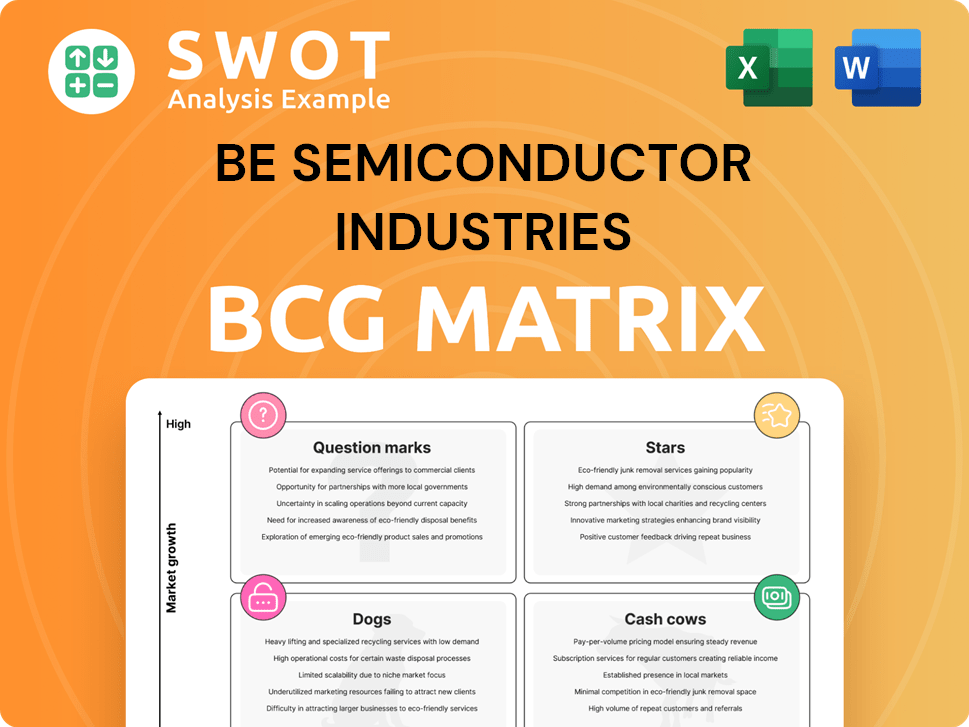

BE Semiconductor Industries Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BE Semiconductor Industries Bundle

What is included in the product

Analysis of BE Semiconductor's portfolio with strategic guidance for each BCG Matrix quadrant.

Printable summary optimized for A4 and mobile PDFs, providing insights on BE Semiconductor Industries' portfolio.

Preview = Final Product

BE Semiconductor Industries BCG Matrix

The displayed preview is identical to the BE Semiconductor Industries BCG Matrix report you'll get. Fully formatted and ready for immediate strategic assessment, it provides comprehensive insights.

BCG Matrix Template

BE Semiconductor Industries (BESI) operates in a dynamic market. Understanding its product portfolio's position is key to investment. This glimpse into the BCG Matrix reveals a strategic product breakdown. See which are high-growth Stars or resource-draining Dogs.

This preview offers a taste of the strategic insights. The full BCG Matrix report provides detailed quadrant analysis. It reveals actionable recommendations for optimal capital allocation. Buy now for a ready-to-use strategic tool.

Stars

Besi's hybrid bonding (HB) equipment is a star in its BCG matrix, driven by robust demand, especially for AI applications. The company's HB revenue surged to €122.6 million in Q1 2024. Besi is expanding its advanced packaging capacity in 2025, reflecting confidence in sustained HB growth. This growth is fueled by increasing orders and a strong market position.

Advanced die placement solutions are crucial for high-performance computing, a "Star" in BE Semiconductor Industries' BCG matrix. Besi's solutions are in high demand, especially from Asian subcontractors. In Q3 2024, Besi's revenue was €184.3 million, with a strong order intake. This highlights Besi's pivotal role in advanced packaging technologies.

The market for 2.5D and 3D packaging is booming, fueled by AI and high-performance computing. BE Semiconductor Industries (Besi) is strategically positioned to benefit from this trend. The company's die placement technologies are key to this growth area, with the addressable market expected to expand significantly. In 2024, the advanced packaging market was valued at $42.8 billion, and it's projected to reach $65 billion by 2029.

