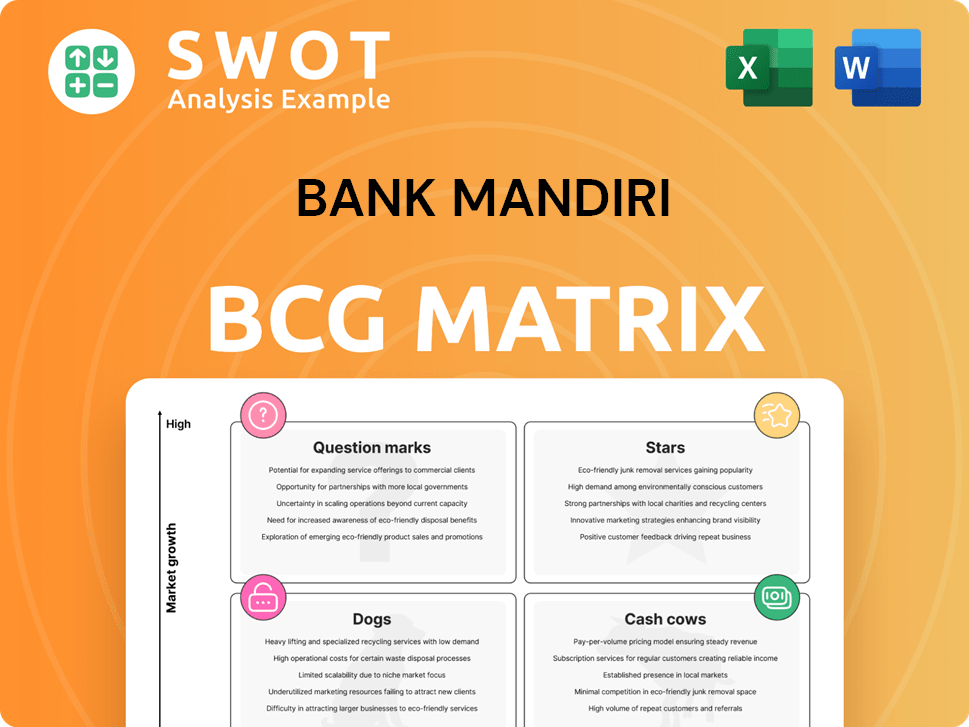

Bank Mandiri Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank Mandiri Bundle

What is included in the product

Strategic overview of Bank Mandiri's business units using the BCG Matrix, guiding investment and divestment decisions.

Clean, distraction-free view optimized for C-level presentation, providing a strategic overview.

Delivered as Shown

Bank Mandiri BCG Matrix

The Bank Mandiri BCG Matrix preview is the complete document you'll receive. It includes a fully-developed strategic analysis, formatted for professional presentations and ready for your immediate implementation. The full report is immediately downloadable with no additional steps after purchase. Get the exact file you see now.

BCG Matrix Template

Bank Mandiri's BCG Matrix helps visualize its diverse portfolio, from high-growth opportunities to established cash generators. This strategic tool classifies each product or service—identifying strengths and weaknesses. Understanding this framework unlocks smarter resource allocation decisions. It helps highlight key investment opportunities, aiding profitability. Knowing the dynamics allows for proactive risk mitigation.

Get instant access to the full BCG Matrix and discover which products are market leaders, which are draining resources, and where to allocate capital next. Purchase now for a ready-to-use strategic tool.

Stars

Livin' by Mandiri shines as a Star in Bank Mandiri's portfolio. It has seen rapid growth and high user engagement. The platform's success was recognized with awards like the Best Digital Banking Platform in Indonesia 2024. Bank Mandiri focuses on enhancing its functionality and attracting new users. Livin' contributed significantly to 2024's digital transaction volume.

Bank Mandiri's corporate banking is a star in its BCG matrix, fueling loan growth and profitability. This segment offers financial solutions like lending and trade finance to large corporations. In 2024, corporate loans grew, boosting overall financial performance. The bank strategically boosts its wholesale ecosystem for national economic growth. Bank Mandiri's focus is on sustainable practices.

Bank Mandiri's SME lending is a growth area. The bank is dedicated to SMEs, offering financial products to aid their growth. In 2024, Bank Mandiri's SME disbursements reached Rp135 trillion. This indicates a 6% rise, showing strong commitment.

International Banking Network

Bank Mandiri's international network is crucial for supporting Indonesian businesses abroad. It offers trade finance and foreign exchange services, connecting clients to global markets. In 2024, the bank expanded its Super Platform Kopra to Singapore, Timor-Leste, Hong Kong, and Shanghai, enhancing its global footprint. This expansion supports cross-border transactions and investment flows.

- Kopra by Mandiri expanded to Singapore, Timor-Leste, Hong Kong, and Shanghai in 2024.

- International banking services include trade finance and foreign exchange.

- Facilitates cross-border transactions and supports Indonesian businesses overseas.

- Supports investment flows and access to international markets.

