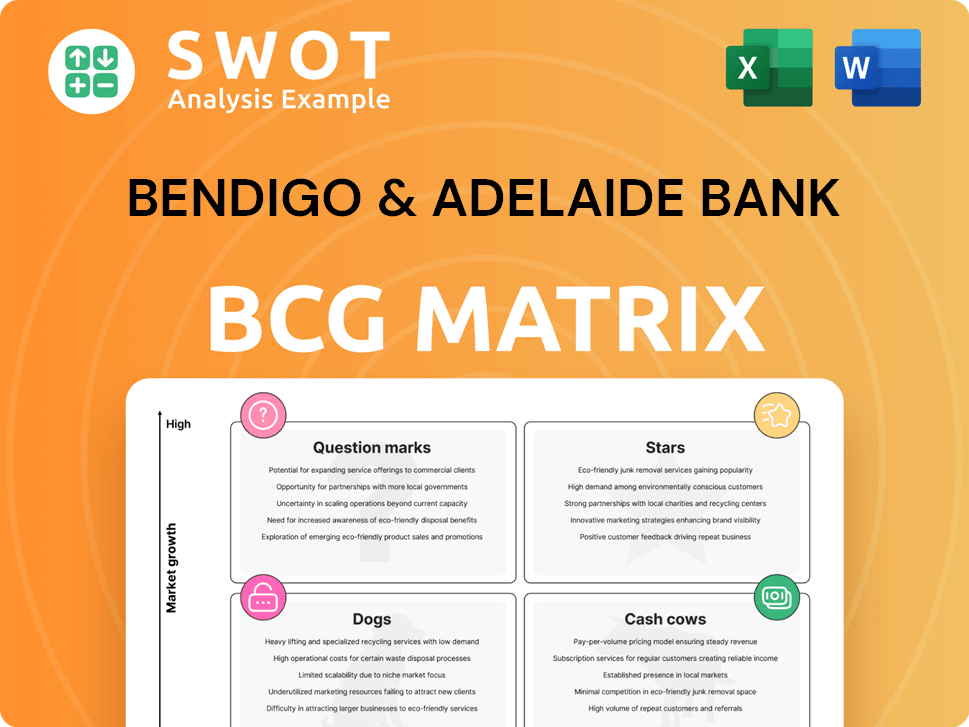

Bendigo & Adelaide Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bendigo & Adelaide Bank Bundle

What is included in the product

Bendigo & Adelaide Bank's BCG Matrix highlights investment, holding, and divestment strategies for business units.

Printable summary optimized for A4 and mobile PDFs, delivering key insights in a portable format.

Preview = Final Product

Bendigo & Adelaide Bank BCG Matrix

The displayed preview mirrors the complete Bendigo & Adelaide Bank BCG Matrix you'll obtain after purchase. This version is print-ready, completely unwatermarked, and perfect for immediate strategic application within your organization.

BCG Matrix Template

Bendigo & Adelaide Bank’s BCG Matrix provides a snapshot of its diverse product portfolio. This analysis categorizes offerings into Stars, Cash Cows, Dogs, and Question Marks. Understanding these classifications is crucial for strategic allocation of resources. The matrix highlights growth potential and identifies areas requiring investment or divestiture. This initial look offers a valuable perspective on market positioning. Purchase the full BCG Matrix for detailed quadrant breakdowns and actionable strategic recommendations.

Stars

Bendigo and Adelaide Bank saw robust growth in residential lending, especially via third-party channels. This expansion marks the most significant increase in six reporting periods. The rise in the residential loan book highlights the success of its offerings in a flourishing market. In 2024, residential lending grew by 6.5%, fueled by competitive rates.

Bendigo Lending Platform is a star in the BCG Matrix for Bendigo & Adelaide Bank. This platform has driven home lending growth, showcasing its success. The platform enhances digital capabilities, which is a key growth driver. Expansion to mobile lenders and branches will boost leadership. In 2024, home lending increased by 6.3%, backed by the platform.

Up Bank, Bendigo and Adelaide Bank's digital arm, has seen strong customer and deposit growth. Customer numbers surged, with deposits up 30% in FY24. Its high Net Promoter Score indicates strong customer satisfaction.

Digital Mortgages

Digital mortgages are a star for Bendigo and Adelaide Bank, reflecting their strong market position. The BEN Express channel has fueled substantial growth in digital home loan settlements. This success underscores the bank's effective digital strategy. The bank is likely investing heavily in this area for future growth.

- Digital mortgages represent a significant portion of Bendigo and Adelaide Bank’s settlements.

