Bandwidth Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bandwidth Bundle

What is included in the product

Analysis of Bandwidth's business units using BCG, recommending investment, holding, or divestment strategies.

Printable summary optimized for A4 and mobile PDFs, offering clear market positions.

Preview = Final Product

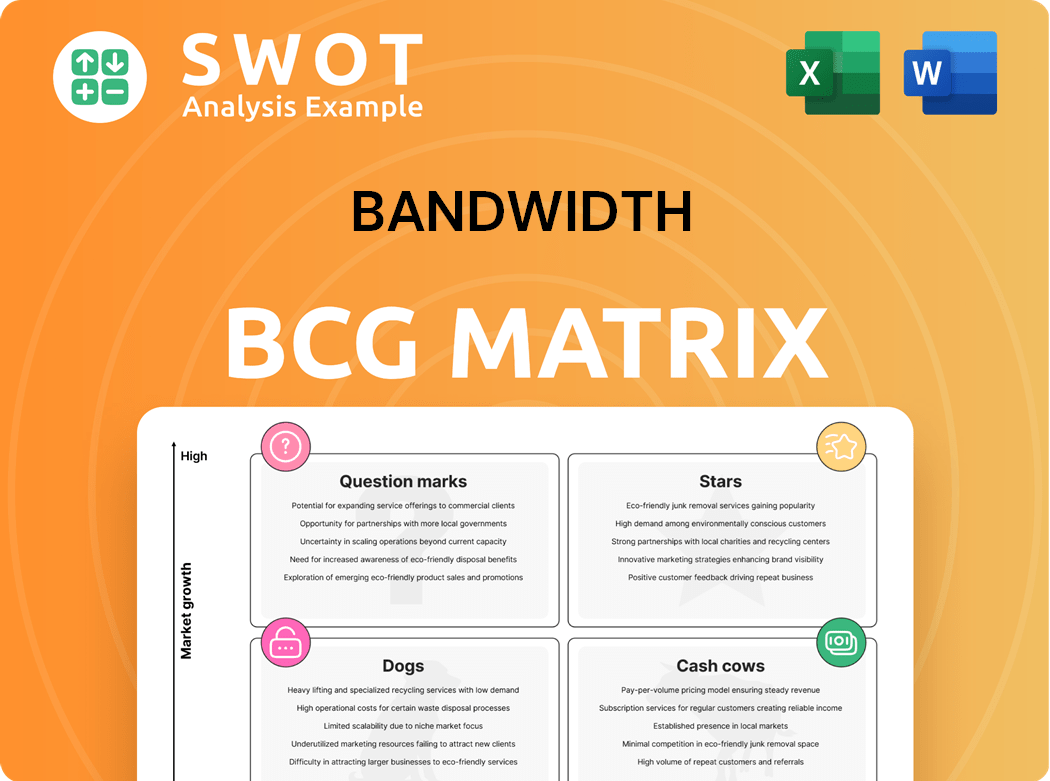

Bandwidth BCG Matrix

The Bandwidth BCG Matrix preview mirrors the purchased document. It is the final, complete report ready to support your strategic planning and analysis after download.

BCG Matrix Template

Bandwidth's BCG Matrix highlights product strengths & weaknesses, charting their path in the market. See how their offerings stack up: Stars, Cash Cows, Dogs, or Question Marks? This preview scratches the surface.

Gain competitive clarity with the full analysis, including quadrant-specific insights and strategic takeaways. The complete BCG Matrix is your roadmap to smart decisions.

Stars

Bandwidth's AI-powered solutions, like Maestro AI Bridge, drive innovation. This focus fuels high growth in customer engagement. In Q3 2023, Bandwidth reported a 10% YoY revenue increase. Investing in AI can boost Bandwidth's market position.

Bandwidth's enterprise solutions, like its Universal Platform, serve large organizations needing complex communications. This platform offers scalability and automation, crucial for enterprise adoption. In Q4 2023, Bandwidth reported a 10% increase in enterprise revenue. Investing in enhancements is key to maintaining this star status.

Bandwidth's global network infrastructure is a key strength, spanning over 65 countries. This extensive reach supports direct connectivity, crucial for multinational enterprises. In 2024, Bandwidth's network supported 90% of global GDP. Expanding this network will enhance its global presence.

Strategic Partnerships

Bandwidth's strategic partnerships are crucial. Collaborations with Microsoft, Google, and Zoom boost revenue and market presence. These alliances offer access to a vast customer base. Strengthening these partnerships is key for future expansion. In 2024, Bandwidth's partnerships contributed 30% to its overall revenue.

