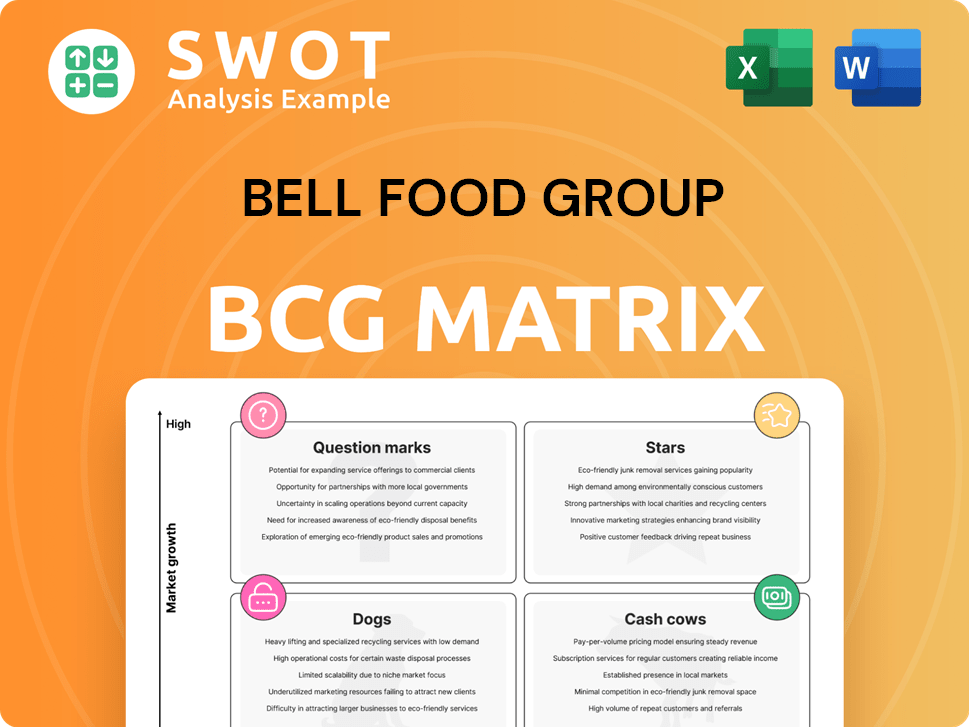

Bell Food Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bell Food Group Bundle

What is included in the product

Bell Food Group's BCG Matrix reveals investment, hold, or divest strategies based on market share and growth rate.

Printable summary optimized for A4 and mobile PDFs of Bell Food Group BCG Matrix.

Preview = Final Product

Bell Food Group BCG Matrix

The BCG Matrix preview mirrors the complete report you'll download after buying. This final version offers a fully formatted, actionable analysis of the Bell Food Group, ready for immediate strategic application.

BCG Matrix Template

Bell Food Group faces complex market dynamics, and understanding its product portfolio is key. This preview gives a glimpse into how its diverse offerings are categorized within the BCG Matrix. Identifying Stars, Cash Cows, Dogs, and Question Marks is crucial for strategic allocation. Analyzing these quadrants informs smarter product development and investment decisions. The full BCG Matrix report offers in-depth insights to drive impactful business outcomes. Purchase now for a ready-to-use strategic tool.

Stars

Bell Switzerland, a star in Bell Food Group's 2024 BCG Matrix, generated 47% of net revenue. It excelled in meat and charcuterie, marked by increased sales volume and revenue, boosting market share. This segment's success stems from effective product management and innovative strategies.

The poultry and seafood sector at Bell Food Group is experiencing substantial growth. A key driver is increasing demand for organic poultry. Hubers/Sütag, Europe's leading organic poultry producer within Bell, saw its net revenue climb by 6.3% year-on-year in 2024, reaching CHF 660 million. This growth underscores the segment's potential to expand within the sustainable food market.

Eisberg's fresh convenience products, specifically the 'freshly made' fruit range, have been a hit, fueling Bell Food Group's expansion. The fruit cups' successful rollouts in Switzerland and Austria drove Eisberg's sales to 8% of the total. This positions Eisberg as a star, promising continued growth in the convenience food market. In 2024, the convenience food sector saw a 6% growth.

Hilcona's Fresh Meals and Tofu

Hilcona's fresh meals and tofu are shining stars in Bell Food Group's portfolio. This segment has shown significant growth, boosting overall sales. In 2024, fresh meals and tofu made up 12% of the group's total sales. Innovation and consumer trend alignment suggest further growth potential.