- BEN Express has shown substantial growth in home loan settlements.

- The bank's digital strategy is effectively capturing market share.

Community Bank Model

The Community Bank model, core to Bendigo and Adelaide Bank, thrives by returning profits to local areas, fostering customer loyalty through a trusted banking experience. This approach strengthens community bonds, which is reflected in the bank's continued investment in this model. In 2024, the Community Bank network supported 320+ branches. The bank's strategy emphasizes enhancing the Community Bank model.

- Community Bank branches generated $206 million in pre-tax profit in FY23.

- Over $280 million has been returned to local communities since inception.

- Customer satisfaction scores remain high, reflecting the model's success.

- The model is crucial for Bendigo and Adelaide Bank's strategic community focus.

Stars in Bendigo and Adelaide Bank's BCG Matrix include key growth drivers.

These include Bendigo Lending Platform and Digital Mortgages, both performing strongly.

Home lending increased by 6.3% and digital mortgages showed substantial growth in 2024.

| Star | Performance | 2024 Data |

|---|---|---|

| Bendigo Lending Platform | Home lending growth | 6.3% Increase |

| Digital Mortgages | Substantial growth | BEN Express growth |

| Up Bank | Strong customer & deposit growth | 30% deposit growth (FY24) |

Cash Cows

Bendigo and Adelaide Bank's extensive branch network, the third largest in Australia, generates a reliable revenue stream. This network supports a strong presence in regional areas, crucial for consistent cash flow. Their dedication to in-person banking, especially in customer-favored locations, ensures steady financial returns. In 2024, the bank's net profit after tax reached $460.8 million.

Bendigo and Adelaide Bank excels in deposit gathering, crucial for financial stability. Their household loan-to-deposit ratio highlights this strength. In 2024, EasySaver and offset accounts showed deposit growth, vital for funding. These deposits offer a cost-effective funding source for lending activities.

Agribusiness lending is a cash cow for Bendigo & Adelaide Bank, especially in thriving states. The bank's strong agricultural sector expertise and sustainable growth focus reinforce this status. The Rural Bank customer migration to Bendigo Bank Agribusiness, completed in 2024, strengthens its position. In 2024, the bank's agribusiness lending portfolio reached a substantial size, contributing significantly to its revenue.

Wealth Management

Bendigo and Adelaide Bank's wealth management arm functions as a cash cow, consistently generating revenue. This is driven by fees from financial advice and investment products. The bank's wealth management services benefit from a growing customer base, ensuring a steady income stream. For example, in 2024, wealth management contributed significantly to overall revenue.

- Steady income from fees.

- Growing customer base.

- Focus on financial advice.

- Contribution to overall revenue.

Business Banking

Bendigo & Adelaide Bank's business banking, especially for microbusinesses, is a consistent revenue source. The Business Direct team and process improvements have boosted customer satisfaction and streamlined operations. Leveraging its strengths and increasing organizational agility will further enhance performance. In 2024, the bank reported a steady increase in business banking customers. This growth is supported by its focus on customer experience and efficiency.

- Consistent revenue stream from business banking services.

- Business Direct team and process improvements enhance customer experience.

- Leveraging strengths and improving organizational agility boosts performance.

- Steady growth in business banking customers was reported in 2024.

Bendigo and Adelaide Bank's cash cows are strong revenue generators. Wealth management and business banking, like agribusiness, offer consistent income streams. The bank's focus on customer satisfaction boosts performance. In 2024, business banking customer growth was notable.

| Cash Cow | Key Features | 2024 Performance Highlights |

|---|---|---|

| Wealth Management | Fees from advice & products, growing customer base | Contributed significantly to overall revenue |

| Business Banking | Microbusiness focus, customer satisfaction | Steady increase in customers |

| Agribusiness Lending | Agricultural expertise, Rural Bank migration | Substantial portfolio size |

Dogs

The Adelaide Bank brand is transitioning to Bendigo Bank, signaling its phase-out. This suggests the Adelaide Bank brand's performance may lag. Consolidating under Bendigo Bank streamlines operations. In 2024, Bendigo and Adelaide Bank reported a statutory net profit of $546.1 million, reflecting strategic shifts.

Homesafe's net realized income dropped due to fewer completed contracts. This indicates potential underperformance compared to other Bendigo & Adelaide Bank products. In 2024, the bank must reassess Homesafe's strategy. Consider its contribution to the overall portfolio and market share.

Specific term deposits, especially the more expensive ones, could be dogs if returns are low. Customer preference shifts towards longer-term, higher-cost deposits affect funding costs. Bendigo & Adelaide Bank must manage its deposit mix to boost profitability. In 2024, the bank saw a need to balance deposit costs.

