Bank of Baroda PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Baroda Bundle

What is included in the product

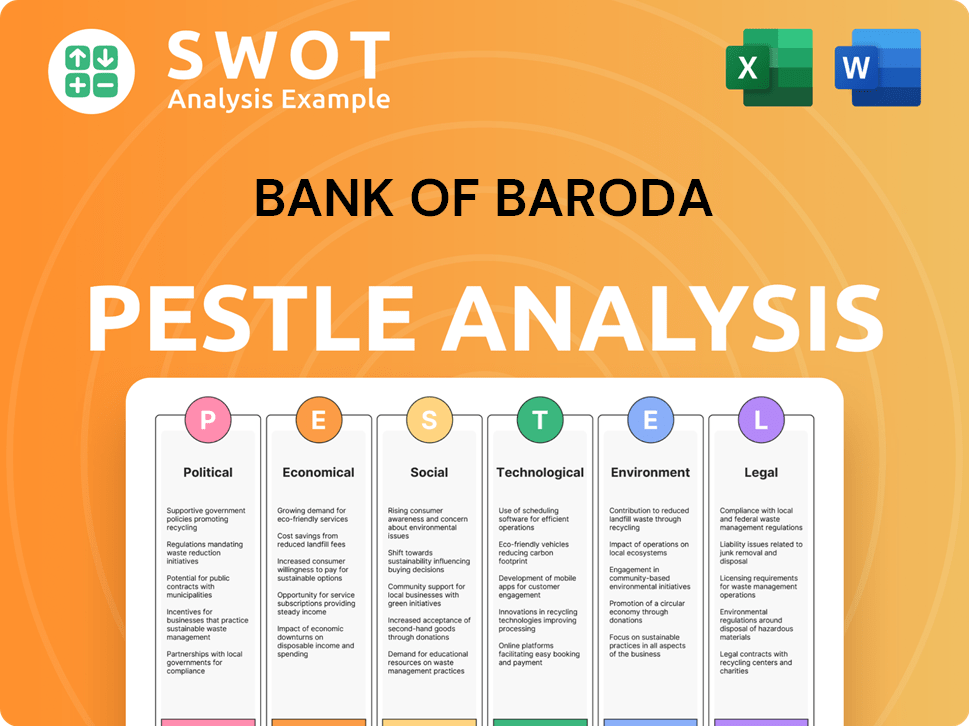

The analysis examines external factors impacting Bank of Baroda through PESTLE dimensions, identifying key threats & opportunities.

Helps support discussions on external risk and market positioning during planning sessions.

Full Version Awaits

Bank of Baroda PESTLE Analysis

This is a complete Bank of Baroda PESTLE Analysis preview. The data, structure, and formatting displayed is precisely what you'll receive upon purchase.

PESTLE Analysis Template

Gain crucial insights into Bank of Baroda's operating environment with our expertly crafted PESTLE Analysis. We dissect political influences like regulatory changes and economic factors impacting profitability.

Understand social trends, technological advancements, legal constraints, and environmental concerns shaping the bank's trajectory.

This in-depth analysis empowers you to forecast risks, identify opportunities, and refine your strategies for success.

Whether you're an investor, consultant, or industry professional, you’ll gain a distinct competitive advantage.

Ready to elevate your understanding of Bank of Baroda and gain the upper hand?

Download the complete PESTLE Analysis now for actionable intelligence at your fingertips.

Political factors

Bank of Baroda (BOB) operates under the Indian government's influence as a public sector bank. The government's majority stake provides substantial backing, bolstering BOB's stability and market standing. This support includes capital injections and policy adjustments, strengthening the bank and the broader financial sector. In fiscal year 2024, the Indian government increased its capital infusion into public sector banks, including BOB, by approximately $1.5 billion, ensuring financial resilience.

The Indian government's banking sector reforms, including potential privatization, directly influence Bank of Baroda. These reforms, alongside amendments to banking laws, may reshape its ownership and governance. The EASE agenda drives improvements in risk assessment and digital transformation. In fiscal year 2023-2024, the government aimed to reduce its stake in public sector banks.

