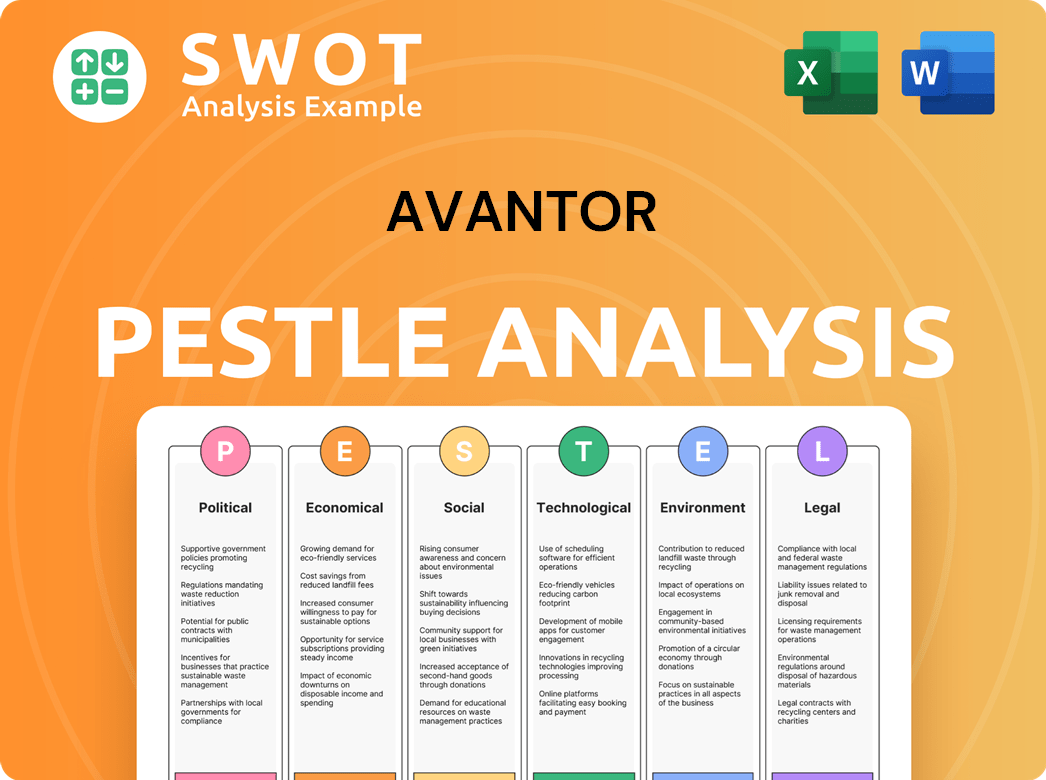

Avantor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avantor Bundle

What is included in the product

Analyzes how external macro-environmental factors affect Avantor.

Provides a concise version for easy review and understanding of market dynamics, and quickly actionable strategy.

What You See Is What You Get

Avantor PESTLE Analysis

What you see now is the exact Avantor PESTLE Analysis report. It is a finished, ready-to-use document. After your purchase, you will receive this same structured, insightful file. No edits are needed—it's instantly downloadable.

PESTLE Analysis Template

Gain a strategic edge with our in-depth PESTLE Analysis of Avantor, illuminating the external forces impacting its business. Understand the political, economic, social, technological, legal, and environmental factors shaping Avantor's trajectory. Use these insights to sharpen your market strategy and anticipate future challenges and opportunities. Download the full analysis now for actionable intelligence and data-driven decision-making.

Political factors

Government funding is crucial for Avantor, especially in biopharma, healthcare, and education. Increased funding boosts demand for its products. In 2024, U.S. federal R&D spending reached $178 billion. Changes in funding priorities, like increased cancer research, can shift demand for specific lab supplies.

Government healthcare policies, including drug pricing and spending, significantly impact Avantor. Regulatory changes, like FDA approvals, affect R&D and production. In 2024, the US healthcare spending reached $4.8 trillion, influencing Avantor's key markets. FDA's oversight remains crucial for Avantor's operations.

International trade policies significantly influence Avantor's operations. Tariffs and trade restrictions directly impact the cost of raw materials and product distribution. For example, in 2024, changes in US-China trade relations could affect Avantor's supply chain. These policies necessitate strategic adjustments for market access and global supply chain management. Companies need to navigate shifting trade landscapes.

Political Stability in Operating Regions

Avantor's global footprint across the Americas, Europe, and AMEA exposes it to varied political risks. Political instability can disrupt operations and supply chains, as seen in some emerging markets. Changes in government policies, such as trade restrictions or tax adjustments, also pose risks. Managing political risk is crucial for Avantor's financial performance.

- Political risk insurance market was valued at $1.2 billion in 2023.

- Avantor's revenue for 2024 is projected to be around $7.5 billion.

