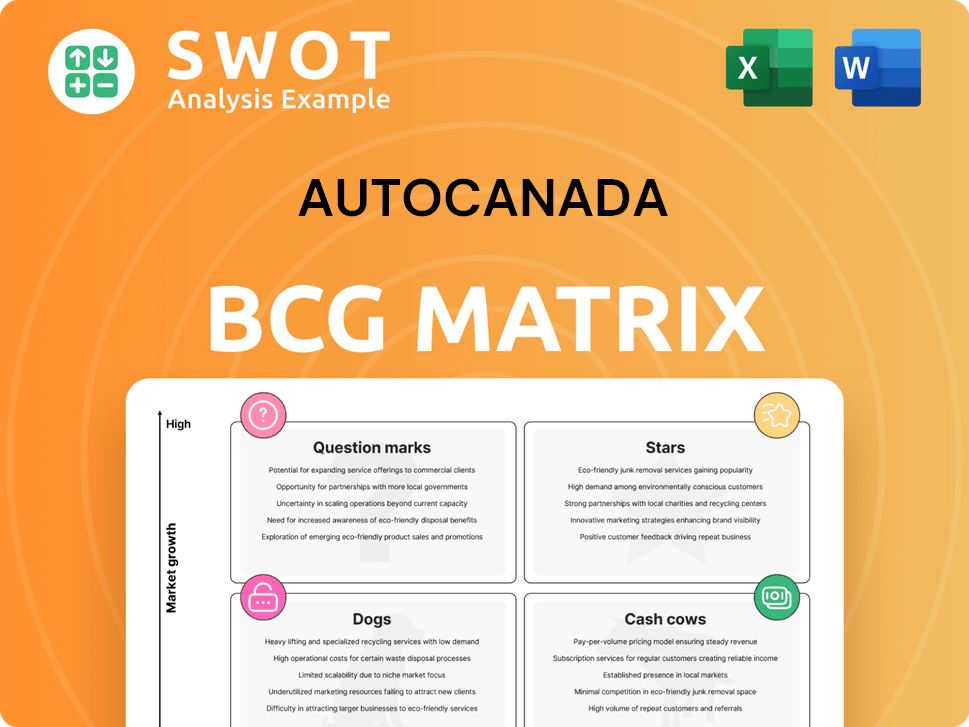

AutoCanada Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AutoCanada Bundle

What is included in the product

Strategic assessment of AutoCanada's diverse automotive units across all BCG Matrix categories.

Export-ready design for quick drag-and-drop into PowerPoint.

What You See Is What You Get

AutoCanada BCG Matrix

The AutoCanada BCG Matrix preview mirrors the purchased version precisely. This is the complete, downloadable document, offering an insightful analysis of AutoCanada's business units. Your final version, free of any alterations, is ready for immediate implementation.

BCG Matrix Template

AutoCanada's BCG Matrix helps visualize its diverse automotive portfolio. Question marks highlight growth potential, while cash cows generate steady revenue. Analyzing Stars reveals market leaders and Dogs expose underperformers. This snapshot offers a glimpse into AutoCanada’s strategic landscape. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

AutoCanada's Canadian dealership operations are its strongest asset. The company's 64 dealerships across Canada, featuring 25 brands, generate substantial revenue. In 2024, these dealerships contributed significantly to the firm’s profitability, reflecting their market dominance. Investments to improve customer experience and efficiency will secure their leadership.

AutoCanada's 29 collision centres offer substantial growth potential and boost customer loyalty. This network enables AutoCanada to capture a larger portion of the auto repair market. In 2024, the collision segment's revenue contributed significantly to AutoCanada's overall performance. Investing in technology and skilled technicians will enhance the centres' competitiveness.

AutoCanada's Parts and Service division shines, fueled by robust demand and solid customer backing. This segment consistently generates revenue, bolstering profitability. In Q3 2024, service revenue grew, mirroring the trend. Digital enhancements could boost customer engagement and solidify its crucial role in revenue.

Operational Transformation Plan

AutoCanada's Operational Transformation Plan is a key initiative, aiming for substantial cost savings. This plan is targeting $100 million in annual run-rate cost savings by the end of 2025. The plan focuses on streamlining operations and centralizing functions. Successful implementation could lead to improved financial outcomes.

- Standardizing dealership operations to improve efficiency.

- Enhancing cost controls across all departments.

- Improving inventory management to reduce holding costs.

- Centralizing administrative functions for better oversight.

