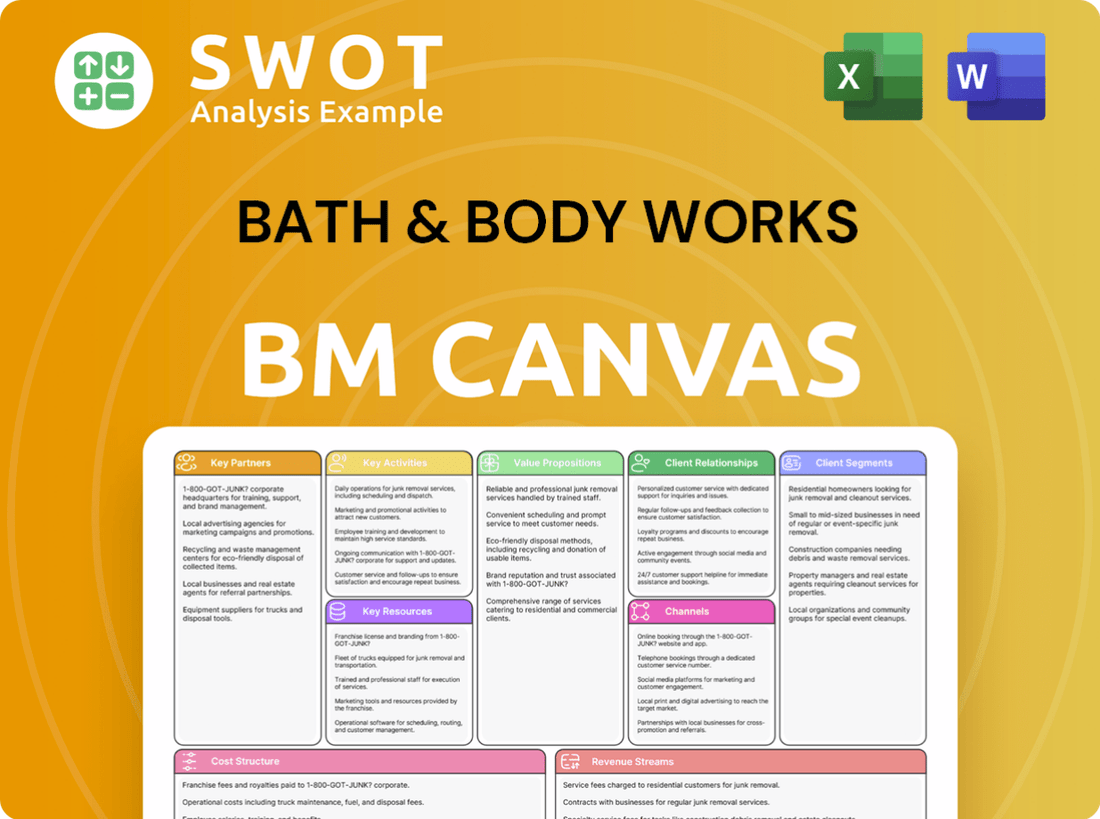

Bath & Body Works Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bath & Body Works Bundle

What is included in the product

Bath & Body Works' BMC covers customer segments, channels, and value propositions in detail.

Shareable and editable for team collaboration and adaptation; Bath & Body Works' canvas allows teams to easily brainstorm and adjust strategies together.

Preview Before You Purchase

Business Model Canvas

This preview showcases the authentic Bath & Body Works Business Model Canvas you'll receive. It’s a direct representation of the file delivered upon purchase. Expect the same professional, ready-to-use document for immediate application and editing.

Business Model Canvas Template

Bath & Body Works thrives on its strong brand, focusing on fragrance and personal care products. Their business model centers on a direct-to-consumer approach, leveraging retail stores and online sales. Key partners include suppliers of raw materials and packaging, and their value proposition offers sensory experiences. Customer segments are diverse, united by their desire for indulgent self-care items.

