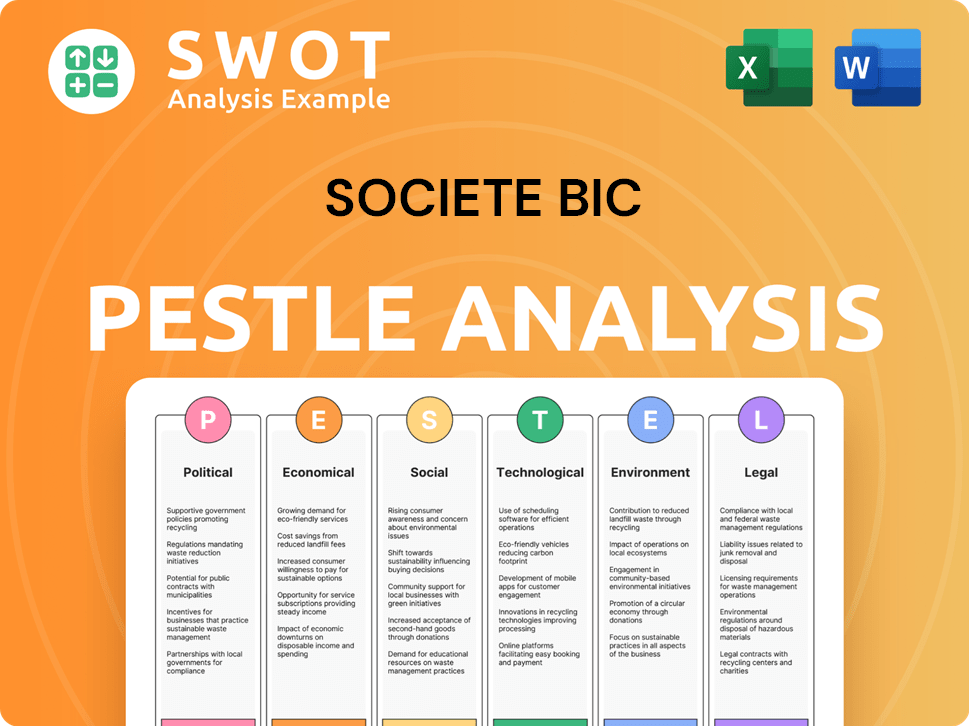

Societe BIC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Societe BIC Bundle

What is included in the product

Analyzes how external factors impact Societe BIC across Political, Economic, etc.

Easily shareable for quick alignment across teams.

Preview Before You Purchase

Societe BIC PESTLE Analysis

The Societé BIC PESTLE Analysis preview is the final product. You're viewing the same, ready-to-use document you'll get instantly after purchase. It's professionally formatted and complete. Everything displayed here is included.

PESTLE Analysis Template

Explore Societe BIC's future with our PESTLE Analysis. We examine how political and economic shifts impact the brand. Learn about evolving social trends affecting consumer choices and legal landscapes shaping the industry. Understand technological advancements and environmental concerns relevant to BIC's strategy. Equip yourself to navigate market complexities, enhancing your competitive edge. Gain strategic foresight and purchase the full analysis today!

Political factors

Government regulations on product safety, manufacturing, and trade significantly affect BIC. For example, the EU's REACH regulation impacts chemical use, raising compliance costs. Tariffs, like those on Chinese goods, influence BIC's import/export expenses. In 2024, BIC faced increased scrutiny over its product safety standards globally, impacting production costs by 3%.

Political stability is crucial for BIC, operating in 160+ countries. Instability, unrest, or government changes can disrupt supply chains, manufacturing, and distribution. This impacts sales and profitability, as seen in 2023 when political tensions in certain regions affected their operations.

Geopolitical instability and shifts in international trade significantly impact BIC. New trade barriers like tariffs or sanctions can disrupt raw material sourcing and product sales. For instance, changes in US tariffs, a key market, are crucial. In 2024, global trade faces challenges, with the IMF projecting slower growth. Consider this when assessing BIC's international operations.

Government Support for Sustainability Initiatives

Government backing for sustainability significantly shapes BIC's operations. Incentives and regulations, like those in the EU's Green Deal, impact production, product design, and environmental spending. For instance, the EU aims to cut emissions by 55% by 2030. This drives BIC to innovate sustainably. Regulatory changes force BIC to adapt its practices.

- EU Green Deal: aims to cut emissions by 55% by 2030.

- Paris Agreement: pushes for global emission reductions.

- Recycled Content Standards: influence material choices.

- Carbon Taxes: affect production costs.

Political Influence on Consumer Behavior

Government policies significantly shape consumer behavior, directly impacting BIC. For example, campaigns against single-use plastics can shift demand. Regulations on product safety and labeling also influence consumer choices. Political stability affects market confidence and investment. These factors necessitate BIC's adaptability.