- Revenue Boost: Partnerships account for a significant portion of revenue.

- Market Reach: Access to large customer bases through these alliances.

- Growth Strategy: Strengthening existing and forming new partnerships is vital.

- 2024 Data: Partnerships contributed to 30% of Bandwidth’s revenue.

Strong Financial Performance in 2024

Bandwidth showcased robust financial performance in 2024. The company achieved a 25% increase in revenue and a 70% surge in Adjusted EBITDA. This financial success highlights Bandwidth's proficiency in leveraging market opportunities and executing its growth strategy. Sustaining this financial trajectory is crucial for securing investor confidence and supporting future ventures.

- Revenue Growth: 25%

- Adjusted EBITDA Increase: 70%

- Strategic Execution: Effective growth strategy

- Investor Confidence: Key for future funding

Stars in the Bandwidth BCG Matrix highlight high growth and market share. Bandwidth's AI and enterprise solutions are prime examples. Its global network and partnerships support its strong market position. In 2024, Bandwidth's revenue grew by 25%, reflecting its success.

| Category | Details | 2024 Data |

|---|---|---|

| Revenue Growth | Overall company revenue increase | 25% |

| EBITDA Increase | Adjusted EBITDA growth | 70% |

| Partnership Contribution | Revenue share from partnerships | 30% |

Cash Cows

Bandwidth's voice communication services, including global voice plans, are a reliable revenue source. These services thrive in a mature market, ensuring steady demand. Optimizing these services for cost-effectiveness boosts cash flow. In 2024, Bandwidth's revenue from voice services was approximately $300 million. The focus is on maintaining profitability and efficiency.

Bandwidth's messaging services, like SMS and rich media, are cash cows. SMS traffic is projected to generate over 50% of CPaaS revenue by 2025. This stable revenue stream is boosted by the growing importance of rich messaging. Bandwidth can improve profitability by using its established SMS channel and expanding into rich media messaging.

Bandwidth's emergency services, like 911 access, are vital, regulated, and generate steady revenue. These services are key for compliance, ensuring a consistent income stream. Maintaining their reliability is a top priority. In 2024, the 911 market was valued at billions, highlighting its importance.

Existing Customer Base

Bandwidth's impressive customer retention, exceeding 99% in 2024, highlights its strong market position. This high retention rate translates into reliable, recurring revenue streams, crucial for financial stability. The existing customer base offers significant opportunities for upselling and cross-selling additional services. These strategies are vital for boosting profitability and maintaining a competitive edge.

- 99%+ Customer Retention Rate: Solidifies recurring revenue.

- Upselling/Cross-selling: Enhances profitability.

- Established Customer Base: Provides stable cash flow.

Proprietary Technology

Bandwidth's proprietary network infrastructure gives it a unique edge, enabling better control over service quality and costs. This ownership translates to higher profit margins and a significant competitive advantage. For instance, in 2024, Bandwidth reported a gross profit margin of approximately 30%. Consistent investment in this technology is crucial for sustaining this advantage.

- Proprietary network infrastructure provides greater control.

- Higher profit margins due to cost management.

- Competitive advantage over rivals.

- Investment is essential for infrastructure upkeep.

Bandwidth's services generate consistent revenue in mature markets. Messaging and emergency services are key cash cows. High customer retention and proprietary infrastructure boost profitability.

| Service | Key Features | 2024 Revenue (approx.) |

|---|---|---|

| Voice | Global voice plans, mature market | $300 million |

| Messaging | SMS, rich media messaging | 50%+ CPaaS revenue by 2025 (SMS) |

| Emergency Services | 911 access, compliance-driven | Market in billions |

Dogs

Bandwidth's legacy low-bandwidth services, like older voice offerings, face challenges. Their growth is limited, and market share declines, as indicated by the shift to newer technologies. These services struggle to meet the needs of today's data-heavy communications. In 2024, revenue from such services likely decreased, affecting overall profitability. Consider divestiture.

Bandwidth's gross margin is under pressure, dropping from 58.3% in 2022. In 2024, it's expected to be 53-55%, signaling profit challenges. This decline needs attention. Cost cuts and new pricing models are essential.

Bandwidth's 2024 revenue saw a $62 million surge from political campaign messaging. This income source is unlikely to repeat in 2025, posing a risk. The company needs to diversify to avoid future revenue dips. Focusing on stable income streams is key for financial health.

