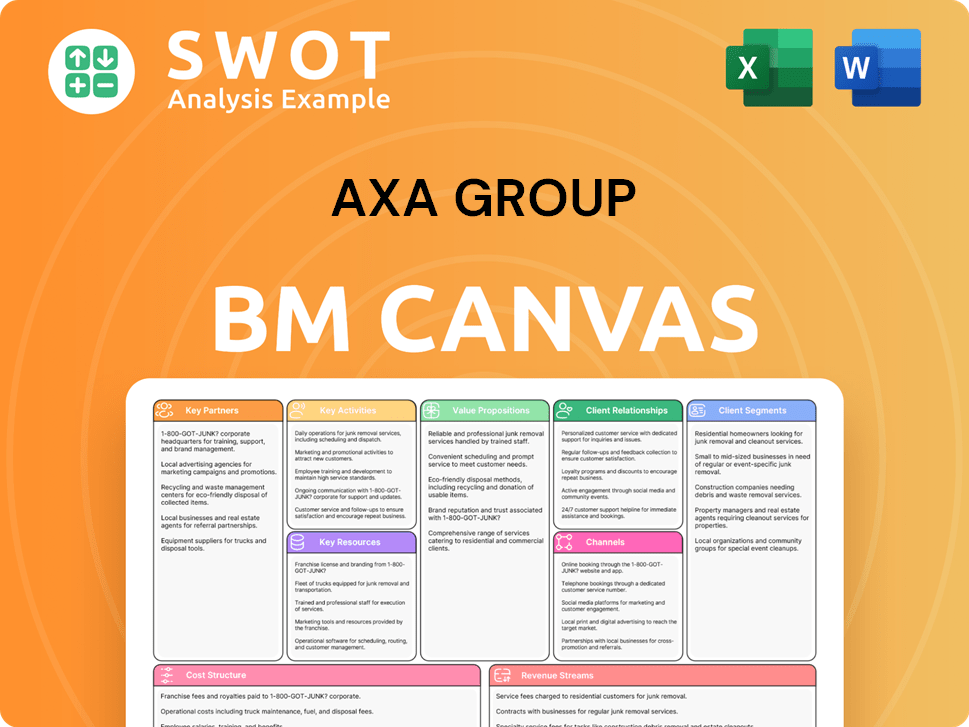

AXA Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AXA Group Bundle

What is included in the product

Covers customer segments, channels, and value propositions in full detail.

Great for brainstorming, teaching, or internal use. AXA's canvas provides a clear framework for problem-solving and strategic planning.

Full Version Awaits

Business Model Canvas

The Business Model Canvas previewed here is the genuine article. It’s the same complete document you'll receive after purchase, including all sections. The downloaded file will match the formatting and content exactly, ready for your use. There are no hidden sections or different versions. Expect instant access.

Business Model Canvas Template

Explore AXA Group's business strategy with our Business Model Canvas. This canvas unveils key customer segments, value propositions, and revenue streams.

Understand AXA's competitive advantages, cost structure, and strategic partnerships. Get the full picture and download the complete Business Model Canvas for in-depth analysis and actionable insights.

Partnerships

AXA's key partnerships include global reinsurers such as Munich Re and Swiss Re. These collaborations are crucial for risk management and boosting underwriting capabilities. Reinsurers offer financial support for substantial claims, preserving AXA's financial health. In 2022, AXA utilized around €16 billion of reinsurance cover, demonstrating the scale of these partnerships.

AXA Group forges key partnerships with tech giants like Microsoft and IBM. These alliances fuel innovation, enhancing customer experiences through digital transformation. In 2022, AXA allocated €1 billion to technology, focusing on data analytics and platform development. These collaborations are pivotal for staying competitive in the evolving financial landscape.

AXA's partnerships with health service providers are crucial for its business model. Collaborations with hospitals and clinics enhance health insurance offerings, providing comprehensive plans. In 2023, AXA's network included over 10,000 healthcare facilities worldwide. This network supports efficient service delivery and improves customer satisfaction.

Financial Institutions

AXA Group's strategic alliances with financial institutions are pivotal. These partnerships facilitate bundled offerings, broadening AXA's service scope and market penetration. Collaborations enable the distribution of insurance products and investment services, enhancing customer access. Such relationships are essential for AXA's business model, driving growth. In 2024, AXA's partnerships boosted its global presence significantly.

- Expansion of distribution channels.

