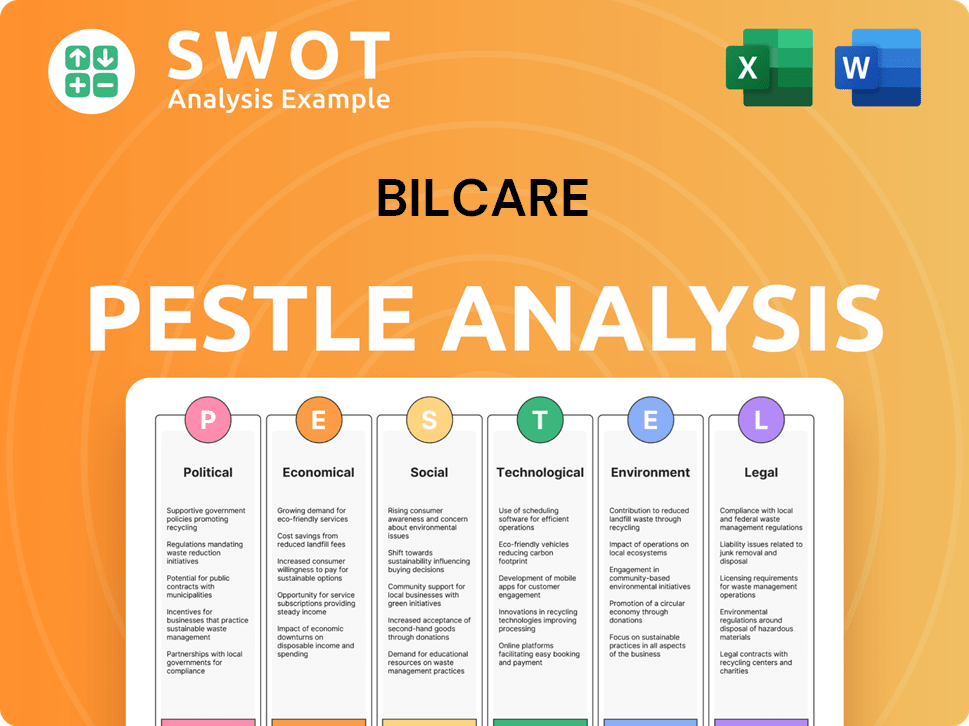

Bilcare PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bilcare Bundle

What is included in the product

Assesses how macro-environmental factors influence Bilcare using Political, Economic, Social, Technological, Environmental, and Legal criteria.

Helps support discussions on external risk and market positioning during planning sessions.

What You See Is What You Get

Bilcare PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured, a complete Bilcare PESTLE analysis. This insightful document covers political, economic, social, technological, legal, and environmental factors. It's meticulously crafted for immediate application. You will download it instantly after purchasing. Ready to use!

PESTLE Analysis Template

Gain an edge with our in-depth PESTLE Analysis, specifically for Bilcare. Uncover the external forces impacting Bilcare's strategies. Understand political, economic, and social trends shaping the company. Leverage actionable intelligence to fortify your market approach. Don't miss crucial insights. Download the full analysis now and stay informed.

Political factors

Government regulations on pharmaceuticals significantly influence packaging standards, crucial for safety and anti-counterfeiting. Bilcare must comply with these rules across its operational regions. Regulatory shifts require production and material adjustments. In 2024, the global pharmaceutical packaging market was valued at $98.5 billion, expected to reach $135.7 billion by 2029.

Trade policies and tariffs significantly influence Bilcare's operations. Changes in international trade agreements can directly affect the cost of raw materials, impacting production expenses. For instance, a 10% tariff increase on key inputs could raise production costs. These shifts in tariffs and trade agreements can also affect the competitiveness of Bilcare’s exported products in global markets.

Political stability in India and other key markets is vital for Bilcare. A stable environment ensures smooth operations and supply chains. Political instability could disrupt manufacturing and impact market demand. India's GDP growth is projected at 6.5% in 2024-25, reflecting relative stability. Any unrest could affect this growth.

