Bally's Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bally's Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Easily share your Bally's BCG matrix, instantly exportable as a high-quality PDF or printout.

What You’re Viewing Is Included

Bally's BCG Matrix

This is the complete Bally's BCG Matrix document you'll receive after buying. It's a ready-to-use, professionally designed report for your strategic analysis and decision-making.

BCG Matrix Template

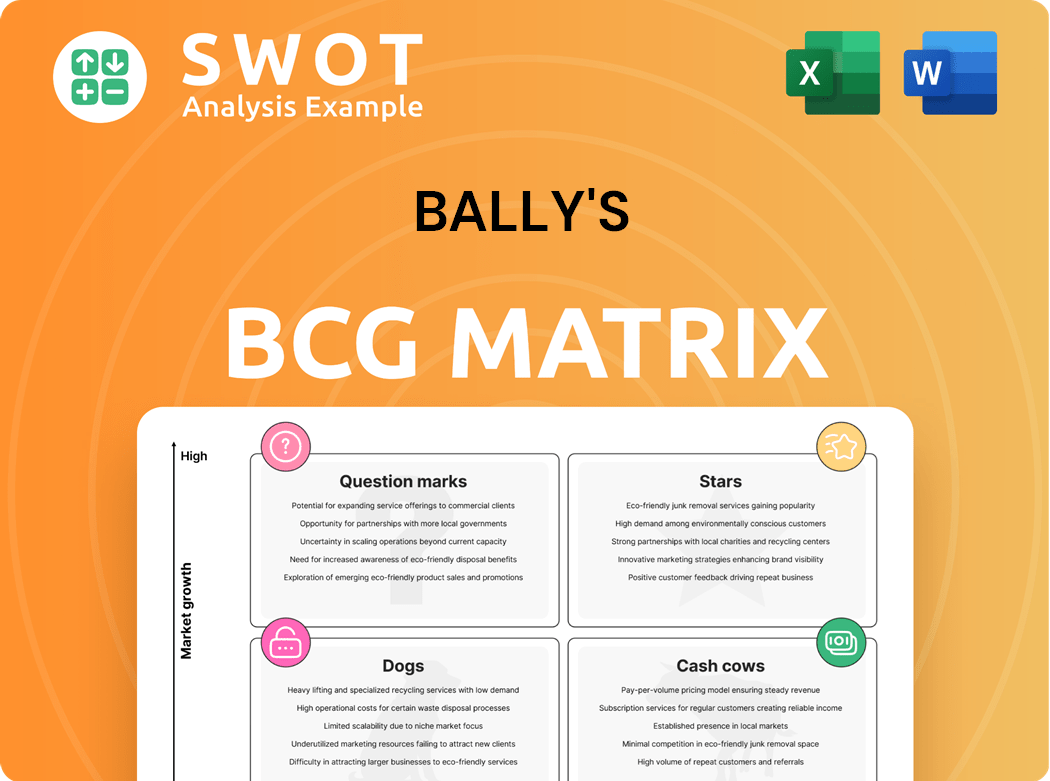

Bally's product portfolio, visualized through the BCG Matrix, offers a strategic snapshot. This framework categorizes products by market share and growth potential: Stars, Cash Cows, Dogs, and Question Marks. Identifying each quadrant reveals crucial insights into resource allocation. Understanding this company's matrix helps pinpoint growth drivers and resource drains. This preview offers a glimpse, but the full BCG Matrix delivers deep analysis and actionable recommendations—crafted for business impact.

Stars

North America Interactive is a "Star" in Bally's BCG Matrix, exhibiting rapid growth. Revenue surged by 24.4% in Q4 2024, signaling its potential. This segment includes Bally Bet and iGaming in states like Rhode Island. Investing further could establish market leadership.

The UK online operations are a strong point for Bally's, showing an 11.3% revenue increase in Q4 2024. This growth, fueled by player retention and revenue strategies, positions them well. Expanding online sports betting could boost their market share further in the UK.

The Chicago casino is a high-growth venture for Bally's. Construction is ongoing, and it's expected to boost revenue significantly. Securing final approvals was a key step in this project. Bally's anticipates substantial returns from this flagship location. This project's success is key for Bally's future.

Queen Casino Synergies

Bally's acquisition of Queen Casino & Entertainment is a Star in its BCG Matrix, promising significant revenue growth and geographic diversification. The integration of Queen's four properties offers opportunities to improve operational efficiency through best practice sharing. This strategic move is expected to bolster Bally's regional market presence. For instance, in 2024, Bally's reported a revenue increase, partly attributed to strategic acquisitions like Queen Casino.

