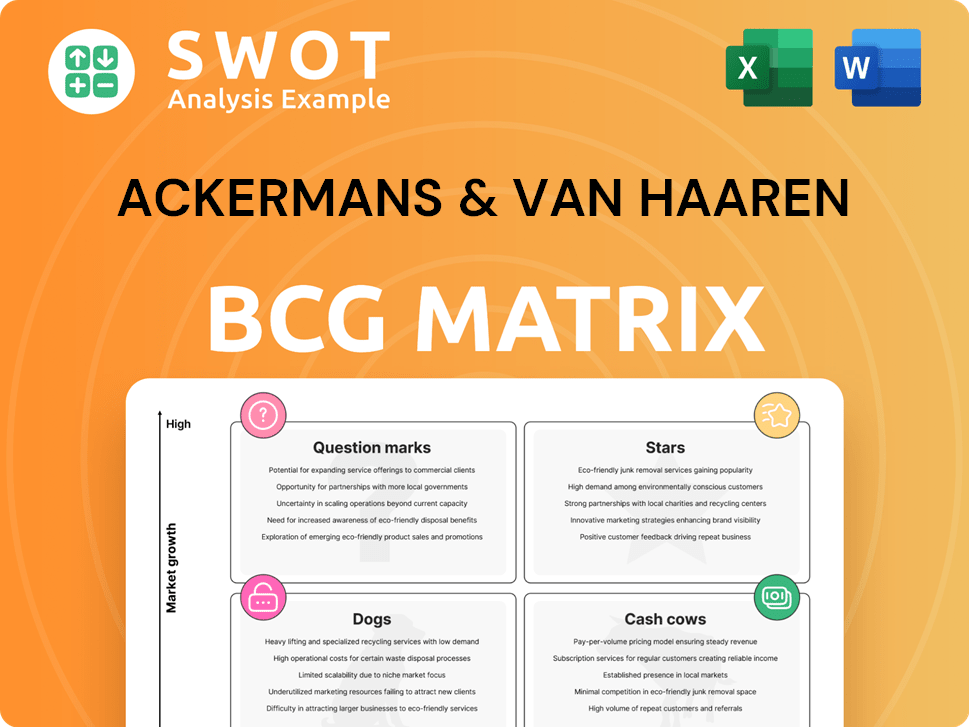

Ackermans & Van Haaren Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ackermans & Van Haaren Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

Clean, distraction-free view optimized for C-level presentation.

What You’re Viewing Is Included

Ackermans & Van Haaren BCG Matrix

This preview shows the complete Ackermans & Van Haaren BCG Matrix you'll receive. It's a ready-to-use report without watermarks, providing detailed strategic insights upon download.

BCG Matrix Template

Ackermans & Van Haaren's portfolio is dynamic. This snapshot shows a glimpse of their product placements within the BCG Matrix. Are they dominating as Stars or struggling as Dogs? This preview only scratches the surface.

Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

DEME, a marine engineering and contracting company, shines as a star within Ackermans & van Haaren's portfolio. In 2024, DEME's turnover surged past 4 billion euros, fueled by robust market demand and successful project delivery. The company showcased strong cash flow and operational prowess. With a record order book, DEME is poised for sustained growth in 2025.

Delen Private Bank and Bank Van Breda, part of Ackermans & van Haaren, saw a combined net profit increase in 2024, reflecting strong growth. They attracted record inflows of new assets by expanding their business models. The private banking sector significantly boosts Ackermans & van Haaren's performance, solidifying its star status. In 2024, the total assets under management increased by 10%.

OMP, part of Ackermans & Van Haaren, shines as a Star in the BCG Matrix, fueled by its Unison Planning™ platform. Gartner consistently acknowledges OMP's global leadership, emphasizing its vision and execution capabilities. OMP's focus on sustainability and waste reduction is a key strength. In 2024, the supply chain software market is projected to reach $21.4 billion.

SIPEF (Sustainable Agriculture)

SIPEF, a part of Ackermans & Van Haaren, shines as a "Star" in the BCG matrix due to its strong commitment to sustainable agriculture, primarily in palm oil production. The company has shown resilience, even with challenges like impairment charges, and has managed to decrease its net financial debt. Favorable palm oil prices are a key driver of SIPEF's profitability, highlighting its strong market position. In 2024, its revenue was EUR 643.4 million.

- Focus on sustainable practices and palm oil.

- Reduced net financial debt, showing financial health.

- Benefited from positive palm oil prices.

