Axway PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axway Bundle

What is included in the product

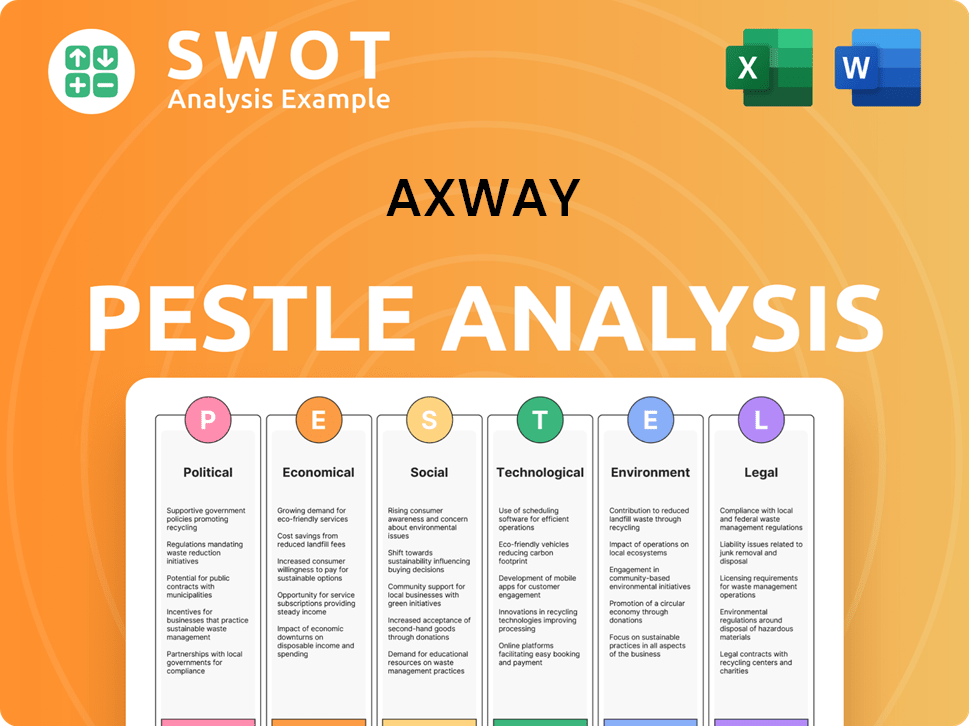

Analyzes how Axway is impacted by Political, Economic, Social, Technological, Environmental, and Legal factors.

Axway's PESTLE Analysis includes key findings summarized, ensuring rapid review and consensus among stakeholders.

Preview the Actual Deliverable

Axway PESTLE Analysis

This Axway PESTLE analysis preview showcases the complete, ready-to-use document.

You're viewing the same analysis you'll download instantly post-purchase.

Expect no content changes; the formatting is exactly as shown.

The provided preview is the complete analysis report.

Download and utilize the presented material immediately.

PESTLE Analysis Template

Navigate Axway's complex landscape with our insightful PESTLE analysis. Discover the external forces shaping their market position. From regulatory changes to technological advancements, we break it down for you. Understand risks and opportunities. Equip your strategic planning with this vital intelligence. Download the full, detailed analysis now!

Political factors

Government regulations heavily influence Axway. Data privacy laws like GDPR, and similar mandates, are critical. Compliance impacts operations and solution demand. The global data privacy market is projected to reach $13.7 billion by 2025. Regulatory changes create both challenges and opportunities.

Axway's global presence means it's sensitive to political stability. For example, IT spending growth in APAC, where Axway has a strong presence, is projected at 6.5% in 2024, influenced by stable governments. Conversely, political unrest in regions like certain parts of Europe could hinder investment. Changes in trade policies can also affect Axway's operations.

Changes in trade policies and tariffs directly impact Axway. For instance, tariffs on technology components could raise production costs. In 2024/2025, monitoring trade agreements like those within the EU and with the US is crucial, as these regions are key markets for Axway. Data from the World Bank shows that global trade volume growth was around 2.4% in 2023, and expected to be around 2.5% in 2024, influencing Axway's international operations.