- EU's Single-Use Plastics Directive aims to reduce plastic waste.

- France's anti-waste law mandates recyclability.

- Political stability correlates with consumer spending.

- BIC's sustainability initiatives respond to these trends.

Political factors critically impact BIC's operations worldwide. Regulations on product safety and trade influence costs and compliance, like the EU's REACH, increasing expenses by 3%. Geopolitical shifts and trade policies, like tariffs, disrupt supply chains, which has increased operating costs by 2% in 2024. Governments' backing for sustainability pushes innovation and product design changes.

| Political Factor | Impact on BIC | Data (2024-2025) |

|---|---|---|

| Regulations | Compliance Costs, Trade Disruptions | REACH, Tariffs, Safety Standards: cost increased by 3% |

| Political Stability | Supply Chain Disruptions, Sales Impacts | Tensions in Specific Regions, Sales impacted |

| Trade Policies | Raw Material Costs, Sales Disruptions | US Tariffs, IMF Slow Growth: affecting revenues |

| Sustainability Policies | Product Design, Environmental Spending | EU Green Deal, Emissions Target: changes products |

Economic factors

Inflation and rising interest rates affect BIC's investment decisions and project costs. Although inflation is moderating, challenges remain. For example, in 2024, the Eurozone's inflation rate was around 2.4%. Access to long-term, low-cost financing aids investment. The European Central Bank (ECB) held rates steady in April 2024.

Fluctuations in raw material costs, like plastics and metals, significantly impact BIC's production costs. In 2024, higher raw material costs affected adjusted EBIT margins in some segments. For instance, resin prices, a key plastic component, can vary widely. These cost changes directly influence the profitability of BIC's products, such as pens, lighters, and shavers.

As a global entity, BIC's financials are sensitive to currency shifts. Positive exchange rate movements boosted adjusted EBIT margins in 2024. Conversely, unfavorable changes impacted fixed cost absorption. In 2024, currency had a 1.9% impact on sales.

Consumer Spending and Disposable Income

Consumer spending and disposable income significantly impact BIC's product demand. Increased disposable income fuels growth in office supplies. In 2024, the global office supplies market is valued at approximately $100 billion, projected to reach $115 billion by 2025. This growth is driven by economic recovery and remote work trends.

- Office supplies market: $100B (2024), $115B (2025)

- Disposable income growth drives demand.

- Remote work trends influence sales.

Economic Growth in Key Markets

Economic growth in key markets is critical for BIC. The US economic health strongly affects BIC's sales. Weakening conditions in the US caused BIC to adjust its 2025 sales forecasts. In 2024, US GDP growth was around 2.1%, impacting BIC's performance.

- US GDP growth in 2024 was approximately 2.1%.

- BIC adjusted its 2025 sales expectations due to economic concerns.

Inflation, while easing, continues to influence investment and costs for BIC. Raw material cost fluctuations, especially for plastics and metals, affect production expenses and profit margins. Currency exchange rates are crucial, with movements in 2024 impacting sales and profitability.

| Metric | Data (2024) | Impact on BIC |

|---|---|---|

| Eurozone Inflation | ~2.4% | Influences project costs and investments |

| US GDP Growth | ~2.1% | Affects sales, leading to adjusted forecasts |

| Currency Impact on Sales | 1.9% | Affects sales, fixed costs. |

Sociological factors

Shifting consumer tastes, including the desire for eco-conscious goods, challenge BIC. In 2024, sustainable product sales rose, influencing market trends. BIC must innovate to meet these evolving demands. For instance, the global market for sustainable products is projected to reach $15.1 trillion by 2027.

Population shifts significantly influence BIC's market. For example, global population growth, expected to reach 8 billion in 2024, drives demand for stationery. Aging populations in developed nations may shift shaver sales towards specific products. Demographic changes and cultural preferences in regions like Asia Pacific, which accounted for 27% of BIC's sales in 2023, directly affect product demand.

Lifestyle trends significantly affect stationery demand. Digital note-taking tools challenge traditional products. In 2024, the global digital pen market reached $2.8 billion. BIC must adapt to these shifts. Anticipate evolving consumer preferences.

Cultural Attitudes Towards Products

Societe BIC's success hinges on understanding diverse cultural attitudes. For example, in some cultures, disposable products like lighters and razors face scrutiny due to environmental concerns. BIC must adapt its marketing, emphasizing sustainability where relevant. In 2024, global sales for BIC's consumer products reached $2.3 billion, demonstrating the importance of aligning with cultural values. This requires localized strategies to resonate with specific consumer preferences and norms.

- Sustainability concerns influence product choices.