Geopolitical Events and Relations

Geopolitical events significantly influence Avantor. International conflicts and shifting alliances can disrupt global markets and supply chains. These events affect raw material costs, logistics, and customer demand. Avantor's global operations make it vulnerable. For instance, the Russia-Ukraine war caused supply chain disruptions.

- Supply chain disruptions from geopolitical events can increase operational costs.

- Changes in international trade agreements can impact market access.

- Political instability in key regions can affect demand.

- Avantor's global presence requires careful monitoring of geopolitical risks.

Political factors heavily influence Avantor's operations and financial outcomes. Government funding in R&D is crucial, impacting demand, with the U.S. spending $178B in 2024. Healthcare policies, such as drug pricing, also affect Avantor's markets. International trade and geopolitical events further create opportunities and risks.

| Aspect | Impact on Avantor | 2024/2025 Data |

|---|---|---|

| R&D Funding | Drives demand for lab supplies. | US R&D spending: $178B in 2024 |

| Healthcare Policies | Affects markets and regulations. | US healthcare spending: $4.8T in 2024 |

| Trade and Geopolitics | Influences supply chains and markets. | Political risk ins. market: $1.2B in 2023, Avantor's projected revenue ~$7.5B in 2024 |

Economic factors

Global economic conditions significantly influence Avantor's performance. A robust global economy encourages increased spending across industries it serves. In 2024, global GDP growth is projected around 3.2%, potentially boosting investment. Conversely, recessions can curb R&D spending. Healthcare spending growth, a key market, is estimated at 5-7% annually.

Inflation poses a risk to Avantor by elevating production costs. The U.S. inflation rate in March 2024 was 3.5%, impacting material and labor expenses. Deflation could lower revenues, affecting profitability. Strategic cost and pricing management are vital.

Avantor faces currency exchange rate risks due to its global operations. Fluctuations impact reported international sales and profits. In Q1 2025, foreign currency translation negatively affected sales growth. This highlights the importance of hedging strategies. The company must manage currency risk to protect financial performance.

Interest Rates

Interest rates significantly affect Avantor's financial strategy. Increased rates elevate borrowing expenses, impacting operational costs and expansion plans. As of March 31, 2025, Avantor's adjusted net leverage stood at 3.2x, making it sensitive to rate fluctuations. Customer investments in equipment might decrease due to higher borrowing costs.

- Higher rates increase borrowing costs.

- Customer spending on equipment may decrease.

- Adjusted net leverage at 3.2x as of March 31, 2025.

Market Demand in Key Industries

Avantor's market demand hinges on biopharma, healthcare, education, and advanced tech sectors. Growth in drug discovery, healthcare use, and government research funding drives demand. In Q1 2025, Avantor saw a net sales decrease, notably in Education and Government. These sectors are crucial for Avantor's financial performance.

- Biopharma: Strong growth expected, driven by R&D spending.

- Healthcare: Steady demand, influenced by aging populations and tech advancements.

- Education & Government: Fluctuations depend on funding and research priorities.

- Advanced Technologies: Consistent expansion due to innovation and material science.

Economic conditions like global GDP growth (3.2% projected in 2024) greatly influence Avantor's performance, impacting spending and investment. Inflation, such as the 3.5% rate in March 2024, raises production costs. Interest rates affect borrowing and investment.

| Factor | Impact | Data Point |

|---|---|---|

| Global GDP | Influences spending | 3.2% growth in 2024 (projected) |

| Inflation | Elevates costs | 3.5% in March 2024 (U.S.) |

| Interest Rates | Affect borrowing & investment | Leverage at 3.2x (March 31, 2025) |

Sociological factors

Aging populations and rising chronic disease rates boost demand for healthcare and biopharma, positively impacting Avantor. The global geriatric population is projected to reach 1.4 billion by 2030, increasing demand for Avantor's products. Shifting regional demographics affect customer needs and market sizes.

Major public health concerns and disease outbreaks, like the ongoing threat of novel viruses, drive demand in biopharma. Avantor's materials are vital for research and therapy development. The company's bioprocessing platform is positioned for growth, with expectations of a 5-7% increase in the biopharma market in 2024/2025. This growth supports Avantor's strategic focus, reflecting its commitment to addressing evolving health needs.

Avantor relies on a skilled workforce in science, manufacturing, and tech. Labor shortages could affect operations and innovation. In 2023, the Human Rights Campaign gave Avantor a high score. This reflects positively on their workforce. A skilled, diverse workforce is key for success.

Societal Values and Expectations

Societal values increasingly prioritize health, wellness, and scientific progress. This shift fuels investment in Avantor's core markets, such as biopharma and healthcare. Public trust in science and healthcare directly impacts demand for Avantor's products. The global wellness market is projected to reach $7 trillion by 2025.