- Revenue of EUR 643.4 million in 2024.

V.Group (Ship Management and Marine Support Services)

Ackermans & van Haaren's investment in V.Group, a leader in ship management and marine support, shows their focus on strong, sustainable business models. This aligns with their goal of investing in promising ventures. V.Group's services fit well with the group’s strategy. In 2024, the global ship management market was valued at approximately $16 billion, highlighting V.Group’s significant potential within this sector.

- Market Leadership: V.Group holds a significant market share in ship management.

- Strategic Alignment: The acquisition reflects Ackermans & van Haaren's focus on sustainable business models.

- Financial Performance: V.Group's financial health is key for the investment's success.

- Market Size: The global ship management market is substantial, providing growth opportunities.

Several Ackermans & van Haaren companies excel as Stars. These companies, including DEME and OMP, demonstrate high growth potential. Strong financial results in 2024 support their star status, driven by market leadership and strategic initiatives.

| Company | Sector | Key Feature |

|---|---|---|

| DEME | Marine Engineering | Record Order Book |

| Delen/Van Breda | Private Banking | Asset Growth |

| OMP | Supply Chain Software | Gartner Leader |

Cash Cows

Ackermans & van Haaren's real estate, especially Nextensa, is transforming strategically. Despite fair value adjustments, it's acquiring assets like Proximus towers. These moves aim for long-term gains and cash flow. In 2024, Nextensa's portfolio value was impacted by market conditions, with specific figures available in their financial reports.

AVH Growth Capital's contributions have grown, reflecting strong performance. Yet, negative fair value shifts in some areas have affected outcomes. In 2023, AVH's net result was €118.9 million. Strategic management could boost cash flow and ensure stability.

Ackermans & Van Haaren's private equity investments act as cash cows, generating consistent revenue. They span diverse sectors, ensuring a stable income stream. Strategic portfolio management is key to maintaining their cash-generating status. In 2024, these investments likely contributed significantly to AVH's financial stability. This diversification helps mitigate risks and support overall company performance.

Long-Term Partnerships

Ackermans & van Haaren (AvH) thrives on long-term partnerships, a core strategy for stable cash flow. These collaborations are crucial for AvH's consistent returns and sustainable growth. Focusing on these partnerships solidifies its "cash cow" status. AvH's 2023 results showed a 10.6% increase in recurring profit, highlighting the success of this approach.

- Partnerships boost cash flow and support growth.

- AvH's 2023 recurring profit increased by 10.6%.

- Long-term focus provides stability.

- Expanding partnerships enhances its "cash cow" position.

Established Market Presence in Europe

Ackermans & Van Haaren's long-standing presence in Europe, dating back to its founding in 1878, provides a solid foundation. This history translates into strong brand recognition, crucial for securing lucrative contracts in competitive markets. The company's established position generates a consistent revenue stream, solidifying its status as a cash cow. They aim to further leverage this advantage.

- Historical Presence: Over 140 years in European markets.

- Revenue Stability: Consistent cash flow from established operations.

- Brand Recognition: Strong reputation aiding contract acquisition.

- Strategic Focus: Leveraging existing strengths for growth.

Ackermans & Van Haaren's private equity investments are stable, revenue-generating "cash cows," vital for income. They cover varied sectors, ensuring a steady stream of money, crucial in fluctuating markets. Strategic portfolio management keeps these investments profitable, with contributions significantly in 2024, supporting overall performance.

| Aspect | Details | Impact |

|---|---|---|

| Investment Strategy | Diverse Private Equity | Consistent Income |

| 2024 Contribution | Significant, stabilizing | Overall Performance |

| Market Adaptation | Strategic Portfolio | Sustainable Growth |

Dogs

Some of Ackermans & van Haaren's real estate holdings might be struggling, causing fair value declines. These assets could be dogs, yielding poor returns. For instance, in 2023, real estate contributed €205 million to the group's result. Selling or reorganizing these assets could boost the company's financial health.

Some Growth Capital investments might be underperforming, causing negative fair value changes. These could be "dogs" due to their poor contribution to the company's earnings. In 2024, Ackermans & Van Haaren's net result from its Growth Capital investments was €10.4 million, a decrease from €49.7 million in 2023. Strategic choices are crucial to improve portfolio performance.

The shift from rubber to oil palm in Indonesia signals underperformance in SIPEF's rubber operations. These rubber activities, being phased out, align with the "dogs" quadrant of the BCG matrix due to low profitability. In 2024, rubber prices faced volatility, with impacts on profitability. This strategic move allows SIPEF to focus on more lucrative sectors, potentially boosting overall financial health. The rubber sector's revenue was approximately €30 million in 2023.