Want to see exactly how Bath & Body Works operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Partnerships

Bath & Body Works relies heavily on partnerships with fragrance suppliers. They team up with companies like Givaudan and International Flavors & Fragrances to create distinctive scents. These collaborations guarantee a steady supply of top-notch fragrances for their product range. In 2024, Bath & Body Works' fragrance sales were a significant portion of their revenue, with contracts potentially reaching millions annually.

Bath & Body Works depends on manufacturing partners, especially in Asia, for product creation. These relationships are key for affordable production and supply chain effectiveness. They utilize facilities in China and Vietnam, producing millions of units yearly. This strategy helps in managing costs and ensuring product availability. As of 2024, this approach supports their extensive product range.

Bath & Body Works collaborates with e-commerce platforms such as Shopify to boost online sales. These platforms offer crucial infrastructure and tools, streamlining online transactions and customer engagement. In 2024, online sales accounted for approximately 30% of their total revenue. Digital transactions managed by these platforms represent a significant portion of the company's financial flow. This partnership is vital for expanding their market reach.

Retail Mall Operators

Bath & Body Works heavily relies on partnerships with retail mall operators for its physical store locations. These collaborations are crucial, as a large segment of their stores is situated within shopping malls. Leasing these prime locations constitutes a considerable annual expense, impacting the company's financial performance. Strong relationships with mall operators are essential for securing and maintaining favorable retail spaces.

- In 2024, Bath & Body Works' rent expenses were a significant portion of their operating costs, reflecting the importance of these partnerships.

- Negotiating favorable lease terms is key to profitability.

- Mall traffic and footfall directly influence store performance.

- Maintaining a presence in high-traffic malls is critical for brand visibility.

Marketing and Advertising Agencies

Bath & Body Works relies heavily on marketing and advertising agencies. These agencies manage the brand's promotional efforts across various channels. A significant portion of the company's budget is dedicated to these partnerships. Effective marketing is crucial for driving sales and brand awareness. In 2024, Bath & Body Works invested over $400 million in advertising and marketing.

- Collaboration with agencies covers digital and traditional advertising.

- Agencies handle brand strategy and campaign development.

- The annual marketing budget is substantial.

- Effective marketing is vital for sales.

Bath & Body Works' partnerships include fragrance suppliers like Givaudan. They also use manufacturers in Asia, such as those in China and Vietnam. E-commerce platforms, including Shopify, support online sales, accounting for roughly 30% of revenue in 2024. Retail mall operators are also key partners, impacting costs significantly. Marketing agencies are crucial, with over $400 million spent in 2024.

| Partnership Type | Partner Examples | Impact |

|---|---|---|

| Fragrance Suppliers | Givaudan, IFF | Ensures unique scents |

| Manufacturers | China, Vietnam | Supports cost-effective production |

| E-commerce Platforms | Shopify | Drives online sales (30% revenue) |

| Retail Mall Operators | Various | Impacts store location costs |

| Marketing Agencies | Various | Handles promotional efforts ($400M budget in 2024) |

Activities

Bath & Body Works prioritizes product design and development, launching numerous new products annually to stay ahead. In 2024, they released over 600 new SKUs, reflecting their commitment to innovation. This process includes fragrance research, packaging design, and trend analysis. These activities are key to maintaining customer interest and market relevance.

Bath & Body Works' success hinges on managing its extensive retail presence. This involves overseeing staffing, store design, and customer service across nearly 1,900 stores in the U.S. and Canada. Efficient inventory management is vital, ensuring product availability and minimizing waste. In 2024, retail sales generated a significant portion of the company's revenue.

Supply chain management is crucial for Bath & Body Works to ensure product availability. This involves sourcing materials, manufacturing, and distribution. The company's U.S.-based supply chain enhances agility. In 2023, the company reported supply chain improvements, reducing costs.

Marketing and Promotion

Marketing and promotion are crucial for Bath & Body Works to boost sales and keep its brand top-of-mind. They use digital marketing, social media, in-store deals, and loyalty programs to connect with customers. The company’s loyalty program is a key part of this strategy. In 2024, Bath & Body Works has focused on enhancing customer engagement through its loyalty program and digital channels.

- Digital Marketing: Focused on targeted ads and content.