- The biopharmaceutical industry is expected to grow, with a forecast of $2.85 trillion by 2025.

- Healthcare spending in the US is estimated to hit $4.8 trillion in 2024.

Educational and Research Priorities

Societal focus on education and research significantly affects Avantor. Government and academic funding, key for Avantor's lab supplies, are driven by these priorities. Shifts in educational trends or research interests directly impact demand for specific products. For instance, in 2024, the U.S. government allocated over $170 billion for R&D.

- U.S. R&D spending in 2024: Over $170 billion.

- Changes in educational focus: Affects product demand.

- Academic and government institutions: Key customers.

Increased health focus and scientific advancement boosts Avantor. The biopharma market is anticipated to reach $2.85 trillion by 2025, impacting Avantor. Education and research are critical for the company.

| Factor | Impact | Data |

|---|---|---|

| Health and Wellness Trends | Increased Demand | Wellness market at $7T by 2025. |

| R&D and Education | Funding Drives Growth | U.S. R&D spending: $170B+ in 2024. |

| Societal Priorities | Boosts Biopharma | Biopharma market expected to reach $2.85T by 2025. |

Technological factors

Technological factors significantly shape Avantor's offerings. Advancements in bioprocessing, like continuous manufacturing, drive demand for Avantor's specialized products. Avantor focuses on innovation, offering chromatography and single-use solutions to meet evolving customer needs. The bioprocessing market is projected to reach $60.7 billion by 2029, highlighting the importance of staying ahead of the curve. Avantor's commitment to innovation ensures it remains competitive in this dynamic landscape.

Avantor benefits from advancements in lab equipment, fueling its product offerings in research and materials. Keeping up with tech is key to meeting customer demands. The company expanded its innovation capabilities, opening a new center in November 2024. In Q4 2024, Avantor's research and development spending reached $85 million, reflecting its commitment to innovation.

Avantor can leverage digitalization and data analytics to boost efficiency. The global data analytics market is projected to reach $650.8 billion by 2029. Digital tools can enhance customer experience and streamline supply chains. Investing in these technologies aligns with industry trends and customer needs.

Automation in Laboratories and Production

Automation is reshaping lab and production efficiency, a trend Avantor must navigate. To stay competitive, Avantor needs to align its offerings with automated customer processes. The company's focus on innovation-driven revenue growth highlights the need for these adaptations. In 2024, the global laboratory automation market was valued at $49.8 billion, projected to reach $78.1 billion by 2029.

- Automation adoption boosts operational efficiency, reducing costs.

- Avantor's R&D spending was $120.9 million in 2023, reflecting its innovation focus.

- Adapting to automation allows Avantor to meet evolving customer needs.

Emerging Scientific Fields

The rise of fields like cell and gene therapy and personalized medicine fuels new markets and demands for specialized products. Avantor's capacity to meet the unique needs of these areas is crucial for future expansion. Avantor's innovation center supports the growing demand for monoclonal antibodies, cell and gene therapy, and mRNA workflows. This strategic focus aligns with the projected growth in these sectors. The global cell therapy market is expected to reach $15.5 billion by 2025.

- Avantor's innovation center supports the growing demand for monoclonal antibodies, cell and gene therapy and mRNA workflows.

- The global cell therapy market is expected to reach $15.5 billion by 2025.

Technological advancements are key drivers for Avantor, especially in bioprocessing. The company's focus on R&D, with $85M spent in Q4 2024, supports innovation. Digitalization, alongside the lab automation market at $49.8B in 2024, reshapes operations.

| Technological Aspect | Impact on Avantor | 2024/2025 Data Points |

|---|---|---|

| Bioprocessing Advancements | Drives demand for specialized products. | Bioprocessing market projected to reach $60.7B by 2029. |

| R&D Spending | Supports innovation and competitiveness. | Q4 2024 R&D spend was $85M; $120.9M in 2023. |

| Digitalization & Automation | Enhances efficiency, customer experience. | Lab automation market valued at $49.8B in 2024; projected to $78.1B by 2029. |

Legal factors

Avantor, deeply embedded in biopharma and healthcare, faces stringent regulatory demands. Compliance with bodies like the FDA is crucial for its operations. Updated FDA guidelines in 2024/2025 directly influence Avantor’s product standards and manufacturing. Regulatory shifts can drastically alter Avantor's product offerings and distribution strategies. In 2024, FDA inspections increased by 15% indicating intensified scrutiny.

Avantor faces environmental regulations globally, impacting manufacturing and supply chains. Compliance, essential for operations, influences costs. In 2024, environmental compliance spending was approximately $50 million. Avantor adheres to environmental laws across all operational regions. This commitment ensures sustainability and regulatory adherence.