Government-led financial inclusion schemes significantly impact Bank of Baroda. Schemes like Pradhan Mantri Jan Dhan Yojana boost its customer base. The bank aids in implementing these initiatives. This expands its reach, especially in underserved areas. These schemes align with social welfare objectives.

Regulatory Environment and Compliance

The Reserve Bank of India (RBI) and other regulatory bodies establish crucial guidelines for the banking sector, significantly impacting Bank of Baroda. Regulatory changes, especially in lending, asset quality, and capital adequacy, directly affect its operations and financial health. Stricter oversight can boost compliance costs, but also strengthens financial stability. For instance, in FY24, the RBI imposed penalties on several banks for non-compliance, highlighting the importance of adherence.

- RBI's guidelines on digital lending and cybersecurity have become more stringent in 2024, requiring banks to invest heavily in these areas.

- Changes in priority sector lending (PSL) targets can affect Bank of Baroda's lending strategies and profitability.

- The implementation of Basel III norms continues to influence capital adequacy ratios.

Geopolitical Stability and International Relations

Geopolitical stability is crucial for Bank of Baroda, given its international footprint. The bank's operations and profitability are directly influenced by political climates and trade policies globally. Recent trade tensions and conflicts, such as those observed in 2024, continue to impact the bank’s growth. These uncertainties can lead to financial risks.

- Bank of Baroda has branches in 17 countries.

- Geopolitical risks can affect cross-border transactions.

- Trade wars and sanctions can limit international business.

Bank of Baroda operates under government influence, which provides backing and stability. Reforms like potential privatization reshape its ownership and governance. Financial inclusion schemes, like Pradhan Mantri Jan Dhan Yojana, significantly boost the bank's customer base.

| Political Factor | Impact on Bank of Baroda | Data/Example (2024/2025) |

|---|---|---|

| Government Ownership & Support | Stability & Capital Infusion | FY24: Govt. infused ~$1.5B in public sector banks including BOB. |

| Banking Sector Reforms | Ownership, Governance changes | EASE agenda for digital transformation continues; Aim to reduce stake. |

| Financial Inclusion Schemes | Customer Base, Reach | Jan Dhan Yojana boosting customer growth. |

Economic factors

India's economic growth rate is crucial for Bank of Baroda. Strong GDP growth boosts demand for loans and deposits. In FY24, India's GDP grew by 8.2%, signaling robust economic activity. This growth supports Bank of Baroda's loan book expansion.

Inflation rates significantly affect consumer spending and investment strategies. The Reserve Bank of India's monetary policy, especially interest rate adjustments, directly impacts Bank of Baroda's profitability. In 2024, the inflation rate in India was around 5.5%. Changes in the repo rate, currently at 6.5%, influence lending rates.

Credit growth indicates lending activity across the economy. Bank of Baroda's credit growth shows positive trends; however, asset quality is vital. The bank's Gross NPA (GNPA) ratio was 3.72% as of December 2023. Reducing GNPA, especially in MSME and agriculture, is a key focus area.

Liquidity Conditions

Liquidity conditions significantly influence Bank of Baroda's lending capacity and funding expenses. The Reserve Bank of India (RBI) uses tools like Open Market Operations to manage liquidity in the banking system. Surplus liquidity can affect deposit rates, potentially lowering them. As of late 2024, the RBI has been actively managing liquidity, with variable repo auctions being a key instrument.

- RBI's liquidity management aims to stabilize financial markets.

- Bank of Baroda's financial performance is influenced by these liquidity dynamics.

- Changes in liquidity impact the bank's profitability and lending strategies.

Global Economic Outlook

Bank of Baroda, with its global presence, is significantly influenced by the worldwide economic climate. The International Monetary Fund (IMF) forecasts global growth at 3.2% in 2024, with a slight increase to 3.3% in 2025. Slowdowns in major economies like the Eurozone, where growth is projected at 0.8% in 2024, pose challenges. Trade conflicts and geopolitical tensions could disrupt international operations and impact the bank's financial results.

