Beijing Enterprises Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beijing Enterprises Bundle

What is included in the product

Tailored exclusively for Beijing Enterprises, analyzing its position within its competitive landscape.

Instantly understand strategic pressure with a powerful spider/radar chart.

Preview the Actual Deliverable

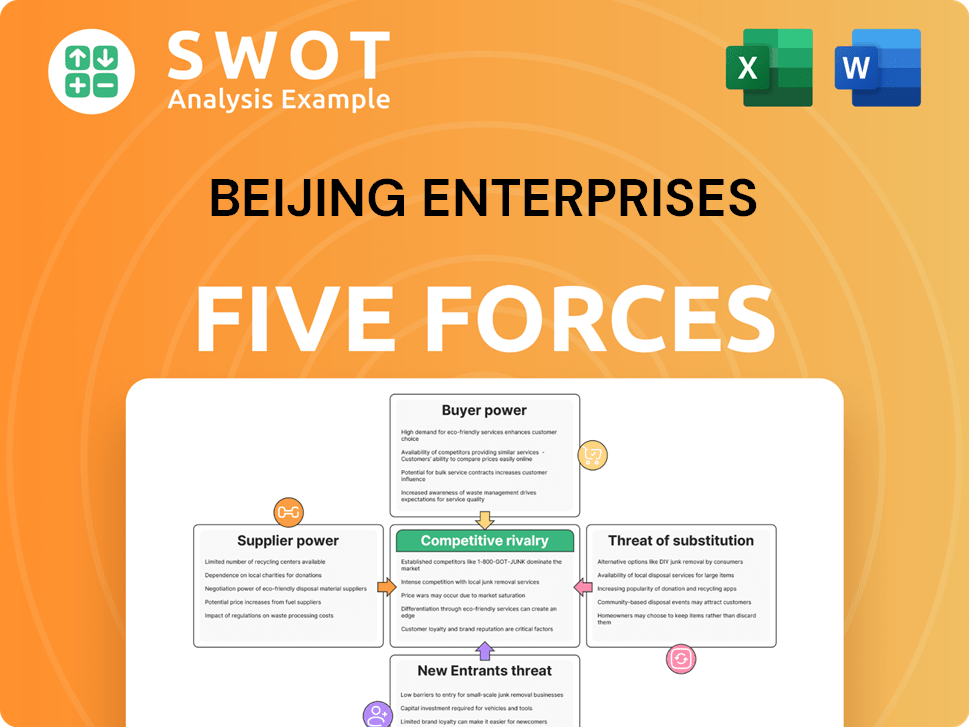

Beijing Enterprises Porter's Five Forces Analysis

This is the complete, ready-to-use analysis file. The Porter's Five Forces analysis you're previewing on Beijing Enterprises is what you get after purchase. It details competitive rivalry, supplier power, and more. Examine it closely – it's the final product. Professionally formatted and ready for your use.

Porter's Five Forces Analysis Template

Beijing Enterprises faces a complex competitive landscape. Supplier power is moderate due to reliance on raw materials. Buyer power varies across its diverse customer base. The threat of new entrants is relatively low, given industry barriers. Substitute products pose a limited threat. Competitive rivalry is intense within its sector.

Ready to move beyond the basics? Get a full strategic breakdown of Beijing Enterprises’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Beijing Enterprises sources from specialized suppliers for gas, water, and other operations. Limited suppliers, especially for tech like water treatment, boost their leverage. This can lead to higher prices and less favorable terms for Beijing Enterprises. In 2024, the cost of specialized equipment rose by 7%, affecting profit margins.

The environmental services sector depends heavily on technology providers, particularly for compliance software, increasing supplier power. These providers can dictate pricing due to their market position, amplified by stricter regulations and tech advancements. In 2024, the compliance software market grew by 15%, reflecting this trend. The rising demand for advanced software enables suppliers to increase prices, impacting operational costs.

Beijing Enterprises leverages long-term contracts, particularly in utilities, to manage supplier power. These contracts help stabilize costs, offering a buffer against supplier price hikes. However, favorable terms at renewal hinge on competitive market conditions. In 2024, utilities like Beijing Gas saw contract adjustments impacting margins. For instance, natural gas supply agreements accounted for a significant portion of operational expenses.

Impact of 'Made in China 2025'

The 'Made in China 2025' plan, designed to bolster domestic supply chains, significantly impacts supplier bargaining power. Its goal is to increase the market share of Chinese suppliers in crucial components and materials. This strategic shift could reduce reliance on foreign suppliers. However, the actual impact depends on the initiative's success and sector-specific outcomes.