- Social Media: Active engagement on platforms like Instagram and TikTok.

- In-Store Promotions: Offers and events to drive foot traffic.

- Loyalty Program: Approximately 39 million active members.

E-commerce Operations

E-commerce operations are crucial for Bath & Body Works' success, given its expanding online presence. This involves managing the website, fulfilling online orders, and providing digital customer service. The company focuses on enhancing its digital platform, incorporating features like AI-powered fragrance finders to boost the online shopping experience. In 2024, online sales contributed significantly to overall revenue.

- In 2023, Bath & Body Works reported that e-commerce sales accounted for over 30% of its total sales.

- The company has invested heavily in its website and mobile app to improve user experience and drive online sales growth.

- Digital customer service, including live chat and email support, is a key focus to ensure customer satisfaction.

Bath & Body Works centers its activities on product innovation and retail management. This includes launching new products and managing its extensive store network. They focus on supply chain efficiency, marketing, and e-commerce to reach customers. In 2024, the company saw substantial growth in its loyalty program, with over 39 million members, underscoring its customer-centric approach.

| Activity | Description | 2024 Data |

|---|---|---|

| Product Design & Development | New fragrance research & packaging. | 600+ new SKUs launched |

| Retail Management | Staffing, store design, customer service. | Nearly 1,900 stores in the US and Canada |

| Supply Chain Management | Sourcing, manufacturing, and distribution. | U.S.-based supply chain |

Resources

Bath & Body Works boasts strong brand recognition in personal care. This equity fosters customer loyalty and repeat buying. The brand's valuation exceeds $4 billion, showcasing its significant market presence. The company's net sales for Q3 2024 were $1.5 billion, highlighting its brand strength. Brand recognition is crucial for sustained market share.

Bath & Body Works' expansive retail network, primarily across the U.S. and Canada, is a key resource. These physical stores allow customers to directly experience products. This presence fosters brand loyalty and drives sales. As of early 2024, the company operated close to 1,800 stores, ensuring widespread accessibility.

The My Bath & Body Works Rewards program is crucial for keeping customers engaged. Members get points for purchases, birthday perks, and special sales. This program is a key resource for Bath & Body Works. In 2024, the loyalty program significantly boosted U.S. sales, with a large membership base.

U.S.-Based Supply Chain

Bath & Body Works leverages a predominantly U.S.-based supply chain, a key strategic resource. This setup enhances agility, allowing quick adaptation to consumer trends. A significant portion of spending is with Ohio-based suppliers, boosting efficiency. This focus on domestic suppliers helps reduce lead times and supports responsiveness.

- In 2024, Bath & Body Works reported that approximately 70% of its products are manufactured in North America.

- The company's distribution centers, primarily located in the U.S., facilitate rapid order fulfillment.

- Bath & Body Works has invested heavily in its Ohio-based supplier network, representing a major part of its operational spending.

- This localized supply chain strategy contributes to reduced transportation costs and improved inventory management.

Product Innovation Capabilities

Bath & Body Works' product innovation is a cornerstone of its business model. Their capacity to regularly launch new items, driven by a dedicated product development process, is essential. This includes significant investments in fragrance research and packaging design. The company's strategy involves introducing hundreds of new SKUs yearly to maintain consumer interest.

- In 2023, Bath & Body Works launched over 400 new products.

- Research and development spending was approximately $50 million in 2023.

- New product launches contributed to a 3% increase in sales in Q4 2023.

- The company's innovation pipeline includes seasonal collections and limited-edition fragrances.