- Sales Contribution: Fresh meals and tofu accounted for 12% of Bell Food Group's sales in 2024.

- Growth Driver: The segment's expansion contributes to the company's revenue growth.

- Strategic Focus: Hilcona prioritizes innovation to meet evolving consumer preferences.

- Future Outlook: The segment is positioned for further growth due to its strategic focus.

Sustainable Initiatives

Bell Food Group's sustainability initiatives, encompassing responsible sourcing and waste reduction, boost its brand image, drawing in eco-aware consumers. The company's emphasis on sustainable products and energy efficiency solidifies its market standing, fostering enduring expansion. A new cattle slaughterhouse in Oensingen (CH) set for summer 2025 will prioritize animal welfare. In 2024, Bell Food Group invested CHF 10.5 million in environmental projects.

- Responsible sourcing and waste reduction initiatives.

- Sustainable value-added products.

- Tailored energy efficiency measures.

- CHF 10.5 million invested in environmental projects in 2024.

The "Stars" in Bell Food Group's 2024 BCG Matrix represent high-growth, high-market-share segments. These include Bell Switzerland, poultry/seafood, Eisberg's fresh convenience items, and Hilcona's fresh meals. They collectively drive revenue growth and are key for market expansion.

| Segment | Contribution to Sales (2024) | Key Highlights |

|---|---|---|

| Bell Switzerland | 47% | Meat/charcuterie sales up, market share increased. |

| Poultry/Seafood | Significant Growth | Hubers/Sütag revenue: CHF 660M (+6.3% YoY). |

| Eisberg | 8% | 'Freshly made' fruit range; Convenience sector up 6%. |

| Hilcona | 12% | Fresh meals & tofu. Innovation focus. |

Cash Cows

Bell, a leading food brand in Switzerland, is a cash cow for Bell Food Group. It provides consistent revenue from meat, poultry, charcuterie, and seafood. Bell Switzerland, with 47% of net revenue in 2024, saw sales growth. This was driven by increased volume and market share gains.

Bell International, operating in Germany, Austria, France, and Poland, is a key revenue driver. Specializing in sliced charcuterie, it significantly boosts the group's earnings. In 2024, Bell International accounted for 11% of the Bell Food Group's total revenue. The expansion of slicing lines emphasizes its commitment to growth and value addition.

Hubers/Sütag, a part of Bell Food Group, is a cash cow, especially its organic poultry. As the largest organic poultry producer in Europe, it benefits from high demand. In 2023, Hubers/Sütag's results exceeded the previous year, driven by strong demand. This profitability is supported by its focus on animal welfare.

Hügli's Convenience Products

Hügli, part of the Bell Food Group, is a cash cow. It offers convenience products like ready meals and ingredients. In 2024, Hügli contributed 8% of the group's revenue, showing strong performance. Despite challenges, it improved margins and results. Its diverse offerings and efficiency drive cash generation.

- Revenue Contribution: 8% of Bell Food Group's total in 2024.

- Product Range: Includes ready-to-heat meals and non-perishable ingredients.

- Performance: Achieved improved margins despite higher procurement costs.

- Strategic Focus: Emphasizes efficiency and product diversification.

Seafood in Switzerland

Bell Food Group's seafood division in Switzerland is a cash cow, given its leading market position. It excels in marketing fresh and frozen seafood products. This success is fueled by a commitment to sustainable sourcing, attracting environmentally conscious consumers. The division generates stable revenues, making it a reliable source of cash for Bell Food Group.

- Market leader in Switzerland's seafood market.

- Focus on sustainable seafood.

- Generates stable revenues.

- Strong market position.

Hügli, a cash cow, contributed 8% of Bell Food Group's 2024 revenue, focusing on ready meals and ingredients.

It improved margins via efficiency despite cost pressures, showing resilience.

The division's performance highlights effective operations and diversification.

| Metric | 2024 Performance | Strategic Focus |

|---|---|---|

| Revenue Contribution | 8% of Group Total | Efficiency, Product Diversification |

| Product Range | Ready Meals, Ingredients | Market Adaptability |

| Margin Trend | Improved despite costs | Operational Excellence |

Dogs

Within Bell Food Group's BCG Matrix, dog product lines include those with low growth and market share. These might need substantial investment for limited returns, potentially leading to divestiture. In 2024, Bell's strategic focus was on streamlining its portfolio. For instance, a specific product line saw a 2% decline in sales, making it a prime candidate for reassessment. Proper management of these underperforming products is key for efficient resource allocation.

