Auxly Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Auxly Bundle

What is included in the product

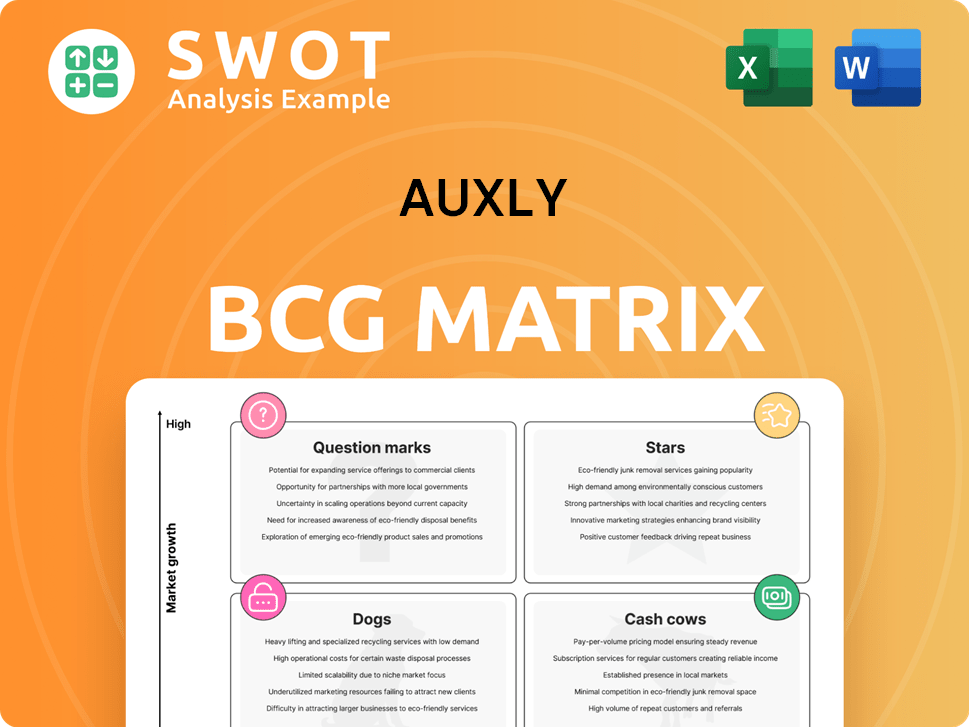

Analysis of Auxly's portfolio using the BCG Matrix, guiding investment, holding, and divestment strategies.

Clean, distraction-free view optimized for C-level presentation of Auxly's product portfolio.

What You See Is What You Get

Auxly BCG Matrix

The BCG Matrix displayed here is identical to the file you’ll receive after purchase. This professional analysis is designed for instant application. Get the full version—ready for presentations, strategy sessions, and in-depth review. Download immediately!

BCG Matrix Template

Auxly's BCG Matrix provides a snapshot of its diverse product portfolio. See how its cannabis brands rank: Stars, Cash Cows, Dogs, or Question Marks? Understand each product's market share and growth potential with this analysis. This tool helps investors and stakeholders assess the company’s strategic direction. This quick look barely scratches the surface.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Back Forty, a leading cannabis brand in Canada, has secured its position as the top brand. This success is backed by its focus on quality and affordability. The brand's all-in-one vape received the 'Innovation of the Year' award. Back Forty's sales in 2024 were approximately CAD 100 million.

Auxly's vape products are a strength, as shown by financial results and market share. The Back Forty brand's vape won 'Innovation of the Year'. Auxly should keep innovating and expanding in this category. This can drive future revenue growth. In Q3 2024, vape sales increased significantly.

Auxly's pre-roll products are Stars, holding the top spot nationally in the non-infused pre-roll category. Their success reflects strong market presence and consumer demand, driven by quality and innovation. In Q3 2023, Auxly's net revenue was $20.1 million. Introducing new pre-roll options allows Auxly to leverage this growth further.

Financial Performance in 2024

Auxly's "Stars" category shines brightly in 2024, showcasing robust financial performance. The company's revenue hit a record $122.3 million, a 21% rise from the previous year, signaling strong market presence. Gross margin climbed to 46% from 34% in 2023, reflecting improved operational efficiency. Adjusted EBITDA soared to $26.7 million, up from $1.5 million in 2023, demonstrating effective profit generation.

- Record net revenue of $122.3 million.

- 21% increase in revenue from the prior year.