- IMF projects global growth of 3.2% in 2024 and 3.3% in 2025.

- Eurozone growth is forecasted at 0.8% in 2024.

- Trade disputes and political instability affect international banking.

Bank of Baroda is highly impacted by India's GDP growth, which hit 8.2% in FY24, affecting loan demand. Inflation, about 5.5% in 2024, and the 6.5% repo rate, significantly impact interest rates and bank profitability. Global economic forecasts, such as the IMF's 3.2% growth for 2024 and 3.3% for 2025, and the Eurozone's 0.8% growth, also play a vital role.

| Economic Factor | Impact on Bank of Baroda | Data (2024) |

|---|---|---|

| GDP Growth | Boosts loan demand | India: 8.2% |

| Inflation | Influences interest rates & profitability | 5.5% |

| Global Growth | Impacts international operations | IMF: 3.2% |

Sociological factors

India's large population, exceeding 1.4 billion in 2024, fuels demand for financial services. Urbanization, with over 35% living in cities by 2024, concentrates this demand. Bank of Baroda can tap into this growth, offering services to meet evolving urban needs. Increased access to banking is driven by demographic shifts.

Financial literacy significantly influences how people use banking services. Bank of Baroda focuses on financial inclusion, vital for growth, particularly in rural areas. In 2024, India's financial literacy rate was around 35%. Initiatives boost adoption of financial products. Expanding financial understanding is crucial for Bank of Baroda's reach.

Changing customer expectations are reshaping banking. Digital adoption fuels demand for convenience and personalization. Banks must adapt service models to meet these needs. Customers want faster, tech-driven experiences. In 2024, 70% of Indians used digital banking regularly, highlighting this shift.

Social Welfare and Community Development

Bank of Baroda actively engages in social welfare and community development. As a public sector bank, it participates in government schemes. This includes initiatives supporting underserved communities, enhancing its public image. The bank's CSR spending for FY2023-24 was ₹25.87 crore, focusing on education, healthcare, and rural development. These efforts align with its social responsibility goals.

- CSR spending of ₹25.87 crore in FY2023-24.

- Focus on education, healthcare, and rural development.

Employment Trends and Income Levels

Employment trends and income levels are crucial for Bank of Baroda's performance. A higher employment rate and rising incomes typically boost demand for retail banking products. This includes loans and wealth management services, directly impacting the bank's revenue streams. Consider India's labor force, where 46.8% are employed as of early 2024. Rising income levels, with a projected 10% increase in average salaries by 2025, also signal growth potential.

- India's labor force: 46.8% employed (early 2024)

- Projected salary increase: 10% by 2025

India's large, young population drives financial service demand; this segment is increasingly urbanized. Financial literacy, although at ~35% in 2024, influences product adoption. Banks adapt to evolving digital expectations, with ~70% using digital banking regularly in 2024.

| Factor | Details | Impact on Bank of Baroda |

|---|---|---|

| Population | >1.4B (2024), youth-heavy. | High demand for services. |

| Financial Literacy | ~35% in 2024 | Impacts adoption of financial products. |

| Digital Adoption | ~70% digital banking usage in 2024 | Requires digital service upgrades. |

Technological factors

Digital transformation is reshaping banking. Bank of Baroda (BOB) boosts efficiency with digital platforms, mobile banking, and online systems. Digital banking users at BOB increased by 25% in FY24. Tech investment is key for staying competitive. BOB's IT spending rose by 18% in FY24.

Cybersecurity and data privacy are paramount for Bank of Baroda, given its digital banking services. In 2024, global cybercrime costs reached $8.4 trillion, highlighting the urgency for strong protections. Bank of Baroda must invest in advanced security to safeguard customer data, as data breaches can lead to significant financial and reputational damage. Maintaining customer trust hinges on robust cybersecurity protocols, ensuring secure transactions and protecting sensitive information.