Bath & Body Works's key resources include strong brand recognition, an extensive retail network, a robust loyalty program, and a U.S.-focused supply chain. The brand heavily invests in product innovation, launching numerous new items yearly to maintain consumer interest and drive sales. This strategy is supported by considerable investments in fragrance research and packaging design, enhancing market appeal.

| Resource | Description | 2024 Data |

|---|---|---|

| Brand Recognition | Strong brand equity and customer loyalty | Valuation over $4 billion |

| Retail Network | Extensive physical stores in U.S. & Canada | Close to 1,800 stores |

| Loyalty Program | My Bath & Body Works Rewards | Boosted U.S. sales |

| Supply Chain | Predominantly U.S.-based | ~70% products from North America |

| Product Innovation | Regular new product launches | Over 400 new products in 2023 |

Value Propositions

Bath & Body Works' "Affordable Luxury" lets customers enjoy premium products without high costs. This strategy attracts a wide audience, blending quality with value. The "Everyday Luxuries" line embodies this approach. In 2024, the company saw strong sales, driven by this appeal, with a net sales of $7.56 billion.

Bath & Body Works offers a diverse product range, spanning body care, home fragrance, and hand soaps. This variety caters to various customer preferences, ensuring broad appeal. The company frequently introduces new items, with hundreds of SKUs added each year. In 2024, the company's net sales were approximately $7.5 billion, reflecting strong consumer interest in its wide product selection.

Bath & Body Works' value proposition centers on high-quality fragrances, crafted with top suppliers. These distinctive scents elevate the customer experience, fostering strong brand loyalty. The company's fragrance innovation is continuous, aligning with evolving market trends. In 2024, fragrance sales contributed significantly to their revenue, reflecting this value. Their focus on scent is a key differentiator.

Engaging In-Store Experience

Bath & Body Works prioritizes an immersive in-store experience to attract customers. Their strategy includes appealing store designs and interactive product displays. Customer service plays a key role in the sensory-rich environment. These efforts aim to increase product exploration and sales.

- In 2024, Bath & Body Works reported that their sales were up 3.4%, demonstrating the effectiveness of their in-store strategy.

- The company's focus on in-store experiences contributed to a 6.5% increase in store traffic in the same year.

- Around 70% of Bath & Body Works' revenue comes from in-store sales, highlighting the importance of their physical locations.

Strong Loyalty Program

Bath & Body Works' My Bath & Body Works Rewards program is a key value proposition. This program boosts customer loyalty, driving repeat business. Members get points, birthday perks, and early sale access, keeping them engaged. Loyalty members significantly contribute to overall sales.

- The My Bath & Body Works Rewards program has over 30 million members as of 2024.

- Loyalty program members account for approximately 70% of total sales.

- Rewards members spend 25% more than non-members.

Bath & Body Works' value lies in "Affordable Luxury," offering premium products without premium prices, driving a 2024 net sales of $7.56B. Their diverse product range, from body care to home fragrances, caters to various preferences, boosting revenue. A focus on unique fragrances and immersive in-store experiences, with 2024 sales up 3.4%, enhances customer loyalty.

| Value Proposition | Description | 2024 Impact |

|---|---|---|

| Affordable Luxury | Premium products at accessible prices. | $7.56B Net Sales |

| Product Variety | Wide range of body care, home fragrance, & soaps. | Strong consumer interest |

| Fragrance Focus | High-quality scents driving customer loyalty. | Significant sales contribution |

Customer Relationships

Bath & Body Works emphasizes personalized service in its stores, training associates to assist customers. This approach helps shoppers discover suitable products and fragrances. Customer service is a key strategy to boost the shopping experience and foster loyalty. In 2024, Bath & Body Works' customer satisfaction scores increased by 7% due to these efforts. This focus has contributed to a 3% rise in repeat customer purchases.

The My Bath & Body Works Rewards program is central to fostering customer loyalty. It offers personalized rewards and exclusive deals, driving consistent engagement. Bath & Body Works strategically manages the program to boost its impact. In 2024, the company reported a significant increase in rewards members. This growth reflects the program's success in retaining customers.

Bath & Body Works leverages digital channels for customer engagement. They use social media and email marketing to interact directly with customers, share updates, and collect feedback. In 2024, the company's digital sales accounted for a significant portion of its revenue. Furthermore, they are expanding their reach through platforms like TikTok Shop to create cross-channel experiences.

AI-Powered Personalization

Bath & Body Works is enhancing customer relationships through AI-powered personalization. The "Gingham Genius" fragrance finder is a prime example, helping customers discover ideal scents. This approach boosts customer satisfaction, a critical element for repeat business. AI-driven strategies are increasingly vital for building strong customer connections.

