussie Broadband | Supporting Data (2024-2025) |

|---|---|---|

| Extreme Weather | Infrastructure Damage & Increased Costs | Natural disasters in Australia cost $6.5B in 2024. |

| Sustainability Regulations | Increased Operating Expenses and Compliance Burden | Australia's emissions reduction target is at least 43% below 2005 levels by 2030. |

| E-waste Management | Increased Operational & Waste Disposal Costs | Australia generated 507,000 tonnes of e-waste in 2020-2021. |

PESTLE Analysis Data Sources

This Aussie Broadband PESTLE Analysis relies on government publications, financial reports, industry analysis, and academic research.