BELIMO Holding Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BELIMO Holding Bundle

What is included in the product

Analysis of BELIMO's products using BCG Matrix, defining strategic actions for each quadrant.

Printable summary optimized for A4 and mobile PDFs, delivering concise insights at a glance.

Full Transparency, Always

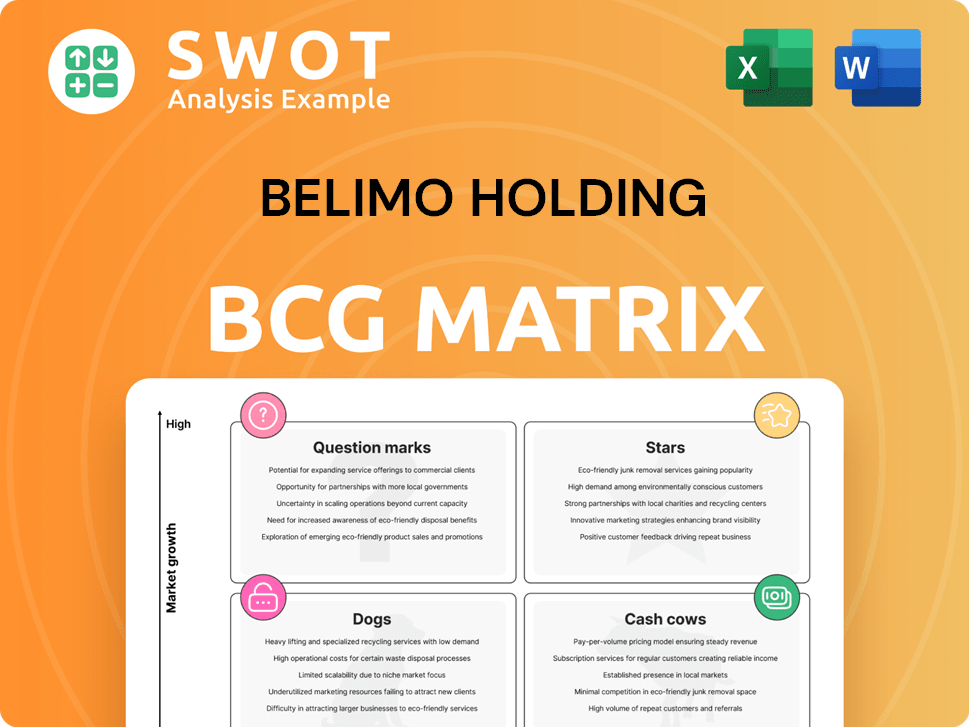

BELIMO Holding BCG Matrix

The preview showcases the complete BELIMO Holding BCG Matrix report you'll receive. This is the final document; download it instantly after purchase, ready for immediate use in your analysis.

BCG Matrix Template

BELIMO Holding's BCG Matrix offers a snapshot of its product portfolio's market positions. Examining the 'Stars' reveals potential for growth, while 'Cash Cows' generate revenue. 'Dogs' require evaluation, and 'Question Marks' need strategic investment decisions. Understanding these classifications is key to optimizing resource allocation. This quick look is just a start.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Belimo's data center solutions are experiencing substantial growth, especially in the Americas and Asia Pacific. The focus on next-generation cooling solutions solidifies their market leadership. Investments in this sector are expected to generate strong returns. In 2024, the data center cooling market was valued at $18 billion, with Belimo capturing a significant share. They invested $50 million in R&D for data center solutions in 2024.

The Americas is Belimo's largest market, driving significant sales growth. In 2023, the Americas accounted for CHF 429.3 million in net revenue. The demand for sophisticated HVAC solutions and reshoring in the U.S. boost performance. Expanding the Americas HQ supports cost reduction and adaptability.

Belimo's control valves are a Star in its BCG Matrix, showing strong growth. They're increasing market share with innovative designs. Pressure-independent control valves are a key success, with sales up. In 2024, Belimo's sales grew, reflecting this business line's strength.

Sensors and Meters Product Line

The Sensors and Meters product line is a Star for Belimo, showing robust growth. Demand is fueled by the need for better indoor air quality and energy efficiency. Belimo's integrated solutions are key to this growth, with a focus on innovation in smart building technology. This segment is a strong contributor to the company's overall performance.