- Gross margin improved to 46% in 2024.

- Adjusted EBITDA of $26.7 million in 2024.

Strategic Partnerships

Auxly's strategic partnerships are crucial for its business model, streamlining cultivation, processing, and distribution of cannabis products. These collaborations allow Auxly to utilize external expertise and resources, expanding its product range and market presence. In 2024, Auxly's partnerships helped it reach more consumers. The company's approach strengthens its competitive position and promotes future expansion.

- Partnerships with licensed producers.

- Distribution agreements with retailers.

- Technology and innovation collaborations.

- Supply chain optimization.

Auxly's pre-roll products, categorized as "Stars," dominate the non-infused pre-roll market. This segment's success is fueled by strong market presence and consumer demand, emphasizing quality and innovation. Auxly's focus on this category boosted its financial performance in 2024.

| Metric | 2023 | 2024 |

|---|---|---|

| Net Revenue | $101M | $122.3M |

| Gross Margin | 34% | 46% |

| Adjusted EBITDA | $1.5M | $26.7M |

Cash Cows

Dried flower continues to be a key product for Auxly, contributing a significant portion of sales. In 2024, dried flower accounted for approximately 40% of Canadian cannabis sales. Despite format shifts, dried flower provides a stable revenue stream, with the market valued at $1.8 billion in 2024. Auxly can secure its position by improving yields and maintaining quality.

The Auxly Leamington facility, a cash cow, boosted cultivation yields via plant density and post-harvest improvements. This facility reliably produces cannabis, meeting market needs. In 2024, Auxly reported increased production efficiency. Ongoing investment and optimization could boost cash flow further.

Auxly's wholesale bulk cannabis deals with licensed producers in Canada are a steady income source. These deals use Auxly's production capacity, boosting its financial health. Maintaining and growing these wholesale ties helps secure revenue and optimize output. In Q3 2023, Auxly reported a gross revenue of $20.3 million, with a focus on wholesale.

Cost Reduction Strategies

Auxly's cash cow status is reinforced by its cost reduction strategies. The company achieved an 8% reduction in Selling, General & Administrative (SG&A) expenses compared to 2023, showcasing strong cost management. Streamlining manufacturing improved gross margins. Continuing these efforts will boost profitability and cash flow.

- SG&A reduction: 8% decrease compared to 2023.

- Focus: Streamlining manufacturing processes.

- Goal: Enhance profitability and cash flow.

Established Distribution Channels

Auxly's established distribution network across all Canadian provinces is a key strength. This wide reach allows Auxly to access a broad customer base. Consistent sales are supported by this extensive market access.

- In 2024, Auxly's products were available in over 2,000 retail stores across Canada.

- Auxly's distribution network covers 100% of Canadian provinces.

- The company's retail presence has increased by 15% year-over-year.

- Distribution costs have been reduced by 8% through optimized logistics.

Auxly's "Cash Cows" in the BCG matrix are its stable, high-market-share products like dried flower and wholesale bulk cannabis, generating reliable revenue. These segments benefit from Auxly's established distribution, cost management, and efficient cultivation practices. In 2024, dried flower sales in Canada were around $1.8 billion.

Auxly’s Leamington facility, a key cash generator, maximizes production efficiency and wholesale deals contribute significantly to financial stability. Cost reductions and optimized logistics further support profitability. The company reported a 15% increase in retail presence in 2024, aiding revenue.

| Category | Details | 2024 Data |

|---|---|---|

| Dried Flower Market | Total Canadian Sales | $1.8 billion |

| SG&A Reduction | Expense Decrease vs. 2023 | 8% |

| Retail Presence | Year-over-year increase | 15% |

Dogs

Auxly's lack of international operations restricts its market to Canada, a competitive landscape. Canadian cannabis sales hit $5.3 billion in 2023. Without global expansion, Auxly misses chances to boost revenue. Diversifying into international markets could offer growth.

Auxly's position in the edibles market is not clearly defined by recent data. The edibles market is expected to grow substantially, fueled by evolving consumer tastes and new products. Without a strong presence, Auxly might miss out on capitalizing on this growth. The Canadian cannabis edibles market was valued at approximately $180 million in 2023.

Auxly's South American ventures don't appear to be top revenue generators. These operations might be struggling due to market dynamics or regulatory hurdles. A strategic move could involve restructuring or divesting to boost profitability. In Q3 2024, Auxly's focus was on core markets, with no specific South American revenue reported.