Trade and export controls significantly influence Avantor's global operations, dictating where it can sell its products. Compliance with international trade laws is crucial for its worldwide distribution. In 2024, Avantor's international sales accounted for approximately 55% of its total revenue, highlighting the impact of trade policies. These policies directly affect Avantor's access to various global markets.

Intellectual Property Laws

Avantor's competitive advantage heavily relies on protecting its intellectual property (IP). This protection includes patents, trademarks, and other legal tools to safeguard its innovations. Changes in IP laws, like those seen in the US with the America Invents Act, directly influence the strength of these protections. As of late 2024, global patent filings have seen a slight increase, indicating a continued emphasis on IP. Avantor uses these rights to protect its specialized offerings, with R&D spending around $70 million in 2023, ensuring innovation stays secure.

- Patent filings globally saw a 3% increase in 2024.

- Avantor's R&D spending was approximately $70 million in 2023.

- Changes in IP laws impact the scope and duration of protections.

- Trademarks and trade secrets are also key IP assets.

Labor Laws and Employment Regulations

Avantor must comply with labor laws and employment regulations across its global operations. Changes in these laws can impact labor costs, hiring processes, and employee relations. The company's commitment to fair labor practices is evident. Avantor scored well on the Human Rights Campaign's 2023 Corporate Equality Index.

- Compliance with diverse international labor laws is essential.

- Regulatory shifts can lead to cost fluctuations.

- Avantor's HR practices are continually evaluated.

- The company's commitment to equality is demonstrated.

Legal factors significantly affect Avantor's operations. Compliance with evolving FDA guidelines and global regulations is essential. In 2024, the rise in patent filings and heightened regulatory scrutiny are pivotal. Labor laws also play a critical role.

| Legal Area | Impact | 2024/2025 Data |

|---|---|---|

| IP Protection | Safeguards innovations, drives R&D. | Global patent filings +3%, R&D $70M (2023) |

| Regulatory Compliance | Affects product standards, distribution. | FDA inspections +15% in 2024 |

| Labor Laws | Impact labor costs, employment practices. | Ongoing evaluations of HR practices |

Environmental factors

Avantor's operations affect the environment via energy use, emissions, and waste. The push for sustainability demands lower environmental impact. Avantor reached its 2025 emissions goals early and set new 2030 targets. In 2023, they reported a 23% reduction in Scope 1 and 2 emissions. This demonstrates their commitment.

Resource scarcity and environmental regulations can impact Avantor's raw material costs. A resilient supply chain is crucial for uninterrupted operations. In 2024, Avantor invested in raw material availability for biopharma. The biopharma sector is expected to reach $685B by 2028, increasing pressure on resources.

Climate change poses significant risks for Avantor. Extreme weather events, like those that caused $28 billion in damages in 2023, can disrupt supply chains and damage facilities. Adapting to climate change is crucial. The global market for climate change adaptation is projected to reach $194 billion by 2025. Climate change is a defining environmental issue.

Waste Management and Recycling

Avantor's waste management and recycling efforts are crucial for meeting environmental regulations and sustainability targets. The company focuses on reducing waste generation across its manufacturing and laboratory operations. Effective waste disposal and recycling programs are essential for minimizing environmental impact. Avantor's commitment to these practices is reflected in its environmental performance data. For example, in 2024, Avantor reported a reduction in waste sent to landfills compared to the previous year.

- Avantor aims to reduce waste sent to landfills by 10% by 2025.

- Recycling rates increased by 5% in 2024 across key facilities.

- Investment in new waste treatment technologies totaled $2 million in 2024.

- Avantor's waste reduction programs saved approximately $1.5 million in disposal costs in 2024.

Customer Demand for Sustainable Products

Customer demand for sustainable products is rising across the biopharma and healthcare sectors. This shift pressures Avantor to provide eco-friendly options. Avantor's sustainability focus aligns with these customer needs. The market for green chemicals is projected to reach $99.9 billion by 2024.

- Avantor's innovation includes sustainable solutions.

- Customer preference for eco-friendly products is growing.

- The green chemicals market is expanding.

Avantor prioritizes environmental sustainability to lessen its footprint and satisfy customer demands for eco-friendly products. Emissions reductions are a focus, with targets set through 2030, following early achievement of 2025 goals. Resource management is critical given that the biopharma sector may reach $685B by 2028; also, Avantor reduced waste disposal costs by $1.5M in 2024.

| Key Environmental Aspect | 2024 Status | Target/Outlook |

|---|---|---|

| Emissions (Scope 1&2) | 23% reduction | New 2030 Targets |

| Waste to Landfill | Reduction YoY | 10% reduction by 2025 |

| Recycling Rates | 5% increase | Ongoing improvements |

PESTLE Analysis Data Sources

This Avantor PESTLE relies on sources such as financial reports, scientific publications, market research, and regulatory bodies.