- Local marketing strategies are crucial for success.

- BIC's revenue reflects the impact of cultural adaptation.

- Consumer preferences vary significantly by region.

Social Responsibility and Ethical Consumerism

Consumers increasingly prioritize social responsibility and ethical sourcing, influencing purchasing decisions. This trend compels companies like BIC to adopt fair labor practices. In 2024, ethical consumerism surged, with 70% of consumers preferring brands with strong ethical stances. This necessitates transparent supply chains and sustainable production. BIC must adapt to meet these evolving consumer expectations to maintain market relevance.

- 2024: 70% of consumers prefer ethical brands.

- Demand for fair labor practices is rising.

- Transparency in supply chains is crucial.

Societal shifts influence consumer behavior. Sustainability, social responsibility, and ethical sourcing impact purchasing decisions. Adaptations require transparent practices and marketing aligned with cultural values. In 2024, ethical consumerism was significant. BIC needs to stay relevant.

| Aspect | Impact | Example |

|---|---|---|

| Sustainability | Drives demand for eco-conscious goods. | Market for sustainable products $15.1T by 2027 |

| Demographics | Shapes demand and market strategies. | Asia Pacific sales were 27% of BIC's total in 2023. |

| Cultural Attitudes | Dictates product choices & marketing. | Global sales for BIC consumer products: $2.3B in 2024. |

Technological factors

BIC benefits from manufacturing tech advancements, boosting efficiency. This includes using advanced robotics and automation. Investment in these areas helped reduce production costs by 5% in 2024. Improved energy-efficient processes also cut operational expenses.

Digitalization and e-commerce are reshaping BIC's landscape. Online sales channels offer growth, with e-commerce sales expected to reach $6.17 trillion in 2024. Digital marketing is crucial, and BIC's supply chain must adapt. In 2023, BIC's digital sales grew, showing the importance of online presence.

Research into novel materials is critical for BIC. This can lead to eco-friendly products, lowering plastic dependence. In 2024, the global bioplastics market was valued at $13.4 billion, growing at 15% annually. BIC's investment in sustainable materials aligns with this trend. Developing biodegradable pens or razors could boost market share.

Innovation in Product Design

Technological innovation in product design is crucial for BIC. This can lead to the development of improved products, such as more advanced writing instruments or enhanced shaving technology, giving BIC a competitive edge. BIC's commitment to innovation is reflected in its R&D spending. In 2024, BIC invested approximately €70 million in research and development. This continuous investment helps the company stay relevant.

- R&D investment of €70 million in 2024.

- Focus on advanced writing instruments and shaving tech.

- Enhances competitive advantage.

Automation and AI in Operations

Societe BIC is increasingly focusing on automation and AI to streamline operations. This includes using AI in manufacturing processes to improve product quality and reduce waste. In 2024, the company invested €15 million in digital transformation, including AI-driven solutions for supply chain optimization. The integration of AI is expected to boost operational efficiency by 10% by 2025.

- AI-driven quality control in manufacturing.

- Robotics in logistics for faster distribution.

- Predictive maintenance to minimize downtime.

- Automation of administrative tasks.

BIC employs tech like AI and automation to boost efficiency and reduce waste. The firm invested €15M in digital transformation in 2024, including AI. These tech steps aim to cut operational costs and enhance supply chain performance.

| Technology Focus | Specifics | Impact |

|---|---|---|

| AI & Automation | AI for quality control, robotics in logistics | Expected 10% efficiency gain by 2025 |

| R&D Spending | €70 million investment in 2024 | Continuous product enhancement |

| Digital Transformation | E-commerce and supply chain upgrades | E-commerce sales projected at $6.17T in 2024 |

Legal factors

BIC faces strict product safety regulations globally. The General Product Safety Regulation (GPSR), effective December 2024 in the EU, demands adherence to stringent safety standards. This impacts BIC's product design, manufacturing, and rigorous testing processes. In 2024, the GPSR's initial impact on compliance costs was approximately €1.5 million.

BIC must adhere to environmental laws. This includes regulations on emissions and waste disposal. The company faces potential fines and legal issues for non-compliance. In 2024, environmental compliance costs for similar companies averaged around 3-5% of operational expenses. Effective environmental management is vital.

BIC must comply with diverse labor laws across its global operations, impacting wages, benefits, and working conditions. In France, for example, labor costs in 2024 averaged around €45 per hour, influencing BIC's cost structure. Compliance with regulations like those concerning minimum wage and working hours is crucial. Non-compliance can lead to significant fines and reputational damage, as seen in some recent cases where companies faced substantial penalties. These factors directly affect BIC's operational costs and its ability to manage its workforce effectively.