Strategic Realignment Initiatives

AutoCanada's strategic moves, like selling off non-essential assets and restructuring, show they're serious about sharpening their focus. This helps free up cash to invest in what matters most and boost profits. By sticking to this plan and executing it well, AutoCanada aims to increase its value over time. In 2024, AutoCanada reported revenues of $3.6 billion, a slight decrease from $3.7 billion in 2023, showcasing the impact of these realignments.

- Portfolio Optimization: AutoCanada is actively managing its portfolio to concentrate on core business areas.

- Capital Allocation: Proceeds from asset sales are being strategically reinvested.

- Operational Efficiency: Restructuring aims to streamline operations.

- Value Creation: These initiatives are designed to create long-term shareholder value.

AutoCanada's Canadian dealerships, collision centres, and parts and service division are key "Stars." These segments generate strong revenue and have growth potential. Revenue in these areas significantly contributed to the firm's overall profitability in 2024. Continued investments can lead to sustained market leadership.

| Segment | 2024 Revenue Contribution | Growth Drivers |

|---|---|---|

| Canadian Dealerships | Significant | Customer experience, efficiency |

| Collision Centres | Significant | Technology, skilled technicians |

| Parts & Service | Consistent | Digital enhancements |

Cash Cows

AutoCanada's franchised dealerships generate dependable revenue. The company leverages brand recognition and manufacturer backing, cutting marketing costs and building trust. Strong manufacturer ties and streamlined operations are key. In 2024, AutoCanada's revenue was approximately $3.8 billion, highlighting its financial stability.

Used vehicle sales are a crucial revenue source for AutoCanada. Their vast dealership network and online presence give them a strong foothold in the used car market. In Q3 2024, used vehicle sales accounted for a substantial portion of total revenue. Inventory management and competitive pricing are key to boosting profits in this area. AutoCanada's focus on this segment is reflected in its strategic initiatives.

Finance and Insurance (F&I) products are a significant revenue source for AutoCanada, offering high profit margins. In 2024, F&I contributed substantially to the company's revenue, boosting profitability per vehicle. AutoCanada's focus on transparent pricing, and regulatory compliance fosters customer trust. This approach drives F&I product sales, enhancing overall financial performance.

Geographic Diversification (Canadian Operations)

AutoCanada's geographic diversification across eight Canadian provinces serves as a robust foundation for its revenue. This strategy grants access to varied regional economies and customer preferences, enhancing stability. Adapting to local market conditions and maintaining a solid presence in key areas are vital for consistent results. This approach helped AutoCanada achieve approximately $3.7 billion in revenue in 2023.

- Exposure to diverse regional economies.

- Adaptation to local market conditions.

- Stable revenue base.

- Approximately $3.7 billion in revenue in 2023.

Customer Loyalty Programs

Customer loyalty programs are a Cash Cow for AutoCanada, boosting customer retention and repeat business. These programs offer exclusive benefits and personalized service, strengthening customer relationships. Investing in CRM systems enhances program effectiveness, optimizing customer engagement and satisfaction. In 2024, companies with robust loyalty programs saw a 15-20% increase in customer lifetime value.

- Enhanced customer retention rates.

- Increased repeat business and sales.

- Improved customer lifetime value.

- Better customer engagement.

AutoCanada's Cash Cows, characterized by high market share in slow-growing markets, ensure consistent revenue and profits. These include franchised dealerships, used vehicle sales, and F&I products, all contributing to financial stability. Geographic diversification and robust customer loyalty programs further solidify their position.

| Aspect | Description | 2024 Data |

|---|---|---|

| Revenue Sources | Key revenue drivers for AutoCanada | Franchised dealerships, Used Vehicle Sales, Finance & Insurance (F&I) |

| Financial Performance | Financial indicators | 2024 Revenue approx. $3.8B, F&I boosts per-vehicle profit |

| Strategic Initiatives | Customer loyalty programs and geographic diversification | Loyalty programs increased customer lifetime value by 15-20% |

Dogs

AutoCanada's U.S. operations, Leader Automotive Group, consistently lost money. These operations were divested because they struggled to be profitable, creating financial strain. The U.S. business was a drag on AutoCanada's overall performance. In 2024, the company finalized the sale of its U.S. assets, as reported.

RightRide, AutoCanada's venture offering credit solutions, faced financial struggles. The operations, aimed at credit-challenged customers, led to substantial losses. AutoCanada closed all RightRide locations. This move aimed to reduce debt and boost efficiency. The closure should help AutoCanada focus on its profitable operations.