Government Investment in Digital Transformation

Government investments in digital transformation, open banking, and secure data exchange initiatives drive demand for Axway's solutions. Favorable policies supporting digitalization are key drivers for Axway's growth, especially in API management, MFT, and B2B integration. For example, the EU's Digital Europe Programme has a budget of €7.6 billion. This supports digital transformation across various sectors. These initiatives create opportunities for companies like Axway.

- EU Digital Europe Programme (€7.6 billion budget)

- Open banking initiatives globally.

- Government cybersecurity regulations.

Cybersecurity Policies and National Security

Governments worldwide are intensifying their focus on cybersecurity, directly impacting data handling and integration practices. This trend is driven by rising cyber threats and the need to protect critical infrastructure. For Axway, this translates into both opportunities and challenges within the 2024-2025 timeframe. The company may experience increased demand for its secure data flow and integration solutions, but must also navigate stricter compliance regulations. This will require Axway to invest in enhanced security features and ensure adherence to evolving standards.

- In 2024, global cybersecurity spending is projected to reach $202.5 billion, a 10.7% increase from 2023.

- The U.S. government's cybersecurity budget for 2025 is approximately $13 billion, reflecting a continued emphasis on digital security.

- Data breaches cost companies an average of $4.45 million globally in 2024.

Axway faces significant political impacts. Data privacy regulations, like GDPR, create operational challenges. However, they also stimulate demand, with the data privacy market hitting $13.7B by 2025. Furthermore, government spending on digital transformation presents growth opportunities for Axway.

| Political Factor | Impact on Axway | 2024/2025 Data |

|---|---|---|

| Data Privacy Regulations | Compliance Costs, Market Demand | Global Data Privacy Market: $13.7B (2025) |

| Political Stability | Investment in Regions | IT Spending Growth (APAC): 6.5% (2024) |

| Government Digital Initiatives | Demand for Solutions | EU Digital Europe Programme: €7.6B Budget |

Economic factors

Global economic growth significantly impacts IT spending. In 2024, global GDP growth is projected at 3.2%, influencing tech investments. Strong economies encourage Axway's software adoption. Economic slowdowns, however, may curb IT budgets. For instance, the Eurozone's 0.5% growth in 2024 could affect spending.

As a global entity, Axway faces currency exchange rate risks. In 2024, currency fluctuations influenced international revenue. For instance, a 10% shift in EUR/USD could alter profitability. These changes require careful financial planning and hedging strategies to mitigate risks.

Inflation significantly impacts Axway's operational costs, including salaries and supplier expenses. Rising inflation can erode customer purchasing power, potentially reducing software investments. In 2024, the U.S. inflation rate hovered around 3.1% as of January, influencing tech spending decisions. For 2025, forecasts suggest a possible stabilization, but it remains a key economic factor to watch for its impact on Axway's pricing and sales strategies.

Interest Rates

Interest rates significantly affect Axway and its clients' borrowing costs. Elevated rates could increase the expense of financing software investments, potentially lengthening sales cycles. For instance, the Federal Reserve held its benchmark interest rate steady in May 2024, between 5.25% and 5.50%. This stability or any future hikes can influence Axway's financial planning and customer spending habits.

- May 2024: Federal Reserve held rates steady.

- Higher rates may slow software investment.

Industry-Specific Economic Trends

Axway's success hinges on industry-specific economic trends. Growth in digital banking, a key sector, boosts demand for API management. Healthcare's digital transformation similarly fuels data exchange needs. Retail's e-commerce expansion also influences Axway's market.

- Banking and financial services are projected to spend $270 billion on IT in 2024.

- The global healthcare IT market is expected to reach $786.7 billion by 2028.

- E-commerce sales in the US reached $1.1 trillion in 2023.

