AutoNation Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AutoNation Bundle

What is included in the product

Tailored analysis for AutoNation's product portfolio across the BCG Matrix.

Export-ready design allows quick insertion into PowerPoint presentations, relieving the hassle of manual creation.

Full Transparency, Always

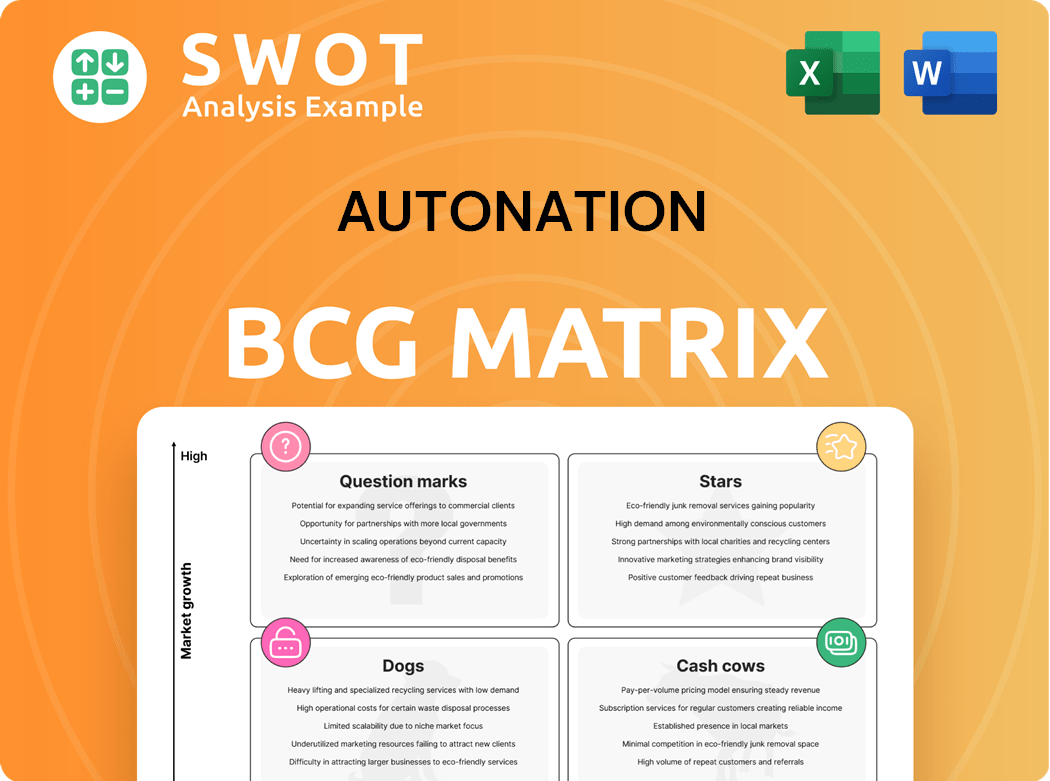

AutoNation BCG Matrix

The AutoNation BCG Matrix you're viewing is the final, downloadable product. It's a complete, ready-to-use report you'll receive after purchase, perfect for immediate strategic analysis.

BCG Matrix Template

AutoNation's BCG Matrix reveals key product positions, from market leaders to potential risks. Understanding these placements is crucial for smart resource allocation and strategic decisions. This preview offers a glimpse into their portfolio's dynamics. See the complete quadrant assignments and actionable strategies to enhance your AutoNation investment.

Stars

AutoNation's new vehicle sales are a "Star" in its BCG Matrix, fueled by robust growth. In Q4 2024, same-store unit sales surged by 12%, highlighting strong market position. This growth is supported by sequential unit profitability gains. AutoNation's success in capturing market share solidifies its leadership in auto retail.

AutoNation's premium luxury segment shines as a Star. It saw a 6% increase in segment income in Q4 2024. Revenue climbed 10% during the same period. This growth indicates strong performance and market demand. Further investment could boost this segment's success.

AutoNation Finance experienced a turnaround in 2024, boosting loan originations to $1.1 billion. The strategic sale of legacy subprime loans improved its financial standing. Q4 2024 saw a $1 million income, a significant leap from a $4 million loss the year before. This growth underscores AutoNation's improving financial health.

After-Sales Service

AutoNation's after-sales service shines as a star in its BCG matrix, fueled by steady growth. This segment saw a 5% rise in same-store gross profit in Q4 2024. The increasing complexity of modern vehicles boosts demand for specialized maintenance. AutoNation's dedication to customer satisfaction fosters loyalty and repeat service visits.

