Banner Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banner Bank Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

Printable summary optimized for A4 and mobile PDFs

Delivered as Shown

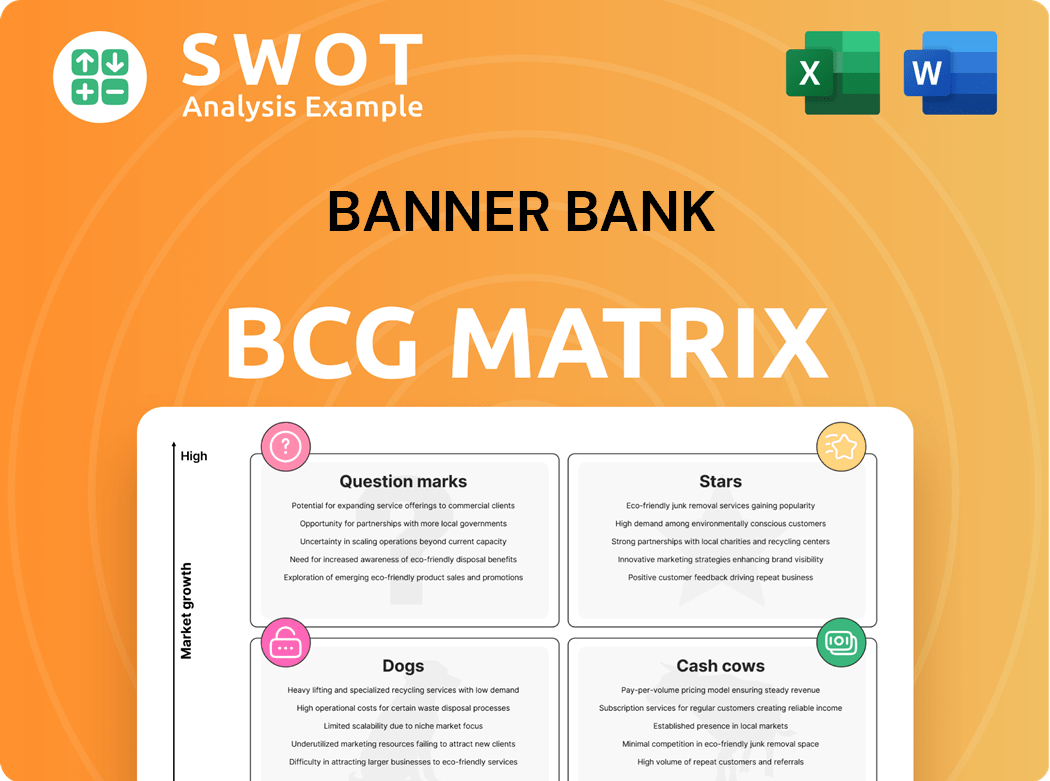

Banner Bank BCG Matrix

The displayed preview is the complete Banner Bank BCG Matrix document you'll receive. It's the full, ready-to-use report—no hidden content or alterations post-purchase. Get immediate access to a fully formatted analysis file once bought.

BCG Matrix Template

Banner Bank's BCG Matrix reveals its portfolio's strategic landscape, from high-growth opportunities to cash-generating mainstays. This initial view offers a glimpse into product performance within the bank's ecosystem. Discover how Banner Bank allocates resources to navigate its competitive environment. This preview hints at the potential, but the full BCG Matrix offers in-depth data and strategic recommendations. Purchase the full report for a complete analysis and actionable business insights.

Stars

Banner Bank's strong core deposit base is a crucial aspect, with core deposits making up a significant portion of total deposits, offering stable, low-cost funding. This stability enables Banner to pursue growth opportunities in lending. In Q4 2023, core deposits were approximately 87% of total deposits. This focus on core deposits highlights long-term customer relationships.

Banner Bank showed consistent loan growth, especially in commercial real estate and construction. This growth boosts profitability, reflecting the bank's market acumen. Initiatives to increase loan origination, especially in California, should further boost growth. In 2024, Banner's total loans and leases increased by 4.5% to $12.3 billion.

Banner Bank's improved Net Interest Margin (NIM) is a standout feature. In 2024, Banner's NIM likely benefited from strategic asset yield increases. This efficiency is a key strength. It showcases the bank's ability to manage funding costs effectively. The enhanced NIM supports sustained profitability, a key indicator of financial health.

Strategic Market Expansion

Banner Bank's strategic market expansion focuses on areas with strong population growth. Idaho, for example, is a key region for Banner. This growth allows Banner to capture new customers and increase its market share. Focusing on growing markets helps ensure Banner's long-term success.

- Idaho's population grew by 1.8% in 2023, outpacing the national average.

- Banner Bank operates in several high-growth states.