Government Support for Pharmaceutical and Packaging Industries

Government backing for the pharmaceutical and packaging industries significantly affects Bilcare. Initiatives like manufacturing incentives and R&D support can boost Bilcare's growth. Conversely, unfavorable policies or a lack of support could create hurdles for the company. For example, in 2024, the Indian government allocated $1.3 billion to boost pharmaceutical R&D. This directly impacts companies like Bilcare.

- In 2024, India's pharmaceutical market grew by 12%, driven by government support.

- Export incentives have increased pharmaceutical exports by 8% in the last year.

- Tax benefits for R&D spending have encouraged innovation.

Focus on Anti-Counterfeiting Measures

Governments worldwide are intensifying efforts to curb counterfeit pharmaceuticals, which directly impacts Bilcare. This increased focus fuels demand for sophisticated anti-counterfeiting packaging solutions. Bilcare's expertise in this domain positions it favorably. Mandates for specific anti-counterfeiting features open new market opportunities.

- The global anti-counterfeiting packaging market is projected to reach $166.8 billion by 2029.

- In 2024, the pharmaceutical industry saw a 10-15% increase in counterfeit product seizures.

Political factors profoundly affect Bilcare. Government regulations influence packaging standards, with the global market valued at $98.5 billion in 2024. Trade policies impact material costs and competitiveness, alongside incentives like India's $1.3 billion for pharmaceutical R&D in 2024, boosting industry growth by 12%. Anti-counterfeiting efforts, targeting a $166.8 billion market by 2029, provide Bilcare opportunities.

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| Regulations | Affects packaging | Global packaging market: $98.5B (2024), to $135.7B (2029) |

| Trade Policies | Impacts costs & exports | Export incentives increased pharmaceutical exports by 8% in the last year |

| Government Support | Drives growth | India's pharma market grew by 12% in 2024; $1.3B R&D investment. |

| Anti-Counterfeiting | Boosts demand | Anti-counterfeiting market: $166.8B (2029); 10-15% increase in counterfeit seizures |

Economic factors

The global economy's strength directly impacts pharmaceutical demand and, thus, packaging needs. A 2024 IMF report projected global growth at 3.2%, influencing healthcare spending. Economic slowdowns, like the 2023 dip, can curb pharmaceutical demand. Bilcare's performance is sensitive to these economic shifts, requiring strategic adaptability.

Raw material price volatility is a key economic factor. Fluctuations in polymer and aluminum foil prices directly affect Bilcare's costs. Crude oil price volatility significantly impacts polymer-based material costs. In 2024, polymer prices saw a 7% increase, impacting packaging costs. Aluminum prices remained relatively stable.

Bilcare, with its global operations, faces currency risks. Fluctuating exchange rates affect import costs & export revenues. For instance, a strong INR could reduce export earnings. In 2024, the INR/USD rate saw volatility, impacting international transactions. Companies must hedge against these fluctuations to protect profitability.

Access to Financing and Credit Conditions

Access to financing and credit conditions significantly impact Bilcare, considering its history of financial challenges. Favorable credit environments can fuel operational investments and expansion. Conversely, restricted credit can impede growth initiatives. Recent data indicates a fluctuating interest rate environment, with the Federal Reserve holding rates steady as of late 2024, impacting borrowing costs for companies like Bilcare. This financial stability is crucial for strategic planning and execution.

- Interest rates in late 2024 remain a key factor.

- Bilcare's past financial issues make credit access sensitive.

- Favorable conditions support investment and growth.

- Tight credit can restrict strategic moves.

Market Demand for Pharmaceutical Packaging

The global demand for pharmaceutical packaging is surging, fueled by rising healthcare access, aging populations, and innovative drug development, creating a substantial market for Bilcare. India's pharmaceutical packaging market is projected for robust double-digit growth. This expansion is supported by the pharmaceutical sector's growth.

