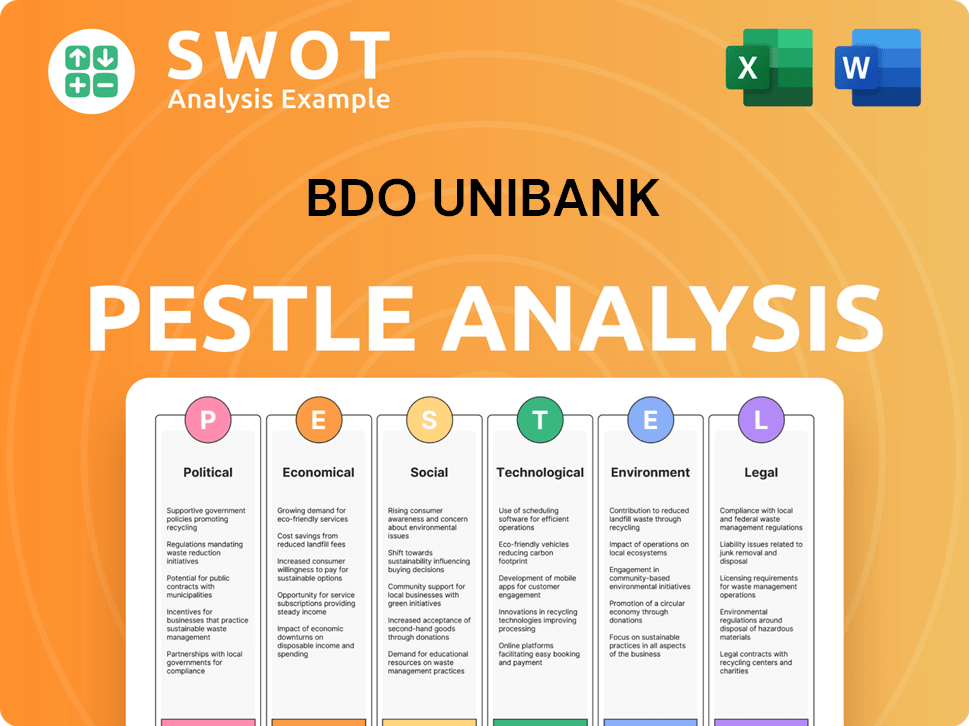

BDO Unibank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BDO Unibank Bundle

What is included in the product

This analysis assesses BDO Unibank through Political, Economic, Social, Tech, Environmental, & Legal factors.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Same Document Delivered

BDO Unibank PESTLE Analysis

What you're previewing here is the actual file—fully formatted and professionally structured. The BDO Unibank PESTLE Analysis you see includes insightful perspectives on political, economic, social, technological, legal, and environmental factors. Examine the details! Get the full analysis instantly.

PESTLE Analysis Template

Navigate the dynamic landscape impacting BDO Unibank with our PESTLE analysis. Discover how political and economic forces shape their strategic moves. Uncover social and technological trends influencing customer behavior and innovations. Our analysis explores legal frameworks and environmental considerations. Get actionable insights for your own market strategy or research. Download the full version today to unlock comprehensive strategic advantages.

Political factors

The Philippine government's e-Government Master Plan supports digital transformation. This encourages banks like BDO to expand digital services. In 2024, the government allocated PHP 1.2 billion for digital infrastructure. This boosts digital banking adoption. BDO can leverage this for growth and wider reach.

Political stability in the Philippines is crucial for BDO Unibank's operations. Geopolitical risks, like those impacting global trade, can affect the economic environment. In 2024, the Philippines' GDP growth was projected at 5.5-6.5%, influencing lending. Changes in trade policies, such as tariffs, could alter this outlook.

Changes in banking regulations and monetary policy from the Bangko Sentral ng Pilipinas (BSP) significantly influence BDO. For example, the BSP's key interest rate impacts BDO's lending rates. In Q1 2024, the BSP held its key rate steady at 6.5%. Reserve requirements and sustainable finance policies also affect BDO's operations.

Government Spending and Infrastructure Projects

Sustained government spending, especially on infrastructure, boosts economic activity, offering banks like BDO Unibank opportunities in lending and investment. The Philippine government's infrastructure spending is projected to reach PHP 1.8 trillion in 2024, supporting sectors that BDO can finance. This fiscal push creates a favorable environment for BDO's growth. Such projects increase demand for financial services.

- Infrastructure spending projected: PHP 1.8 trillion (2024)

- Positive impact on lending and investment.

- Supports economic sectors BDO finances.