- In 2024, China's manufacturing output accounted for approximately 30% of global manufacturing.

- China's domestic market share for core components has increased, but still faces challenges in high-end sectors.

- The plan aims for 40% self-sufficiency in core materials by 2025, according to government targets.

- Trade tensions and geopolitical factors could influence the bargaining power of both domestic and international suppliers.

Government influence and regulation

The Chinese government's substantial influence over Beijing Enterprises can significantly shape supplier dynamics, especially in regulated sectors such as utilities. Government policies can dictate procurement processes, pricing, and supplier relationships, thus limiting the power suppliers hold. This is particularly evident in the utility market, where regulations heavily restrict supplier negotiation leverage. For example, in 2024, government interventions in energy markets aimed to stabilize prices, directly impacting supplier contracts.

- Government policies can limit supplier power.

- Regulations significantly constrain supplier negotiation leverage.

- Utility markets are highly regulated, affecting supplier relationships.

- Government interventions in energy markets impact contracts.

Beijing Enterprises faces supplier challenges, particularly in tech-dependent areas. Limited supplier options for essential tech boost their leverage, potentially increasing costs. Long-term contracts mitigate supplier power but depend on market conditions; in 2024, gas supply agreements impacted margins.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Tech Dependency | Higher costs | Equipment costs up 7% |

| Contract Influence | Cost stabilization | Gas supply agreements |

| Government Role | Regulation impact | Energy market interventions |

Customers Bargaining Power

Beijing Enterprises, offering essential utilities like water and gas, faces limited customer bargaining power. Inelastic demand for these services means customers are less price-sensitive. This protects revenue stability: in 2024, the utilities sector saw steady demand despite economic shifts. For example, water revenue grew by 3%.

Beijing Enterprises benefits from geographical monopolies in water and gas, reducing customer bargaining power. This dominance, particularly in regions like Beijing, limits consumer choices. In 2024, the company's water and gas distribution revenue reached $5 billion, showing its market control. This geographical advantage allows for less price negotiation.

Beijing Enterprises operates within sectors like utilities and environmental services, facing strict regulatory oversight. This oversight influences pricing strategies and service standards. Regulatory frameworks typically ensure stable revenue streams for utilities. However, this also limits customers' ability to negotiate lower prices or demand bespoke services beyond regulatory stipulations. For example, in 2024, the regulatory environment in China saw increased scrutiny of environmental projects, impacting pricing flexibility.

Limited customer switching options

Beijing Enterprises benefits from limited customer switching options due to high infrastructure costs and regulatory barriers. This restricts competition, strengthening its market position. Customers have little negotiation power because water services are essential. For instance, in 2024, the company's water supply revenue was approximately RMB 20 billion, underscoring its strong market control.

- Market dominance stems from high entry barriers.

- Essential services limit customer negotiation.

- Revenue of RMB 20 billion in 2024 highlights market power.

- Regulatory hurdles ensure limited competition.

Price sensitivity in beer segment

In the beer segment, Beijing Enterprises faces moderate customer bargaining power due to price sensitivity. Consumers can easily switch between brands, increasing their ability to negotiate prices. Yet, brand loyalty and demand for craft beers reduce this power. The global beer market was valued at $625.6 billion in 2023, with premiumization trends lessening price sensitivity.

- Price sensitivity is influenced by the availability of substitutes.

- Brand loyalty and preference for premium beers can mitigate this.

- The shift toward premiumization indicates reduced price sensitivity.

- The global beer market was worth $625.6 billion in 2023.

Beijing Enterprises has strong bargaining power over utility customers due to essential services. This is enhanced by geographical monopolies, especially in areas like Beijing. Limited switching options and regulatory oversight further constrict customer influence.

| Factor | Impact | 2024 Data |

|---|---|---|

| Essential Services | Inelastic demand | Water revenue +3% |

| Geographical Monopoly | Reduced consumer choice | Water/Gas revenue $5B |

| Regulatory Oversight | Limits negotiation | Env. projects scrutiny |

Rivalry Among Competitors

Beijing Enterprises confronts robust competition from formidable state-owned enterprises and established entities across its operational sectors. ENN Energy, a key rival in the gas market, and China Water Affairs in water treatment, possess substantial resources and strong market footprints, intensifying rivalry. Beijing Gas's Tianjin Nangang project processed over 1 million tons of LNG. BE Water maintained its leading position in China's water industry for 14 years.

