AVIC Capital Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AVIC Capital Bundle

What is included in the product

AVIC Capital's BCG Matrix analysis, highlighting investment, hold, or divest decisions across its portfolio.

Export-ready design for quick drag-and-drop into PowerPoint

What You See Is What You Get

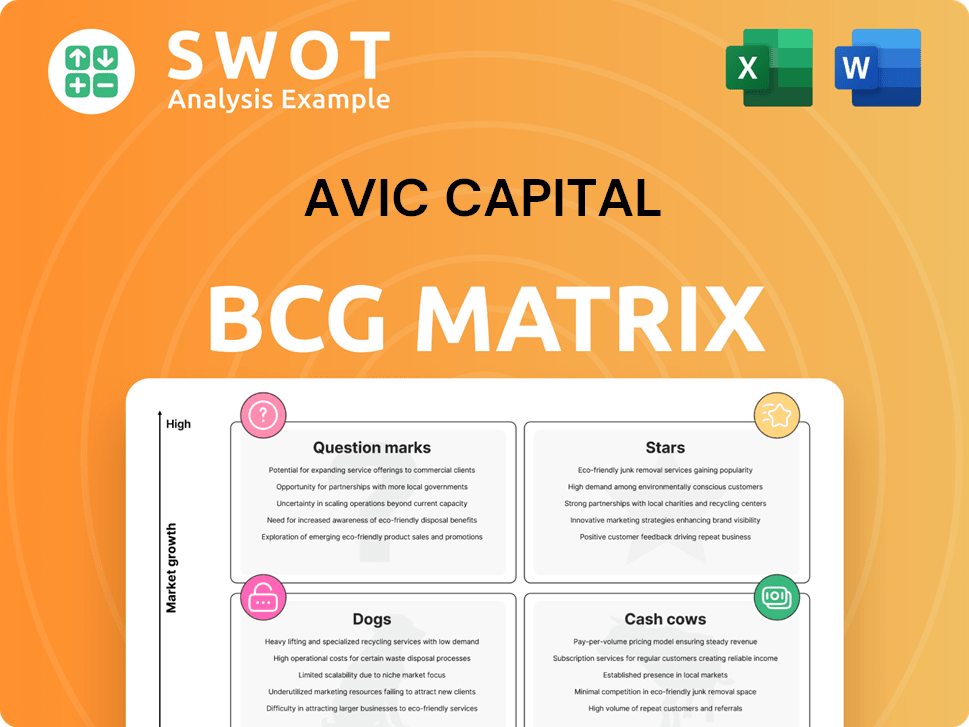

AVIC Capital BCG Matrix

This preview shows the full AVIC Capital BCG Matrix report you'll receive post-purchase. It's a ready-to-use analysis tool, free of watermarks, and instantly downloadable for your strategic needs. The complete document provides a clear view of investment strategies. Get the same high-quality matrix after your purchase.

BCG Matrix Template

AVIC Capital's BCG Matrix reveals its product portfolio's strategic landscape. This analysis classifies products as Stars, Cash Cows, Dogs, or Question Marks. Understanding these placements is crucial for informed decision-making. It helps optimize resource allocation and fuel growth. Discover AVIC's competitive positioning and strategic opportunities.

Get instant access to the full BCG Matrix and discover which products are market leaders, which are draining resources, and where to allocate capital next. Purchase now for a ready-to-use strategic tool.

Stars

AVIC Capital's aviation finance arm is a "Star" in its BCG matrix, capitalizing on the soaring demand for aircraft, especially in developing economies. This sector demands consistent investment to preserve its leading market position. In 2024, global aircraft financing reached approximately $150 billion, highlighting the segment's growth potential. AVIC's strategic focus on aviation finance aligns with projected industry expansions.

AVIC Capital's leasing business focuses on financial and operating leases for assets like aircraft and ships, capitalizing on global trade and infrastructure growth. In 2024, the global aircraft leasing market was valued at approximately $250 billion. This sector benefits from the constant need for asset financing and management, offering stable revenue streams.

AVIC Capital's investment banking arm, focusing on securities underwriting, thrives on China's active capital markets. Maintaining a competitive edge requires significant investment. In 2024, the total value of China's stock offerings reached approximately $80 billion. This sector is a 'Star' due to high growth potential.

Emerging Industries Investments

AVIC Capital's investments in emerging industries, classified as "Stars," target high-growth sectors. These strategic moves aim for substantial returns, aligning with the dynamic expansion of new technologies. Success hinges on adept resource management and strategic allocation. For instance, the AI market is projected to reach $200 billion by 2025.

- High growth potential in new tech.