- Q4 2024 same-store gross profit increase: 5%

- Focus: Customer experience and service quality.

- Benefit: Increased complexity of vehicles.

Strategic Acquisitions

AutoNation's strategic acquisitions are key to its expansion. The purchase of Groove Ford and Mazda in Colorado in March 2024 boosted its presence. These moves increase revenue and market share significantly. Strategic acquisitions solidify AutoNation's "Star" status in its BCG Matrix.

- In 2024, AutoNation acquired dealerships that added roughly 5,000 vehicle sales.

- Strategic acquisitions are a key driver of AutoNation's revenue growth.

- AutoNation aims to increase its market footprint through acquisitions.

- These moves enhance AutoNation's position as a leading automotive retailer.

AutoNation's "Stars" are thriving segments, with significant growth potential. New and premium luxury vehicle sales are high-growth, high-share. AutoNation Finance and after-sales services are also gaining traction. Strategic acquisitions enhance "Star" positions.

| Segment | Q4 2024 Growth | Strategic Actions |

|---|---|---|

| New Vehicles | 12% unit sales increase | Market share capture |

| Premium Luxury | 10% revenue increase | Segment income boost |

| AutoNation Finance | $1M income in Q4 | Strategic loan sales |

| After-Sales Service | 5% gross profit increase | Customer experience focus |

Cash Cows

AutoNation's used vehicle sales are a cash cow, generating consistent revenue. In Q3 2023, used vehicle revenue reached approximately $2.7 billion. The segment's profitability is aided by effective inventory control. Strategic pricing enhances cash flow from this reliable income source.

Customer Financial Services (CFS) are a cash cow for AutoNation, contributing to a steady revenue stream. In Q4 2024, CFS saw a 6% increase in same-store gross profit. This segment thrives on financing needs, which are consistent in the auto market. AutoNation's ability to offer competitive rates and solid service is key.

AutoNation's parts and service segment is a cash cow, consistently generating revenue through vehicle maintenance. Their extensive network of service centers ensures steady demand. Investments in tech and training are key. In 2024, this segment contributed significantly to overall revenue, with service revenue up.

Sunbelt Metropolitan Areas

AutoNation's focus on Sunbelt metropolitan areas positions it favorably as a cash cow. These regions, including Florida, California, and Texas, offer a consistent customer base, vital for stable revenue. In 2024, these states likely contributed significantly to AutoNation's total sales, reflecting their strong market presence. This strategic concentration supports sustained profitability.

- Sunbelt states like Florida and Texas account for a substantial portion of AutoNation's revenue.

- AutoNation has a strong presence in high-growth Sunbelt markets.

- These regions provide a stable customer base.

- This strategic focus supports sustained profitability.

DRV PNK Campaign

AutoNation's DRV PNK campaign, a key cash cow, boosts brand image and customer loyalty. This initiative supports cancer research, creating a positive brand association. Continuous community involvement strengthens customer engagement, potentially driving sales. In 2023, AutoNation reported over $27 billion in revenue, highlighting the campaign's impact.

- Supports cancer research and treatment, enhancing brand perception.

- Long-term commitment fosters positive community association.

- Increased customer engagement can lead to higher sales figures.

- 2023 revenue over $27 billion reflects the campaign's influence.

AutoNation's "Cash Cows" consistently generate substantial revenue. They include used vehicle sales and customer financial services. Parts and services also contribute, along with a focus on Sunbelt markets and the DRV PNK campaign.

| Cash Cow | Key Driver | 2024 Data |

|---|---|---|

| Used Vehicles | Sales Volume | Q3 Revenue ~$2.7B |

| Customer Financial Services | Financing & Service | Q4 profit +6% |

| Parts & Service | Maintenance | Service Revenue Up |

| Sunbelt Focus | Market Presence | Significant Revenue |

Dogs

Divested stores, like the seven Domestic stores AutoNation sold in 2023, fit the "Dogs" category. These stores likely faced low growth and market share, impacting profitability. AutoNation's 2023 divestitures totaled approximately $200 million. Selling these underperformers enables focus on better investments.

Underperforming AutoNation dealerships, deemed "Dogs" in the BCG Matrix, consistently lag behind the company average. These locations, potentially facing poor management or weak marketing, drag down profitability. In 2024, AutoNation's net income was $1.4 billion, with underperforming locations needing urgent attention. Closing or restructuring these sites could boost overall financial performance.

Segments with declining revenue, like AutoNation's Domestic segment, saw a 6% revenue decrease in 2024. These segments often fall into the 'Dogs' category within the BCG Matrix. AutoNation must decide whether to revitalize or divest these underperforming units. Revitalization efforts are key for boosting overall financial health.