Economic factors greatly affect Axway's operations. Global GDP growth, forecast at 3.2% in 2024, influences IT spending. Currency fluctuations and inflation also pose financial risks. Interest rates and sector-specific economic trends must be monitored.

| Economic Factor | Impact | 2024 Data/Forecast |

|---|---|---|

| GDP Growth | Influences IT Spending | Global GDP Growth: 3.2% (Projected) |

| Currency Exchange Rates | Affects International Revenue | EUR/USD: Potential 10% Shift |

| Inflation | Impacts Costs & Purchasing Power | U.S. Inflation Rate: ~3.1% (Jan 2024) |

| Interest Rates | Affect Borrowing Costs | Federal Reserve Rate: 5.25%-5.50% (May 2024) |

Sociological factors

The availability of skilled IT professionals, especially in API management and cybersecurity, is vital for Axway. A skills shortage can affect project timelines. In 2024, the cybersecurity workforce gap hit 4 million globally. Demand for API specialists is rising.

The rise of remote and hybrid work significantly impacts data management. This shift fuels demand for secure data access solutions. Recent data shows remote work adoption increased by 15% in 2024. This trend directly benefits Axway's MFT solutions, as organizations need robust data exchange tools. Specifically, the market for secure file transfer is projected to reach $2.5 billion by 2025, highlighting the potential for Axway.

Customer expectations now prioritize seamless digital experiences, driving businesses to embrace digital channels. This societal shift boosts demand for integration and API strategies like Axway's. Digital transformation spending is projected to reach $3.4 trillion in 2024, signaling massive market growth. The adoption rate of digital-first strategies has increased by 30% in the last year.

Privacy Concerns and Data Ethics

Societal focus on data privacy and ethics is rising, impacting business practices regarding sensitive data. This shift stresses the need for robust, compliant data solutions, like Axway's offerings. The global data privacy market is expected to reach $136.7 billion by 2025. Businesses face significant penalties for non-compliance; for example, the GDPR can impose fines up to 4% of annual global turnover.

- Data breaches increased by 15% in 2023, highlighting risks.

- GDPR fines totaled over €1.1 billion in 2023, reflecting enforcement.

- Consumer trust in data handling is declining, impacting brand reputation.

- Axway's solutions help firms to navigate these challenges.

Demographic Shifts

Demographic shifts significantly influence business strategies, especially for tech companies like Axway. Changes in age, income, and population distribution directly impact demand for specific services and applications. An aging global population, where the 65+ age group is projected to reach 16% by 2050, increases demand for healthcare data solutions. This demographic shift necessitates enhanced data management and integration capabilities.

- Global elderly population is growing, creating demand for healthcare solutions.

- Aging population drives demand for healthcare data exchange solutions.

- By 2050, the 65+ age group is projected to reach 16%.

Data privacy concerns drive demand for secure solutions, with the global market projected at $136.7B by 2025. Data breaches increased by 15% in 2023, impacting consumer trust. Businesses face GDPR fines up to 4% of global turnover, highlighting the need for robust compliance.

| Factor | Impact | Data |

|---|---|---|

| Data Privacy | Increased demand for compliant solutions | Data Privacy Market: $136.7B by 2025 |

| Data Breaches | Erosion of consumer trust and financial losses | Breaches increased by 15% in 2023 |

| GDPR Compliance | Significant penalties for non-compliance | GDPR fines > €1.1B in 2023 |

Technological factors

Rapid advancements in API management, managed file transfer, and B2B integration technologies directly impact Axway. Staying at the forefront of technological changes is essential. In 2024, the API management market was valued at $6.2 billion, with projected growth. Axway must adapt to remain competitive.

Cloud computing and hybrid IT are significantly impacting businesses. Worldwide cloud spending is projected to reach $678.8 billion in 2024 and $800 billion in 2025. Axway's support for hybrid and multi-cloud environments is crucial. This allows for smooth data and application integration across diverse platforms.

Axway must continually enhance its security features due to evolving cyber threats. Protecting data during transit and storage is paramount for customer trust and regulatory compliance. The global cybersecurity market is projected to reach $345.7 billion in 2024. Investing in robust security is essential. Axway's security measures must adapt to protect against sophisticated attacks.