Non-Digital Account Opening

Non-digital account opening at Bendigo & Adelaide Bank can be seen as a "dog" due to its inefficiency and high costs. The bank is actively moving away from these manual processes through its digital transformation strategy. This shift aims to enhance both efficiency and customer experience. The bank's focus is to streamline operations.

- Inefficient manual processes lead to higher operational costs.

- Digital transformation is a key strategic focus for Bendigo & Adelaide Bank.

- The goal is to improve customer experience.

- Streamlining operations.

Low LVR Home Loans

Bendigo and Adelaide Bank's focus on low Loan-to-Value Ratio (LVR) home loans positions them in the "Dogs" quadrant of the BCG matrix, indicating low market share in a slow-growing market. This strategy helps reduce credit risk, as lower LVRs mean less risk for the bank if property values decline. The bank's transformation program, aiming for a single core banking system by the end of 2025, aims to improve efficiency. In 2024, Bendigo and Adelaide Bank reported a net profit after tax of $473.4 million, a decrease of 1.5% compared to 2023.

- Low LVR home loans reduce credit risk.

- The bank is targeting cost growth at no higher than inflation.

- Transformation program aims for one core banking system by end of 2025.

- 2024 net profit after tax was $473.4 million.

Low LVR home loans, categorized as "Dogs," have low market share in a slow-growth sector. This strategy reduces risk but may limit profit. In 2024, these loans were part of the bank's performance.

| Financial Metric | Value | Year |

|---|---|---|

| Net Profit After Tax | $473.4 million | 2024 |

| Cost Growth Target | No higher than inflation | 2024 |

| Transformation Program Goal | Single core banking system | End of 2025 |

Question Marks

Business and Agri lending at Bendigo & Adelaide Bank faced contraction, signaling a need for strategic focus. The bank is investing in capability and process improvements to enhance customer experience. A turnaround could elevate it to a star performer. In 2024, the bank reported a decrease in B&A loan volume, with targeted efforts underway.

Bendigo & Adelaide Bank's new digital banking initiatives are positioned within the BCG matrix. These initiatives need further investment to capture market share. The bank's transformation program is crucial for enhancing digital capabilities and customer experience. Their success will determine if they become stars or turn into dogs. In 2024, the bank's digital banking users grew, showing potential for these initiatives.

The broker channel presents considerable growth opportunities for Bendigo & Adelaide Bank's mortgage business. In 2024, brokers facilitated a substantial portion of home loans. Deepening broker relationships and broadening offerings could increase market share. Ongoing investment is crucial to fully capitalize on this channel's potential. The bank's 2024 data showed a 15% growth in broker-originated loans.

Sustainable Lending Products

New sustainable lending products at Bendigo & Adelaide Bank are a question mark in its BCG Matrix. These offerings align with environmental and social goals, but their market adoption is uncertain. Significant investment might be needed to establish these products. The bank's sustainability focus could boost growth, but it remains unproven.

- In 2024, Bendigo & Adelaide Bank increased its sustainable finance portfolio.

- The bank's environmental and social lending grew, but the exact figures are not available.

- Market penetration of these products is being actively monitored.

- Investment in sustainable initiatives continues to be prioritized.

AI and Data Modernization

Bendigo and Adelaide Bank's AI and data modernization efforts are classified as question marks within its BCG matrix. The bank is investing in AI to revamp its legacy applications, moving towards an AI-enabled cloud infrastructure. This is a relatively new venture for the bank, and its success is yet to be determined. These initiatives aim to enhance both efficiency and customer experience, but their ultimate impact remains uncertain.

- AI and data modernization projects are high-risk, high-reward initiatives.

- The bank's investment in AI aims to improve operational efficiency.

- The success of these projects will determine future growth.

- Data modernization aims to improve customer service.

Sustainable lending products and AI initiatives represent question marks. Their market success is uncertain, requiring significant investment and monitoring. The bank’s focus on sustainability and AI could drive growth, but outcomes remain unproven. In 2024, investment in these areas continued despite unclear immediate returns.

| Category | Initiative | Status |

|---|---|---|

| Question Mark | Sustainable Lending | Growing Portfolio |

| Question Mark | AI/Data Modernization | Ongoing Investment |

| Uncertain | Market Adoption | Requires Monitoring |

BCG Matrix Data Sources

This BCG Matrix leverages robust sources. These include Bendigo & Adelaide Bank's financial reports, market research data, and competitor analysis.