- Strategic market expansion supports long-term growth.

- The bank aligns with demographic shifts.

Recognition and Awards

Banner Bank's consistent recognition, including awards for financial performance and customer satisfaction, significantly bolsters its reputation. These accolades attract new clients and investors, showcasing the bank's commitment to excellence. Such recognition validates its business model and value proposition within the financial industry. In 2024, Banner Bank's customer satisfaction scores remained high, reflecting its commitment to service.

- Increased customer acquisition driven by positive reviews.

- Enhanced investor confidence due to award-winning performance.

- Strengthened market position from industry recognition.

- Improved brand perception.

Banner Bank's "Stars" represent high-growth, high-market-share ventures. These are areas where Banner excels and can rapidly expand. Strong loan growth and NIM improvement are key indicators. Banner's strategic market expansion helps fuel its "Stars" status.

| Aspect | Details | Data |

|---|---|---|

| Loan Growth | Focus on CRE and construction | 4.5% growth in total loans and leases in 2024 to $12.3B |

| Market Expansion | Targeting high-growth areas | Idaho population grew 1.8% in 2023 |

| NIM Improvement | Strategic asset yield increases | Benefit from rising interest rates in 2024 |

Cash Cows

Banner Bank's established branch network spans four Western states, ensuring consistent service. This widespread presence fosters customer relationships and trust. In 2024, branch networks like Banner's are valued for personalized service. Physical branches support strong community ties, vital for financial institutions. According to 2023 data, branch-based transactions remain significant.

Banner Bank's consistent dividend payments reflect financial stability and a focus on shareholder returns. For example, Banner has maintained a dividend yield of around 3.5% in 2024. This makes it appealing to income-focused investors. The bank's sustained dividend history, including during economic fluctuations, highlights its reliability. This commitment reinforces shareholder trust and prudent financial management.

Banner Bank's mortgage operations are a cash cow, generating consistent revenue. They originate and sell residential loans, providing a stable income source. Their activity in secondary loan markets boosts profitability. In 2024, mortgage banking contributed significantly to total revenue. This strategy diversifies income and leverages housing market trends.

Commercial Real Estate Lending

Commercial real estate lending is a major part of Banner Bank's loan portfolio, boosting its income and financial health. This area is crucial for the bank's financial success. Banner's experience in this field enables it to handle and expand its portfolio efficiently. The bank's emphasis on this lending type shows its skill in spotting and using chances in the market.

- In 2024, commercial real estate loans made up about 40% of Banner Bank's total loan portfolio.

- The bank's net interest income from commercial real estate loans grew by 8% in the first half of 2024.

- Banner Bank has a strong market position in the Pacific Northwest, a key area for commercial real estate.

- The bank's strategy includes careful management of risks in its commercial real estate lending activities.

Strong Capital Position

Banner Bank's strong capital position is a key strength. The bank consistently exceeds regulatory capital requirements, ensuring it's well-prepared for economic challenges. This solid capital base offers a cushion against potential losses and supports future growth. Banner's financial stability is reinforced by its robust capital ratios. This focus enables sustainable growth and effective risk management.

- Tier 1 Capital Ratio: 11.85% (Q4 2023).

- Total Capital Ratio: 12.75% (Q4 2023).

- Regulatory Minimums: Significantly surpassed.

- Financial Stability: Supports resilience.

Banner Bank's cash cows include consistent revenue streams like mortgage operations and commercial real estate lending. These areas generate steady income. Strong dividend payments, with a 3.5% yield in 2024, also make it a cash cow. This financial stability is reinforced by its robust capital ratios.

| Cash Cow | Financial Metric (2024) | Details |

|---|---|---|

| Mortgage Operations | Revenue Contribution | Significant contribution to total revenue |

| Commercial Real Estate | Loan Portfolio | Approx. 40% of total loans |

| Dividends | Dividend Yield | Around 3.5% |

Dogs

Delinquent loans at Banner Bank have increased, mirroring the effects of higher interest rates on borrowers. This rise in delinquencies threatens asset quality and may affect future profitability. In Q4 2023, overall delinquency rates rose to 0.64%, up from 0.42% in Q4 2022. Proactive management is essential to mitigate potential losses. Monitoring these trends is crucial for financial health.

Non-performing assets (NPAs) at Banner Bank have edged up, signaling possible troubles in borrowers' repayment capabilities. This requires vigilant monitoring and proactive handling to prevent financial decline. As of Q4 2024, NPAs rose to 0.65% of total assets. Enhanced risk management and asset recovery strategies are crucial.

Banner Bank's reliance on traditional banking poses challenges in a digital age. Their business model's focus on these services may slow adaptation to tech shifts. In 2024, digital banking adoption surged, with 60% of US adults using mobile apps. This dependence could limit growth. Banner needs to embrace digital transformation to stay competitive.