Intellectual Property Laws

BIC heavily relies on intellectual property (IP) to safeguard its innovations and brand. Patents, trademarks, and copyrights are crucial for protecting its writing instruments, lighters, and razor products. In 2024, BIC spent approximately €40 million on R&D, highlighting its commitment to innovation and IP. IP protection is critical for BIC's global market presence, especially in regions with high counterfeiting risks.

- Patents protect new technologies.

- Trademarks safeguard brand identity.

- Copyrights protect creative works.

- Counterfeiting significantly impacts revenue.

Advertising and Marketing Regulations

Advertising and marketing regulations significantly shape BIC's promotional strategies. Restrictions on marketing certain products, such as lighters, vary greatly by region. For example, regulations in the EU and North America are stricter than in some other markets. Compliance with these rules is crucial to avoid penalties and maintain brand reputation. BIC's marketing expenses in 2024 were approximately €180 million, reflecting the need to navigate complex legal landscapes.

- EU regulations heavily influence BIC's marketing.

- North American rules also impact advertising strategies.

- Marketing spending was about €180M in 2024.

- Compliance is key to avoid penalties.

BIC is significantly influenced by legal factors like product safety. Strict rules, especially the GPSR, dictate product design and testing; compliance costs in 2024 hit about €1.5 million. Environmental regulations demand compliance, affecting emissions and waste, with costs typically at 3-5% of operational expenses.

Labor laws worldwide impact BIC's operational expenses via wages and benefits. Intellectual property protection is critical, as BIC invested €40 million in R&D in 2024 to protect innovations and brand presence. Advertising regulations influence marketing strategies.

| Legal Area | Impact | 2024 Data/Examples |

|---|---|---|

| Product Safety | Compliance Costs | GPSR: €1.5M initial impact |

| Environmental | Operational Costs | Compliance costs: 3-5% expenses |

| Labor Laws | Wage and Benefit Costs | French labor cost: €45/hour |

Environmental factors

Climate change concerns are pushing for reduced carbon footprints. BIC aims to cut emissions and boost renewable energy use in its operations. BIC has set targets for 2025 and 2030. In 2023, BIC reduced its carbon emissions by 10% compared to 2022, showing progress. The company plans to increase its use of renewable energy to 50% by 2025.

Environmental concerns about plastic waste are escalating, pushing companies to cut plastic use and boost recyclability. As of 2024, global plastic production reached 400 million metric tons. BIC targets 100% recyclable packaging by 2025, utilizing recycled materials. In 2023, the company reported a 10% increase in the use of recycled materials in its products.

Water scarcity and stringent regulations on water usage and wastewater management pose challenges for BIC's manufacturing operations. In 2024, many regions where BIC operates faced increased water stress, necessitating the adoption of water-efficient technologies. Compliance with environmental standards, like those set by the EU, required significant investment in wastewater treatment. BIC's financial reports for 2024 show a 2.5% increase in water management-related operational costs.

Sustainable Sourcing of Raw Materials

Societe BIC faces growing pressure to sustainably source raw materials. This includes wood for pencils and bio-based materials, driven by environmental regulations and consumer demand. The company's commitment to sustainable practices is crucial for long-term viability. A 2024 report indicated a 15% rise in consumer preference for eco-friendly products.

- BIC's wood sourcing adheres to FSC standards.

- They aim to increase the use of recycled materials.

- This reduces environmental impact.

- It also enhances brand reputation.

Circular Economy Initiatives

The global shift towards a circular economy significantly influences companies like BIC. This encourages designing products for durability, reducing waste, and improving recyclability. BIC's approach emphasizes extending product lifespans and minimizing their environmental footprint. This includes initiatives like using recycled materials and designing for disassembly.

- 2024: BIC launched a new line of pens made with recycled materials.

- 2024: The company is investing €20 million in eco-friendly packaging solutions.

- 2023: BIC reported a 15% increase in sales of products with eco-friendly features.

BIC addresses climate change by reducing carbon emissions; a 10% reduction was achieved in 2023 compared to 2022. It focuses on recyclable packaging with a goal of 100% by 2025. Water management costs rose by 2.5% in 2024.

| Environmental Factor | BIC Initiative | 2024/2025 Data Point |

|---|---|---|

| Carbon Emissions | Reduce emissions, renewable energy | 10% reduction (2023 vs 2022); 50% renewable energy target by 2025 |

| Plastic Waste | Recyclable packaging, recycled materials | 100% recyclable packaging target by 2025; 10% increase in recycled materials used in 2023 |

| Water Management | Water-efficient technologies, wastewater treatment | 2.5% increase in water management costs (2024) |

PESTLE Analysis Data Sources

This PESTLE Analysis draws data from economic indicators, legal frameworks, market research, and environmental reports for accurate insights.