AutoCanada strategically offloaded non-core Stellantis dealerships to boost profitability. These dealerships, underperforming, didn't fit the company's growth plans. The move allows capital reallocation to better-performing segments. This strategy aligns with AutoCanada's goal to enhance financial outcomes. In 2024, AutoCanada's strategic shifts are evident.

Underperforming Franchises (Terminated)

AutoCanada has strategically terminated underperforming franchises to streamline its operations. This includes locations like the Volvo franchise at Bloomington/Normal Auto Mall. These terminations aim to boost profitability by focusing on high-performing brands. The move reflects AutoCanada's efforts to improve efficiency and returns.

- Volvo's Q3 2024 sales decreased by 10% year-over-year.

- AutoCanada's 2024 operating margin is targeted to improve by 1.5%.

- The termination of underperforming franchises is a part of the company's cost-cutting strategy.

Excessive Debt and Leverage

AutoCanada faces considerable financial risks due to high debt and leverage. The company's debt-to-EBITDA ratio has been a concern. In 2024, AutoCanada had to amend its senior credit facility. Reducing debt and boosting profitability are key to improving its financial health.

- Elevated Debt-to-EBITDA Ratio: Indicates a high level of financial risk.

- Senior Credit Facility Amendments: Required to manage debt obligations.

- Need for Profitability Improvement: Essential for financial stability.

- Focus on Debt Reduction: Critical for mitigating leverage risks.

AutoCanada's "Dogs" include struggling U.S. operations and RightRide, resulting in losses. Strategic terminations of underperforming franchises aimed to cut costs. These moves, part of a broader cost-cutting strategy, were essential. The company's strategic shift aims to reduce debt and improve profitability.

| Category | Details |

|---|---|

| U.S. Operations | Divested due to consistent losses. |

| RightRide | Closed due to financial struggles. |

| Franchise Terminations | Focus on high-performing brands. |

Question Marks

The EV market's growth offers AutoCanada chances but also hurdles. EV adoption is increasing; thus, the company must adjust its operations. In 2024, EV sales rose significantly, with Tesla leading. Investment in infrastructure and training is crucial. Navigating price changes and consumer acceptance is essential.

The used EV market is an emerging segment, offering growth opportunities. AutoCanada must strategize sourcing, pricing, and sales to gain market share. Addressing consumer concerns regarding battery life and residual values is critical. In 2024, used EV sales are expected to rise, with Tesla models leading the way. AutoCanada's success hinges on effectively navigating this evolving landscape.

Digitalization and online sales are reshaping auto retail. AutoCanada must boost its digital presence to engage customers effectively. A smooth online-to-offline experience can boost satisfaction. In 2024, online car sales grew, indicating a need for investment. AutoCanada's digital strategy is crucial for future growth.

Emerging Automotive Technologies

Emerging automotive technologies are a question mark for AutoCanada, requiring careful strategic consideration. Autonomous driving and connected car services offer opportunities for innovation. AutoCanada must adapt its business model to incorporate these technologies. Partnerships and R&D investments are key for future positioning.

- The global autonomous vehicle market was valued at $66.45 billion in 2023.

- Connected car services are projected to reach $200 billion by 2027.

- AutoCanada's R&D spending in 2024 should increase by 15% to stay competitive.

- Strategic partnerships are necessary to navigate these technological shifts.

Adaptation to Changing Consumer Preferences

Adapting to shifting consumer tastes is crucial for AutoCanada. The surge in demand for SUVs and hybrid vehicles necessitates changes in inventory management and marketing efforts. AutoCanada must closely track consumer trends, adjusting its vehicle offerings to stay relevant. A flexible strategy is vital for AutoCanada to remain competitive in the evolving automotive market.

- In 2024, the SUV market share continued to grow, accounting for over 50% of new vehicle sales in North America.

- Hybrid vehicle sales increased by 20% in 2024, reflecting growing consumer interest in fuel efficiency.

- AutoCanada's strategic focus on these segments is essential for maintaining market share.

- Adjusting inventory to meet this demand is key.

Emerging automotive technologies present uncertainties for AutoCanada, demanding careful strategic planning. Autonomous driving and connected car services offer innovation opportunities; however, adaptation is essential. Partnerships and R&D investments are vital for AutoCanada's future positioning, with a focus on evolving technologies.

| Category | Details | 2024 Data |

|---|---|---|

| Autonomous Vehicle Market | Global market value | $75B (projected) |

| Connected Car Services | Market projection by 2027 | $200B |

| AutoCanada R&D | Increase in spending | 15% (recommended) |

BCG Matrix Data Sources

The AutoCanada BCG Matrix uses company filings, market analysis, and financial data from industry publications to create insightful strategic evaluations.