Focus on Financial Inclusion

The Philippine government's strong focus on financial inclusion significantly impacts BDO Unibank. This is evident through the Digital Payments Transformation Roadmap and potential new digital bank licenses. These initiatives push banks to offer accessible and affordable services, targeting the unbanked and underbanked. The Bangko Sentral ng Pilipinas (BSP) reported that in 2024, 56% of Filipino adults have bank accounts, showing progress in inclusion.

- Digital Payments Transformation Roadmap aims for 50% of payments to be digital by 2024.

- BSP targets to onboard 70% of Filipino adults into the formal financial system by 2023.

- BDO's strategy includes expanding its digital banking platform, enabling more Filipinos to access financial services.

Political factors significantly affect BDO Unibank's strategic landscape. The government's digital push, with a PHP 1.2 billion allocation for digital infrastructure in 2024, fosters digital banking. Economic stability, including a projected GDP growth of 5.5-6.5% in 2024, is critical for lending.

| Political Aspect | Impact on BDO | Data/Fact (2024) |

|---|---|---|

| Digital Transformation | Boosts digital services, expands reach. | PHP 1.2B allocated for digital infra. |

| Economic Stability | Influences lending, impacts operations. | GDP growth forecast: 5.5-6.5%. |

| Banking Regulations | Affects lending rates, operations. | BSP key rate steady at 6.5% in Q1. |

Economic factors

The Philippine economy's GDP growth directly affects banking. With projected expansion in 2024 and 2025, the environment is favorable for loan growth. The Philippine economy is expected to grow by 6.0-7.0% in 2024. This positive outlook supports BDO's profitability.

The Bangko Sentral ng Pilipinas (BSP) actively manages inflation, which impacts BDO's profitability. In 2024, inflation averaged 3.9%, within the BSP's target range. The BSP's monetary policy, including interest rate adjustments, affects BDO's loan demand and net interest margins. Potential rate cuts can stimulate economic activity but could squeeze bank profits.

Domestic consumption is a major economic driver in the Philippines, fueled by a robust labor market and substantial remittances. Overseas Filipino Workers (OFWs) sent home \$3.6 billion in March 2024 alone. This boosts household income and spending, increasing demand for banking services like those offered by BDO Unibank.

Investment Levels and Business Confidence

Investment levels and business confidence are crucial economic factors that influence BDO Unibank's performance. Corporate lending and overall business growth are directly affected by the level of public and private investment, which is, in turn, influenced by economic conditions and business confidence. A rise in corporate capital expenditure is expected to boost GDP growth. In 2024, the Philippines saw a 6.2% increase in investment. This positive trend is projected to continue into 2025.

- Investment in the Philippines increased by 6.2% in 2024.

- Corporate capital expenditure is expected to rise.

- Business confidence is a key factor.

- This contributes to GDP growth.

External Economic Conditions

Global economic conditions present challenges. Trade tensions and financial volatility in major economies can affect the Philippines. BDO Unibank monitors these external uncertainties closely. The International Monetary Fund (IMF) projects global growth at 3.2% in 2024 and 3.2% in 2025. These factors influence BDO's strategic planning.

- IMF projects global growth at 3.2% for both 2024 and 2025.

- Trade tensions and financial volatility are key concerns.

- BDO remains cautious due to external uncertainties.

The Philippine economy’s growth, projected at 6.0-7.0% in 2024, boosts BDO. Investment rose 6.2% in 2024. The IMF forecasts global growth at 3.2% for 2024/2025, impacting BDO's strategy.

| Factor | Impact on BDO | Data (2024) |

|---|---|---|

| GDP Growth | Favorable for loan growth | 6.0-7.0% (Projected) |

| Inflation | Impacts profitability | 3.9% (Average) |

| Investment | Boosts business growth | 6.2% Increase |

Sociological factors

The Philippines boasts a substantial and youthful population, fueling robust consumer demand and a vibrant workforce. This demographic structure creates opportunities for banks to meet changing financial needs. The median age is about 25 years old. As of 2024, over 60% of the population is under 30, driving demand for digital banking.

Financial inclusion in the Philippines shows ongoing challenges. About 34.4% of Filipinos remain unbanked as of 2024. BDO Unibank focuses on digital banking to reach this population, but financial literacy is key. The Bangko Sentral ng Pilipinas (BSP) has initiatives to boost financial literacy, which should help expand BDO's customer base and improve financial access.

Consumers increasingly favor digital banking. BDO Unibank must evolve to meet these demands. In 2024, mobile banking users grew by 15%. Digital transactions now make up over 80% of all transactions.

Urbanization and Branch Network

Urbanization in the Philippines fuels demand for accessible financial services, crucial for BDO Unibank. BDO's extensive branch network, with over 1,100 branches and 4,400 ATMs, is strategically located in urban areas. The bank's expansion plans continue to enhance customer accessibility, reflecting its commitment to meet the needs of a growing urban population. This focus supports financial inclusion and convenience.