Cannabis 2.0 Products (If Underperforming)

If Auxly's Cannabis 2.0 products, like edibles and beverages, are underperforming, they could be "dogs" in the BCG Matrix. Initially, Auxly emphasized these products. However, their current revenue and profitability contributions need evaluation. For instance, in 2024, the edibles market grew, but Auxly's specific performance in this segment should be checked. A strategic review is crucial if these products underperform.

- Revenue Contribution: Assess the percentage of overall revenue derived from Cannabis 2.0 products versus dried flower and pre-rolls.

- Profitability Analysis: Determine the gross and net profit margins of Cannabis 2.0 products compared to other product categories.

- Market Share: Evaluate Auxly's market share in the Cannabis 2.0 segment and compare it to competitors.

- Strategic Alternatives: Consider options like product reformulation, marketing adjustments, or portfolio restructuring.

Older, Less Popular Brands

If brands like Parcel, Foray, Dosecann, or Kolab Project within Auxly's portfolio aren't thriving, they're "Dogs." These brands might have smaller market shares, less brand recognition, or dwindling sales figures. For example, in 2024, Auxly's Q3 revenue was approximately $16.4 million, indicating potential struggles for some brands. A strategic review could mean repositioning, rebranding, or even dropping underperforming brands.

- Low market share.

- Weak brand recognition.

- Declining sales.

- Q3 2024 revenue of $16.4M.

In the BCG Matrix, "Dogs" represent products or brands with low market share in a slow-growth market. Auxly's underperforming Cannabis 2.0 products or brands like Parcel could be considered "Dogs". The Q3 2024 revenue of $16.4M suggests potential struggles for some of Auxly's brands.

| Category | Q3 2024 Revenue | Status |

|---|---|---|

| Total Revenue | $16.4M | Overall |

| Cannabis 2.0 | Needs Assessment | Potential Dog |

| Underperforming Brands | Needs Review | Potential Dog |

Question Marks

The cannabis market is dynamic, with new product categories regularly surfacing. Auxly should consider investing in emerging areas like cannabis-infused drinks or topicals to stay competitive. These categories offer growth potential but demand thorough market analysis and product development strategies. For example, the infused beverage market is projected to reach $2 billion by 2024.

Auxly has listings in all Canadian provinces, yet market penetration varies. Provinces with high growth potential should be prioritized for expansion. This strategy could boost revenue, but requires attention to regulations and consumer demand. In 2024, the Canadian cannabis market is estimated to reach $5.8 billion.

With the Canadian cannabis market saturated, Auxly must seek international growth. Emerging legal markets worldwide offer Auxly's products expansion prospects. Navigating regulations, cultures, and logistics is crucial for success. In 2024, the global legal cannabis market is projected to reach USD 44.8 billion. However, international expansion is a complex undertaking.

Innovative Product Development

Innovative product development is a question mark for Auxly, meaning significant investment is needed with uncertain returns. Auxly must invest in research and development to stay competitive. New cannabis products can attract customers and boost revenue. However, innovation involves risk and potential product failure.

- Auxly's R&D spending in 2024 was approximately $3 million.

- The cannabis edibles market is projected to reach $4.5 billion by 2025.

- New product failure rates in the cannabis industry average around 30%.

Strategic Acquisitions

Auxly could explore strategic acquisitions to boost its market presence, product offerings, or geographical footprint. Acquiring smaller cannabis firms with matching assets or technologies could speed up Auxly's expansion and improve its competitive edge. However, thorough due diligence and integration are vital for successful acquisitions. In 2024, the cannabis industry saw several mergers and acquisitions, demonstrating this strategy's potential.

- Acquisitions can broaden Auxly's reach into new markets.

- They can add new products to the portfolio.

- Integration needs careful planning.

- Industry data from 2024 highlights the importance of strategic M&A.

Innovative product development is a question mark, demanding substantial investment with uncertain returns. Auxly's 2024 R&D spending was approximately $3 million. New product failure rates in the cannabis industry average around 30%. Thus, careful evaluation is needed.

| Metric | Data | Year |

|---|---|---|

| Auxly's R&D Spending | $3 million | 2024 |

| Edibles Market Projection | $4.5 billion | 2025 |

| New Product Failure Rate | 30% | Industry Average |

BCG Matrix Data Sources

The Auxly BCG Matrix leverages financial reports, market analysis, and industry trends from reputable sources to guide strategic decisions.