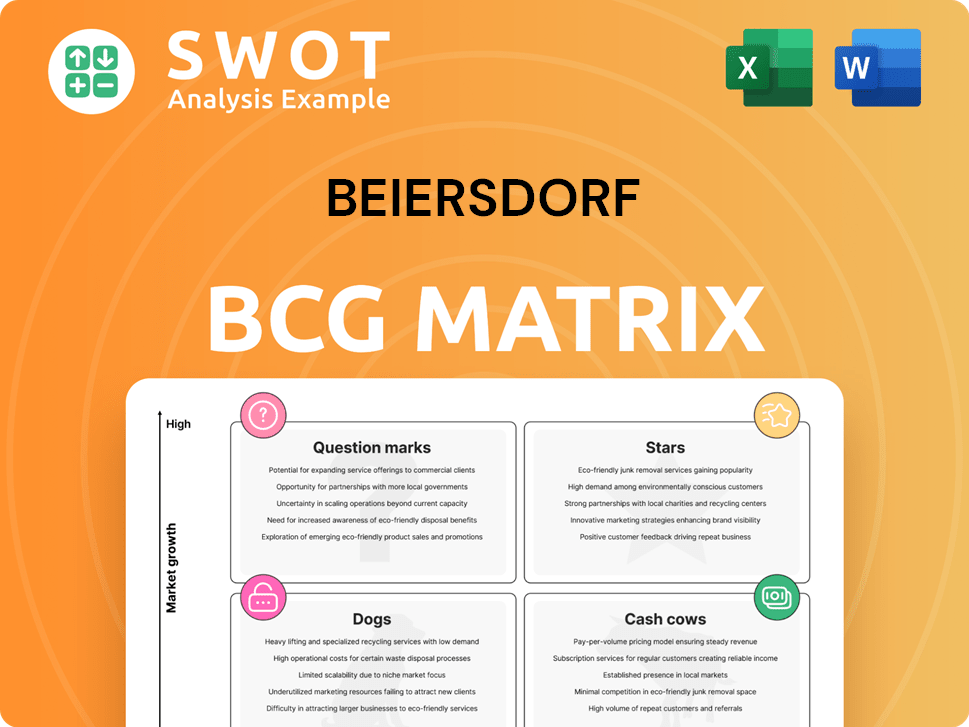

Beiersdorf Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beiersdorf Bundle

What is included in the product

Beiersdorf's BCG Matrix analyzes its portfolio, guiding investments for growth and profitability.

Quickly assess strategic options using a clear, actionable framework.

What You’re Viewing Is Included

Beiersdorf BCG Matrix

The preview mirrors the Beiersdorf BCG Matrix you'll receive. After purchase, get the complete, actionable report for brand portfolio analysis, fully formatted and ready for strategic decisions. No hidden extras, only the document you see now.

BCG Matrix Template

Uncover Beiersdorf's product portfolio strategy! The BCG Matrix reveals where iconic brands like Nivea stand: Stars, Cash Cows, Dogs, or Question Marks. This analysis highlights growth potential and investment opportunities. Gain clarity on resource allocation and market positioning. Discover the competitive landscape. Purchase the full BCG Matrix for data-driven insights!

Stars

Eucerin, a dermocosmetics brand, is a star for Beiersdorf. It has a high market share, driven by dermatologist recommendations and science. Beiersdorf should invest in R&D, aiming to expand the product line. In 2024, the global dermocosmetics market was valued at $68.7 billion.

Nivea Q10, a key part of Beiersdorf's portfolio, is positioned as a "Star" due to its high growth and market share in anti-aging, a sector valued at approximately $60 billion in 2024. Continued investment in marketing and innovation, such as new formulations, can increase its appeal and market penetration. For instance, in 2024, the global anti-aging market grew by 8%.

Hansaplast's advanced wound care, a star in Beiersdorf's portfolio, thrives in a growing market. This segment requires sustained investment in R&D and marketing. In 2024, the global wound care market was valued at over $20 billion. Beiersdorf should focus on smart dressings, potentially with integrated sensors.

Nivea Sun (Specific Regions)

In regions with intense sun and rising sun protection awareness, Nivea Sun shines as a Star. Its strong market share and growing demand signal success. Tailored marketing and product development are key for these areas. For instance, sunscreen sales in the Asia-Pacific region reached $1.8 billion in 2024.

- High market share in key regions.

- Increasing demand for sun protection products.

- Need for region-specific marketing.