Artificial Intelligence and Machine Learning

Axway can significantly benefit from integrating Artificial Intelligence (AI) and Machine Learning (ML). These technologies boost data analysis, automate tasks, and strengthen threat detection within software solutions. The global AI market is projected to reach $1.81 trillion by 2030, growing at a CAGR of 36.8% from 2023. This growth presents opportunities for Axway.

- AI and ML can improve Axway's API management and data integration platforms.

- Automation through AI can streamline operations, reducing costs.

- Enhanced threat detection via ML can boost security.

- By leveraging AI, Axway can offer more valuable services.

Emergence of New Technologies (e.g., Blockchain, IoT)

The rise of blockchain and IoT presents Axway with both opportunities and hurdles. These technologies generate new data streams, potentially enhancing Axway's integration capabilities. However, Axway must adapt its solutions to manage these complex data flows, requiring strategic investments. The global blockchain market is projected to reach $94.0 billion by 2024, highlighting the importance of this adaptation.

- Data Integration: Integrating blockchain and IoT data into existing systems.

- Security: Ensuring secure data transfer and storage within these new technologies.

- Compliance: Addressing regulatory requirements related to these technologies.

- Innovation: Developing new solutions that leverage blockchain and IoT capabilities.

Technological factors profoundly influence Axway's strategy.

The API management market, valued at $6.2 billion in 2024, is growing, demanding constant adaptation to remain competitive.

AI and ML integration, with the global AI market reaching $1.81 trillion by 2030, presents significant opportunities for enhancing Axway's services and operational efficiency, making their offerings even more valuable.

The blockchain market, expected to reach $94.0 billion in 2024, and the Internet of Things (IoT) necessitate strategic investments for seamless integration and data security across new technologies.

| Factor | Impact on Axway | Data |

|---|---|---|

| API Management | Must Adapt | $6.2B market in 2024 |

| Cloud Computing | Essential | $678.8B spend in 2024, $800B in 2025 |

| AI & ML | Enhance Services | $1.81T market by 2030 (36.8% CAGR from 2023) |

Legal factors

Data privacy regulations, like GDPR and CCPA, are crucial. They dictate how businesses handle personal data, which impacts Axway. Changes in these laws directly affect Axway's software and customer needs. The global data privacy market is projected to reach $17.1 billion by 2024. Therefore, staying compliant is vital for Axway's offerings.

Axway's operations in finance and healthcare are heavily shaped by industry-specific rules. Open Banking directives, for instance, require secure data sharing, which Axway's solutions support. HIPAA compliance is crucial in healthcare, impacting how patient data is handled. These regulations influence product development and market strategies.

Axway heavily relies on software licensing and intellectual property laws to safeguard its products. These laws dictate how Axway can protect its source code and innovations. A 2024 report shows that software piracy costs the industry billions annually, emphasizing the importance of these protections for Axway's revenue. Any shifts in these legal frameworks, such as new copyright regulations or patent reforms, could significantly impact Axway's operations and profitability.

Contract Law and Service Level Agreements (SLAs)

Legal factors are crucial for Axway, especially regarding contracts and Service Level Agreements (SLAs). Contract law dictates the validity and execution of Axway's agreements with clients and collaborators. SLAs are essential for defining service quality and accountability, influencing customer satisfaction and retention. The enforceability and interpretation of these legal documents directly affect Axway's operational efficiency and financial stability.

- In 2024, contract disputes in the tech sector led to an average settlement cost of $2.5 million.

- Axway's revenue in 2024 was approximately €250 million, with a significant portion tied to contractual obligations.

- Legal compliance costs accounted for about 3% of Axway's operational expenses in 2024.

- Successful SLA management can increase customer lifetime value by up to 20%.

Antitrust and Competition Laws

Antitrust and competition laws are critical for Axway, influencing its market standing and M&A activities. These laws scrutinize market dominance and prevent unfair practices. For example, the acquisition of Sopra Banking Software faced regulatory review. Compliance ensures Axway can operate and grow legally.

