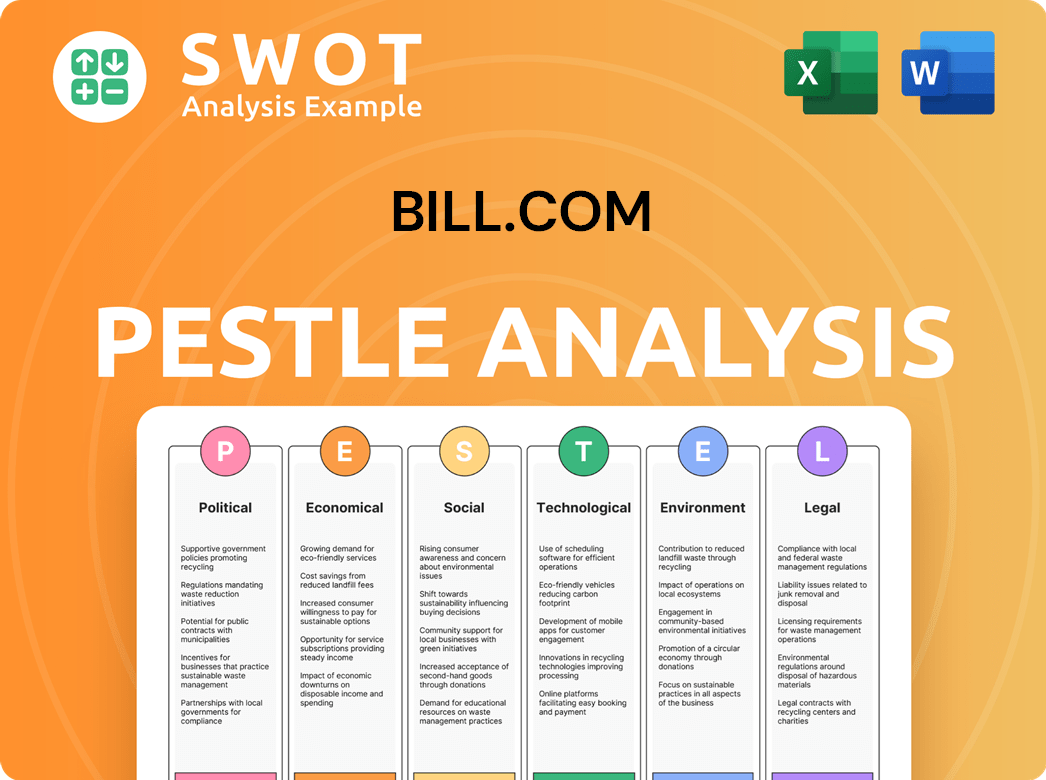

Bill.com PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bill.com Bundle

What is included in the product

This analysis assesses how external factors affect Bill.com's operations across six macro-environmental areas: PESTLE.

Uses clear and simple language to make the content accessible to all stakeholders.

Preview Before You Purchase

Bill.com PESTLE Analysis

The content displayed in the preview is identical to what you'll receive. The Bill.com PESTLE analysis is fully formatted and ready to use.

PESTLE Analysis Template

Explore Bill.com through our comprehensive PESTLE analysis, unveiling external factors. Discover how political landscapes, economic shifts, and technological advancements impact their strategies. Our report delivers critical insights into social trends and legal influences on the company's performance. Get a competitive advantage—purchase the full PESTLE analysis for deep, actionable intelligence. Understand the full picture now.

Political factors

The U.S. government's backing of digital innovation significantly benefits Bill.com. Policies encouraging digital tech and cloud solutions foster growth. The Small Business Administration (SBA) offers tech assistance. In 2024, over $20 billion was allocated for digital infrastructure. This aids Bill.com's SMB market reach.

Shifts in employment policies, including labor regulations and immigration laws, can significantly impact Bill.com and its SMB customers. For instance, the US Department of Labor proposed a rule in 2024 to redefine independent contractor status, potentially affecting how businesses classify their workforce. This could lead to changes in workforce management. These changes require careful monitoring.

Fiscal and trade policy shifts can create uncertainty for SMBs, Bill.com's core clients. These changes might affect SMB confidence and spending, potentially lowering demand for Bill.com's offerings. For example, in 2024, trade tensions led to fluctuating import costs, impacting SMB profitability. Bill.com must track these macroeconomic trends and their customer impact.

Government Regulation of Fintech

The fintech sector faces evolving government regulations. Data privacy, security, and financial transaction rules are key. New regulations could raise Bill.com's compliance costs. Staying compliant is vital for market success. For example, in 2024, the SEC proposed new rules on cybersecurity for investment advisors.