- In 2024, the sensors and meters segment saw a 15% increase in sales.

- Belimo invested $20 million in R&D for sensor technology in 2024.

- The market for smart building sensors is projected to grow by 10% annually through 2028.

RetroFIT+ Initiative

The RetroFIT+ initiative is a shining star for BELIMO, especially in EMEA, fueled by building renovations and energy upgrades. This boosts Belimo's market performance amidst new construction challenges. A robust pipeline of projects supports confidence in meeting future goals. For instance, Belimo's sales in EMEA grew by 10.4% in the first half of 2024, driven by this initiative.

- Focus on building renovations and energy efficiency.

- Outperforms the market, despite new construction challenges.

- Strong project pipeline to support future targets.

- EMEA sales growth of 10.4% in H1 2024 demonstrates success.

Stars in Belimo's portfolio show strong growth and high market share. Control valves and Sensors & Meters are key contributors, fueled by innovation. The RetroFIT+ initiative in EMEA also shines, driven by building upgrades.

| Product Line | Market Growth | 2024 Sales Increase |

|---|---|---|

| Control Valves | High | Significant |

| Sensors & Meters | High | 15% |

| RetroFIT+ (EMEA) | High | 10.4% (H1 2024) |

Cash Cows

Damper actuators are a steady source of income for BELIMO. Growth is moderate, but the OEM channel is recovering. This segment's innovation and reliability ensure profitability. In 2023, BELIMO's net revenue was CHF 875.6 million, with a solid contribution from this product line.

Belimo's EMEA market, though facing headwinds in new non-residential construction, especially in Germany, shows resilience. The company is expanding, supported by RetroFIT+ and data center projects. In 2024, Belimo's sales in Europe, the Middle East, and Africa increased by 5.1% in local currencies. This growth showcases Belimo's strong position in a demanding region.

Belimo's strong customer relationships are key to consistent cash flow. They focus on trust and top-notch products. Customer loyalty drives repeat business and revenue. In 2024, Belimo's net revenue was CHF 824.2 million, showing their financial stability.

Operational Efficiency

Belimo's operational efficiency, including strategic price adjustments and a favorable product mix, underpins its healthy profit margins. Effective cost management and streamlined processes contribute to a strong cash flow. This efficiency allows Belimo to sustain profitability even in tough market conditions. In 2024, Belimo reported a gross profit margin of 59.7%.

- Strategic price adjustments enhance profitability.

- Favorable product mix boosts margins.

- Effective cost management improves cash flow.

- Streamlined processes increase efficiency.

Sustainable Solutions

Belimo's dedication to sustainability, offering energy-efficient solutions, perfectly matches global trends and regulations. This makes Belimo the top choice for customers aiming to lower their environmental footprint. The increasing need for sustainable building solutions guarantees a consistent cash flow from these offerings. In 2024, Belimo's focus on eco-friendly products boosted their market share.

- Belimo's sustainable solutions align with global trends.

- Customers prefer Belimo for reducing environmental impact.

- Demand ensures steady cash flow.

- Eco-friendly focus boosted market share in 2024.

BELIMO's cash cows are damper actuators and the EMEA market. These segments offer consistent revenue with moderate growth. Customer loyalty and operational efficiency further solidify their financial stability. In 2024, these areas contributed significantly to the company's CHF 824.2 million net revenue.

| Aspect | Details | 2024 Data |

|---|---|---|

| Key Products | Damper Actuators | Steady revenue stream |

| Market | EMEA | 5.1% sales growth |

| Financials | Net Revenue | CHF 824.2 million |

Dogs

The weak new construction in EMEA, particularly in Germany and the Nordics, is a "Dog" for Belimo. High interest rates and regulatory changes have shrunk demand; in 2024, construction output in Germany fell by 1.5%. Belimo must carefully manage resources in these areas. Reallocating investments to better growth prospects is key.

The OEM channel's destocking phase, which previously affected damper actuator sales, is over. Despite the conclusion of destocking, the OEM channel might still pose challenges relative to the contracting channel. In 2024, Belimo's sales showed fluctuations; for example, in the first half of 2024, sales in the Americas decreased by 4.6%. Adapting to OEM demand changes remains key.