- Antitrust fines can reach up to 10% of global turnover.

- The EU and US are major enforcers of antitrust laws.

- Axway must navigate these laws to avoid penalties.

- Compliance is a continuous process, requiring diligence.

Axway must adhere to data privacy rules like GDPR; the global data privacy market hit $17.1B in 2024. Industry-specific regulations impact finance and healthcare, shaping product development.

Intellectual property and software licensing protect Axway's innovations; software piracy costs the industry billions annually. Contract law and SLAs are vital; in 2024, contract disputes averaged $2.5M.

Antitrust laws affect market standing and M&A. Axway must navigate these laws; antitrust fines can reach up to 10% of global turnover, which impacts legal compliance.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Data Privacy | Compliance, product development | Global market: $17.1B |

| Contracts | Operational efficiency, legal costs | Average dispute cost: $2.5M |

| Antitrust | Market standing, M&A | Fines up to 10% of revenue |

Environmental factors

Environmental factors are increasingly important for businesses like Axway. The energy consumption of IT infrastructure is under scrutiny, with a push towards sustainability. Axway's cloud solutions could offer energy efficiency compared to on-premises setups. Data centers globally consumed ~2% of the world's electricity in 2023. Cloud adoption might help lower these figures in 2024/2025.

E-waste regulations, like those in the EU's WEEE Directive, mandate proper disposal of electronic goods. These rules affect hardware used in on-premises software deployments, influencing costs. In 2023, global e-waste reached 62 million tonnes. Cloud solutions may gain favor due to reduced hardware needs and compliance burdens. The market for e-waste recycling is expected to reach $96.6 billion by 2028.

Corporate Social Responsibility (CSR) and sustainability are increasingly important. Businesses prioritize eco-friendly partners. In 2024, sustainable investing reached $19 trillion. Axway's CSR affects its market position. Companies with strong CSR often attract more clients.

Climate Change and Extreme Weather Events

Climate change and extreme weather, while not directly affecting software, can impact IT infrastructure and operations. Increased frequency of extreme weather events, like the 2024 floods in Europe, could disrupt data centers. Customers will prioritize the resilience of Axway's solutions in various environments. The World Bank estimates climate change could push 100 million people into poverty by 2030.

- 2023 saw $28 billion in damages from extreme weather in the US alone.

- Data center downtime can cost businesses upwards of $5,600 per minute.

- Companies are increasingly investing in climate-resilient IT infrastructure.

Environmental Regulations Affecting Customers' Industries

Environmental regulations are increasingly shaping the operational landscape for many of Axway's customers. These regulations, such as those related to carbon emissions or waste management, can directly affect how businesses operate and manage their data. This creates a need for Axway's solutions to support environmental monitoring, reporting, and compliance efforts.

- The global environmental technology and services market is projected to reach $1.6 trillion by 2030.

- Companies are facing stricter reporting requirements under regulations like the EU's Corporate Sustainability Reporting Directive (CSRD).

- Demand for data management solutions that facilitate environmental compliance is growing.

Axway's environmental considerations include energy use, with cloud solutions offering efficiency. E-waste rules and hardware affect costs; global e-waste reached 62 million tonnes in 2023. CSR and sustainability are increasingly prioritized, as sustainable investing reached $19 trillion in 2024. Climate impacts, such as the 2024 floods in Europe, can disrupt data centers and data center downtime can cost businesses upwards of $5,600 per minute. Environmental regulations drive the need for solutions.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Energy Consumption | IT infrastructure and cloud vs. on-premise | Data centers globally consumed ~2% of the world's electricity in 2023; cloud adoption helps. |

| E-waste Regulations | Affects hardware and disposal costs | Global e-waste reached 62 million tonnes in 2023. |

| Sustainability & CSR | Impacts market position; attracts clients | Sustainable investing reached $19 trillion in 2024. |

PESTLE Analysis Data Sources

Our PESTLE relies on official reports, industry analyses, and policy updates from reputable institutions, delivering a data-backed view.