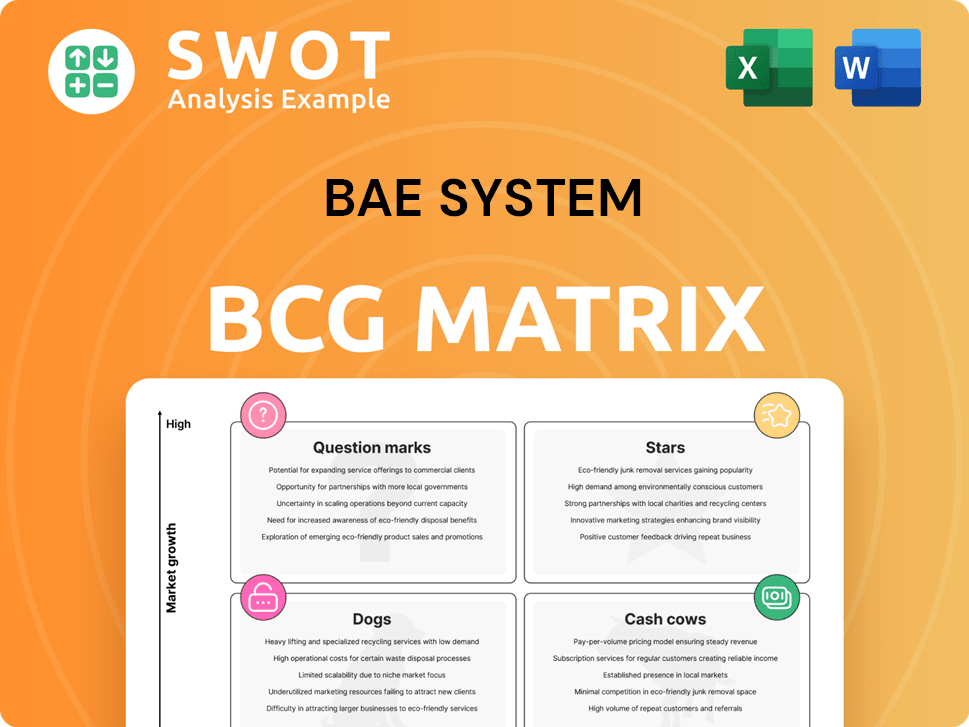

BAE System Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BAE System Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Printable summary optimized for A4 and mobile PDFs, to share insights.

What You See Is What You Get

BAE System BCG Matrix

The BCG Matrix preview is the complete document you'll get. Expect a fully functional, strategic tool ready for immediate use post-purchase, offering clear insights for decision-making.

BCG Matrix Template

BAE Systems’ diverse portfolio offers a glimpse into its market positioning, with some offerings likely shining as Stars and others facing the harsh realities of Dogs. This preview highlights key products but offers a limited scope. Explore the full BCG Matrix report for a complete picture.

Stars

BAE Systems' impressive order backlog, reaching £77.8 billion by the close of 2024, signals robust demand and assures future revenue streams. This substantial backlog reinforces the company's growth prospects, highlighting customer trust in its offerings. A considerable part of this backlog is slated to convert into revenue within the next few years, supporting sustained business performance.

BAE Systems demonstrated strong financial performance in 2024, with a 14% increase in sales and underlying EBIT. This growth highlights the company's operational efficiency and solid financial health. Generating significant free cash flow further bolsters its position in the market. This financial strength supports strategic investments for future expansion.

Space & Mission Systems, a star in BAE Systems' portfolio, stems from the Ball Aerospace acquisition. This integration boosts BAE's space tech offerings, with 2024 sales expected to grow. The business unit is performing well, with enhanced margins. The strategic move strengthens BAE's market position, especially in the defense sector.

Global Combat Air Programme (GCAP)

BAE Systems' involvement in the Global Combat Air Programme (GCAP) signifies a strategic move towards future growth within the advanced aerospace sector. This collaborative project highlights BAE's capability to engage in state-of-the-art defense projects, fostering innovation. GCAP is anticipated to generate substantial long-term revenue prospects for the company. The project is backed by significant financial commitments from participating nations.

- The GCAP is a collaborative effort involving the UK, Italy, and Japan, aimed at developing a next-generation fighter jet.

- BAE Systems plays a key role in the GCAP, focusing on the development of advanced technologies and systems.

- The program is expected to generate billions of dollars in revenue for BAE Systems over the coming decades.

- GCAP is designed to replace existing fighter aircraft, ensuring long-term market relevance.