- BDO has over 1,100 branches.

- BDO operates about 4,400 ATMs.

Social Impact and Community Development

Societal expectations increasingly pressure banks like BDO Unibank to boost social development and financial inclusion efforts. BDO’s microfinance programs and backing of gender-focused businesses directly address these expectations. In 2024, BDO's microfinance arm served over 1 million clients. This commitment helps underserved communities.

- BDO Unibank's microfinance portfolio reached PHP 25.8 billion in 2024.

- The bank's gender-focused initiatives saw a 15% increase in funding.

- BDO's community development projects impacted over 500,000 individuals.

BDO Unibank navigates societal pressures by promoting financial inclusion, and supports community development, and focuses on financial literacy. Its microfinance arm assisted over 1 million clients in 2024. The bank’s community development projects affected over 500,000 individuals, demonstrating its impact. Gender-focused initiatives saw a 15% rise in funding.

| Metric | Value (2024) | Impact |

|---|---|---|

| Microfinance Clients | 1M+ | Expanded access |

| Community Impact | 500,000+ individuals | Community Development |

| Gender-focused Funding | +15% | Enhanced Inclusion |

Technological factors

The Philippines' high smartphone and internet penetration fuels digital banking growth. BDO Unibank's digital investments are vital for competitiveness. In 2024, BDO's mobile banking users rose, reflecting this trend. Digital transactions continue to surge, with mobile now a primary channel. This ensures BDO meets customer needs efficiently.

Fintech innovation is rapidly reshaping the financial sector, with the Philippine government actively supporting its growth. BDO Unibank faces increased competition from these agile fintech firms. To stay ahead, BDO must embrace innovation, possibly through strategic partnerships or in-house development. In 2024, the Philippine fintech market was valued at $6.2 billion, a trend BDO needs to address.

Cybersecurity and data protection are critical. BDO Unibank must invest in security to protect customer data. In 2024, global cybersecurity spending reached $214 billion, showing the scale of the challenge. BDO's digital banking growth requires strong fraud detection.

AI and Automation in Banking Operations

BDO Unibank is increasingly integrating Artificial Intelligence (AI) and automation to boost efficiency across its operations. This includes leveraging AI for tasks such as fraud detection and customer service. In 2024, the global AI in banking market was valued at approximately $40 billion, and is projected to reach $150 billion by 2030. BDO's adoption of these technologies aims to enhance customer experiences and streamline internal processes.

- AI-driven fraud detection systems can reduce fraudulent transactions by up to 60%.

- Automated customer service chatbots can handle up to 80% of routine inquiries.

- BDO's investment in fintech solutions is expected to grow by 15% annually.

Technology Infrastructure and Resilience

BDO Unibank prioritizes a strong technology infrastructure to ensure seamless banking operations. Their focus on system resilience and a multi-cloud strategy is crucial for continuous digital service availability. This approach minimizes disruptions and supports customer service. BDO's tech investments are significant, with IT spending reaching PHP 10.2 billion in 2023.

- PHP 10.2 Billion: BDO's IT spending in 2023.

- Multi-cloud strategy: Enhances service availability.

BDO Unibank thrives on tech due to high digital adoption. They are embracing fintech innovation, addressing threats like cybersecurity and data protection. AI integration is vital for fraud detection and better customer service. Their tech investments reached PHP 10.2 billion in 2023.

| Technological Factor | Impact | Data |

|---|---|---|

| Digital Banking Growth | Enhances Customer Experience | Mobile banking users grew in 2024 |

| Fintech Competition | Requires Strategic Responses | Philippine fintech market $6.2B (2024) |

| AI Integration | Boosts efficiency | AI in banking $40B (2024) |

Legal factors

BDO Unibank adheres to the General Banking Law and other Philippine banking regulations. These laws dictate operational standards and financial conduct. In 2024, the Bangko Sentral ng Pilipinas (BSP) increased scrutiny on banks. BDO must comply to avoid penalties. The bank's legal team ensures adherence to evolving regulatory requirements.

BDO Unibank must comply with BSP regulations. These cover capital adequacy, risk management, and consumer protection. The BSP aims to ensure financial stability. In 2024, the BSP maintained a 12% capital adequacy ratio. This is above the international standard of 8%.

BDO Unibank, like all banks, faces stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) regulations. These laws mandate banks to prevent financial crimes. BDO must implement comprehensive systems and processes to adhere to these regulations. In 2024, the Bangko Sentral ng Pilipinas (BSP) intensified its AML/CFT supervision, reflecting global efforts. BDO continuously invests in technology and training to ensure compliance, spending approximately PHP 1.5 billion annually on compliance-related activities, as reported in its 2024 financial filings.