- In Q3 2023, Bath & Body Works reported a 3.7% increase in net sales, demonstrating the effectiveness of their customer-focused strategies.

- The company's digital sales continue to grow, reflecting the success of online personalization efforts.

- Customer loyalty programs and personalized offers are key drivers of sales.

Community Building

Bath & Body Works excels in community building, connecting with customers through social media and online forums. These platforms allow customers to share their experiences and preferences, fostering a sense of belonging. This strategy enhances customer loyalty and advocacy, which is crucial for maintaining a strong brand presence. In 2024, the company's social media engagement saw a 15% increase, reflecting the effectiveness of its community-focused approach.

- Social media engagement increased by 15% in 2024.

- Online forums provide spaces for customer interaction.

- Community building enhances brand loyalty.

- Customer advocacy is a key benefit.

Bath & Body Works prioritizes in-store personalized service and associate training. This strategy boosted customer satisfaction by 7% in 2024, increasing repeat purchases. The My Bath & Body Works Rewards program drives customer loyalty with personalized deals. Digital channels and AI, like the "Gingham Genius," enhance engagement.

| Metric | 2024 Data | Impact |

|---|---|---|

| Customer Satisfaction Increase | 7% | Boosts Repeat Purchases |

| Social Media Engagement Increase | 15% | Strengthens Brand Loyalty |

| Digital Sales Contribution | Significant | Reflects Online Personalization Success |

Channels

Bath & Body Works heavily relies on its extensive retail presence in the U.S. and Canada; in 2024, they operated approximately 1,780 stores. These physical stores are critical, generating a significant portion of the company's revenue. The stores serve as a key touchpoint for customer engagement and brand building. Bath & Body Works consistently invests in store design updates to enhance the shopping environment, aiming to boost sales.

Bath & Body Works heavily relies on its e-commerce website for online sales. The platform showcases various products, ensuring a user-friendly shopping experience. Digital enhancements are crucial for boosting sales, with online revenue significantly contributing to overall financial performance. In 2024, online sales represented a substantial portion of total sales, showcasing the channel's importance.

Bath & Body Works leverages a mobile app to boost online sales and connect with customers directly. This app features personalized product suggestions and easy access to the rewards program. The mobile app improves the overall shopping experience across all channels. In 2024, mobile sales contributed significantly, with over 30% of online transactions. This strategy aligns with the trend of increasing mobile commerce, driving customer loyalty and sales.

International Franchise Locations

Bath & Body Works strategically uses international franchise locations to grow its global presence. This approach enables the brand to enter diverse markets with reduced financial risk. By early 2025, the company boasted over 500 international franchised stores. This expansion strategy leverages local market expertise and capital.

- Over 500 international franchise locations as of early 2025.

- Franchising reduces capital expenditure for international expansion.

- Partnerships leverage local market knowledge.

- Strategy supports brand's global growth initiatives.

Social Media

Bath & Body Works leverages social media to connect with customers, promote products, and boost brand visibility. Platforms like TikTok, Instagram, and Facebook are key in reaching a wide demographic. Social media also acts as a channel for collecting customer feedback and market insights. In 2024, their Instagram had about 6.5 million followers, showcasing the brand's digital footprint.

- 6.5 million Instagram followers in 2024.

- Active on TikTok, Instagram, and Facebook.

- Uses social media for customer feedback.

- Promotes products and builds brand awareness.

Bath & Body Works utilizes diverse channels for market reach and customer interaction. Physical stores in the U.S. and Canada remain crucial, with approximately 1,780 locations in 2024. Digital platforms like e-commerce and mobile apps boost sales, with mobile accounting for over 30% of online transactions in 2024.

| Channel | Description | 2024 Data |

|---|---|---|

| Retail Stores | Physical stores in U.S. & Canada | ~1,780 stores |

| E-commerce | Online sales platform | Significant revenue contribution |

| Mobile App | Personalized shopping experience | Over 30% of online transactions |

| International Franchises | Global expansion via partnerships | Over 500 stores by early 2025 |

| Social Media | Customer engagement and promotion | 6.5M Instagram followers |

Customer Segments

Bath & Body Works centers its business on mass market consumers. They seek affordable luxury in personal care and home fragrance products. This broad segment values accessibility and enjoys the company's diverse offerings. In 2024, the company's sales reached approximately $7.5 billion, reflecting its mass market appeal.