- Potential for tailored product formulations.

Digital Personalization Initiatives

Beiersdorf's digital personalization efforts, like AI-powered skincare tools, position it as a potential Star. These initiatives demand substantial investment for market expansion. Success hinges on capturing a larger share in the competitive personalized skincare sector. In 2024, the global personalized skincare market was valued at approximately $12 billion.

- Investment in AI diagnostic tools and customized recommendations is key.

- Expansion depends on capturing a significant market share.

- Personalized skincare is a growing market.

- Focus on digital platforms for product recommendation.

Beiersdorf's Stars have high market shares in growing segments. They need investment in R&D and marketing. Expansion relies on innovation and tailored strategies.

| Brand | Market | 2024 Market Value |

|---|---|---|

| Eucerin | Dermocosmetics | $68.7 billion |

| Nivea Q10 | Anti-aging | $60 billion |

| Hansaplast | Wound care | $20 billion |

Cash Cows

Nivea's core body care, like its classic creams, holds a strong market share in a stable market. Its success is driven by brand loyalty and efficient operations. Strategic pricing and supply chain management are key.

Traditional Nivea Men products, like shaving creams, are cash cows. They generate strong cash flow thanks to their established market position. Minimal investment is needed to keep these products going. Beiersdorf's focus should be on cost optimization. In 2024, Beiersdorf's sales reached approximately €8.1 billion.

Hansaplast standard plasters are a cash cow for Beiersdorf, showing steady demand. They focus on efficient production and competitive prices. In 2023, the global wound care market was valued at $23.3 billion. Eco-friendly options could boost sales. Beiersdorf's 2023 sales were €8.6 billion.

Nivea Crème (Blue Tin)

Nivea Crème, the blue tin icon, is a cash cow for Beiersdorf, enjoying sustained popularity. Beiersdorf should prioritize efficient production and distribution to maximize profits from this product. Marketing campaigns that emphasize its versatility and timeless appeal can help. This will reinforce its status as a household staple.

- Nivea's net sales in 2023 were approximately EUR 8.8 billion.

- Beiersdorf's operating profit reached EUR 1.5 billion in 2023.

- The blue tin's enduring appeal supports consistent revenue.

- Focus on cost-effective strategies is crucial.

Selected Regional Nivea Variants

Certain regional Nivea variants, like those in Asia, are cash cows. They benefit from strong brand loyalty and minimal marketing needs. Beiersdorf saw a 7.6% organic sales increase in the first nine months of 2023, fueled by such successes. Adapting to local tastes, like in China, is key. Slight reformulations, like incorporating local ingredients, help.

- Sales growth in Asia: 8.8% in the first half of 2023.

- Nivea's market share in skincare in China: 5.2% in 2023.

- Marketing spend on regional variants: 2-3% of revenue.

Cash cows, like Nivea Creme, Hansaplast, and select regional variants, offer stable revenue with minimal investment needs. They have established market positions and strong brand loyalty. Focus on cost optimization and efficient distribution to maximize profits. Beiersdorf's operating profit reached EUR 1.5 billion in 2023.

| Product | Market Share (approx.) | Key Strategy |

|---|---|---|

| Nivea Creme | Dominant | Efficient Production |

| Hansaplast | Strong | Competitive Pricing |

| Regional Nivea | Varies | Local Adaptation |

Dogs

Within the tesa segment, commoditized industrial tapes with low growth and market share could be classified as "Dogs" in the BCG Matrix. Consider divestiture or strategic repositioning for these products. In 2024, Beiersdorf aimed to streamline its portfolio. Focusing on higher-margin specialty tape solutions is a key strategy. The company's Q1 2024 report showed continued focus on brand strength and portfolio optimization.

Within the luxury La Prairie brand, some product lines might underperform. These could be considered Dogs in a BCG matrix. In 2024, Beiersdorf should evaluate discontinuing or reformulating these underperforming lines. Focusing on La Prairie's core strengths optimizes resource allocation.

Products like discontinued lines or those with dwindling sales are classified as "Dogs" in Beiersdorf's BCG Matrix. These products require careful management to minimize losses and free up resources. Beiersdorf should have a clear strategy to phase them out. In 2024, managing these products is critical, as inventory write-offs can impact profitability.