Treasury Services

Bank Mandiri's Treasury Services play a vital role, generating non-interest income through foreign exchange, money market, and fixed income products. In 2024, the bank's treasury activities were a key component in providing tailored solutions to corporate and institutional clients. Bank Mandiri is focusing on expanding fee-based income, including treasury services, to maintain growth in 2025.

- Treasury services include foreign exchange, money market, and fixed income products.

- Bank Mandiri provides customized solutions to corporate and institutional clients.

- The bank aims to sustain growth by diversifying revenue streams.

- Fee-based income initiatives, including treasury services, are a focus for 2025.

Bank Mandiri's digital platform, Livin' by Mandiri, is a high-growth Star. It earned the Best Digital Banking Platform in Indonesia 2024 award. The platform's user engagement and digital transaction volume surged in 2024. Bank Mandiri continues to enhance Livin's features.

| Platform | Key Metrics (2024) | Notes |

|---|---|---|

| Livin' by Mandiri | Rapid User Growth | Best Digital Banking Platform Award |

| Digital Transaction Volume | Significant Increase | Continued Feature Enhancements |

| Corporate Banking | Loan Growth | Focus on Sustainable Practices |

Cash Cows

Bank Mandiri's retail banking is a cash cow, providing consistent income through savings, current accounts, and consumer loans. Its large customer base and broad branch network in Indonesia contribute to this stability. Retail and subsidiary loans jumped 113 percent to Rp 757.2 trillion in 2024, showcasing strong growth.

Bank Mandiri's mortgage lending is a cash cow within its BCG matrix. The mortgage portfolio consistently generates revenue. Demand for mortgages is robust due to rising homeownership in Indonesia. Mortgage loans grew strongly, with a +16.9% year-over-year increase in 2024.

Bank Mandiri's credit card services are a cash cow, generating fee income and interest revenue. The bank aggressively expands its customer base, offering attractive rewards. Credit card loans saw robust growth, with +15.4% y/y in 2024.

Mandiri Prioritas (Wealth Management)

Mandiri Prioritas, Bank Mandiri's wealth management division, is a "Cash Cow" within the BCG matrix. It focuses on high-net-worth clients, offering investment products and financial advice. This segment consistently produces significant fee income, boosting the bank's profitability. Mandiri Prioritas clients enjoy privileged banking services and exclusive benefits.

- Focus on high-net-worth individuals.

- Generates substantial fee income.

- Offers privilege banking services.

- Contributes to overall bank profitability.

Pension Fund Services

Bank Mandiri's pension fund services, focusing on government entities and state-owned enterprise pension plans, are a stable revenue source. The Government Institution segment offers loans, deposits, and other transactions tailored to these entities. These services are a reliable source of income due to the consistent nature of pension fund operations. This stability makes it a "Cash Cow" within the BCG Matrix.

- In 2023, Bank Mandiri's total assets reached approximately IDR 2,142 trillion.

- The Government Institution segment consistently contributes a significant portion of Bank Mandiri's overall revenue.

- Pension funds provide a steady stream of deposits and transaction fees.

- Bank Mandiri's net profit for the year 2023 was around IDR 51.4 trillion.

Bank Mandiri's cash cows generate consistent revenue and require minimal investment. Retail banking, with its large customer base, provides stable income. Credit cards, mortgage lending and wealth management services also act as cash cows. The pension fund services are reliable.

| Cash Cow | Key Feature | 2024 Data (approx.) |

|---|---|---|

| Retail Banking | Savings, loans, branch network | Loans +113% (Rp 757.2T) |

| Mortgage Lending | Consistent revenue, homeownership | Loans +16.9% y/y |

| Credit Cards | Fees, rewards, customer base | Loans +15.4% y/y |

| Mandiri Prioritas | Wealth mgmt, high-net-worth | Significant fee income |

| Pension Funds | Govt & SOE, steady revenue | IDR 2,142T (2023 assets) |

Dogs

Traditional branch services at Bank Mandiri, lacking digital integration, could see reduced usage as digital banking grows. These services might need cost adjustments or repurposing. Bank Mandiri's digital push aims to improve efficiency and security. In 2024, Mandiri's digital transactions increased. The bank continues to invest in digital transformation.

Specific legacy IT systems at Bank Mandiri, which are outdated or inefficient, present challenges to innovation and competitiveness. These systems require modernization or replacement to boost operational efficiency. In 2024, Bank Mandiri accelerated its technology transformation. The bank allocated IDR 2.2 trillion for IT in 2023, aiming to enhance service efficiency and security.

Certain agricultural loans, especially those with high risk and low returns, might lag behind other areas. These loans need vigilant risk management and possible restructuring. In 2024, Bank Mandiri is strategically focused on key sectors, including agriculture, with approximately 15% of its loan portfolio allocated to this sector. This focus reflects a commitment to supporting vital industries, despite potential challenges in low-yield agricultural loans.