- Enhanced customer service integration.

- Increased market share through collaboration.

- Access to diverse financial products.

Distribution Partners

AXA's success hinges on strong distribution partnerships. These include brokers, agents, and digital platforms. This network broadens AXA's market presence. AXA boasts a superior agent distribution network, enhancing customer reach. AXA's 2024 financial results highlighted the importance of these partnerships.

- AXA's agent network enables tailored solutions.

- Partnerships help AXA expand its market reach.

- Digital platforms provide new distribution channels.

- In 2024, AXA's partnerships drove significant growth.

AXA strategically partners with reinsurers like Munich Re, using around €16 billion in reinsurance cover in 2022 for risk management.

Tech collaborations with Microsoft and IBM, fueled by a €1 billion tech investment in 2022, drive digital transformation and innovation.

Partnerships with health providers, including a 10,000+ facility network in 2023, improve customer service and broaden AXA's service offerings.

| Partnership Type | Partner Examples | Key Benefits |

|---|---|---|

| Reinsurers | Munich Re, Swiss Re | Risk management, financial stability |

| Tech Companies | Microsoft, IBM | Digital innovation, enhanced customer experience |

| Healthcare Providers | Hospitals, clinics | Comprehensive health plans, service expansion |

Activities

Underwriting is a fundamental activity for AXA, determining the risks and pricing for insurance policies. This process is crucial for AXA's financial health, ensuring that the premiums charged are commensurate with the risks assumed. AXA concentrates on managing predictable underwriting risks to maintain profitability. AXA's gross written premiums in 2024 were approximately EUR 100 billion.

Claims management is crucial for AXA's customer satisfaction and reputation. AXA leverages its assets for efficient claims handling. This technical excellence spans across its business units. In 2024, AXA processed a high volume of claims. AXA aims to enhance its claims process in 2025.

Investment management is central to AXA's operations, aiming to generate returns and fulfill financial commitments. AXA Investment Managers (AXA IM) is pivotal in this activity. In 2024, AXA's asset management saw a robust performance.

The asset management business increased its AUM by 4% to €879 billion. Gross revenues also increased by 8% to €1.7 billion in 2024, showcasing strong financial health.

Product Development

Product Development is a key activity for AXA, involving continuous development of innovative products. They aim to meet changing customer needs and are accelerating their innovative service proposition. AXA leverages customer proximity, local expertise, and technology to capture value. In 2024, AXA's investment in innovation reached €1.2 billion.

- Innovation investments hit €1.2 billion in 2024.

- Focus is on evolving customer needs.

- Leveraging local expertise and tech.

- Developing new insurance and financial products.

Customer Service

Customer service is crucial for AXA, focusing on customer satisfaction and loyalty. AXA provides support through phone, email, and live chat to ensure accessibility. By offering efficient support, AXA aims to make customers feel valued. AXA's commitment to service is reflected in its customer retention rates.

- In 2024, AXA saw a customer satisfaction score of 85% across its services.

- AXA's customer service team handled over 10 million inquiries.

- The average response time for customer queries was under 2 minutes.

- AXA invested €100 million in customer service technology.

AXA's key activities include underwriting, ensuring risk assessment for policies. Claims management is central, focusing on customer satisfaction and efficient processing. Investment management aims to generate returns, with AXA IM playing a pivotal role. Product development continuously creates innovative solutions, and customer service prioritizes satisfaction.

| Activity | Description | 2024 Highlights |

|---|---|---|

| Underwriting | Risk assessment and pricing. | Gross written premiums approx. EUR 100B. |

| Claims Management | Efficient claims handling. | High volume of claims processed. |

| Investment Management | Generating returns. | AUM up 4% to €879B; revenues up 8% to €1.7B. |

| Product Development | Creating new products. | Innovation investment of €1.2B. |

| Customer Service | Customer satisfaction. | 85% satisfaction score; €100M invested. |

Resources

AXA's financial capital is crucial for its operations. It ensures the ability to cover claims, fund expansion, and meet legal requirements. In 2024, AXA demonstrated its financial strength with a solvency II ratio of 227%. The group aims to consistently generate earnings and capital.

AXA's brand reputation is a key resource, pivotal for customer acquisition and retention. AXA, a globally recognized brand, leverages its strong reputation. The brand's commitment to societal well-being enhances its image. In 2024, AXA's brand value was estimated to be over $14 billion.