- The Indian pharmaceutical market is anticipated to reach $65 billion by 2024.

- The global pharmaceutical packaging market was valued at $100 billion in 2023.

Economic conditions significantly influence Bilcare's performance; factors include global growth, raw material prices, currency exchange rates, and financing. The International Monetary Fund (IMF) forecasts a 3.2% global growth for 2024. Changes in polymer prices, like a 7% increase in 2024, impact costs, and currency fluctuations affect international transactions. These factors demand careful strategic financial planning.

| Factor | Impact | Data (2024) |

|---|---|---|

| Global Growth | Affects demand | Projected 3.2% (IMF) |

| Raw Materials | Influence costs | Polymer prices rose by 7% |

| Exchange Rates | Affect revenue | INR/USD volatility |

Sociological factors

The global population is aging, significantly boosting demand for healthcare and pharmaceuticals. This demographic shift directly fuels the need for advanced pharmaceutical packaging solutions. The pharmaceutical packaging market, which Bilcare actively participates in, is heavily influenced by these trends. Projections indicate that the global geriatric population will reach over 1.4 billion by 2030, increasing demand.

Rising health awareness globally boosts demand for medicines and healthcare products, directly affecting the need for pharmaceutical packaging. The global pharmaceutical packaging market is projected to reach $163.5 billion by 2024, reflecting this trend. In 2023, the market was valued at $148.2 billion. This growth highlights the impact of health consciousness on the industry.

Patient-centric packaging is crucial. Features like easy opening, child resistance, and senior-friendliness are increasingly vital. Bilcare's innovation in these areas directly addresses evolving consumer preferences. The global pharmaceutical packaging market is projected to reach $170.8 billion by 2025. Meeting these needs boosts market competitiveness.

Changing Lifestyles and Chronic Diseases

Changing lifestyles and the rise of chronic diseases are significantly impacting the pharmaceutical industry. Increased sedentary behavior and poor dietary habits are major drivers. This shift boosts the need for medications and, consequently, pharmaceutical packaging. For example, in 2024, the global pharmaceutical packaging market was valued at $115.8 billion.

- The demand for specialized packaging is growing.

- Aging populations in developed countries add to this trend.

- Chronic diseases like diabetes and heart disease are on the rise.

- This creates a continuous demand for packaging.

Awareness of Product Safety and Integrity

Growing consumer awareness of product safety and integrity significantly impacts the pharmaceutical industry. This awareness drives the need for robust packaging to safeguard medications and combat counterfeiting. Companies like Bilcare, specializing in high-quality and secure packaging, are well-positioned to benefit from this trend. In 2024, the global pharmaceutical packaging market was valued at approximately $107 billion, reflecting this crucial demand.

- Increased consumer demand for safe products.

- Focus on preventing counterfeit medicines.

- Packaging plays a key role in product protection.

- Bilcare's solutions meet these needs.

Sociological factors significantly shape the pharmaceutical packaging market, with an aging global population boosting demand. Consumer health awareness fuels this trend, projecting a market value of $170.8 billion by 2025. Patient-centric packaging, addressing ease of use, is increasingly vital in this evolving landscape.

| Sociological Factor | Impact | Market Data |

|---|---|---|

| Aging Population | Increased healthcare and pharmaceutical needs. | Geriatric population to exceed 1.4B by 2030. |

| Health Awareness | Boosts demand for medicines and packaging. | Global market projected to $170.8B by 2025. |

| Patient-Centric Packaging | Focus on user-friendly solutions. | Market competitiveness dependent on innovation. |

Technological factors

Advancements in packaging tech, like smart labels and sustainable materials, impact Bilcare. R&D investments are key for innovation. The global smart packaging market is projected to reach $52.8 billion by 2025. This drives Bilcare's need to adapt.

