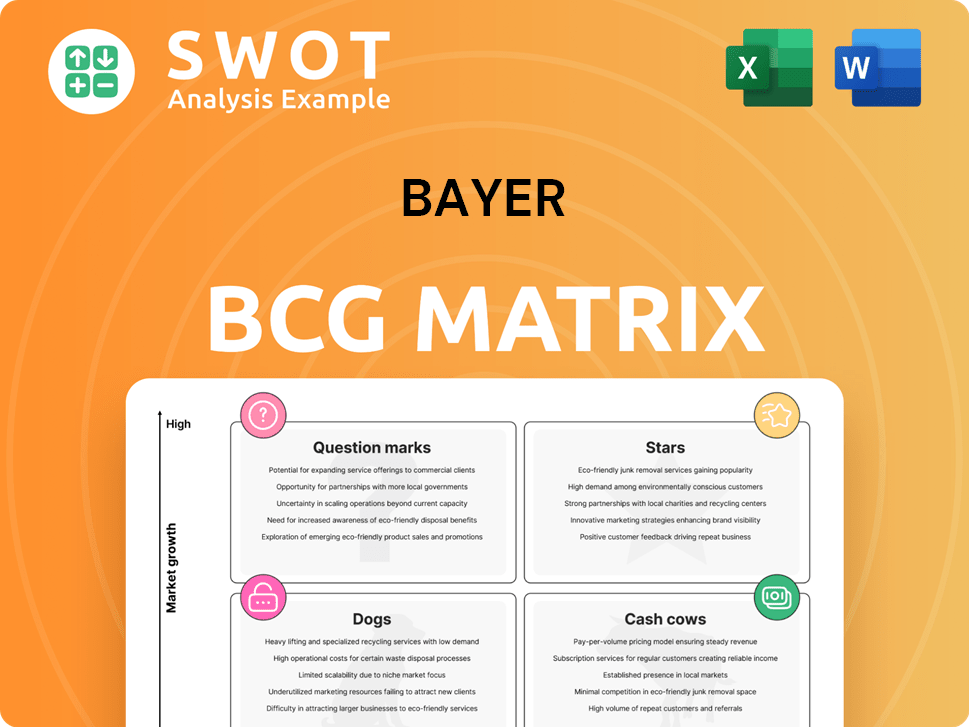

Bayer Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bayer Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

One-page overview placing each business unit in a quadrant.

Preview = Final Product

Bayer BCG Matrix

The BCG Matrix you are viewing now is the identical document you’ll receive after purchase. This complete, ready-to-use report is professionally designed, ensuring immediate application for strategic decision-making.

BCG Matrix Template

The Bayer BCG Matrix analyzes product portfolios based on market share and growth. This framework categorizes offerings as Stars, Cash Cows, Dogs, or Question Marks. Understanding these classifications helps identify resource allocation needs and strategic priorities. This snapshot is just the beginning.

Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Nubeqa, a prostate cancer treatment, is a star in Bayer's portfolio. It's experiencing rapid growth, with combined sales with Kerendia projected to hit 2.5 billion euros in 2025. This signifies strong market leadership and growth potential within oncology. Bayer is prioritizing oncology for future expansion.

Kerendia, Bayer's chronic kidney disease treatment, is a Star in the BCG matrix. It is projected to reach €2.5 billion in combined sales by 2025, alongside Nubeqa. Regulatory submissions for heart failure indications are underway in key markets. The FDA granted Priority Review for a new heart failure indication.

Bayer is advancing in cell and gene therapy, focusing on Parkinson's. They've invested heavily, with spending up to 5 billion euros. The goal is to launch new treatments by late 2025. This strategy is pivotal for Bayer's future growth.

Innovation in Radiology AI

Bayer's "Stars" in the BCG matrix highlights its innovation in Radiology AI. They've embraced AI early, aiming to improve patient outcomes and assist radiologists. This includes partnerships, like Systalyze, a spin-off from MIT, to foster AI solutions. The AI Innovation Platform supports the development of AI-enabled software.

- Bayer's Radiology AI market is projected to reach $2.8 billion by 2024.

- Systalyze's collaboration with Bayer is expected to accelerate AI solution development.

- Bayer's investment in AI research and development increased by 15% in 2024.

Pipeline Blockbuster Products

Bayer is set to unveil several high-impact products in 2025, as per company reports. These innovations aim to tackle significant medical challenges and transform treatments. Their R&D efforts have markedly improved, leading to a strong, differentiated pipeline. The company's focus is on products with blockbuster potential, signaling a strategic shift.