Cybersecurity Solutions

BAE Systems' cybersecurity solutions are a rising star, fueled by escalating cyber threats. These solutions provide robust protection for critical infrastructure and sensitive data. The demand for these services is reflected in the market's growth; the global cybersecurity market was valued at $200 billion in 2023. BAE's expertise positions it well for continued expansion.

- Market Growth: Cybersecurity market valued at $200B in 2023.

- BAE's Role: Secures critical infrastructure and data.

- Demand: High due to rising cyber threats.

- Growth Potential: Significant in the current climate.

Stars, like Space & Mission Systems, drive growth with rising sales, and enhanced margins. Cybersecurity, a rising star, capitalizes on a $200B market (2023). The Global Combat Air Programme (GCAP) promises billions in revenue.

| Business Unit | Description | Revenue Drivers |

|---|---|---|

| Space & Mission Systems | Ball Aerospace integration | Sales growth, margin improvements |

| Cybersecurity | Protection solutions | High demand due to cyber threats |

| GCAP | Next-gen fighter jet | Long-term revenue, market relevance |

Cash Cows

BAE Systems' military equipment, including fighter jets and armored vehicles, experiences sustained demand due to geopolitical tensions. This segment consistently generates strong revenue, fueled by events like the Russia-Ukraine war. In 2024, global defense spending is projected to reach nearly $2.5 trillion. This ensures a stable market position for BAE's core products.

BAE Systems thrives on long-term government contracts, ensuring a steady revenue flow. These deals cover developing, manufacturing, and maintaining defense systems. For example, in 2024, BAE secured a $2.3 billion contract for the U.S. Navy. Their quality reputation helps secure these lucrative agreements. The company's consistent performance makes it a reliable partner.

BAE Systems' naval systems, like submarines and naval guns, are solid cash cows, driven by global naval modernization. Their expertise ensures consistent demand, securing revenue. These systems are vital for maritime security, a high priority for many countries. In 2024, BAE Systems secured a £4.2 billion contract for the next phase of the Dreadnought submarine program.

Munitions Manufacturing

BAE Systems' munitions manufacturing, a cash cow, benefits from steady revenue via long-term UK Ministry of Defence contracts. These contracts guarantee a stable supply of crucial munitions, ensuring consistent income. In 2024, BAE Systems' total sales reached £25.28 billion. They also focus on supply chain resilience for added stability.

- Revenue: BAE Systems' 2024 sales reached £25.28 billion.

- Contracts: Long-term contracts with the UK Ministry of Defence.

- Focus: Supply chain resilience to maintain stability.

- Impact: Provides a consistent revenue stream.

US Market Presence

BAE Systems has a robust presence in the U.S. market, bolstered by its major subsidiary, BAE Systems, Inc., and numerous facilities. The U.S. is the company's largest market, contributing significantly to its revenue stream. This strong market position provides a solid foundation for sustained growth and stability in the defense sector. BAE Systems's U.S. sales in 2023 were approximately $13 billion, a key indicator of its market strength.

- BAE Systems, Inc. is a major subsidiary.

- U.S. is the largest market.

- U.S. sales in 2023 were ~$13B.

- Provides stability and growth.

BAE Systems' cash cows include military equipment and naval systems. These segments generate consistent revenue due to sustained demand and long-term contracts. In 2024, BAE Systems secured major contracts, bolstering its financial stability.

| Cash Cow Segment | Revenue Source | 2024 Data Highlights |

|---|---|---|

| Military Equipment | Geopolitical Demand, Contracts | Global defense spending ≈ $2.5T |

| Naval Systems | Naval Modernization, Contracts | £4.2B Dreadnought contract |

| Munitions | UK MoD Contracts | Sales of £25.28B |

Dogs

The regional aircraft segment, a potential 'dog' in BAE Systems' portfolio, faces limited growth. This sector may not receive significant investment. It's crucial to assess its profitability contribution. In 2024, regional aircraft saw moderate demand, impacting overall returns.

Outdated legacy systems within BAE Systems could be considered 'dogs' in the BCG Matrix, representing products or services with low market share and growth. These systems often demand substantial investment for modernization, potentially diverting resources from more promising areas. In 2024, such systems might include older defense platforms or IT infrastructure, which are less competitive. Divestiture might be a strategic option if the costs outweigh the benefits, as suggested by the company's ongoing portfolio reviews.