Data Privacy and Protection Laws

Data privacy and protection laws are vital for BDO Unibank, especially with increasing digital banking. They must protect customer data responsibly and securely. Failure to comply can lead to hefty fines and reputational damage. BDO needs to stay updated with evolving regulations like the Data Privacy Act of 2012 in the Philippines.

- In 2024, the Philippines saw a 20% rise in data breaches.

- The Data Privacy Act of 2012 imposes fines up to PHP 5 million.

Regulations on Digital Banking and Fintech

BDO Unibank faces a dynamic regulatory environment concerning digital banking and fintech. These regulations impact the bank's digital service offerings and competitive positioning. Compliance with licensing, operational rules, and consumer protection laws in the digital realm is essential. The Bangko Sentral ng Pilipinas (BSP) continues to update its guidelines.

- BSP Circular No. 1149 (2022) outlines digital bank regulations.

- The Philippines saw a 21% increase in fintech adoption in 2023.

- Consumer complaints related to digital banking increased by 15% in 2024.

BDO Unibank must follow Philippine banking laws, covering operational and financial conduct, with the BSP's strict oversight. The bank’s AML/CFT compliance, supported by tech and training, faces intensified scrutiny to prevent financial crimes.

Data privacy is key due to digital banking's growth, where compliance protects customer data and avoids penalties. Digital banking and fintech regulations, influenced by BSP updates, affect digital service offerings and market competition.

Compliance requires significant investments to ensure operations within a legally sound framework, which influences operational standards, risk management, and market standing.

| Legal Aspect | Regulatory Focus | 2024/2025 Impact |

|---|---|---|

| Banking Laws | BSP regulations, General Banking Law | Compliance, risk management; capital adequacy ratio at 12% |

| AML/CFT | Preventing financial crimes | Increased BSP supervision, PHP 1.5B spent yearly on compliance. |

| Data Privacy | Data Privacy Act of 2012 | 20% rise in data breaches, potential fines up to PHP 5M. |

Environmental factors

The Philippines faces significant climate change and environmental risks. Extreme weather events, like typhoons, are becoming more frequent and intense. These events can disrupt BDO Unibank's operations and impact the economy. For example, in 2024, the Philippines experienced several typhoons, causing billions in damage. This can affect loan portfolios and asset quality, as businesses and individuals struggle with recovery.

The Bangko Sentral ng Pilipinas (BSP) drives sustainable finance, mandating environmental and social risk integration. In 2024, the BSP issued Circular 1158, emphasizing climate risk management. Banks must disclose their sustainability efforts. This aligns with global trends, boosting BDO's green initiatives.

BDO Unibank actively finances environmental projects, aligning with the global shift towards sustainability. The bank's investments support renewable energy and green infrastructure. In 2024, BDO allocated PHP 29.1 billion for sustainable projects, up from PHP 26.7 billion in 2023. This underscores its commitment to a low-carbon economy and environmental stewardship.

Environmental and Social Risk Management

Environmental and social risk management is crucial for banks like BDO. They must evaluate the environmental and social impacts of their financial activities. BDO has established policies to handle these risks effectively. This includes assessing projects for sustainability. In 2024, environmental, social, and governance (ESG) assets grew significantly.

- BDO integrates ESG considerations into its credit risk assessment process.

- The bank supports sustainable projects and initiatives.

- BDO complies with environmental and social regulations.

- ESG assets reached $40.5 trillion globally in 2024.

Internal Environmental Practices

BDO Unibank is actively managing its internal environmental impact, aiming to decrease its carbon footprint and promote sustainable practices. This includes implementing digital solutions to reduce paper consumption and streamline operations. In 2024, BDO Unibank launched several green initiatives, including energy-efficient upgrades in branches. The bank's commitment to sustainability is evident in its investments in eco-friendly technologies. These internal efforts are a part of its broader sustainability strategy.

- Reduction in paper usage by 15% through digital initiatives in 2024.

- Investment of $5 million in energy-efficient upgrades across branches.

- Target to reduce carbon emissions by 10% by the end of 2025.

Environmental factors are critical for BDO Unibank. The bank faces climate risks from extreme weather. BDO actively finances green projects. In 2024, ESG assets hit $40.5 trillion globally.

| Key Environmental Aspect | 2023 Performance | 2024 Performance |

|---|---|---|

| Sustainable Project Allocation (PHP) | 26.7 Billion | 29.1 Billion |

| Paper Usage Reduction | 12% | 15% |

| Investment in Energy Efficiency | $3 Million | $5 Million |

PESTLE Analysis Data Sources

The BDO Unibank PESTLE Analysis uses official data from the BSP, government agencies, and reputable financial news.