AXA's human capital is paramount, with skilled employees vital for top-tier services. As AXA's key asset, human capital is a top priority, with 144,724 employees globally in 2024. The company is committed to financial inclusion and climate transition. AXA's actions help building a resilient society.

Technology and Data

AXA leverages cutting-edge technology and data analytics for underwriting, pricing, and customer interaction. They possess a scalable tech infrastructure to support its global operations. The company is significantly investing in new technologies, particularly AI, to enhance its strategic plan. This focus aims to improve efficiency and decision-making across all business segments.

- AXA's digital transformation initiatives saw a 17% increase in digital sales in 2024.

- The company allocated €1.5 billion to technology investments in 2024.

- AXA's AI-driven fraud detection systems saved approximately €100 million in 2024.

- AXA's customer engagement platform has over 20 million active users in 2024.

Distribution Network

AXA's distribution network is a cornerstone of its business model, enabling widespread customer reach. The company leverages agents, brokers, and digital channels. AXA's agent distribution is particularly strong, enhancing customer proximity and local expertise. This network supports AXA's value capture through technology capabilities.

- AXA's global presence includes operations in over 50 countries.

- In 2024, AXA reported that its distribution network generated €102 billion in revenues.

- Digital channels contribute to 20% of new business for AXA.

- AXA's agent network comprises over 100,000 agents globally.

AXA’s financial strength relies on its capital, with a 227% solvency II ratio in 2024. Brand value, exceeding $14 billion in 2024, supports customer trust. Human capital is vital, with 144,724 employees globally in 2024. Technology investments totaled €1.5 billion in 2024.

| Resource | Description | 2024 Data |

|---|---|---|

| Financial Capital | Funds claims and expansion | Solvency II ratio: 227% |

| Brand Reputation | Customer acquisition | Brand value: $14B+ |

| Human Capital | Skilled employees | 144,724 employees |

| Technology | Tech & data analytics | €1.5B investment |

Value Propositions

AXA's value proposition centers on comprehensive insurance coverage. They provide diverse insurance products for property, casualty, life, and health needs. This broad coverage offers customers financial protection and peace of mind. AXA aims to strengthen its core businesses through disciplined execution. AXA reported a 2023 revenue of €102.7 billion, reflecting its market strength.

AXA's core value proposition centers on financial security, offering protection against life's uncertainties. This builds customer trust and loyalty, vital for long-term relationships. In 2024, AXA's revenue reached €102.7 billion, showing its financial strength. AXA aims for consistent earnings and capital growth, underpinning its commitment to customer security.

AXA's value proposition centers on expert advice, guiding customers in insurance and financial decisions. The Group enhances its technical capabilities, expanding proprietary assets in pricing and claims management. In 2024, AXA's revenue reached approximately €102 billion, reflecting strong performance. This strategy drives innovative service propositions.

Global Presence

AXA's extensive global reach offers customers access to insurance and financial services worldwide. Operating across Western Europe, North America, Asia-Pacific, and the Middle East, with a footprint in Africa, AXA tailors its services to diverse markets. This widespread presence allows AXA to cater to various customer needs. AXA's decentralized structure ensures compliance with local laws and regulations.

- AXA operates in 50 countries.

- The Asia-Pacific region contributed €3.9 billion to AXA's revenue in 2023.

- AXA's international business accounted for 55% of its underlying earnings in 2023.

- AXA serves 93 million customers globally.

Innovative Solutions

AXA’s value proposition centers on innovative solutions, adapting to shifting customer needs and market dynamics. In 2024, AXA invested significantly in its digital platforms, with over €1 billion allocated to technology and innovation. This includes scaling proprietary assets in pricing and claims management, and accelerating innovative service offerings. AXA leverages customer proximity, local expertise, and group technology to create value.

- AXA's tech investments were around €1B in 2024.

- Focus on proprietary pricing and claims solutions.

- Leveraging local expertise and technology.

AXA focuses on providing financial security, expert advice, and innovative solutions to its customers.

In 2024, AXA's revenue reached €102.7 billion, demonstrating its market strength and robust financial performance. Their international business accounted for 55% of its underlying earnings in 2023.