- Revenue growth expected from the merger.

- Geographic diversification is a key benefit.

- Operational efficiencies through integration.

- Strengthened competitive position in regional gaming.

Las Vegas Redevelopment

The Tropicana Las Vegas site redevelopment is a strategic move for Bally's, aiming to establish a significant presence. Bally's plans to build an integrated resort. This aligns with the A's stadium construction, enhancing the site's appeal. This project could significantly boost Bally's revenue.

- Redevelopment cost: Estimated at $1.7 billion.

- Projected revenue increase: Potential for a 20-25% rise.

- Brand presence: Expected to increase market share by 15%.

- Construction start: Expected in late 2024.

Bally's "Stars" include high-growth segments like North America Interactive and UK online operations. These segments saw revenue increases in 2024, reflecting strong performance. Strategic acquisitions like Queen Casino are enhancing geographic reach and revenue. Key projects, such as the Chicago casino and Tropicana redevelopment, are set to boost future earnings.

| Segment | Q4 2024 Revenue Change | Key Strategy |

|---|---|---|

| North America Interactive | +24.4% | Further investment in Bally Bet and iGaming |

| UK Online | +11.3% | Focus on player retention, online sports betting |

| Queen Casino Acquisition | Significant Growth | Operational efficiency, regional expansion |

Cash Cows

Bally's Casinos & Resorts, a cash cow, brought in $324.4 million in Q4 2024. Although it saw a 5.2% year-over-year dip, it still forms a strong financial base. Improving its operational efficiency can boost cash flow significantly. This segment offers a predictable revenue stream.

Bally's Regional Gaming Portfolio, a cash cow, includes 19 casinos across 11 states. This portfolio offers a stable revenue stream, benefiting from domestic gaming. In Q3 2023, Bally's reported $588.6M in revenue from its casinos. Unifying assets and best practices can boost performance.

Bally's acquired Aspers Casino in Newcastle, UK, boosting its global presence and offering a stable revenue source. This well-established casino is a dependable income generator. In 2024, the UK casino market was valued at approximately £1.2 billion. Ensuring Aspers' success and seeking growth opportunities can cement its cash cow status.

Land-Based Casino Operations

Bally's land-based casinos are a steady source of income, even with some regional issues. These casinos, with their established customer bases and various games, are well-positioned. Enhancing customer experiences and making operations more efficient are key to their ongoing success. For example, in Q3 2023, Bally's reported $576.8 million in revenue from its casinos.

- Consistent Revenue: Land-based casinos provide a reliable income stream.

- Customer Loyalty: Established casinos benefit from repeat customers.

- Operational Efficiency: Optimizing operations is crucial for success.

- Diverse Gaming: Offering various games attracts a broad audience.

Sports Betting Licenses (North America)

Bally's holds online sports betting licenses in 13 North American jurisdictions, a key asset. These licenses allow Bally's to operate in significant markets, vital for revenue. Expanding sports betting operations using these licenses can boost cash flow significantly. Bally's aims to increase its market share through these strategic moves.

- Licenses in 13 North American jurisdictions.

- Enables sports betting services in key markets.

- Potential for increased cash flow generation.

- Focus on expanding market share.

Bally's cash cows, like its regional casinos, generate consistent revenue streams. The land-based casinos benefit from repeat customers and diverse gaming options. Bally's online sports betting licenses in 13 North American jurisdictions are also valuable assets. Focus on enhancing operational efficiency and expanding market share.

| Segment | Revenue (Q4 2024) | Key Strategy |

|---|---|---|

| Regional Casinos | $324.4M | Improve Operational Efficiency |

| Aspers Casino | Stable | Growth Opportunities |

| Online Sports Betting | Growing | Expand Market Share |

Dogs

Bally's temporary Chicago casino has underperformed, generating $26.8 million in revenue in January 2024. This falls short of initial projections. Consistent disappointing results necessitate strategic improvements.

Bally's divested its Asian interactive business because it wasn't performing well financially. This shift led to a licensing model for revenue. The move likely addressed underperformance. In Q3 2023, Bally's revenue from Asia was negligible.

Certain Bally's properties, including Lincoln Casino Resort and Bally's Atlantic City, have underperformed recently. Traffic disruptions and changes in marketing teams have hindered their success. Bally's Atlantic City saw a 16.9% decrease in net revenue in Q3 2023. Focusing on these issues is key to boosting their financial results.