Beijing Enterprises operates in sectors with varying competitive landscapes. Utilities are concentrated, but environmental services and beer are more fragmented. This fragmentation intensifies competition, particularly regionally. Data from 2024 shows the waste management sector remains fragmented, with numerous regional players. This leads to more price wars and innovation.

Beijing Enterprises prioritizes operational efficiency to stay competitive, optimizing its capital structure. This involves boosting cash flow, streamlining processes, and using digital tools. In 2024, such strategies helped the company improve its operational performance. Enhanced efficiency is crucial for market positioning, as seen in the sector's competitive dynamics.

Innovation and technology adoption

Competitive rivalry significantly drives Beijing Enterprises to invest in innovation and technology. The company focuses on environmental services and waste management, developing advanced waste-to-energy solutions. This includes improving water treatment processes. In 2024, Beijing Enterprises optimized its debt structure, issuing over RMB10 billion in Panda Bonds.

- Innovation in Waste-to-Energy: Beijing Enterprises invests in cutting-edge waste-to-energy technologies.

- Debt Optimization: The company issued over RMB10 billion in Panda Bonds.

- Technological Advancements: Focus on improving water treatment processes.

- Competitive Pressure: Drives continuous investment in new technologies.

Regulatory and policy environment

Government policies and regulations are crucial in the utilities and environmental sectors. Changes in environmental standards and pricing influence competition, requiring companies to adapt. China's government actively addresses air quality, affecting industry dynamics. The Chinese government invested significantly in environmental protection, with spending reaching ¥789.8 billion in 2023. This spending reflects policy impacts on the sector.

- Regulatory changes directly affect Beijing Enterprises' operations and competitiveness.

- Environmental standards and pricing policies are key factors.

- China's focus on air quality influences strategic decisions.

- Government investment in environmental protection is substantial.

Beijing Enterprises faces intense rivalry, particularly from SOEs and regional players in fragmented markets. This competition drives innovation in waste-to-energy and technological advancements in water treatment. The company strategically optimizes its capital structure to enhance operational efficiency and maintain a competitive edge. In 2024, China's environmental spending hit ¥789.8 billion, influencing industry dynamics.

| Aspect | Details |

|---|---|

| Key Competitors | ENN Energy, China Water Affairs, and regional players |

| Strategic Focus | Waste-to-energy, water treatment, debt optimization |

| 2024 Stats | China's Environmental spending: ¥789.8 billion |

SSubstitutes Threaten

In the water sector, substitutes include rainwater harvesting, desalination, and increased water conservation efforts. The feasibility and cost-effectiveness of these alternatives vary, limiting their immediate threat to Beijing Enterprises. The essential nature of water services and the lack of direct substitutes also limits this threat. For example, in 2024, the water sector saw investments in conservation, but large-scale desalination remains costly, impacting the threat level.

In the gas sector, substitutes include electricity, renewable energy, and coal. China's growing renewable energy adoption threatens gas demand, particularly in power generation. LNG faces competition from alternative fuels, but implications for China's energy security are key. In 2024, renewable energy accounted for over 30% of China's total energy consumption. Coal still remains a dominant player.

For solid waste treatment, alternatives include recycling, composting, and waste reduction. Beijing's waste management faces pressure from circular economy principles and diversion strategies. In 2024, China's recycling rate for key materials like paper and metals is around 50-60%. This reduces demand for traditional waste treatment. The threat of substitutes for air purifiers remains low to moderate.

Substitute beverages

Substitute beverages pose a significant threat to Beijing Enterprises' beer segment. Consumers can easily switch to alternatives like wine, spirits, or non-alcoholic drinks. This availability increases price sensitivity, as consumers compare costs and perceived value. The low cost-performance ratio of many substitutes strengthens this threat. In 2024, the global alcoholic beverage market was valued at approximately $1.6 trillion, highlighting the scale of alternatives.

- Wine and spirits offer diverse tastes.

- Non-alcoholic options provide health-conscious choices.

- Availability impacts consumer price sensitivity.

- The global market for beverages is huge.

Air purification substitutes

Air conditioners present a substitute for air purifiers, particularly when cooling is the primary need. This substitution effect is expected to be moderate. In 2024, the global air purifier market was valued at approximately $13.8 billion. However, the availability and adoption of air purifiers are increasing, driven by growing health consciousness.

- Air conditioners offer cooling with some air purification.

- Substitute threat is moderate due to market dynamics.

