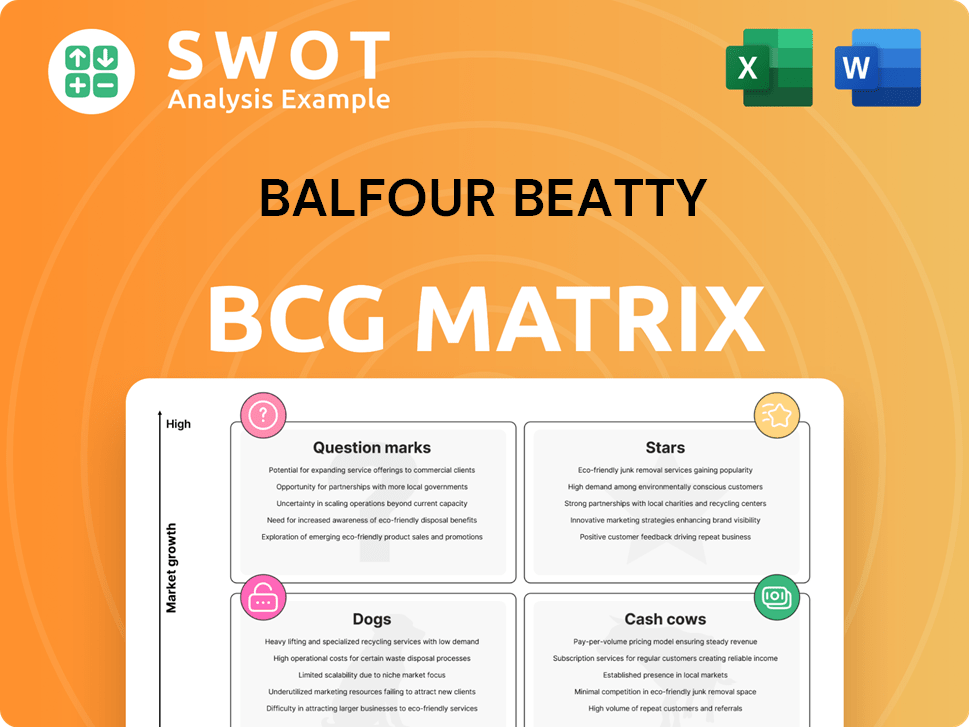

Balfour Beatty Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Balfour Beatty Bundle

What is included in the product

Balfour Beatty's BCG Matrix categorizes business units, guiding investment, holding, or divestment decisions.

Easily switch color palettes for brand alignment, ensuring your matrix always reflects Balfour Beatty's visual identity.

Preview = Final Product

Balfour Beatty BCG Matrix

This preview showcases the identical Balfour Beatty BCG Matrix report you'll receive. After purchase, the full document, expertly formatted and analyzed, is available instantly, ready for your strategic planning.

BCG Matrix Template

Balfour Beatty's BCG Matrix offers a glimpse into its diverse portfolio. It categorizes business units based on market share and growth rate. Question Marks indicate high-growth, low-share areas, and Cash Cows generate substantial revenue. Stars represent market leaders, while Dogs struggle for viability. This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Balfour Beatty is deeply engaged in upgrading the UK's energy infrastructure, including major projects like Hinkley Point C. This sector benefits from strong government support and net-zero goals, indicating substantial growth. In 2024, the UK government invested £1.2 billion in energy infrastructure. Balfour Beatty's expertise positions it well to capitalize on these opportunities and increase its order book, reflecting a strategic focus.

The US Buildings business is a "Star" in the Balfour Beatty BCG Matrix, showing strong growth. This segment focuses on aviation, leisure, and education, which saw increased demand in 2024. The US order book grew by 26% in 2024, fueled by a stable economy. This segment is a major growth driver for the company.

The Support Services division at Balfour Beatty is a "Star" due to its robust performance. In 2024, this division saw a strong revenue increase, with margins consistently hitting the upper end of their target range. Expansion in power transmission and distribution, less dependent on government funds, fuels this growth. The division's long-term contracts and service diversity further solidify its "Star" status.

Gammon Joint Venture in Hong Kong

Gammon, Balfour Beatty's Hong Kong joint venture, is a key player, boosting revenue and profit. Gammon is a leading Hong Kong construction firm working on major infrastructure projects. Its performance reinforces Balfour Beatty's financials, showcasing geographical diversification advantages. In 2024, Gammon secured several significant contracts, enhancing its market position.

- Gammon's revenue contribution is substantial to Balfour Beatty's group results.

- Gammon focuses on major infrastructure projects in Hong Kong.

- Gammon's financial success supports Balfour Beatty's overall performance.