Geopolitical instability can disrupt operations. Political unrest might delay projects, affecting timelines. This uncertainty can decrease sales. Diversifying geographically is crucial to mitigate risks. For example, in 2024, political instability in Eastern Europe impacted several Belimo projects.

Negative Foreign Exchange Impacts

Negative foreign exchange impacts can significantly affect BELIMO Holding's revenue and profitability. Unfavorable currency movements can erode the value of international sales, especially in regions like Europe, where economic volatility in 2024 impacted several businesses. To combat this, effective currency risk management and hedging strategies are crucial for BELIMO. This involves closely monitoring global economic conditions and adjusting pricing strategies.

- Currency fluctuations can reduce profit margins.

- Hedging strategies are essential.

- Monitor global economic conditions.

Commodity Price Volatility

Commodity price volatility, a "Dog" for BELIMO, affects raw material costs. Supply chain risks and pricing negotiations are crucial. Consider the 2024 surge in copper prices, impacting actuator production. Diversifying suppliers is vital to offset these impacts.

- Copper prices increased by 15% in Q2 2024, affecting manufacturing costs.

- BELIMO's Q1 2024 report highlighted supply chain disruptions as a key challenge.

- Negotiating long-term contracts helped mitigate some price volatility in 2024.

- Exploring alternative materials reduced reliance on single-source commodities.

Dogs in Belimo's portfolio include areas facing significant challenges. These include weak construction in EMEA and OEM channel fluctuations. The strategic focus should be on resource reallocation.

| Category | Impact | Mitigation |

|---|---|---|

| EMEA Construction | 1.5% drop in German output (2024) | Reallocate investments. |

| OEM Channel | Fluctuating sales (Americas -4.6% in H1 2024) | Adapt to demand. |

| Commodity Prices | Copper up 15% (Q2 2024) | Diversify suppliers. |

Question Marks

Belimo's 2025 strategy includes new product launches, creating growth opportunities. These require marketing and sales investments. Successful launches are key for market share gains. In 2024, R&D spending was CHF 48.6 million.

Data center cooling innovations, like liquid immersion cooling, are emerging but face adoption challenges. The market for advanced cooling is projected to reach $6.8 billion by 2024. Early investment needs thorough market and tech evaluation, but successful commercialization can lead to high growth.

Expansion into emerging markets beyond India and China offers BELIMO significant growth potential, but also introduces complexities. Navigating diverse regulatory environments and understanding local consumer preferences are essential. Strategic partnerships can mitigate risks, and in 2024, BELIMO could explore Southeast Asia. Market research is crucial; for example, the HVAC market in Brazil grew by 7.5% in 2023.

AI-Driven Building Automation

AI in building automation is a growing area for Belimo, fitting the Question Mark quadrant. Belimo should investigate integrating AI to improve energy efficiency and building performance. This could unlock new revenue opportunities. The global smart building market is projected to reach $134.5 billion by 2024, showing strong potential.

- Market Growth: The smart building market is expanding rapidly.

- Efficiency Gains: AI can significantly improve energy usage.

- Revenue Streams: New services can be created through AI.

- Strategic Focus: Belimo should prioritize AI integration.

Sustainability Reporting and Compliance

Sustainability reporting and compliance are becoming increasingly important, spurred by regulations like the Corporate Sustainability Reporting Directive (CSRD). This shift necessitates investments in data collection and reporting systems, which can be a competitive advantage. Environmentally conscious customers are drawn to sustainable practices, and proactive engagement enhances Belimo's reputation and brand value.

- The CSRD, effective from 2024, impacts around 50,000 companies in the EU.

- Companies face potential fines for non-compliance with sustainability reporting regulations.

- Sustainable investments reached $40.5 trillion globally in 2022.

- Consumers increasingly favor brands with strong sustainability records.

In the BCG Matrix, Question Marks represent high-growth markets with low market share. Belimo's AI initiatives fit this description. The smart building market, a key area, is projected to hit $134.5 billion in 2024. Belimo must strategically invest in AI to capitalize on this growth.

| Aspect | Details | Data |

|---|---|---|

| Market | Smart Building | $134.5B Market in 2024 |

| Strategy | AI integration | Improve efficiency, drive sales |

| Implication | Investment Required | High Growth Potential |

BCG Matrix Data Sources

This BCG Matrix uses financial data, market reports, competitor analysis, and industry forecasts to inform strategic recommendations.