AXA operates in 50 countries, serving 93 million customers globally, adapting to various needs across diverse markets.

| Value Proposition | Key Aspects | 2024 Data |

|---|---|---|

| Financial Security | Comprehensive Insurance | €102.7B Revenue |

| Expert Advice | Guidance in Insurance and Finance | Tech Investments €1B |

| Innovative Solutions | Digital Platforms, Local Expertise | 55% Earnings from International Business (2023) |

Customer Relationships

AXA focuses on personalized service to cultivate strong customer relationships. Tailoring marketing to local cultures is key. For example, in 2024, AXA expanded its digital customer service in several Asian markets, improving customer satisfaction scores by 15%. This localized approach recognizes the importance of market-specific strategies.

AXA leverages digital platforms for customer engagement, offering easy access to services and information. This includes online policy management and claims filing. In 2024, AXA reported a significant increase in digital customer interactions. Specifically, 70% of claims were filed digitally.

AXA prioritizes responsive customer support. In 2024, AXA invested heavily in digital tools, with a 15% increase in online service usage. This focus aims to make customers feel valued. This commitment boosts AXA's brand reputation for reliability. Customer satisfaction scores rose by 8% in the last year.

Advice and Guidance

AXA excels in customer relationships by providing advice and guidance, ensuring clients make informed financial decisions. The Group focuses on technical excellence, scaling proprietary assets in pricing and claims management, enhancing service offerings. AXA's commitment is evident in its 2024 financial results, showing a 3% increase in revenues from its customer-centric services. This strategic approach boosts customer satisfaction and loyalty, vital for long-term growth.

- Customer-centric services revenue increased by 3% in 2024.

- Focus on technical excellence.

- Enhanced service offerings.

- Increased customer satisfaction and loyalty.

Community Involvement

AXA actively participates in community programs and backs social projects to foster a positive image and strengthen its standing. AXA is deeply dedicated to helping build a strong society by focusing on financial inclusion and climate change initiatives. AXA, with its employees and partners, aims to provide value to all stakeholders through these efforts. In 2023, AXA's community investments totaled €60 million.

- AXA allocated €60 million to community investments in 2023.

- AXA emphasizes financial inclusion and climate transition in its strategy.

- AXA collaborates with employees and partners to create value.

- Community involvement enhances AXA's reputation.

AXA personalizes customer service and tailors marketing. Digital platforms enhance engagement, with 70% of 2024 claims filed digitally. AXA prioritizes responsive support, boosting brand reputation and customer satisfaction.

| Metric | 2023 | 2024 |

|---|---|---|

| Customer-centric revenue growth | N/A | 3% |

| Digital claims filing | N/A | 70% |

| Community investments | €60M | N/A |

Channels

AXA's success heavily depends on its extensive agent and broker network for product distribution and client advice. In 2024, AXA's distribution network included over 100,000 agents and brokers globally, showcasing its robust reach. AXA is known for superior agent distribution, key to its market penetration. The Group is actively simplifying insurance, constantly reinventing its business model.

AXA leverages digital platforms, such as websites and mobile apps, to interact with customers. These platforms enable online policy management, claims filing, and support access, enhancing customer convenience. In 2024, AXA's digital sales increased, reflecting the importance of these platforms. Digital initiatives also contributed to operational efficiency.

AXA strategically partners with various entities to broaden its market presence. Collaborations with financial institutions and retailers are key. These partnerships facilitate the distribution of AXA's diverse offerings. In 2024, AXA's partnerships contributed significantly to its global revenue, enhancing customer access.

Direct Sales

AXA utilizes direct sales channels, including its sales force and online platforms, to engage customers directly. In established markets, AXA leverages salaried sales networks to enhance customer relationships. This strategy enables AXA to capitalize on its customer proximity and local expertise. For instance, in 2024, direct sales accounted for approximately 15% of AXA's total revenue.

- Direct sales channels include online platforms and sales force.

- AXA uses salaried sales networks in mature markets.

- Building on customer proximity and local expertise.

- Direct sales made up roughly 15% of revenue in 2024.

Call Centers

AXA Group utilizes call centers to offer customer support and facilitate sales. They recognize the importance of exceptional customer service in fostering enduring loyalty. AXA's marketing approach emphasizes customer satisfaction. In 2024, AXA's customer satisfaction scores increased by 7%, reflecting the impact of these strategies.

- Call centers handle a significant volume of customer interactions daily.

- Customer support is a key component of AXA's marketing strategy.

- AXA invests in training and technology to improve call center efficiency.

- Customer satisfaction directly influences AXA's brand perception.