International Interactive (Excluding UK)

The International Interactive segment, excluding the UK, presents a mixed picture within Bally's portfolio. Weakness in some markets has been noted. Operational issues and logistical challenges have impacted its performance. Bally's is working on streamlining operations to boost its results. Focusing on market-specific challenges is key.

- Revenue from international interactive operations, excluding the UK, was $115.5 million in Q3 2023.

- There was a decrease in revenue compared to Q3 2022.

- Bally's is aiming for operational improvements in this segment.

- The company is addressing challenges in specific markets to enhance profitability.

Low Market Share Sports Betting

Bally Bet operates in the "Dogs" quadrant of the BCG Matrix, holding a minimal market share. Currently, Bally Bet captures only about 1% of the U.S. sports betting market, a significant challenge against industry leaders. This low market share hinders revenue growth and profitability, despite favorable customer reviews. A strategic reassessment is crucial for Bally Bet to improve its competitive positioning.

- Market Share: Roughly 1% of the U.S. sports betting market.

- Customer Feedback: Positive, but market presence is limited.

- Strategic Need: Overhaul required to boost market share and profitability.

- Financial Impact: Low revenue and potential losses due to small market share.

Bally Bet is categorized as a "Dog" in the BCG Matrix. It struggles with a small market share. Revenue and profitability are negatively impacted.

| Metric | Value | Notes |

|---|---|---|

| Market Share (U.S. Sports Betting) | ~1% | Significantly below industry leaders. |

| Customer Feedback | Positive | Doesn't translate to market dominance. |

| Strategic Need | Major Overhaul | To boost share and profitability. |

Question Marks

Rhode Island's iGaming launch, exclusively through Bally's, is a question mark in their BCG Matrix. Its success hinges on customer acquisition and retention against rivals. Rhode Island's online casino market generated $30.8 million in revenue in 2024. Adapting strategies is critical for sustained growth.

The Monopoly Casino app's launch in New Jersey, a venture by Bally's, shows promise with an initial positive customer response. Sustained user engagement and market penetration are crucial for its long-term success. Bally's needs continued investment in marketing and product development to solidify its market presence. In 2024, the New Jersey online casino market generated over $1.9 billion in revenue.

Bally Bet's expansion into states like Tennessee is a Question Mark in its BCG Matrix. Its potential for growth is there, but success isn't guaranteed. Bally Bet's market share and customer attraction in these new areas is uncertain. In 2024, Tennessee's sports betting handle was $415.6 million. Adapting to market feedback is key for Bally Bet's strategy.

Land-Side Conversions (Belle of Baton Rouge, Casino Queen Marquette)

The land-side conversions at Belle of Baton Rouge and Casino Queen Marquette are considered potential growth projects within Bally's BCG Matrix. Successfully integrating these projects is vital for unlocking their full value and contributing to the company's expansion. Effective planning and execution are essential for maximizing returns from these conversions. As of 2024, Bally's is focused on these projects to boost revenue and market presence.

- Land-side conversions aim to enhance guest experience and operational efficiency.

- These projects are part of Bally's strategic plan to grow its regional footprint.

- Successful conversions are expected to increase profitability and market share.

- Investments in these projects reflect Bally's commitment to long-term growth.

Spanish Operations

Bally's Spanish operations fall into the question mark category within the BCG matrix. This is due to the recent lifting of advertising restrictions, offering potential for growth. The company can now invest more, aiming for faster expansion in the market. However, it's uncertain if Bally's can successfully seize this opportunity and gain significant market share.

- Advertising restrictions lifted, creating growth opportunities.

- Increased investment is now possible, potentially boosting expansion.

- Market share gains are not guaranteed despite the changes.

- Bally's needs to capitalize on the new environment to succeed.

Question Marks in Bally's BCG Matrix need strategic investment to realize growth. Success depends on effective market adaptation. Expansion efforts require careful management to ensure profitable outcomes.

| Project | Status | Considerations |

|---|---|---|

| Rhode Island iGaming | Launched | Compete with rivals for customer retention; $30.8M revenue (2024). |

| Monopoly Casino App | Launched | Sustain engagement; NJ market over $1.9B (2024). |

| Bally Bet Expansion | New States | Attract customers; Tennessee handle $415.6M (2024). |

BCG Matrix Data Sources

Bally's BCG Matrix is built using company financials, market share data, industry reports, and competitor analyses.