- Significant returns possible.

- Requires careful resource allocation.

- AI market reaching $200B by 2025.

Overseas Public Service Segment

AVIC International's overseas public service segment is booming, boosting gross profit. Investing more in this area could strengthen AVIC's international presence and revenue. This segment might include infrastructure projects and public services in foreign countries. The growth reflects strategic diversification and global expansion efforts.

- Overseas projects contribute significantly to revenue growth.

- Increased investment can lead to higher market share.

- Public service projects often have long-term contracts.

- This segment supports AVIC's global footprint.

AVIC Capital's "Stars" include aviation finance, investment banking, and emerging industries. These sectors demand continual investment for sustained market leadership. The AI market alone is projected to hit $200 billion by 2025. Success relies on smart resource allocation.

| Sector | 2024 Market Value | Key Strategy |

|---|---|---|

| Aviation Finance | $150B | Capitalize on global aircraft demand |

| Investment Banking | $80B (China stock offerings) | Leverage active capital markets |

| Emerging Industries | $200B (AI by 2025) | Target high-growth sectors |

Cash Cows

AVIC Capital's internal deposit and loan business, a 'Cash Cow', offers steady income. This segment leverages existing AVIC relationships for minimal promotion investment. In 2024, it likely generated significant revenue with low operational costs, mirroring similar internal finance models. This business provides stable returns, benefiting from the group's established financial ecosystem.

The trust business, including fund, movable property, and real estate trusts, provides steady cash flow, a hallmark of a Cash Cow. It benefits from a well-established market, reducing the need for significant promotional spending. In 2024, the real estate trust market showed a stable yield of around 6%, indicating reliable returns.

Securities brokerage is a cash cow for AVIC Capital, providing a stable revenue source. This mature business leverages existing infrastructure and a loyal customer base. It generates consistent profits without significant new investment. For example, in 2024, the sector's total revenue reached approximately $5 billion.

Centralized Fund Management

Centralized fund management within AVIC Capital likely represents a "Cash Cow" due to its consistent revenue streams. Investments in infrastructure are crucial to enhance operational efficiency and boost cash flow in this area. This business segment benefits from established market positions and strong cash generation capabilities, supporting AVIC Capital's overall financial health. In 2024, the fund management industry saw assets under management (AUM) grow, suggesting ongoing stability and revenue potential.

- Stable Revenue: Centralized fund management provides predictable income.

- Infrastructure Investment: Needed for efficiency and cash flow improvement.

- Market Position: Benefits from an established presence.

- 2024 Industry Trends: AUM growth indicates potential.

Insurance Agency

An insurance agency within AVIC Capital's BCG Matrix represents a Cash Cow. It offers a stable, although not high-growth, revenue source, capitalizing on established client connections. These agencies require minimal marketing expenditure due to their existing customer base and predictable income.

- 2024: Insurance sector revenue reached $1.5 trillion.

- Customer retention rates are above 80% for established agencies.

- Marketing expenses are typically below 5% of revenue.

- Profit margins are consistently around 10-15%.

Cash Cows within AVIC Capital consistently generate stable revenue and predictable income, crucial for financial health.

These segments, including insurance agencies and fund management, leverage established customer bases and efficient infrastructure. They require minimal marketing, resulting in consistent profit margins. The insurance sector's 2024 revenue was approximately $1.5 trillion.

| Business Segment | Revenue Stability | Key Features |

|---|---|---|

| Insurance Agencies | High | Established client base, low marketing costs, 10-15% profit margins |

| Fund Management | High | Consistent revenue, infrastructure investment, market position, AUM growth |

| Securities Brokerage | High | Leverages existing infrastructure, loyal customer base, consistent profits |

Dogs

Underperforming industrial investments with low growth are "dogs" in the AVIC Capital BCG Matrix. These investments drain capital without adequate returns, signaling a need for divestiture. Consider the challenges faced by China's industrial sector in 2024, with some areas experiencing slow growth. For instance, the machinery industry saw a modest 3% growth in the first half of 2024, indicating potential "dog" investments.

Low-growth securities trading involves activities with consistently low returns in stagnant markets. These typically necessitate costly turnaround strategies that offer inadequate returns. For example, the average return on low-growth stocks in 2024 was around 3%, significantly underperforming the market. Consider minimizing exposure to such assets to improve overall portfolio performance.

Dogs. Futures brokerages that fail to capture market share in low-growth sectors are "Dogs." These ventures consistently underperform. For example, small brokerages saw a 15% decline in market share in 2024. Minimize exposure to these, as they rarely generate profits.