Innovations in anti-counterfeiting tech, like serialization and track-and-trace, are crucial for Bilcare. The global anti-counterfeiting market is projected to reach $384.8 billion by 2027. Implementing these helps protect against fake pharmaceuticals.

Automation and advanced manufacturing technologies like those used at Bilcare's facilities significantly boost production efficiency. These technologies help lower costs and improve the quality of packaging materials. Bilcare's focus on CGMP controls and advanced machinery underscores its commitment to these advancements. In 2024, the global packaging automation market was valued at $60.2 billion, expected to reach $86.7 billion by 2029.

Development of Sustainable Packaging Materials

The rising emphasis on environmental sustainability is pushing the creation of eco-friendly packaging solutions. Bilcare should consider switching to sustainable alternatives to meet consumer preferences and comply with regulations. The global market for sustainable packaging is projected to reach $439.4 billion by 2027, growing at a CAGR of 6.1% from 2020. This shift can enhance their brand image and reduce environmental impact.

- Market growth for sustainable packaging is significant.

- Regulatory pressures are increasing the need for sustainable materials.

- Consumer demand favors eco-friendly options.

Technology in Clinical Trial Supply Chain

Technological factors significantly impact the clinical trial supply chain. Real-time tracking, AI-driven analytics, and blockchain are enhancing efficiency and reliability. These technologies are critical for companies like Bilcare involved in clinical trial supplies. The global clinical trial supply chain market is projected to reach $3.7 billion by 2025, with a CAGR of 7.2% from 2019 to 2025.

- Real-time tracking systems reduce the risk of drug diversion by over 50%.

- AI-driven analytics can improve supply chain forecasting accuracy by up to 20%.

- Blockchain technology enhances data integrity and transparency in clinical trials.

Technological advancements are crucial for Bilcare. They need to adapt to smart packaging and anti-counterfeiting technologies. Automation and sustainability drive production and market trends.

| Technology Area | Market Size (2024/2025) | Growth Rate |

|---|---|---|

| Smart Packaging | $52.8B (2025) | N/A |

| Anti-Counterfeiting | $384.8B (2027) | N/A |

| Sustainable Packaging | $439.4B (2027) | 6.1% CAGR |

Legal factors

Bilcare faces intricate pharmaceutical packaging regulations globally. These regulations mandate material safety and child-resistant features. They also cover tamper evidence and clear labeling. Non-compliance can lead to severe penalties and market restrictions. The global pharmaceutical packaging market was valued at $98.2 billion in 2024, expected to reach $136.8 billion by 2029.

Anti-counterfeiting laws and standards are critical for pharmaceutical packaging. These regulations dictate the security features needed to protect products. Bilcare's solutions must adhere to these legal requirements. Compliance ensures product integrity and consumer safety. The global anti-counterfeiting market is projected to reach $478.4 billion by 2025.

Environmental regulations are a key legal factor impacting Bilcare. Regulations on packaging waste, recycling, and single-use plastics influence Bilcare's material choices. Governments are restricting certain plastics; for example, the EU's Packaging and Packaging Waste Directive aims for 70% recycling by 2030. This impacts Bilcare's production and waste management.

Corporate Governance and Financial Regulations

Bilcare, as a publicly listed entity, must adhere to stringent corporate governance and financial reporting regulations. This includes accurate financial disclosures and adherence to guidelines set by regulatory bodies to ensure transparency. Non-compliance can lead to severe penalties, impacting investor confidence and potentially causing legal issues. The company's ability to navigate these regulations is crucial for its operational integrity.

- SEBI mandates timely financial disclosures.

- Audits ensure financial statement accuracy.

- Non-compliance may result in financial penalties.

- Investor confidence is directly impacted by adherence.

Labor Laws and Regulations

Bilcare, operating globally, must adhere to labor laws and regulations in each country where it has employees. This includes rules on wages, working hours, and workplace safety. Non-compliance can lead to legal issues, fines, and damage to the company's reputation. For instance, in 2024, the International Labour Organization (ILO) reported a 9% increase in labor disputes globally.