Outdated Marketing Strategies

Outdated marketing strategies that fail to attract customers fall under the "Dogs" category. These strategies may be ineffective and out of sync with current market trends, requiring immediate attention. Refreshing marketing efforts with modern techniques and data-driven insights is crucial for improvement, especially in a competitive landscape like the automotive industry. For instance, AutoNation's Q3 2023 earnings showed a focus on digital marketing, indicating a shift away from less effective methods.

- Ineffective strategies are considered "Dogs."

- Outdated methods fail to attract customers.

- Modern techniques are necessary for improvement.

- Data-driven insights are crucial for success.

Inefficient Inventory Management

Inefficient inventory management at AutoNation, leading to high costs and slow turnover, is a "Dog" in the BCG Matrix. These practices drain capital and hurt profitability. Streamlining inventory and optimizing stock levels are key to improving efficiency and cash flow. For example, in 2024, excessive inventory can lead to a 15-20% increase in holding costs.

- High Carrying Costs: Inventory holding can increase costs by 15-20%.

- Slow Turnover: Leads to reduced profitability.

- Capital Tie-Up: Inefficient practices ties up capital.

- Inefficiency: Streamlining stock levels can help.

Dogs in AutoNation's BCG Matrix represent underperforming segments. In 2024, domestic sales declined 6%, affecting profitability. Outdated marketing and inventory issues also place segments in this category. AutoNation divested $200M in underperforming stores in 2023.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Domestic Sales | Revenue Decrease | -6% |

| Divestitures (2023) | Focus on Growth | $200M |

| Inventory Costs | Holding Cost Rise | 15-20% Increase |

Question Marks

AutoNation's AutoNation USA expansion, targeting 130+ stores by 2026, is a 'Question Mark.' It requires substantial investment. In Q3 2024, pre-owned sales rose, yet profitability varies. Focused marketing and customer experience are vital for growth.

AutoNation Mobile Service, a 'Question Mark' in its BCG Matrix, demands substantial investment. This mobile repair solution, previously RepairSmith, aims for market share growth. Success hinges on marketing, technician training, and customer adoption. In 2024, AutoNation's revenue was $27.4 billion, reflecting ongoing strategic initiatives.

AutoNation is investing in new technologies. These include online sales platforms and advanced diagnostic tools. These technologies aim to boost efficiency and customer experience. Careful implementation and integration are crucial. Monitoring their performance and ROI is key. In 2024, AutoNation spent $150 million on digital initiatives.

Electric Vehicle (EV) Initiatives

AutoNation is actively involved in electric vehicle (EV) initiatives, focusing on sales and service to capitalize on the growing EV market. This market is experiencing rapid expansion, yet faces infrastructure and customer demand challenges. Strategic investments in EV infrastructure and technician training are crucial for AutoNation's success in this evolving sector.

- AutoNation's EV sales increased significantly in 2024, reflecting market growth.

- Investments in EV charging stations and service centers are ongoing.

- Training programs for technicians to service EVs are being expanded.

- Customer demand for EVs is steadily rising, driving sales efforts.

Partnerships and Collaborations

AutoNation's strategic partnerships and collaborations are evolving, especially with the integration of new technologies. These alliances aim to boost revenue and improve services, which is a key part of their growth strategy. Careful management is essential to ensure these partnerships benefit both AutoNation and its partners. They are constantly looking for ways to enhance customer experiences and expand their service offerings.

- In Q4 2024, AutoNation reported a total revenue of $6.9 billion, reflecting their ongoing efforts.

- The company is focused on improving customer service through strategic initiatives.

- Partnerships include those with technology providers to enhance digital retail experiences.

- These collaborations are designed to create new revenue streams.

AutoNation's 'Question Marks' demand significant investment. These include new ventures like AutoNation USA and AutoNation Mobile Service, aimed at growing market share. Success depends on effective marketing, technician training, and strategic partnerships. In 2024, AutoNation's total revenue was $27.4 billion.

| Initiative | Description | Investment Focus |

|---|---|---|

| AutoNation USA | Expansion to 130+ stores by 2026 | Pre-owned vehicle sales, marketing |

| AutoNation Mobile Service | Mobile repair solution, RepairSmith | Technician training, market penetration |

| New Technologies | Online sales platforms, diagnostic tools | Digital initiatives, customer experience |

| EV Initiatives | EV sales and service expansion | Charging stations, technician training |

BCG Matrix Data Sources

AutoNation's BCG Matrix leverages financial statements, market analysis, and sales data to accurately position each business segment.