Inefficient Leasing Operations

Inefficient leasing operations, characterized by low profitability and limited growth, are categorized as "Dogs" in the BCG matrix. These operations often drain resources without contributing significantly to overall company performance. Restructuring or divesting these underperforming units can free up capital and improve strategic focus. For instance, a 2024 analysis might show a leasing segment with a return on assets (ROA) below 3%, indicating inefficiency.

- Low Profitability: Leasing operations with ROA below 3%.

- Minimal Growth Potential: Stagnant or declining market share.

- Resource Drain: Consumes capital without substantial returns.

- Restructuring/Divestiture: Actions to improve company performance.

Stagnant Financial Consulting Services

Stagnant financial consulting services, failing to evolve with market shifts, fit the 'Dogs' category. These services suffer from low growth and profitability. For instance, in 2024, traditional financial advisory firms saw a 2% decrease in new client acquisition due to digital disruption. Re-evaluation or discontinuation is often necessary.

- 2024: Traditional financial advisory firms faced a 2% decrease in new client acquisition.

- Low growth and profitability characterize these services.

- Adaptation to digital trends is crucial for survival.

- Re-evaluation or discontinuation might be needed.

Dogs represent underperforming business units with low growth and profitability, requiring strategic attention. These units often drain resources without providing substantial returns, signaling the need for restructuring or divestiture. Consider the real estate sector in 2024, which faced challenges.

| Characteristic | Financial Impact | Example (2024) |

|---|---|---|

| Low Growth | Reduced revenue, stagnant market share | Real estate: 1% growth in some markets. |

| Low Profitability | Negative cash flow, limited returns | <3% ROA for certain leasing operations. |

| Resource Drain | Capital tied up, opportunity cost | Inefficient leasing segments consuming resources. |

Question Marks

AVIC Capital should consider AI-driven financial services, a high-growth area with a small market share now. These services demand substantial investment to boost adoption and compete. The global AI in fintech market was valued at $7.9 billion in 2023 and is projected to reach $26.7 billion by 2028. However, the risk is high due to the competitive landscape.

Fintech investments pose a "Question Mark" for AVIC Capital due to their high growth potential but uncertain market share. AVIC Capital must decide whether to aggressively invest to capture market share or divest if growth targets aren't met. Globally, fintech funding in 2024 reached $137.6 billion, showing significant growth. AVIC Capital's strategy will depend on detailed market analysis and risk assessment.

Sustainable finance and green investments are expanding quickly, potentially offering AVIC Capital high growth. However, the current market share might be low, indicating a 'Question Mark' status. To avoid becoming a 'Dog', substantial investment is crucial. In 2024, global green bond issuance reached $500 billion, highlighting the opportunity.

Cross-Border Financial Services

Venturing into cross-border financial services presents a high-growth opportunity, though AVIC Capital's current market presence might be limited. Such expansion requires significant upfront investment to establish a competitive international footprint. The cross-border payments market alone is projected to reach $200 trillion by 2027, highlighting the potential. However, success depends on navigating complex regulations and intense competition from established players.

- Market size: The global cross-border payments market was valued at $148.81 trillion in 2023.

- Growth forecast: It is projected to reach $200 trillion by 2027.

- Key players: Major players include large banks and fintech companies.

- Investment needed: Significant capital for technology, compliance, and marketing.

Digital Asset Management

Digital asset management and blockchain-related financial products present a potentially high-growth opportunity for AVIC Capital. However, AVIC Capital's current market share in this area might be relatively low. A strategic assessment is crucial to determine the best course of action. The BCG Matrix suggests either significant investment or divestiture based on growth prospects.

- Blockchain technology is projected to reach $85.37 billion by 2024.

- The global digital asset management market was valued at $2.3 billion in 2023.

- Strategic decisions must consider market dynamics and AVIC's capabilities.

- Investment or divestiture depends on the potential for future growth.

Question Marks for AVIC Capital involve high-growth, low-share markets. These require strategic decisions: invest for growth or divest. AVIC Capital's choices hinge on market analysis and risk assessment.

| Strategic Area | Market Growth | AVIC Capital's Position |

|---|---|---|

| AI-Driven FinTech | High, $26.7B by 2028 | Low Market Share |

| Sustainable Finance | Rapid Growth, $500B in 2024 | Potentially Low Share |

| Cross-Border Services | $200T by 2027 | Limited Presence |

| Digital Assets | Blockchain $85.37B in 2024 | Potentially Low Share |

BCG Matrix Data Sources

AVIC Capital's BCG Matrix utilizes financial reports, market data, and industry analysis, complemented by expert insights for robust strategic guidance.