FinTech's growth reshapes financial services. Bank of Baroda must adapt to stay competitive. In 2024, FinTech investments hit $111.8 billion globally. Partnering with FinTechs can boost innovation. Failure to adapt risks losing market share to digital rivals.

Automation and Artificial Intelligence

Automation and AI are transforming Bank of Baroda. They boost efficiency and customer service via chatbots and personalized advice. AI aids risk management and fraud detection, crucial in today's climate. The bank is actively using AI for customer support and engagement.

- Bank of Baroda is investing heavily in AI-powered solutions to streamline operations.

- AI is enhancing customer interactions through chatbots and personalized services.

- The bank utilizes AI for fraud detection, reducing financial risks.

- AI is used to nudge customers and provide support.

Infrastructure and Connectivity

Technological infrastructure and internet connectivity are crucial for Bank of Baroda's digital banking success, especially in rural areas. Reliable infrastructure ensures seamless service delivery to a broader customer base. In 2024, India's internet penetration reached approximately 60%, yet rural areas lag urban centers. This gap impacts digital banking adoption.

- India's internet users: 850 million in 2024.

- Rural internet users: 300 million.

- Mobile internet penetration: 80% in urban areas, 50% in rural areas.

Technological factors profoundly affect Bank of Baroda's operations and future success. Digital banking drives efficiency; the bank must stay competitive. Investments in AI, cybersecurity, and infrastructure are crucial for adapting to digital changes.

| Aspect | Impact | Data (2024) |

|---|---|---|

| Digital Transformation | Boosts efficiency, expands services | 25% rise in digital banking users |

| Cybersecurity | Protects data, maintains trust | Global cybercrime cost: $8.4T |

| AI and Automation | Improves services, reduces risk | AI used for customer support |

Legal factors

Bank of Baroda's operations are heavily influenced by India's banking laws. The Banking Regulation Act and RBI guidelines are critical for compliance. Any changes in these regulations directly impact the bank. In 2024, the bank faced scrutiny regarding KYC norms, reflecting the importance of legal adherence. Updated regulatory frameworks in 2025 will continue to shape its operational strategies.

The Reserve Bank of India (RBI) enforces prudential norms and capital adequacy standards, including the Capital to Risk-weighted Assets Ratio (CRAR), for Bank of Baroda. As of December 2023, the CRAR for Bank of Baroda stood at 16.21%, surpassing the regulatory minimum. These regulations are vital for the bank's financial health and its capacity to manage risks. The RBI regularly revises these requirements, impacting the bank's operational strategies.

Asset quality and recovery laws significantly influence Bank of Baroda. Strong frameworks, like the SARFAESI Act and IBC, aid in managing stressed assets. In 2024, the gross NPA ratio for Bank of Baroda was around 3.09%, a decrease from 3.72% in 2023, showing improvements due to better recovery. Effective debt recovery is crucial for financial stability.

Customer Protection Laws and Grievance Redressal

Customer protection laws and grievance redressal are vital for Bank of Baroda. These regulations, focused on customer rights, data privacy, and effective complaint handling, are essential. Adherence to these laws and robust complaint systems are crucial for trust. Bank of Baroda's compliance helps maintain its reputation. In 2024, customer complaints decreased by 15% due to improved redressal mechanisms.

- Data privacy regulations include GDPR and CCPA, impacting data handling.

- Bank of Baroda's compliance with these laws is regularly audited.

- Grievance redressal includes multiple channels: online, phone, and branches.

International Banking Regulations

Bank of Baroda's global footprint means it's subject to diverse international banking regulations, adding compliance complexity. These regulations vary widely across countries, impacting operational strategies. For instance, the Basel III framework influences its capital adequacy requirements globally. The bank also faces scrutiny regarding anti-money laundering (AML) and counter-terrorism financing (CTF) laws.

- Bank of Baroda operates in 17 countries outside India.

- Basel III implementation impacts capital requirements.

- AML/CTF compliance is a constant focus.