- Expected peak sales for key products could reach billions, as estimated by analysts.

- R&D spending in 2024 was approximately €5.4 billion, reflecting a commitment to innovation.

- The pipeline includes treatments for cardiovascular diseases and oncology, areas of high unmet need.

- Bayer's market capitalization stands around €33.5 billion as of late 2024, influencing its strategic decisions.

Bayer's "Stars," like Nubeqa and Kerendia, drive substantial growth; combined sales are projected at €2.5B by 2025. Oncology and chronic kidney disease treatments exemplify Bayer's success. Investments in cell/gene therapy and Radiology AI further boost its portfolio.

| Product | 2024 Sales (Est.) | 2025 Sales (Projected) |

|---|---|---|

| Nubeqa | €1.1B | €1.4B |

| Kerendia | €0.9B | €1.1B |

| Radiology AI | $2.8B (Market) | $3.2B (Market) |

Cash Cows

Bayer's Consumer Health division is a Cash Cow, showing consistent growth. The division saw a 6% sales increase in Q3 2024, hitting €1.4 billion in revenue. Dermatology and digestive health drive this growth. Bayer focuses on volume and quicker product launches for this segment.

Bayer's pharmaceutical division, a Cash Cow in the BCG Matrix, excels in areas like cardiovascular disease and women's healthcare. These established products consistently deliver strong revenue streams. In 2024, Bayer's pharmaceutical sales reached approximately €18.7 billion, showcasing their financial strength. The company prioritizes maintaining market share and maximizing profits within these key segments.

Glyphosate-based herbicides are a key part of Bayer's Crop Science. Sales increased, especially in North America, boosting revenue. Strong demand and volume recovery offset pricing pressures. However, litigation risks tied to glyphosate could affect results. In 2024, despite challenges, they remain a revenue driver.

Established Crop Protection Products

Bayer's established crop protection products are cash cows, providing a reliable revenue stream. The company actively manages costs to boost profitability. Generic competition and pricing pressures present ongoing challenges. In 2024, Bayer's Crop Science division generated approximately €23 billion in sales.

- Steady Income: Established products ensure consistent revenue.

- Cost Management: Focus on optimizing the product portfolio.

- Market Challenges: Generic competition and pricing pressures.

- Financial Data: Crop Science sales of €23 billion in 2024.

Animal Health Products

Bayer's animal health products are a cash cow, consistently generating revenue and cash flow. The company actively expands its product range and market reach. The animal health market is projected to grow due to livestock increases and health awareness. In 2024, this sector is expected to contribute significantly to Bayer's overall financial performance.

- Revenue from Bayer's animal health segment reached approximately €2.2 billion in 2023.

- Bayer aims to increase its market share in key regions, including Asia-Pacific, by 15% by 2025.

- The global animal health market is forecast to grow at a CAGR of 6.5% from 2024 to 2029.

- Bayer invests roughly €200 million annually in R&D for animal health products.

Bayer's cash cows consistently generate substantial revenue, with the Consumer Health division reporting €1.4 billion in Q3 2024 sales, up 6%. The pharmaceutical division's sales reached about €18.7 billion in 2024, with Crop Science generating approximately €23 billion. Animal health generated approximately €2.2 billion in 2023.

| Division | Segment | 2024 Sales (approx.) |

|---|---|---|

| Consumer Health | Various | €1.4B (Q3) |

| Pharmaceuticals | Cardiovascular, Women's Health | €18.7B |

| Crop Science | Glyphosate, Crop Protection | €23B |

| Animal Health | Various | €2.2B (2023) |

Dogs

Older crop protection products at Bayer encounter fierce competition from generics, impacting sales and profitability. In 2024, certain products saw sales declines of up to 15% due to generic alternatives. Divesting these underperforming assets could free up resources. These products may not yield substantial future returns, as evidenced by a projected 8% decrease in revenue for 2024.

Dicamba herbicides, a product in Bayer's portfolio, have encountered regulatory hurdles, affecting their market presence. Restrictions and potential registration losses pose a risk to Bayer's revenue streams. In 2024, Bayer faced legal challenges and restrictions in certain regions. The company must seek alternatives, or find ways to mitigate these issues.