AXA's diverse channels include agents, digital platforms, strategic partnerships, and direct sales, ensuring wide market access. In 2024, agents and brokers remained vital, contributing significantly to sales. Digital channels enhanced customer convenience, leading to a rise in online engagement.

| Channel Type | Description | 2024 Impact |

|---|---|---|

| Agents & Brokers | Extensive network for product distribution and advice. | Over 100,000 globally; major sales contributor. |

| Digital Platforms | Websites and apps for online policy management. | Increased digital sales; improved customer access. |

| Strategic Partnerships | Collaborations with banks, retailers for wider reach. | Significant revenue contribution; enhanced customer access. |

Customer Segments

AXA caters to individuals by offering diverse insurance and financial products addressing personal requirements. AXA focuses on simplifying insurance through continuous business reinvention and digital transformation. This includes accessible products, advice, and assistance across all channels. In 2024, AXA's individual customer base grew, reflecting its commitment to digital accessibility and personalized services. AXA's strategy aims to provide tailored solutions to meet evolving individual needs.

Families represent a core customer segment for AXA. They offer a variety of insurance solutions, including home, auto, and life insurance. In 2024, AXA's focus on family protection, including health and business continuity, drove significant growth. AXA EssentiALL extends these protections, with family-focused insurance products. AXA reported a 3% increase in family-related insurance policies in Q3 2024.

AXA caters to small businesses with tailored insurance and risk solutions. These offerings simplify policy management, claim filing, and support access. In 2024, AXA's small business segment saw a 5% increase in policy uptake. The company focuses on digital tools for efficiency.

Large Corporations

AXA Group caters to large corporations by providing specialized insurance and risk management solutions. A key player in underwriting large corporate commercial lines is AXA XL. This segment's performance significantly impacts AXA's overall financial health. In 2023, AXA XL's strong results helped offset underperformance in other areas.

- AXA XL contributed significantly to the Group's revenue.

- AXA XL's gross written premiums were substantial.

- AXA XL focuses on complex risk management.

- AXA's diversification strategy includes corporate insurance.

Affluent Clients

AXA caters to affluent clients by providing wealth management and investment services. This focus aligns with sustained demand, particularly in Property & Casualty (P&C) Commercial lines and Life & Health insurance. Customer satisfaction remains high, boosting retention rates, and growth initiatives contribute to this segment's success.

- In 2024, AXA's global revenue reached €102.7 billion.

- AXA's underlying earnings per share increased by 7% to €3.62 in 2024.

- Customer satisfaction scores in key markets consistently exceed industry averages.

- AXA's Life & Health segment saw continued growth in premiums.

AXA serves diverse customers, offering tailored products. Individual clients benefit from digital access and personalized services, experiencing growth in 2024. The company focuses on families and small businesses providing risk management solutions. AXA XL handles large corporate risks, contributing significantly to overall revenue.

| Customer Segment | Description | Key Focus (2024) |

|---|---|---|

| Individuals | Diverse insurance and financial products. | Digital accessibility, personalized services. |

| Families | Home, auto, and life insurance solutions. | Family protection, health, business continuity. |

| Small Businesses | Tailored insurance and risk solutions. | Digital tools, simplified management. |

| Large Corporations | Specialized insurance and risk management. | Underwriting, complex risk. |

| Affluent Clients | Wealth management and investment services. | Customer satisfaction, retention. |

Cost Structure

Claims costs represent a substantial portion of AXA's expenses, directly tied to fulfilling its insurance obligations. Efficient underwriting and risk assessment are vital for managing these costs effectively. In 2024, AXA's property & casualty claims were influenced by weather events. For instance, AXA estimated that Hurricanes Milton and Helene would cost less than €200 million before tax, after considering reinsurance.

Operating expenses at AXA, encompassing salaries, rent, and marketing, are a key focus for efficiency. AXA's operational excellence strategy aims to streamline these costs across the board. In 2023, AXA reported operating expenses of EUR 20.9 billion. The company is committed to disciplined execution. AXA's strategic emphasis is on bolstering its core business.

AXA's cost structure includes significant technology investments. These investments focus on enhancing operational efficiency and customer experiences through digital solutions. In 2024, AXA allocated a substantial portion of its budget, roughly 7%, to technology initiatives. This includes AI and digital infrastructure upgrades. These investments are essential for achieving AXA's strategic goals.