- Global air purifier market was valued at $13.8 billion in 2024.

- Growing health consciousness drives air purifier adoption.

In the water sector, alternatives like rainwater harvesting and conservation pose a limited threat, with large-scale desalination remaining costly in 2024. Gas faces competition from renewables and coal; renewables accounted for over 30% of China's total energy consumption in 2024. For waste management, recycling and composting challenge traditional waste treatment, with China's recycling rate at 50-60% for key materials in 2024.

Substitute beverages significantly threaten Beijing Enterprises' beer segment, with consumers easily switching to wine, spirits, or non-alcoholic options; the global alcoholic beverage market was valued at approximately $1.6 trillion in 2024. Air conditioners act as a moderate substitute for air purifiers, with a global market value of $13.8 billion in 2024, alongside increasing health consciousness driving air purifier adoption.

| Sector | Substitute Examples | Threat Level (2024) |

|---|---|---|

| Water | Rainwater, Desalination, Conservation | Low |

| Gas | Electricity, Renewables, Coal | Moderate to High |

| Solid Waste | Recycling, Composting, Reduction | Moderate |

| Beer | Wine, Spirits, Non-Alcoholic | High |

| Air Purification | Air Conditioners | Moderate |

Entrants Threaten

The utilities and infrastructure sectors, where Beijing Enterprises operates, demand significant upfront capital, acting as a major hurdle for potential entrants. Water utility infrastructure, for instance, can cost between $1.5 million to $3 million per mile for water main installations, based on 2024 figures. These substantial capital needs make it exceedingly difficult for new competitors to enter the market. The high financial commitment deters smaller firms, favoring established players with deep pockets and existing infrastructure. The capital-intensive nature of the industry thus limits the threat from new entrants.

Stringent regulatory approvals pose a significant barrier for new entrants in Beijing Enterprises' sectors. Obtaining necessary licenses in water, gas, and environmental services is a complex, time-intensive process. The industry faces strict environmental, health, and safety regulations, varying regionally. For instance, in 2024, regulatory compliance costs increased by 15% due to stricter environmental standards. This deters potential competitors.

Beijing Enterprises, with its established brand, enjoys a significant advantage against new competitors. Strong brand recognition fosters customer loyalty, which acts as a barrier to entry. In 2024, the company's brand value was estimated at $15 billion, reflecting its strong market position. New entrants face the challenge of building such a reputation, which takes time and substantial investment.

Economies of scale

Existing companies in the solid waste industry benefit from economies of scale, enabling them to operate more efficiently and offer competitive pricing, posing a barrier to new entrants. Established firms like Waste Management leverage their size for cost advantages. These advantages make it difficult for newcomers to compete on price and profitability. The waste management market in the U.S. in 2024 was valued at approximately $70 billion, highlighting the scale of operations.

- Waste Management's revenue in 2023 was about $20 billion.

- Republic Services, another major player, generated around $15 billion in revenue in 2023.

- Economies of scale allow for lower per-unit costs.

Government support and relationships

Beijing Enterprises Holdings Limited, as a state-owned enterprise (SOE), benefits significantly from government support and relationships, creating a formidable barrier to entry for new competitors. These advantages include preferential treatment in securing contracts and navigating complex regulatory environments, making it challenging for private or foreign companies to compete effectively. The company's strong ties with the government provide a strategic edge in sectors like gas, water, environmental services, and breweries.

- Beijing Enterprises Holdings Limited is a diversified conglomerate based in Hong Kong, primarily engaged in the gas, water, environmental, and brewery sectors.

- SOEs often have strong relationships with the government.

- These relationships provide advantages in securing contracts and navigating regulatory hurdles.

- This creates a barrier for private or foreign companies seeking to enter the market.

The threat of new entrants for Beijing Enterprises is low due to high capital requirements and regulatory hurdles, common in utilities and infrastructure. Brand strength and economies of scale further protect the company. Moreover, government support for SOEs like Beijing Enterprises creates significant barriers.

| Barrier | Description | Impact |

|---|---|---|

| Capital Intensity | High upfront costs, e.g., water main installations costing $1.5M-$3M/mile. | Deters small firms. |

| Regulation | Complex licensing and compliance costs (up 15% in 2024). | Slows or blocks new entrants. |

| Brand & Scale | Established brand value of $15B (2024) and cost advantages | Makes it hard to compete. |

Porter's Five Forces Analysis Data Sources

The analysis leverages diverse sources: company reports, financial databases, regulatory filings, and industry publications for competitive force assessments.