- Data privacy regulations, like GDPR in Europe and CCPA in California, impact how Bill.com handles user data.

- Financial transaction regulations, such as those related to money laundering (AML) and know-your-customer (KYC) rules, add compliance complexity.

- Cybersecurity regulations require robust data protection measures.

- Changes in regulations can lead to increased operational costs.

International Political Stability

International political instability indirectly impacts Bill.com. Geopolitical conflicts can create economic volatility, affecting SMBs' financial health. This, in turn, influences their adoption of financial automation platforms. For example, the Russia-Ukraine war caused a 20% increase in global energy prices in 2022, affecting SMB operational costs.

- SMBs' financial health is crucial for Bill.com's business.

- Economic volatility can reduce SMB spending on automation.

- Global instability creates market uncertainty.

- Bill.com's growth can be indirectly affected.

U.S. digital innovation policies boost Bill.com's growth. Employment shifts, like independent contractor rules changes, impact operations. Fiscal and trade policies cause SMB uncertainty, affecting demand. Fintech regulation evolution increases compliance costs.

| Political Factor | Impact on Bill.com | 2024/2025 Data |

|---|---|---|

| Digital Innovation | Fosters growth through cloud adoption and tech support | $20B allocated for digital infrastructure (2024) |

| Employment Policies | Affects workforce management for SMB customers | US DOL proposed rule on independent contractors (2024) |

| Fiscal and Trade Policies | Influences SMB confidence, potentially lowering demand | Trade tensions caused fluctuating import costs (2024) |

| Fintech Regulations | Increases compliance costs for data privacy and security. | SEC proposed new rules on cybersecurity (2024) |

Economic factors

Persistent inflation and high interest rates pose significant challenges for SMBs, Bill.com's core customer base. In Q1 2024, the U.S. inflation rate was around 3.5%, influencing business costs. These conditions may cause SMBs to reassess expenses and potentially reduce transaction volumes. Bill.com must monitor how macroeconomic trends, like the Federal Reserve's interest rate decisions, affect customer financial health and spending.

Economic growth significantly impacts SMBs' financial health and spending. Slow economic growth can reduce demand for Bill.com's services. The SMB sector's economic resilience is crucial for Bill.com's growth. In 2024, U.S. GDP growth was around 3%, influencing SMB spending.

The fintech sector is incredibly competitive. Bill.com faces rivals like Intuit and smaller startups. This competition puts pressure on pricing, potentially impacting Bill.com's revenue. In 2024, the SMB fintech market was valued at over $35 billion. Bill.com must innovate to retain its market share.

Monetization Rates and Revenue Growth

Bill.com generates revenue through subscription fees, transaction fees, and interest on client funds. Changes in economic conditions, like interest rate fluctuations, directly affect its float income. Shifts in payment preferences and overall transaction volumes significantly influence transaction revenue. For example, in Q1 2024, Bill.com's total revenue was $302.5 million, a 33% increase year-over-year.

- Subscription revenue is a recurring source of income.

- Transaction revenue is tied to the volume of payments processed.

- Float income is generated from the temporary investment of client funds.

- Economic factors can affect all revenue streams.

Investment in Technology and Growth Initiatives

Bill.com's financial well-being and expansion hinge on its investments in innovation, including AI and blockchain. Economic conditions directly affect the accessibility of funding and the potential for investment returns. Strategic investments are vital for Bill.com to stay competitive and increase its market share. In fiscal year 2024, Bill.com's revenue grew by 32% to $1.2 billion, showing strong growth. The company's focus on innovation is evident in its R&D spending, which was $187 million in fiscal year 2024.

- R&D spending of $187 million in fiscal year 2024 reflects Bill.com's commitment to innovation.

- Revenue increased by 32% to $1.2 billion in fiscal year 2024.

Economic factors such as inflation and interest rates affect Bill.com's SMB customers. In early 2024, U.S. inflation hovered around 3.5%. GDP growth in 2024 was about 3%, which impacted SMB spending. Fluctuations influence revenue streams like transaction and float income.

| Metric | Q1 2024 | Fiscal Year 2024 |

|---|---|---|

| Inflation Rate (U.S.) | ~3.5% | - |

| GDP Growth (U.S.) | - | ~3% |

| Total Revenue | $302.5 million | $1.2 billion (32% YoY growth) |

Sociological factors

SMBs' embrace of fintech, like Bill.com, is crucial. Adoption rates are rising; however, trust, perceived value, and ease of use impact this. A 2024 survey showed 68% of SMBs now use at least one fintech solution. Bill.com thrives on this ongoing financial automation uptake.

The shift to remote and hybrid work models presents new financial management hurdles for SMBs. These models demand tools that support distributed teams and streamline operations. Bill.com must adapt to evolving work preferences. In 2024, 60% of U.S. SMBs used hybrid models.