- The joint venture benefits from geographical diversification strategies.

Innovation and Technology Adoption

Balfour Beatty actively fosters innovation, utilizing programs like My Contribution (MyC) to boost efficiency and cut costs. They integrate new technologies and emphasize industrialized construction to minimize on-site work. The company trials advanced technologies, such as exoskeletons, to enhance worker safety and productivity. In 2024, Balfour Beatty reported a 4% reduction in project costs via these innovations.

- MyC program drives efficiency and cost savings.

- Focus on industrialized construction methods.

- Testing of new technologies like exoskeletons.

- 4% reduction in project costs in 2024.

Stars in Balfour Beatty's portfolio include sectors with high growth and market share. These segments, like US Buildings, Support Services, and Gammon, are key revenue drivers. Their strong performance reflects strategic focus and effective market positioning. The US order book grew by 26% in 2024.

| Sector | Description | 2024 Performance Highlights |

|---|---|---|

| US Buildings | Aviation, leisure, and education projects | Order book grew by 26% in 2024 due to stable economy. |

| Support Services | Power transmission and distribution | Strong revenue increase with margins at target range. |

| Gammon (JV) | Hong Kong infrastructure projects | Secured significant contracts, boosting revenue and profit. |

Cash Cows

UK Construction Services, a cash cow, saw modest growth in 2024. Its improved 2.7% operating margin resulted from strong operations and a lower-risk portfolio. The segment focuses on low-risk contracts and disciplined project execution. Balfour Beatty aims for a 3% margin long-term.

Balfour Beatty's Infrastructure Investments, a cash cow, provides consistent income from student accommodation and residential projects. In 2024, the portfolio's value rose by 3% to £1.3 billion. The firm focuses on disciplined investments and disposals. This strategy ensures investment returns meet set targets.

Balfour Beatty's long-term maintenance contracts, like the one with Southampton, are cash cows. These deals with local authorities ensure stable revenue. This allows for effective resource allocation. Their expertise in highways services is key. In 2024, Balfour Beatty's order book reached £16.2 billion.

Fleet and Driver Safety Management

Balfour Beatty's Fleet and Driver Safety Management is a cash cow, ensuring operational efficiency and reducing risks. Their collaboration with Drivetech has significantly improved safety metrics. This focus on safety and compliance is critical for cost management.

- Drivetech partnership resulted in a 67% reduction in high-risk drivers.

- Safety and compliance efforts help minimize accident-related costs.

Sustainable Procurement Practices

Balfour Beatty's commitment to sustainable procurement is a core strength, reflecting its "Cash Cow" status in the BCG matrix. The company's UK operations were the first globally to meet the ISO20400:2017 sustainable procurement standard. This focus supports long-term profitability by reducing environmental impact and operational costs. Their Sustainable Procurement Policy prioritizes lowering carbon emissions and enables Scope 3 emissions reporting.

- ISO20400:2017 certification underscores Balfour Beatty's leadership.

- Sustainable practices improve brand reputation and investor relations.

- The policy includes reducing emissions throughout product lifecycles.

- Ongoing assessments show continued progress in sustainable procurement.

Cash Cows at Balfour Beatty are characterized by stability and consistent returns. UK Construction Services saw a 2.7% operating margin in 2024, reflecting strong operations. Infrastructure Investments' value rose by 3% to £1.3 billion, driven by disciplined investments.

| Cash Cow | Description | 2024 Data |

|---|---|---|

| UK Construction Services | Focuses on low-risk contracts. | 2.7% Operating Margin |

| Infrastructure Investments | Provides consistent income. | Portfolio Value: £1.3B (+3%) |

| Fleet & Driver Safety | Improves operational efficiency. | 67% Reduction in High-Risk Drivers |

Dogs

A few delayed US civils projects have hurt Balfour Beatty's US Construction segment profits. These delays drove up costs, reducing overall profitability in 2024. For instance, in the first half of 2024, the US Construction segment saw a decrease in underlying profit. Fixing these issues is key for improving US operations.

Projects like the A57 Mottram Bypass, facing legal hurdles, can turn into "dogs." Delays and rising costs erode profitability. In 2024, legal issues significantly impacted infrastructure projects. Balfour Beatty's focus should be risk mitigation to protect against further financial losses.

Balfour Beatty's profitability in 2024 was affected by increased costs related to the Building Safety Act. A £49 million non-underlying charge in 2024 highlighted the financial impact of addressing building safety issues. Managing these liabilities and potential recoveries is crucial. This reflects the company's commitment to safety.