Legal factors substantially shape Bank of Baroda's operations, primarily through India's banking laws and RBI regulations. The bank adheres to the Banking Regulation Act and guidelines that enforce prudential norms, including the CRAR, which was at 16.21% as of December 2023. Compliance extends to asset quality and customer protection regulations. As of 2024, customer complaints decreased by 15% due to better redressal mechanisms.

| Aspect | Details | Impact |

|---|---|---|

| CRAR | 16.21% (December 2023) | Ensures financial stability, Risk Management |

| NPA Ratio (2024) | Approximately 3.09% | Improves debt recovery and financial stability |

| Customer complaints decrease | By 15% in 2024 | Demonstrates effective resolution and trust. |

Environmental factors

Bank of Baroda (BoB) is actively embedding climate risks into its core operations. This includes evaluating climate change impacts on its assets and lending practices. In 2024, BoB allocated ₹1,500 crore towards green initiatives. This strategic shift reflects a commitment to sustainable finance and risk mitigation. BoB's integration efforts align with global climate goals.

Sustainable finance and green lending are increasingly important. Bank of Baroda finances eco-friendly projects, including renewables, with green financing targets. In FY24, the bank's green portfolio grew significantly. They offer products like Green Deposits, attracting ₹1,500 crore in deposits by December 2024.

Banks are increasingly focused on reducing their environmental impact. Bank of Baroda is improving energy efficiency and optimizing resource use. They are also working to cut emissions from their operations.

Bank of Baroda has established goals to lessen its Scope 1 and Scope 2 emissions. In 2024, the bank's sustainability report highlighted these efforts. This commitment aligns with global sustainability trends.

The bank’s initiatives show a dedication to environmental responsibility. This includes investments in green technologies and sustainable practices. These steps are crucial for long-term sustainability.

Environmental, Social, and Governance (ESG) Focus

Bank of Baroda, like other financial institutions, faces growing scrutiny regarding Environmental, Social, and Governance (ESG) factors. Investors and stakeholders increasingly prioritize ESG considerations in their investment decisions. The bank has implemented an ESG policy to address environmental stewardship, social responsibility, and governance practices. This commitment aims to boost stakeholder confidence and ensure long-term sustainability. For example, in 2024, ESG-focused funds saw inflows of approximately $2 trillion globally, reflecting the rising importance of these factors.

- ESG policies align with international standards.

- Stakeholder confidence is enhanced through transparency.

- Long-term sustainability is a key focus.

- Compliance with regulations is ensured.

Compliance with Environmental Regulations

Bank of Baroda (BoB) operates under stringent environmental regulations. The bank must adhere to environmental norms established by governmental and regulatory bodies. This involves avoiding the financing of projects with potentially significant environmental damage. In 2024, BoB allocated approximately ₹1,500 crore towards green projects and sustainable initiatives. This commitment reflects BoB's dedication to environmental sustainability and regulatory compliance.

- Environmental regulations compliance is crucial for BoB's operations.

- BoB's financing decisions avoid projects with negative environmental impacts.

- In 2024, BoB invested ₹1,500 crore in green projects.

Bank of Baroda actively incorporates climate risk assessment into its operations, as seen in the allocation of ₹1,500 crore towards green initiatives in 2024. The bank prioritizes sustainable finance and green lending, evidenced by its growing green portfolio and products like Green Deposits, attracting ₹1,500 crore by December 2024.

BoB also focuses on reducing its environmental footprint through improved energy efficiency and emission reductions, setting specific goals for Scope 1 and Scope 2 emissions highlighted in their 2024 sustainability report. BoB adheres to environmental regulations, avoiding environmentally damaging projects, which reinforces its commitment to regulatory compliance and sustainability.

| Aspect | Details | Data (2024) |

|---|---|---|

| Green Financing | Investment in renewable energy and sustainable projects | ₹1,500 crore allocated |

| Green Deposits | Attracted in deposits | ₹1,500 crore by Dec |

| ESG Funds | Global Inflows | $2 trillion (approx.) |

PESTLE Analysis Data Sources

Bank of Baroda's PESTLE analysis draws on IMF, World Bank, and government data, plus financial reports.