Inefficient production processes within Bell Food Group, like outdated facilities or high operational costs, are classified as dogs. Addressing these, Bell focuses on energy efficiency and CO2 reduction. For example, in 2024, Bell invested heavily in modernizing facilities. This strategy aims to streamline operations and cut expenses. This helps improve their overall financial performance.

Dogs in the Bell Food Group BCG matrix include products with dwindling demand. These items need innovation or a strategic pivot to stay relevant. Bell Food Group must adapt, as consumer tastes shift; the company's 2024 sales saw a 2.8% decrease in the Convenience division.

Operations in Highly Competitive Markets

In the Bell Food Group's BCG Matrix, operations in highly competitive, low-growth markets are often categorized as "Dogs." These segments face intense pressure, potentially eroding profitability. Strategic adjustments, like consolidation or focused innovation, are vital for these areas. Bell Food Group's 2024 annual report highlights specific strategies to navigate these challenging environments, aiming for improved performance.

- Intense competition and low growth impact profitability.

- Strategic adjustments and consolidation are key.

- The company's strategies aim to address challenges.

- Bell Food Group's 2024 annual report provides insights.

Unprofitable Export Ventures

Bell Food Group's unprofitable export ventures, classified as "Dogs" in the BCG matrix, are a concern. These ventures face challenges like trade barriers and high transportation costs. They need reevaluation and restructuring to boost financial health. The company's international strategy must tackle these issues.

- In 2024, Bell Food Group's international sales decreased by 3.2% due to these challenges.

- Specific regional export ventures saw a 7% decline in revenue.

- Transportation costs increased by 5% in key export markets.

- Re-evaluating these ventures is crucial for future growth.

Dog product lines at Bell Food Group have low growth and market share, demanding significant investment. In 2024, Bell observed a 2% sales decline in specific lines, prompting reassessment. Streamlining and managing underperforming products are key for better resource allocation.

| Category | 2024 Performance | Strategic Actions |

|---|---|---|

| Sales Decline | -2% | Portfolio Streamlining |

| Operational Costs | High | Facility Modernization |

| Export Revenue | -3.2% | Re-evaluating Ventures |

Question Marks

Bell Food Group's plant-based ventures fit the "Question Mark" quadrant, a high-growth, low-share area. They face the challenge of gaining market share in a competitive landscape. Investment in marketing and product innovation is vital to boost penetration. In 2023, 15 new products were launched, including plant-based options.

International market entries for Bell Food Group represent a question mark in the BCG matrix due to their high growth potential but uncertain future. These ventures need substantial investment to build brand awareness and distribution channels. The group plans to enter nine new countries, including France and Greece. In 2024, Bell Food Group's international sales accounted for a significant portion of its revenue, highlighting the importance of these expansions.

Innovative convenience foods, like Bell Food Group's ready-to-eat meals, are question marks. These new products, featuring unique flavors and ingredients, need market success. Non-perishable items such as soups and sauces are included. To become stars, they require consumer acceptance and strong sales growth. In 2024, the convenience food market is valued at approximately $700 billion.

Sustainable Packaging Initiatives

Sustainable packaging is a question mark for Bell Food Group. Investments in eco-friendly materials are driven by changing regulations and consumer demand. The company plans to boost organic product sales to CHF 370 million by 2026. Such initiatives need careful planning to balance costs and environmental gains.

- Bell Food Group is aiming for 72% of its seafood to be sustainable by 2026.

- The market for sustainable packaging is expected to grow significantly.

- Regulatory changes like the EU's Packaging and Packaging Waste Regulation (PPWR) influence packaging choices.

- Consumer preference for eco-friendly products impacts investment decisions.

Digital Transformation Projects

Digital transformation initiatives, such as smart packaging and e-commerce platforms, position as question marks for Bell Food Group. These projects demand substantial investment and expertise without guaranteed returns. In 2024, investment in advanced analytics boosted production efficiency, resulting in a 10% increase in output. Success hinges on effective implementation and market adoption.

- Focus on advanced analytics.

- Invest in smart packaging.

- Expand e-commerce platforms.

Question Marks require strategic investment due to high-growth, low-share market positions. They need marketing and innovation to gain traction. Bell Food Group's initiatives include international entries and new product launches. Their success depends on market adoption and effective execution.

| Initiative | Investment | Focus |

|---|---|---|

| Plant-Based | Marketing, Innovation | Market Share |

| International Entry | Brand Awareness | Distribution |

| Convenience Foods | Consumer Acceptance | Sales Growth |

BCG Matrix Data Sources

Bell Food Group's BCG Matrix utilizes financial statements, market analysis, and industry reports for insightful assessments.