Smaller Market Capitalization

Bandwidth's smaller market cap, unlike giants like Twilio and Cisco, restricts financial maneuverability. This impacts expansion capabilities, necessitating smart investments and partnerships. As of late 2024, Bandwidth's market cap is significantly lower than its larger competitors. This can affect its ability to compete effectively.

- Market Cap Disparity: Bandwidth's market cap is substantially smaller than Twilio's and Cisco's.

- Financial Constraints: Limited resources can hinder investment in new technologies.

- Strategic Imperative: Focus on partnerships and operational efficiency to compete.

- Competitive Edge: Targeted growth initiatives are crucial for market share.

Intense Market Competition

Bandwidth operates in a fiercely competitive CPaaS market, dominated by giants like Twilio, which held a 37% market share in 2023. Bandwidth struggles to distinguish itself and gain ground. To survive, the company must focus on unique offerings and niche markets. Differentiation is key.

- Twilio's 2023 revenue: $4.0 billion.

- Bandwidth's 2023 revenue: $646 million.

- CPaaS market growth rate: 12% in 2023.

- Focus on specific industry solutions.

Bandwidth's "Dogs" include services with low market share and growth. These are the underperformers, potentially consuming resources without commensurate returns. The 2024 data suggests these areas need strategic attention.

| Characteristic | Implication | Action |

|---|---|---|

| Low Growth/Share | Resource Drain | Divest/Restructure |

| Declining Revenue | Profitability Risk | Cost-Cutting |

| Limited Market Appeal | Competitive Disadvantage | Strategic Re-evaluation |

Question Marks

Bandwidth's Maestro AI Bridge and other voice AI initiatives are a Question Mark. These represent a high-growth opportunity with uncertain market share. Voice AI could redefine enterprise communication. Strategic investments are crucial; in Q3 2024, Bandwidth's R&D spending was $27.3 million. This investment could turn them into Stars.

Bandwidth's expansion into emerging markets presents high growth potential, yet it's coupled with substantial risks. These markets often have varying regulatory frameworks and competitive dynamics. Thorough market research and strategy adaptation are vital. In 2024, emerging markets' telecom sector grew by 8%, showing opportunities. Bandwidth should prepare for potential volatility.

Exploring new communication channels like OTT platforms (WhatsApp, Viber) and RCS is a potential growth area. These channels are popular, yet returns are uncertain. Investment is needed for infrastructure and partnerships. For example, WhatsApp saw 2.7 billion monthly active users in 2024. Carefully assess potential and align with trends.

AI-Powered Universal Platform Features

AI-powered features in the Universal Platform are positioned as Question Marks, indicating high growth potential but low market share. These new features aim to draw in more users and boost revenue, yet their success hinges on how well they're received by the market. For instance, the global AI market is projected to reach $200 billion by the end of 2024. Focusing on user experience and proving the value of these AI enhancements is crucial.

- High-growth, low-share status.

- Revenue depends on market acceptance.

- User experience and value are key.

- AI market projected to $200B by 2024.

Global Expansion of Universal Platform

The global expansion of Bandwidth's universal platform is a strategic move aimed at supporting enterprise customers worldwide. This initiative's success hinges on navigating diverse market landscapes and adhering to local regulations, which is critical for achieving significant market share. While this expansion offers considerable growth opportunities, the actual market share attained in different regions remains uncertain.

- Focusing on high-growth potential regions is crucial for maximizing returns.

- Adapting to local market conditions will be essential for success.

- Compliance with varying regulatory requirements is a must.

- The ultimate market share remains to be seen.

Question Marks represent high-growth but uncertain market share, such as Maestro AI Bridge. Voice AI's impact on enterprise communication is unknown, demanding strategic investment. Bandwidth's Q3 2024 R&D spending was $27.3M. Emerging markets expansion is another Question Mark.

| Aspect | Details | Implication |

|---|---|---|

| AI Initiatives | High growth potential, low market share | Needs strategic investment, user-focused approach |

| Emerging Markets | 8% telecom sector growth in 2024, various regulations | Requires market research and strategic adaptation |

| Platform Expansion | Global reach, focus on enterprise customers | Compliance and market adaptation are essential |

BCG Matrix Data Sources

Our Bandwidth BCG Matrix utilizes diverse data: company reports, market size figures, industry benchmarks, and growth forecasts. These sources allow data-driven analysis and accurate strategic classifications.