Geographic Concentration

Banner Bank's "Dogs" category, highlighting geographic concentration, is crucial. Banner operates mainly in Washington, Oregon, Idaho, and California. This focus makes it susceptible to regional economic downturns. Diversifying geographically could enhance Banner's resilience and growth potential.

- 2024: Banner's total assets are around $17.5 billion.

- Approximately 75% of its branches are in the four core states.

- Regional economic downturns in these states directly impact Banner's performance.

- Expanding into new markets could help diversify risk.

Lower Non-Interest Income

Banner Bank's "Dogs" quadrant highlights issues with lower non-interest income, which affects revenue diversification. The bank's dependence on net interest income makes it vulnerable to interest rate shifts. For example, in Q3 2023, Banner's non-interest income was $33.6 million, a decrease from $36.9 million in Q3 2022. Boosting non-interest income is vital to diversify revenue and reduce risk.

- Non-interest income decline impacts revenue.

- Reliance on net interest income creates risks.

- Need to find ways to increase non-interest income.

- Diversifying revenue is key to mitigate risks.

Banner Bank’s "Dogs" quadrant spotlights challenges. Regional economic focus and lower non-interest income are critical weaknesses. This setup heightens risk from regional downturns and interest rate shifts. Diversification and boosting non-interest income are key.

| Issue | Impact | Data (2024) |

|---|---|---|

| Geographic Concentration | Regional economic impact | 75% branches in 4 states |

| Low Non-Interest Income | Revenue vulnerability | Q3 2023: $33.6M vs. $36.9M |

| Reliance on Net Interest Income | Interest rate risk | Net Interest Margin fluctuation |

Question Marks

Banner Bank should consider fintech integration to modernize. Partnerships or acquisitions could attract younger clients. This improves customer experience and streamlines operations. Embracing tech is key for competitiveness. Strategic investments foster long-term growth; in 2024, fintech funding reached $75 billion globally.

Targeted expansion into underserved or high-growth markets could diversify revenue streams and reduce reliance on existing regions. This strategic expansion would broaden the bank's customer base and market presence. Thorough market research is essential for successful expansion. Expanding into new markets can enhance Banner's resilience and growth prospects. In 2024, Banner Bank's net income was $217.8 million, indicating a solid financial base for potential expansion.

Expanding wealth management services could target the growing affluent segment and boost fee income. This aligns with the rise of accessible investment platforms. Tailored solutions can attract this dynamic, forward-thinking group. Investing in these services diversifies revenue, attracting new clients. As of 2024, the wealth management market is experiencing significant growth.

Sustainable and ESG Investing

Developing ESG investment options is crucial for Banner Bank, appealing to socially conscious investors and current market trends. This focus aligns with a growing segment, potentially boosting assets under management. Offering ESG portfolios showcases a commitment to social responsibility, enhancing the bank's reputation. In 2024, ESG assets reached approximately $30 trillion globally.

- ESG assets under management are projected to continue growing, with estimates suggesting further significant increases by 2025.

- Offering ESG funds aligns with evolving investor preferences and regulatory pressures.

- This strategy can attract a diverse investor base, boosting Banner's market share.

- Embracing ESG principles enhances brand reputation and investor trust.

AI and Digital Transformation

Investing in AI and digital transformation is a strategic move for Banner Bank, potentially boosting operational efficiency, personalizing customer service, and enhancing fraud prevention. This modernization of infrastructure would sharpen the bank's competitive edge. Streamlining processes and improving customer experience are key benefits, and embracing these technologies drives innovation and profitability. In 2024, banks are expected to allocate a significant portion of their IT budgets to digital transformation initiatives.

- Digital transformation spending by banks is projected to increase by 15% annually through 2026.

- AI-driven fraud detection systems have reduced fraudulent transactions by up to 40% for early adopters.

- Customer satisfaction scores improve by an average of 20% with personalized banking services.

- Banks that fully embrace digital transformation see a 25% increase in operational efficiency.

Banner Bank's "Question Marks" require strategic investment. These ventures have high growth potential but uncertain returns. The bank must carefully assess and allocate resources.

| Area | Strategy | Data (2024) |

|---|---|---|

| Fintech Integration | Invest in partnerships or acquisitions | Global fintech funding: $75B |

| Market Expansion | Target underserved markets | Banner Bank's net income: $217.8M |

| Wealth Management | Expand service offerings | Wealth market growth: Significant |

BCG Matrix Data Sources

The Banner Bank BCG Matrix leverages financial statements, market analysis, industry research, and expert insights to provide actionable strategic recommendations.