Distribution Costs

Distribution costs for AXA encompass commissions paid to agents and brokers, alongside expenses for digital channel maintenance. In 2023, AXA's distribution expenses totaled approximately €4.5 billion, reflecting its extensive agent network. AXA's focus is on leveraging its agent distribution network to enhance customer proximity and local expertise, supported by strong technology capabilities. This approach positions AXA to capture value effectively.

- Agent and broker commissions are a significant part of distribution costs.

- Digital channel maintenance is also a key expense.

- AXA emphasizes its agent network for customer reach.

- Technology supports AXA's distribution strategy.

Regulatory Compliance

AXA's cost structure includes significant expenses for regulatory compliance, crucial in the insurance sector. These costs encompass maintaining licenses and adhering to diverse global insurance regulations. As a conglomerate, AXA operates many independent businesses, each needing compliance with local laws. In 2023, AXA reported a €1.3 billion in operating expenses related to regulatory requirements.

- Compliance costs include legal, auditing, and reporting fees.

- AXA manages compliance across numerous jurisdictions, increasing costs.

- Regulatory changes can lead to unexpected compliance investments.

- These costs are essential for legal and operational integrity.

AXA's cost structure includes claims, operating expenses, tech investments, and distribution costs. Claims costs are major, impacted by events, with property & casualty claims influenced by weather events, such as Hurricanes Milton and Helene estimated below €200 million before tax after reinsurance in 2024. Operating expenses, like salaries, reached €20.9 billion in 2023. Technology investments and distribution costs, around €4.5 billion in 2023, are also significant.

| Cost Category | Description | 2024 Data/Estimate |

|---|---|---|

| Claims | Insurance obligations, risk assessment | Hurricanes Milton/Helene: < €200M (est.) |

| Operating Expenses | Salaries, rent, marketing | ~ €20.9B (2023) |

| Technology | Digital solutions, AI | ~ 7% of budget (est.) |

Revenue Streams

AXA's core revenue stream is insurance premiums, a significant source of income. These premiums come from property, casualty, life, and health insurance policies. In 2023, insurance premiums accounted for approximately 68% of AXA's total revenue, a substantial portion. This includes a broad range of insurance products offered globally.

AXA generates substantial revenue from investment income. This includes returns from investing premiums and company assets, a core revenue stream. AXA also earns fees through its investment management services. In 2023, AXA's underlying earnings were €7.3 billion. Investment income significantly contributes to this figure.

AXA Group earns significant revenue through asset management fees. AXA IM's management fees are a key revenue driver, increasing by 8% to €1.7 billion. This growth is fueled by managing assets for clients. Assets under management rose to €759 billion, influenced by positive market conditions.

Underwriting Profits

AXA's revenue streams include underwriting profits, crucial for financial health. These profits stem from accurately assessing and pricing risks in insurance policies. In 2024, the P&C segment saw underlying earnings increase by 10% year-on-year, reaching €5.5 billion, significantly boosted by a €1.4 billion underwriting result. This highlights AXA's proficiency in risk management and its direct impact on profitability.

- Underwriting profits come from risk assessment.

- P&C segment earnings rose to €5.5B in 2024.

- Underwriting result contributed €1.4B.

- Risk management boosts profitability.

Service Fees

AXA's service fees are a key revenue stream, generated from supplementary services like financial planning and risk management consulting. These offerings position AXA as a one-stop shop, catering to comprehensive client risk management needs. AXA leverages data-driven tools and solutions, such as AXA Climate solutions, to enhance its service offerings. These tools include AI-powered applications for exposure control and cyber risk scenario assessments, improving risk management.

- Financial planning and risk management consulting fees generate additional revenue.

- AXA provides a comprehensive suite of risk management services for clients.

- Data-driven tools include AXA Climate solutions.

- AI-powered applications for exposure control and cyber risk assessment are utilized.

AXA's revenue streams are diverse, including insurance premiums and investment income. Asset management fees and service fees also contribute significantly to overall earnings. Underwriting profits are essential for financial health.

| Revenue Stream | Description | 2024 Data (Approx.) |

|---|---|---|

| Insurance Premiums | Core income from various insurance policies. | ~68% of total revenue |

| Investment Income | Returns from investments and fees. | Underlying earnings €7.3B |

| Asset Management Fees | Fees from managing client assets. | AXA IM fees €1.7B |

Business Model Canvas Data Sources

AXA's BMC uses market analysis, financial reports, and company filings for data. This approach helps construct a model accurately.