Strong Presence in Computing End-User Markets

BE Semiconductor Industries (Besi) shines as a "Star" in its BCG Matrix due to its robust presence in the computing end-user market. Besi has seen a surge in orders, especially in AI-related applications. This growth highlights Besi's capacity to capitalize on expanding market demands.

- Besi's revenue from the computing segment grew significantly in 2024.

- Orders from the AI sector have been a major driver of this growth.

- The company's advanced packaging solutions are crucial.

- Besi is strategically positioned for further expansion.

High-Accuracy and Productivity Equipment

BE Semiconductor Industries (Besi) excels in providing assembly equipment with high accuracy, productivity, and reliability, crucial for advanced semiconductor manufacturing. This solidifies Besi's leading market position, attracting clients seeking top-tier performance. Besi's strong gross margins reflect its success in this high-value segment. In 2024, Besi's gross margin was approximately 60%, demonstrating its premium positioning.

- High-Accuracy Equipment: Essential for advanced semiconductor manufacturing.

- Market Leader: Maintains a strong position in the industry.

- High Gross Margins: Reflects the value and performance of Besi's equipment.

- 2024 Performance: Approximately 60% gross margin.

BE Semiconductor Industries (Besi) is a star due to its leading role in high-performance computing. This position is fueled by significant revenue growth in 2024, especially in AI-related applications. Besi's advanced packaging solutions and high gross margins reflect its strength.

| Metric | Data | Year |

|---|---|---|

| HB Revenue | €122.6M | Q1 2024 |

| Gross Margin | ~60% | 2024 |

| Advanced Packaging Market | $42.8B | 2024 Value |

Cash Cows

BE Semiconductor Industries (Besi) holds a strong position in the die attach equipment market. This segment is considered a cash cow due to its mature nature, providing consistent revenue. In 2024, Besi's die attach revenue accounted for a significant portion of its total sales. The company's established market share and technological expertise support its cash cow status, ensuring financial stability.

Conventional molding equipment represents a cash cow for BE Semiconductor Industries (Besi). This segment benefits from steady demand in the packaging sector. Besi could boost cash flow by investing in infrastructure. In 2024, this segment contributed significantly to Besi's revenue, about 20%.

Besi's plating equipment, especially for mature tech, can be cash cows. These areas have steady demand and loyal customers. Low growth means less need for big marketing or placement spending. Besi's 2024 revenue was €659.2 million, reflecting its strong market position.

Aftermarket Services

Aftermarket services, including tooling, conversion kits, and spare parts, represent a lucrative recurring revenue stream for BE Semiconductor Industries. This segment boasts high margins with minimal additional investment, making it a highly desirable area of focus for the company. These services provide consistent income. For instance, in 2024, recurring revenue from such services accounted for a significant portion of overall revenue.

- High-Margin Business

- Recurring Revenue Stream

- Minimal Investment Required

- Focus on Existing Equipment

Leadframe Assembly Equipment

BE Semiconductor Industries (Besi) offers leadframe assembly equipment, a cornerstone of its business. This equipment is used in leadframe packaging, a mature technology. Although leadframe assembly has lower growth prospects, it provides Besi with a steady revenue stream. In 2024, this segment contributed significantly to Besi's stable financial performance.

- Leadframe assembly equipment is part of Besi's portfolio.

- Leadframe packaging is a more traditional packaging method.

- This segment generates reliable revenue.

- Growth potential is moderate.

Cash cows generate steady income with minimal investment, supporting overall financial stability for BE Semiconductor Industries (Besi). These segments include mature technologies and aftermarket services. They contribute significantly to revenue, such as the €659.2 million from plating in 2024.

| Cash Cow Segment | Key Feature | 2024 Revenue Contribution |

|---|---|---|

| Die Attach Equipment | Mature Market, Established Share | Significant Portion |

| Conventional Molding | Steady Demand | Approx. 20% |

| Plating Equipment | Mature Tech, Loyal Customers | €659.2 Million |

Dogs

BE Semiconductor Industries (Besi) confronts headwinds in declining end-user markets like mobile and automotive. Equipment sales have decreased because of market weakness. Turnaround plans are expensive and often ineffective. Besi's 2024 revenue dipped, reflecting these challenges.

Besi's solar plating systems, classified as dogs, face challenges from market volatility and stiff competition. These systems, with low market share and growth, are prime candidates for divestiture. Despite potential for innovation, their current performance lags. In 2024, the solar sector's fluctuations impact profitability, making divestment a strategic consideration. Besi's focus shifts to core, high-growth areas.