Underperforming Overseas Branches

Overseas branches of Bank Mandiri that underperform fall into the "Dogs" quadrant of the BCG Matrix. These branches struggle with profitability and low market share, potentially requiring closure or restructuring. Bank Mandiri's Kopra platform has extended to Singapore, Timor-Leste, Hong Kong, and Shanghai, indicating strategic expansions. However, the success of these overseas ventures varies. In 2024, Bank Mandiri's net profit reached Rp 33.8 trillion, but specific branch contributions are key to evaluating their status.

- Underperforming branches face potential closure or restructuring.

- Kopra's expansion aims to boost international presence.

- Branch profitability data is crucial for BCG analysis.

- Bank Mandiri's 2024 net profit was Rp 33.8 trillion.

Niche Financial Products with Limited Market

Niche financial products with low demand and returns are "dogs" in Bank Mandiri's BCG matrix. These might include specialized investment products with limited appeal. Bank Mandiri focuses on low-cost transactions to boost deposits and credit growth. The bank's net profit in 2024 reached Rp 33.8 trillion. Re-evaluation or discontinuation of underperforming products is crucial.

- Niche Products: Specialized financial offerings with limited market reach.

- Low Returns: Products generate insufficient profits relative to resources used.

- Strategic Focus: Bank Mandiri emphasizes low-cost transactions.

- Financial Performance (2024): Bank Mandiri's net profit was Rp 33.8 trillion.

Overseas branches with low profitability and market share are categorized as "Dogs". These branches may face closure or restructuring due to poor performance. Niche financial products with low demand also fall into this category. Bank Mandiri reported a net profit of Rp 33.8 trillion in 2024, while reevaluating "Dogs" is crucial.

| Category | Characteristics | Strategic Action |

|---|---|---|

| Underperforming Branches | Low Profitability, Low Market Share | Closure/Restructuring |

| Niche Financial Products | Low Demand, Low Returns | Re-evaluation/Discontinuation |

| 2024 Financials | Net Profit: Rp 33.8T | Performance Assessment |

Question Marks

Bank Mandiri's digital payment solutions for MSMEs are a major growth area. Expanding payment methods, e-commerce platforms, and management tools is key. Livin' SUKHA simplifies MSME operations with sales and stock features. In 2024, digital transactions in Indonesia grew significantly, highlighting the potential. Bank Mandiri's focus on MSMEs aligns with this trend.

Bank Mandiri actively partners with fintechs to boost innovation. Collaborations introduce novel financial products, attracting customers. Digital banking security is enhanced, reducing fraud. Partnerships have helped cut fraud by 80% in 2024, strengthening the bank's market position. This strategic move ensures competitiveness.

Bank Mandiri's focus on sustainable and green financing aligns with increasing investor interest in ESG. As of Q3 2024, Bank Mandiri's ESG portfolio expanded. It offers green loans and investments, supporting Indonesia's sustainability goals. Bank Mandiri's commitment is evident in its recognition as a leading sustainable bank, showing its dedication to ESG. The bank aims to boost its green financing portfolio by 20% by the end of 2024.

AI-Powered Customer Service

AI-powered customer service is a Question Mark in Bank Mandiri's BCG Matrix. Implementing AI, like chatbots, enhances customer satisfaction and cuts costs. This includes automating tasks and personalizing financial advice. Mandiri's "Mimin" automates interactions, boosting efficiency.

- AI in banking is projected to reach $25.6 billion by 2024.

- Chatbots can resolve 80% of routine inquiries.

- Banks using AI see a 20-30% reduction in operational costs.

Expansion into Underserved Regions

Bank Mandiri can significantly expand into underserved regions within Indonesia, capitalizing on new market opportunities and fostering financial inclusion. This strategy involves setting up new branches, utilizing mobile banking services, and collaborating with local communities to extend its reach. Bank Mandiri's existing extensive network and robust electronic banking capabilities provide a solid foundation for this expansion. By focusing on these underserved areas, the bank can enhance its market presence and contribute to broader economic development.

- Indonesia's financial inclusion rate increased to 85.1% in 2022.

- Bank Mandiri's net profit reached IDR 33.1 trillion in 2023.

- The bank has over 4,000 branches across Indonesia.

- Mobile banking users have grown significantly in recent years, reaching over 15 million users.

AI-powered customer service, a "Question Mark," is risky but offers high potential for Bank Mandiri. AI in banking is predicted to hit $25.6 billion by 2024. Chatbots could solve 80% of routine queries. Banks using AI see operational cost reductions of 20-30%.

| Metric | Value | Year |

|---|---|---|

| AI in Banking Market Size | $25.6 Billion | 2024 (Projected) |

| Chatbot Resolution Rate | 80% | Various (Industry Average) |

| Operational Cost Reduction | 20-30% | Various (Banks Using AI) |

BCG Matrix Data Sources

Bank Mandiri's BCG Matrix leverages financial statements, market reports, and analyst valuations for precise quadrant positioning and actionable strategies.