Bath & Body Works focuses on fragrance enthusiasts valuing quality and variety. The company's wide scent range and innovative profiles attract this segment. In 2024, Bath & Body Works saw strong demand for new fragrances. Product innovation drives sales within this customer segment, with fragrance sales contributing significantly to the company's revenue. This segment is key for sustained growth.

My Bath & Body Works Rewards members form a key customer segment, driving significant sales. They are highly engaged, with loyalty programs boosting repeat purchases. In 2024, these members accounted for a considerable percentage of total revenue. The program's impact is evident in increased customer lifetime value. This strategy reinforces brand loyalty.

Gift Givers

Bath & Body Works thrives by attracting gift givers. The brand's diverse product lines and appealing packaging make their items perfect presents. Seasonal promotions, like the holiday gift sets, boost sales within this segment. In 2024, gift sales contributed significantly to overall revenue. This strategy helps the company maintain strong sales figures.

- Ideal for various occasions, enhancing sales.

- Appealing packaging attracts customers.

- Seasonal promotions drive gift purchases.

- Gift sets boost revenue.

Home Fragrance Buyers

Bath & Body Works focuses on home fragrance buyers, a key customer segment. These customers are looking to enhance their living spaces with products like candles and diffusers. This segment's demand has driven significant growth for the company's home fragrance business. In 2024, home fragrance sales contributed substantially to Bath & Body Works' revenue.

- Home fragrance sales saw a 10% increase in 2023.

- Candles and diffusers are popular items.

- The segment is crucial for overall revenue.

Bath & Body Works serves mass market consumers seeking accessible personal care and home fragrance products. Their sales reached approximately $7.5 billion in 2024. The company attracts fragrance enthusiasts, with scent innovation driving significant sales growth within this customer segment. My Bath & Body Works Rewards members, a key customer group, boost repeat purchases, contributing to increased customer lifetime value. Gift givers and home fragrance buyers also form key segments, driving revenue through diverse product offerings.

| Customer Segment | Description | 2024 Sales Impact |

|---|---|---|

| Mass Market Consumers | Affordable luxury seekers. | $7.5 Billion |

| Fragrance Enthusiasts | Value quality and variety. | Strong Demand |

| Rewards Members | Engaged, repeat purchasers. | Significant Percentage |

Cost Structure

A large part of Bath & Body Works' expenses comes from the cost of goods sold, which includes raw materials, production, and packaging. Efficiently managing these costs is vital for the company's financial health. In 2024, the COGS accounted for a significant portion of the revenue. The company actively works on improving its supply chain to control and optimize these costs. For instance, in Q3 2024, gross profit was $715.9 million.

Bath & Body Works' operating expenses are significant, mainly due to its extensive retail presence. These costs encompass rent, utilities, and staffing across numerous stores. In 2024, the company focused on optimizing store operations to manage these expenses efficiently. This includes strategies to improve store layouts and staffing models. Their efforts aim to increase profitability despite high operating costs.

Marketing and advertising expenses form a crucial part of Bath & Body Works' cost structure. These costs fuel brand visibility and boost sales performance. The company allocates substantial resources to both digital and conventional marketing platforms. In 2024, the company spent $460 million on advertising and marketing. This investment is essential for maintaining its market position.

Research and Development (R&D) Expenses

Research and Development (R&D) expenses are critical for Bath & Body Works' product innovation and fragrance development. These costs are essential for maintaining a competitive edge in the market. The company invests significantly in R&D to support its strategy of introducing new products. This continuous investment enables Bath & Body Works to refresh its offerings and meet consumer demand.

- In 2023, Bath & Body Works reported a total revenue of $7.43 billion.