In competitive segments, Besi's products could be dogs. They might have low market share, with low growth rates. These products should be avoided. These products often break even. In 2024, Besi's revenue was €660.7 million.

Outdated Technologies

In BE Semiconductor Industries' BCG matrix, "Dogs" represent outdated technologies. These technologies have a low market share and limited growth. They often break even, not generating or consuming significant cash. Turnaround strategies are rarely effective for these offerings. For instance, older die-attach systems might fit this category, with 2024 sales figures reflecting a decline compared to newer, more efficient models.

- Outdated equipment with low market share.

- Limited growth potential.

- Typically break even financially.

- Turnaround plans are generally ineffective.

Low-Margin Products

In BE Semiconductor Industries' BCG matrix, low-margin products with little growth are "dogs." These products tie up capital without generating substantial returns. Minimizing investment in these areas is crucial for financial health.

- Low-margin products drain resources.

- Limited growth means minimal future value.

- Businesses often face challenges in this segment.

Dogs in Besi's portfolio include equipment with low market share and growth. Solar plating systems exemplify this, struggling in volatile markets. These products often yield modest financial returns. Strategically, divestment is considered to redirect resources.

| Category | Characteristics | Strategic Action |

|---|---|---|

| Dogs | Low market share, slow growth. | Divest, or minimize investment. |

| Examples | Older die-attach systems, solar plating. | Reduce capital allocation. |

| Financial Impact | Breakeven or loss-making. | Reallocate resources to stars/cash cows. |

Question Marks

Thermo Compression Bonding (TCB) is crucial for advanced packaging, especially in AI. Besi is expanding its TCB capabilities to meet the growing AI demand. TCB adoption is a key marketing strategy for Besi. In 2024, the AI chip market is projected to reach over $200 billion. This makes TCB a vital growth area for Besi.

Besi's wafer-level molding systems fit the "question mark" category in its BCG matrix. These systems operate in growing markets such as advanced packaging, yet Besi holds a relatively low market share. In 2024, the advanced packaging market is projected to reach $45 billion. Besi should invest if growth potential exists, or consider divesting if not.

Equipment for emerging memory technologies, like High Bandwidth Memory (HBM), positions BE Semiconductor Industries (Besi) as a question mark in its BCG matrix. Besi faces high demand but potentially low returns because of its current market share. In 2024, the HBM market is rapidly growing, with a projected value of $4.5 billion. Besi's marketing strategy focuses on driving market adoption of these products.

Photonics Assembly Equipment

Besi's photonics assembly equipment falls into the "Question Mark" category within the BCG matrix, reflecting its position in a high-growth market but with a low market share. The strategic options involve significant investment to boost market share or divesting the product line. The photonics market is expanding rapidly, driven by demand from data centers and other sectors. In 2024, the global photonics market was valued at approximately $800 billion, with an expected compound annual growth rate (CAGR) of around 8-10% through 2030.

- Market Growth: High, driven by data centers and 5G.

- Market Share: Low, indicating a need for strategic investment or divestiture.

- Strategic Options: Invest to grow or sell.

- Market Value: Global photonics market was $800 billion in 2024.

New Generation Interconnect Technologies

As semiconductor packaging advances, new interconnect technologies are crucial. These technologies, if adopted, could boost market share rapidly. If BE Semiconductor Industries (Besi) is developing equipment for these, they are question marks in the BCG Matrix. Success here hinges on swift market penetration and adoption. Besi's investment in these areas signifies a strategic bet on future growth.

- Besi's investments in new technologies are crucial for future growth.

- These technologies need rapid market adoption to succeed.

- Besi's position in this area is a strategic gamble.

- The BCG Matrix helps in evaluating these investments.

Besi's question mark products, like photonics assembly equipment, operate in high-growth sectors but with low market share. Strategic choices include investing for growth or exiting. The global photonics market hit $800 billion in 2024, indicating significant potential.

| Category | Description | 2024 Data |

|---|---|---|

| Market Growth | High, driven by data centers, 5G | Photonics: $800B market |

| Market Share | Low, requires investment/divestiture | HBM market: $4.5B |

| Strategic Options | Invest to grow or sell | Advanced Packaging: $45B |

BCG Matrix Data Sources

This BCG Matrix leverages financial statements, industry analysis, and market data to understand BE Semiconductor's position and dynamics.