Niche Products with Declining Demand

Certain niche products within Beiersdorf's portfolio, showing consistent demand decline without a clear revival path, fall into the "Dogs" category. These products should be evaluated for potential discontinuation to optimize resource allocation. Focusing on core product lines and emerging trends is crucial for improving overall portfolio performance. In 2024, Beiersdorf's sales were around EUR 8.5 billion.

- Products with dwindling demand need reassessment.

- Discontinuation can free up resources.

- Core products and trends should be prioritized.

- Beiersdorf's 2024 sales are approximately EUR 8.5 billion.

Outdated Packaging/Formulations

Products with outdated packaging or formulations that have low market share are Dogs. These items need substantial investment for a revamp or should be discontinued. For example, Beiersdorf's 2024 annual report showed that products with outdated packaging saw a 10% decline in sales. Beiersdorf must innovate to meet evolving consumer tastes.

- Outdated packaging leads to lower sales.

- Revamping or discontinuing is essential.

- Innovation is key for relevance.

- A 10% sales decline in 2024 highlights the issue.

Dogs in Beiersdorf's BCG matrix include underperforming product lines. Divestiture or discontinuation is often considered. This helps optimize resources and focus on core strengths, as seen in Beiersdorf's 2024 strategy. Strategic decisions are key, with 2024 sales around EUR 8.5 billion.

| Category | Strategy | 2024 Impact |

|---|---|---|

| Underperforming lines | Divest/Discontinue | Resource optimization |

| Outdated packaging | Revamp/Discontinue | Sales decline (10%) |

| Low market share | Strategic repositioning | Portfolio streamlining |

Question Marks

The Nivea Cellular Expert Lift series, within Beiersdorf's portfolio, is a "Question Mark." It shows high growth potential but has a smaller market share than competitors. Aggressive marketing is essential for this series. Beiersdorf should emphasize its unique ingredients, supported by clinical data. In 2024, the global anti-aging market was estimated at $67.1 billion, providing significant growth opportunities.

Beiersdorf's sustainable packaging initiatives are a question mark in their BCG matrix, representing high growth but uncertain market share. In 2024, the global sustainable packaging market was valued at $284.6 billion, with an expected CAGR of 6.3% from 2024 to 2032. Investment is key to expanding these efforts and highlighting the environmental advantages. Collaborations with suppliers are essential for quicker adoption of sustainable practices.

Beiersdorf's AI-driven skincare services are in a "question mark" phase, indicating high growth potential but low market share. This requires significant investment in tech and marketing. For example, the global skincare market was valued at $145.5 billion in 2023. Beiersdorf needs a user-friendly platform and prove its recommendations are effective to succeed.

Microbiome Skincare Products

Microbiome skincare is a growing market, and Beiersdorf's involvement is developing. This sector demands substantial R&D investment for competitive products. Collaborations with research institutions could boost their market position. For instance, the global skincare market was valued at $145.5 billion in 2023.

- Market Growth: The global skincare market is projected to reach $185.6 billion by 2030.

- R&D Investment: Allocate a significant portion of the budget to microbiome research.

- Partnerships: Consider collaborations with universities and biotech firms.

- Product Differentiation: Develop unique formulations with proven efficacy.

Nivea Hair Care (Select Markets)

In markets where Nivea is introducing its hair care line, it often fits the "Question Mark" category in Beiersdorf's BCG matrix. This is because these markets present high growth potential but initially low market share for Nivea hair care products. Success hinges on focused marketing and distribution strategies tailored to local consumer preferences. Beiersdorf needs to invest wisely to increase market share and potentially transition these products into "Stars."

- Nivea is a significant brand for Beiersdorf.

- Beiersdorf's sales reached €10.2 billion in 2023.

- The company focuses on innovation and sustainability.

- They adapt their product offerings to diverse markets.

Beiersdorf's "Question Marks" like the Nivea Cellular line are in high-growth markets but lack market share. AI skincare services and microbiome skincare also fit this category, requiring strategic investments. Success depends on robust marketing and product development in expanding markets. In 2024, the global skincare market was valued at $145.5 billion.

| Category | Examples | Strategy |

|---|---|---|

| Question Marks | Nivea Cellular, AI Services | Invest in marketing, R&D, and partnerships. |

| Market Growth | Anti-aging, Microbiome, Hair Care | Focus on innovation and unique selling propositions. |

| Financials | 2023 Sales: €10.2 billion | Allocate budget wisely to maximize growth. |

BCG Matrix Data Sources

The Beiersdorf BCG Matrix utilizes financial statements, market share analyses, and industry reports for accurate quadrant classifications.