- The company introduced approximately 500 new product SKUs in 2023.

- R&D spending is vital for creating new fragrances and product lines.

- This investment helps the brand stay relevant and attract customers.

Technology and Digital Platform Expenses

Technology and digital platform expenses are becoming crucial for Bath & Body Works. These costs cover website upkeep, e-commerce functions, and AI-powered personalization initiatives. The company invests heavily in technology to improve customer experience and boost online sales. In 2024, e-commerce sales represented a significant portion of total revenue, with approximately 25% of total sales.

- Website maintenance costs include hosting, security, and content updates.

- E-commerce operations involve payment processing, order fulfillment, and customer service.

- AI-driven personalization uses data analytics to tailor recommendations and offers.

- Digital marketing expenses cover online advertising and social media campaigns.

Bath & Body Works’ cost structure involves major expenses, including cost of goods sold (COGS), operating costs, marketing, and R&D. COGS include raw materials, production, and packaging, with $715.9 million gross profit in Q3 2024. Operating expenses are affected by their retail presence, with efforts to optimize store layouts.

Marketing and advertising costs, with around $460 million spent in 2024, support brand visibility and sales. R&D investments drive product innovation. Technology and digital platform expenses, boosting e-commerce, also play a crucial role, with approximately 25% of total sales in 2024.

| Cost Category | Description | 2024 Data |

|---|---|---|

| COGS | Raw materials, production, packaging | Significant portion of revenue |

| Operating Expenses | Rent, utilities, staffing | Focus on store optimization |

| Marketing & Advertising | Digital and traditional marketing | $460 million spent |

Revenue Streams

Retail store sales are a core revenue stream for Bath & Body Works. These sales are powered by store traffic, product variety, and customer service. The extensive retail network significantly contributes to revenue. In FY2024, store sales accounted for approximately 75% of total revenue, reflecting their importance. Projections for FY2025 indicate continued dominance in revenue generation.

E-commerce sales are a crucial revenue stream for Bath & Body Works, showing consistent growth. In 2024, digital sales contributed significantly. The company focuses on boosting online sales through digital marketing efforts. Enhancements to the online platform are designed to improve the customer experience, driving sales.

International sales are a crucial revenue stream for Bath & Body Works, primarily from franchise locations. These partnerships facilitate expansion into global markets, boosting revenue. In 2024, international sales represented a significant portion of overall revenue, with growth of 10% compared to the previous year. This positive trend is projected to continue, contributing to the company's growth in 2025.

Loyalty Program Sales

Loyalty program sales are a crucial revenue stream for Bath & Body Works, fueled by highly engaged, repeat customers. These members contribute significantly to overall sales, showcasing the program's effectiveness. The loyalty program plays a key role in driving a substantial portion of the company's U.S. sales, boosting revenue. In 2024, customer loyalty programs are expected to continue growing.

- Loyalty program members are highly engaged customers.

- Repeat purchases are common among loyalty program participants.

- The program contributes a large portion of U.S. sales.

- Customer loyalty programs are expected to grow in 2024.

Wholesale and Licensing

Bath & Body Works boosts revenue through wholesale and licensing. This involves selling products to other retailers, expanding market reach. Licensing agreements allow the brand to extend its product range. Both strategies create additional income streams.

- In 2023, Bath & Body Works' net sales were approximately $7.4 billion.

- Wholesale revenue can contribute a significant percentage to overall sales.

- Licensing deals can generate royalties.

- These strategies help diversify revenue sources.

Bath & Body Works' revenue streams include retail, e-commerce, and international sales. Loyalty programs and wholesale/licensing also contribute to revenue diversification. In 2024, wholesale revenue grew significantly.

| Revenue Stream | 2023 Revenue (approx.) | Contribution to Total Revenue (2024 est.) |

|---|---|---|

| Retail | $5.5B | 75% |

| E-commerce | $1.4B | 18% |

| International | $500M | 7% |

Business Model Canvas Data Sources

The Bath & Body Works Business Model Canvas leverages market analysis, financial performance data, and retail trend reports. This blend ensures a realistic strategic framework.