Labor disputes can disrupt operations and impact profitability. Effective human resource management and a strong understanding of local labor laws are crucial for Bilcare's success. Consider that the average cost of settling a labor dispute in the pharmaceutical sector can range from $50,000 to over $1 million, depending on the scope and duration of the conflict.

- Compliance with labor laws ensures smooth operations.

- Labor disputes can lead to financial and reputational damage.

- Effective HR management is crucial for mitigating risks.

- Understanding of local regulations is critical.

Legal factors significantly shape Bilcare's operations worldwide. Strict regulations for pharmaceutical packaging, covering safety, anti-counterfeiting, and environmental aspects, are critical. Compliance is key to avoiding penalties, ensuring product safety, and maintaining market access.

| Legal Area | Impact | Data |

|---|---|---|

| Packaging Regulations | Mandates for safety, tampering, labeling | Pharma packaging market: $98.2B in 2024, to $136.8B by 2029 |

| Anti-Counterfeiting Laws | Protects product integrity, security features | Anti-counterfeiting market: $478.4B by 2025 |

| Environmental Laws | Affects material choice, recycling | EU target: 70% recycling by 2030 |

Environmental factors

Growing environmental sustainability concerns drive demand for eco-friendly packaging. Companies face pressure to cut their environmental impact. Bilcare's sustainability efforts in materials and processes are crucial. The global green packaging market is projected to reach $400 billion by 2025.

Waste management and recycling regulations are crucial for packaging producers like Bilcare. These rules cover collection, sorting, and recycling targets. Compliance is essential for Bilcare's operations and sustainability. The global recycling rate for plastics was around 9% in 2024, highlighting the need for enhanced waste management strategies. In 2025, the EU aims to increase recycling rates for packaging waste to 65%.

Reducing carbon emissions and energy use is crucial in manufacturing. Bilcare might face pressure to adopt energy-efficient methods. In 2024, global manufacturing emissions accounted for about 20% of total emissions. Companies like Bilcare need to comply with environmental regulations, potentially increasing operational costs.

Impact of Raw Material Sourcing

Bilcare's environmental footprint includes raw material sourcing. Consider the sustainability of paper from forestry and the impact of plastic production. These factors are crucial, even if the focus is polymers and aluminum. The packaging industry faces increasing scrutiny regarding its environmental impact.

- Globally, the plastic packaging market was valued at $300 billion in 2023.

- Approximately 40% of global paper production is used for packaging.

- Recycling rates for plastics remain low, with less than 10% being effectively recycled in many regions.

Climate Change and Extreme Weather Events

Climate change and extreme weather pose risks to Bilcare. Severe weather can disrupt manufacturing and logistics. These events may lead to supply chain issues. The World Bank estimates that climate change could push 100 million people into poverty by 2030.

- Disruptions from extreme weather events could increase operational costs by 5-10% annually.

- Supply chain vulnerabilities might reduce production efficiency by up to 15%.

- Insurance premiums could increase by 20-30% due to climate-related risks.

Environmental sustainability drives the green packaging market, which is anticipated to reach $400 billion by 2025. Waste management regulations, especially in the EU (targeting 65% recycling for packaging), influence Bilcare. Reducing carbon emissions and ensuring sustainable material sourcing are essential, with manufacturing emissions accounting for 20% of global totals in 2024. Climate change risks, including severe weather disrupting operations and potentially increasing costs, also pose challenges.

| Aspect | Impact | Data |

|---|---|---|

| Green Packaging Market | Demand | $400B by 2025 |

| Plastic Recycling Rate | Low | Around 9% globally in 2024 |

| Manufacturing Emissions | High | 20% of global emissions in 2024 |

PESTLE Analysis Data Sources

This Bilcare PESTLE relies on industry reports, governmental databases, and financial publications for credible insights. It incorporates market research and scientific papers.