Markets with Low Growth Prospects

In markets with low growth, like some segments of the UK construction industry, projects might just break even, consuming little cash. Balfour Beatty needs to assess its activities in these areas, possibly selling off or reorganizing to concentrate on better prospects. For example, the UK construction sector saw a growth of only 0.7% in 2023, a stark contrast to more dynamic markets. Therefore, Balfour Beatty should focus on areas with a projected growth of 7% annually through 2029, exceeding national averages.

- UK construction sector growth in 2023: 0.7%

- Projected growth rate Balfour Beatty should target: 7% annually until 2029

- Strategic response: Divestiture or restructuring in low-growth markets

High-Risk Projects with Low Margins

High-risk, low-margin projects can tie up capital and hinder returns. Balfour Beatty must be strategic in project selection, using higher bid margins and strong risk management. This approach helps reduce risk and enhance the quality of future projects. The goal is to build a balanced project portfolio with favorable terms.

- In 2024, Balfour Beatty's focus is on improving project margins.

- Emphasis on risk management to avoid low-margin contracts.

- The company aims for a portfolio of projects with suitable terms.

- Balfour Beatty is implementing stricter bid margin thresholds.

Dogs represent ventures with low market share in slow-growing markets.

Balfour Beatty faces "dogs" in delayed US civils and low-growth UK construction sectors.

These projects drain resources, necessitating divestiture or restructuring.

| Category | Impact | Example |

|---|---|---|

| Financial Drain | Low profitability | Delayed US projects |

| Market Stagnation | Slow growth, high risk | UK construction 0.7% growth (2023) |

| Strategic Action | Restructure or sell | Targeting 7% growth sectors |

Question Marks

New infrastructure technologies, like modular building, are a question mark for Balfour Beatty. These require major upfront investment but could boost safety and productivity. Balfour Beatty aimed to cut onsite work by 25% by 2025 using these methods. In 2024, the construction industry saw a 6% rise in tech adoption.

Balfour Beatty's ventures into carbon capture and storage, like Net Zero Teesside, place them in the question mark category. These projects, targeting a potentially high-growth market, face considerable financial and technological risks. The Net Zero Teesside project aims to capture up to 4 million tonnes of CO2 annually. Currently, CCS projects have low returns, so Balfour Beatty must strategically manage these high-investment, high-risk endeavors. Turning these into star projects requires careful allocation of resources and market positioning.

Balfour Beatty's EV infrastructure investments are a question mark in its BCG Matrix. The EV market is expanding, yet infrastructure needs and adoption rates are unclear. In 2024, EV sales rose, but charging station availability lagged. Balfour Beatty's strategic investment is key to growth, mitigating risks in this sector.

Expansion into New Geographies

Venturing into new geographic territories places Balfour Beatty in the 'Question Mark' quadrant of the BCG Matrix. These expansions demand substantial capital, potentially facing regulatory hurdles and fierce competition. Success hinges on meticulous growth assessment and risk management within these new markets. For instance, in 2024, Balfour Beatty's international revenue might constitute a smaller portion, signaling potential for growth but also inherent uncertainties.

- Market Entry Costs: Significant initial investment in infrastructure and compliance.

- Regulatory Risks: Navigating unfamiliar legal and operational landscapes.

- Competitive Pressure: Facing established local or international firms.

- Growth Potential: Opportunity for high returns but also high risk.

Nature Positive Initiatives

Balfour Beatty's nature-positive initiatives, aiming to halt nature loss, are classified as a question mark in the BCG Matrix. These efforts align with sustainability goals but demand significant investment without immediate financial returns. The company must strategically manage these initiatives to ensure they contribute to long-term value creation. This involves balancing environmental responsibility with financial performance in the construction and infrastructure sectors.

- Balfour Beatty's commitment includes setting targets to halt nature loss.

- These initiatives require investment and may not yield immediate financial benefits.

- Strategic management is crucial to ensure long-term value creation.

- The initiatives fit into the sustainability goals.

Question marks for Balfour Beatty represent high-growth, high-risk areas requiring significant investment. These include new technologies, carbon capture, EV infrastructure, geographic expansions, and nature-positive initiatives. Success depends on strategic resource allocation and risk management. In 2024, these sectors showed varying growth rates.

| Initiative | Risk Level | 2024 Status |

|---|---|---|

| New Tech | High | Tech adoption rose 6% |

| Carbon Capture | High | Low returns initially |

| EV Infra | Medium | Sales up, stations lag |

| Geographic | High | Revenue share varies |

| Nature-Positive | Medium | Investment needed |

BCG Matrix Data Sources

The BCG Matrix relies on financial filings, market research, and expert analysis to create a well-informed strategic guide.