Less Strategic Real Estate Properties

In 2024, Nextensa, part of Ackermans & Van Haaren, divested less strategic real estate. This move suggests these properties underperformed. The divested assets fit the "dogs" category, as they offered limited value. The strategy aims to boost real estate performance. Focusing on key assets, like those in the logistics sector, is key.

- Nextensa's 2024 divestments included properties with lower returns.

- These properties were likely classified as "dogs" in a BCG matrix analysis.

- Divestment helps optimize the real estate portfolio's profitability.

- The focus shifts towards more strategic, high-growth assets.

Cyclical Headwinds in Real Estate

The real estate sector faces cyclical headwinds, potentially affecting assets. These challenges could classify certain real estate holdings as dogs within the BCG matrix. Strategic adjustments are crucial to navigate these downturns effectively. In 2024, U.S. existing home sales decreased, and new construction slowed, reflecting these headwinds.

- Cyclical downturns can diminish asset values.

- Strategic moves are key to lessening the impact.

- Market conditions may require asset restructuring.

- Focus on adaptability and risk management.

Dogs in the BCG matrix represent underperforming assets. These investments generate low returns or experience fair value declines. For Ackermans & van Haaren, this includes underperforming real estate and growth capital holdings. Strategic actions like divestments are crucial to improving overall financial health.

| Category | Example | 2023 Data |

|---|---|---|

| Real Estate | Fair Value Declines | €205M Contribution |

| Growth Capital | Underperforming Investments | €49.7M Net Result |

| SIPEF | Rubber Operations | €30M Rubber Revenue |

Question Marks

OMP's new Green Planning offering is a question mark in Ackermans & Van Haaren's BCG Matrix. It's a growth area, but its market impact is uncertain. Investments could drive future growth. In 2024, the green tech market is projected to reach $80 billion.

Ackermans & van Haaren's (AvH) investment in Confo Therapeutics is a "question mark" in its BCG matrix. The biotech firm's future is uncertain, despite AvH's backing. In 2024, AvH's net profit was €407.8 million; Confo's impact is still developing. Strategic support is crucial to boost its potential.

Delen Private Bank's expansion in the Netherlands is a question mark in the Ackermans & Van Haaren BCG Matrix. While representing potential growth, its long-term success isn't guaranteed. As of 2024, Delen aims to increase its assets under management in the Netherlands. Strategic investment and management are crucial for market share growth.

Proximus Towers Acquisition by Nextensa

Nextensa's acquisition of the Proximus towers is a "Question Mark" in Ackermans & Van Haaren's BCG Matrix. This classification is due to the inherent uncertainties surrounding the project's future. The towers' success hinges on strategic execution and market dynamics, making it a high-potential, high-risk venture. In 2024, the Brussels office market faces challenges, with vacancy rates around 9%.

- High initial investment with uncertain returns.

- Dependent on market conditions and strategic planning.

- Potential for significant growth if successful.

- Risks include market volatility and operational challenges.

Green Offshore Initiatives

Green Offshore initiatives within Ackermans & Van Haaren's Marine Engineering & Contracting sector are classified as question marks in the BCG Matrix. These ventures, focusing on sustainable solutions, represent potential growth but face market uncertainty. Their long-term success and market share are yet to be fully established, making them high-risk, high-reward investments. Investing in these could yield significant future returns, aligning with growing environmental demands.

- 2024: Renewable energy investments in offshore wind increased, signaling potential for growth.

- Market share and profitability are currently being evaluated.

- Technological advancements and regulatory changes are key drivers.

- Successful initiatives could transform the Marine Engineering sector.

Question Marks in Ackermans & Van Haaren's BCG Matrix represent high-growth potential but uncertain outcomes. These ventures require strategic investment and face market volatility. Success depends on effective execution and market conditions. By 2024, the market's reaction is yet to be determined.

| Category | Characteristics | Examples within AvH |

|---|---|---|

| High Growth Potential | Significant market opportunities | Green Planning |

| Uncertainty | Unclear market share | Confo Therapeutics |

| Strategic Investment | Requires dedicated resources | Delen's expansion in Netherlands |

BCG Matrix Data Sources

This BCG Matrix relies on credible company reports, industry research, and market share analysis to accurately assess Ackermans & Van Haaren's portfolio.