Specific loss-making contracts at BAE Systems, fitting the 'dogs' category, consistently underperform. These contracts often face cost overruns. In 2024, BAE Systems reported losses from certain projects due to evolving demands.

Commoditized services

Commoditized services at BAE Systems, facing fierce price competition, could be categorized as 'dogs' within the BCG matrix. These services may lack unique features and struggle to achieve high-profit margins. For instance, in 2024, the defense sector experienced a 5% rise in cost-cutting pressures. Focusing on value-added services or niche markets is crucial for better performance.

- Intense price competition erodes profit margins.

- Lack of differentiation makes it hard to stand out.

- Value-added services offer a potential solution.

- Niche markets can provide a competitive edge.

Divested Business lines

Divested business lines at BAE Systems often fall into the 'dogs' category within the BCG matrix before disposal. These units no longer fit the company's strategic focus. Divestiture enables BAE Systems to concentrate on core, more profitable areas. For example, in 2023, BAE Systems divested its Combat Vehicle Repair business. This shift aligns with a strategy to streamline operations and boost overall profitability.

- Divestitures streamline operations.

- Focus on core strengths and growth.

- Combat Vehicle Repair business was divested in 2023.

- Enhances profitability and strategic alignment.

Dogs in BAE Systems' BCG Matrix include regional aircraft, legacy systems, loss-making contracts, and commoditized services. These elements typically show low market share and slow growth. Strategic actions like divestiture and focusing on value-added services are key.

| Category | Characteristics | Strategic Actions |

|---|---|---|

| Regional Aircraft | Limited growth; moderate demand in 2024. | Assess profitability; consider investment levels. |

| Legacy Systems | Low market share; require modernization. | Divestiture; focus on competitive platforms. |

| Loss-making Contracts | Cost overruns; underperformance in 2024. | Renegotiate; improve project management. |

| Commoditized Services | Intense price competition; low margins in 2024. | Value-added services; niche markets. |

Question Marks

BAE Systems is venturing into autonomous platforms, a high-growth sector with an unclear market position. These platforms could revolutionize defense and security. Investments in R&D and strategic partnerships are vital for market share gains. In 2024, the global autonomous military systems market was valued at approximately $12 billion.

Future Combat Air Systems (FCAS) are a high-growth opportunity for BAE Systems, though market leadership remains unconfirmed. These systems are vital for future air warfare, emphasizing advanced technology. BAE Systems must strategically invest to secure a competitive advantage. In 2024, the global market for advanced air combat systems is estimated at $30 billion.

Cyber intelligence within BAE Systems could be a 'question mark' in the BCG matrix. Its market potential is still under evaluation, despite the increasing need for advanced cybersecurity. In 2024, the cybersecurity market is projected to reach $202.5 billion, showing growth. Further investment is crucial for market validation.

Advanced Munitions

Advanced munitions, like hypersonic weapons, are a high-growth, high-uncertainty area for BAE Systems. These technologies aim to counter emerging threats and boost military strength. Securing contracts and showcasing technological prowess are crucial for success. BAE Systems' focus on this area is reflected in its R&D spending, with a notable portion allocated to advanced weapons development.

- Hypersonic weapons market is projected to reach $26.9 billion by 2028.

- BAE Systems invested $2.5 billion in R&D in 2023.

- Key contracts include those with the U.S. Department of Defense for advanced missile systems.

Emerging Market Expansion

Emerging market expansion for BAE Systems, a question mark in the BCG matrix, involves high potential but also considerable risks. These markets, with rising defense spending, offer growth opportunities. Success hinges on adapting to local needs and building strong relationships. Thorough market analysis and strategic partnerships are vital for navigating these complexities.

- Global defense spending is projected to reach $2.77 trillion in 2024.

- Emerging markets, like those in the Asia-Pacific region, are seeing rapid defense budget increases.

- BAE Systems has a history of forming partnerships to enter new markets.

- Adapting products to local requirements is crucial for market penetration.

Emerging market expansion presents high potential yet significant risks for BAE Systems. These markets, with increased defense spending, offer growth prospects. Success depends on local adaptation and strong partnerships. Global defense spending is predicted to hit $2.77 trillion in 2024.

| Aspect | Details |

|---|---|

| Market Opportunity | High growth potential in regions with rising defense budgets. |

| Challenges | Adapting products to local requirements and building partnerships. |

| Key Data | Global defense spending estimated at $2.77T in 2024. |

BCG Matrix Data Sources

BAE Systems' BCG Matrix leverages company financials, market analysis, industry reports, and expert evaluations for reliable strategic insights.