Some of Bayer's older consumer health products, classified as "Dogs" in the BCG matrix, may be declining. These products struggle to compete with newer, innovative offerings. For example, sales of older brands like Alka-Seltzer may be facing pressure. Bayer might consider reformulating or discontinuing these products. In 2024, Bayer's consumer health segment's revenue was reported at €6.1 billion, which requires constant evaluation of each product.

Products Facing Litigation

Products like Roundup, entangled in litigation, fit the "Dogs" category due to financial and reputational risks. These lawsuits strain Bayer's finances; in 2024, the company faced billions in Roundup-related costs. Bayer aims to mitigate risks by 2026, but long-term consequences linger.

- Roundup litigation costs have significantly impacted Bayer's financial performance in 2024.

- Bayer is actively working to manage and reduce these risks by 2026.

- The long-term implications of these lawsuits remain a key concern for investors.

Products with Declining Market Share

Dogs in the Bayer BCG matrix represent products with declining market share in low-growth markets. These products often require substantial investment to reverse their trajectory, which may not be economically viable. For instance, in 2024, Bayer's crop science segment faced challenges, indicating potential "Dog" products. Considering this, divesting these assets could free up resources. Bayer should prioritize allocating funds to areas with stronger growth prospects.

- Products with declining market share.

- Low-growth markets.

- Require significant investment.

- Divestment may be more efficient.

Bayer's "Dogs" include products facing decline in low-growth markets. Roundup litigation costs heavily impacted Bayer's 2024 financials. These products often demand significant investment with uncertain returns. Divesting underperforming assets like those in Crop Science could free up resources.

| Category | Description | 2024 Impact |

|---|---|---|

| Roundup Litigation | High legal and financial risks. | Billions in costs. |

| Crop Science | Declining market share, low growth. | Potential "Dog" products. |

| Consumer Health | Older brands, competition. | Revenue €6.1 billion. |

Question Marks

Beyonttra (acoramidis), approved in the EU in February 2025, is a new therapy for transthyretin amyloidosis cardiomyopathy. European launches are scheduled to start in April 2025. Its future is uncertain, but it could become a Star if it gains market share. Bayer is aiming to grow its cardiology portfolio with this treatment.

Elinzanetant, Bayer's investigational menopause treatment, sits in the Question Mark quadrant. Its potential hinges on regulatory approval and market success. Bayer aims for a 2025 launch of this hormone-free treatment. The global menopause market is substantial, with a projected value of $24.4 billion by 2029.

Preceon Corn and 5-Way Soybean herbicide tolerance represent Bayer's innovative push in crop science. Regulatory approvals and market acceptance are key for their success. These could become Stars, boosting revenue if adopted widely. Bayer's R&D spending in 2024 was about €6 billion.

Digital Health Solutions

Bayer is positioning digital health solutions as a Question Mark in its BCG matrix. The company is investing in AI-driven platforms for medical imaging and remote patient monitoring. Success hinges on improved patient outcomes and revenue generation. Digital tech, including AI and big data, could transform pharma's value chain.

- Bayer's R&D spending in 2023 was €5.8 billion.

- The digital health market is projected to reach $600 billion by 2027.

- AI in drug discovery could reduce R&D costs by 30-40%.

- Remote patient monitoring market expected to grow significantly.

Iblon Fungicide, Plenexos Insecticide, and Icafolin Herbicide

Iblon Fungicide, Plenexos Insecticide, and Icafolin Herbicide are key products in Bayer's Crop Science division. They represent a strategic bet to boost growth, aiming to improve profitability. Bayer is focusing on these new products to capitalize on high-value opportunities. Their success hinges on market dynamics and how they compete.

- These launches are crucial for Bayer's Crop Science division.

- Their success is tied to market conditions and competition.

- Bayer is aiming to improve profitability with these.

- They are part of a larger R&D and commercial strategy.

Question Marks require significant investment with uncertain outcomes. Elinzanetant, a menopause treatment, exemplifies this, with a 2025 launch target. Digital health solutions and innovative crop science products also fall into this category. Success depends on regulatory approval, market adoption, and competitive dynamics.

| Product | Status | Market Potential |

|---|---|---|

| Elinzanetant | Question Mark | $24.4B (Menopause market by 2029) |

| Digital Health | Question Mark | $600B (Market by 2027) |

| Preceon/5-Way | Question Mark | R&D investment of €6B (2024) |

BCG Matrix Data Sources

The Bayer BCG Matrix is built on financial reports, market analysis, and industry research to position each business segment. It uses reliable sources for insights.