The influx of Gen Z into the workforce, now representing a significant portion of new hires, is changing corporate cultures. For instance, a 2024 survey showed that 70% of Gen Z workers value flexible work arrangements. Bill.com must adapt to these preferences. This includes features designed for mobile use and cloud-based accessibility, which are favored by this generation. Moreover, their emphasis on transparency will require Bill.com to clearly communicate its value proposition.

Importance of Financial Literacy and Education

Financial literacy significantly influences how small and medium-sized businesses (SMBs) adopt financial automation platforms. Bill.com must consider the varying financial literacy levels of its users to ensure platform effectiveness. Investing in educational resources is crucial for SMBs to fully utilize the platform and manage finances well.

- In 2024, a study showed only 34% of U.S. adults are financially literate.

- Bill.com's user base includes SMBs, where financial knowledge varies.

- Educational support can boost platform adoption and financial management.

- Resources could include tutorials, webinars, and user guides.

Trust and Security Concerns

Trust and security are major sociological factors affecting fintech adoption. People worry about the safety of their financial data. Bill.com needs strong cybersecurity to earn user trust. Recent data shows a 20% rise in cyberattacks on financial firms in 2024. Building trust is crucial for Bill.com's success.

- 20% rise in cyberattacks on financial firms in 2024.

- Users' trust is crucial for fintech success.

Sociological factors heavily influence Bill.com's market presence. Fintech adoption depends on trust and data security, amid rising cyberattacks; there was a 20% increase in attacks on financial firms in 2024.

User trust is critical. Financial literacy varies widely. Educational tools boost platform use; only 34% of U.S. adults were financially literate in 2024.

| Factor | Impact | Data |

|---|---|---|

| Trust & Security | Essential for adoption | 20% rise in cyberattacks in 2024 |

| Financial Literacy | Influences platform usage | 34% financially literate in 2024 |

| Workforce Shifts | Adaptation to new norms | 70% of Gen Z valuing flexible work in 2024 |

Technological factors

Advancements in AI and automation are transforming financial software. This includes tasks like invoice processing and financial analysis, boosting efficiency. Small and medium-sized businesses (SMBs) are actively adopting these technologies. Bill.com's success hinges on leveraging AI to improve its platform. In 2024, the AI in finance market was valued at $12.9 billion.

Digital payment solutions are rapidly evolving, with faster payment rails and new methods impacting Bill.com. To remain competitive, Bill.com must integrate these advancements for smooth, secure payments. The growing use of pay-by-bank services is a significant trend. As of late 2024, the global digital payments market is projected to reach $10 trillion, showing huge growth potential. The pay-by-bank transactions are expected to increase by 40% in 2025.

Cybersecurity is crucial for cloud-based financial platforms. Bill.com needs strong security to protect sensitive financial data. They must invest in advanced tech and maintain user trust. Relevant certifications are also essential. In 2024, cybersecurity spending is expected to reach $215 billion globally.

Integration with Accounting Software

Seamless integration with accounting software is a cornerstone of Bill.com's functionality. This capability is vital for offering complete solutions to small and medium-sized businesses (SMBs), broadening its market presence. As of Q1 2024, Bill.com supported integrations with over 100 accounting systems. Continuous development and upkeep of these integrations are crucial.

- Integration with platforms like QuickBooks and Xero is a key aspect of its value proposition.

- The company's ability to quickly add new integrations and maintain existing ones is a key factor in its competitive advantage.

Cloud Computing Infrastructure

Bill.com heavily relies on cloud computing infrastructure for its operations. This infrastructure ensures the platform's reliability, security, and performance, which are key for user satisfaction. As of late 2024, the cloud computing market is valued at over $600 billion, with projections to exceed $1 trillion by 2027. Bill.com's investment in and efficient management of this infrastructure are essential for its long-term success.

- Cloud infrastructure crucial for platform's performance.

- Cloud computing market is valued at over $600 billion.

- Market is projected to exceed $1 trillion by 2027.

Bill.com is significantly shaped by technological factors like AI, digital payments, and cybersecurity.

It must adopt AI and improve payment methods. Cybersecurity is very important for protecting financial data and gaining user trust. The focus of Bill.com lies on integrating seamlessly with other systems.

These actions enable better performance of a platform based on cloud computing.

| Technological Aspect | Impact on Bill.com | 2024-2025 Data |

|---|---|---|

| AI in Finance | Enhances Efficiency & Automation | Market Valued at $12.9 Billion (2024) |

| Digital Payments | Competitive Advantage via New Solutions | $10 Trillion Digital Payment Market (2024 Projection); Pay-by-Bank Up 40% (2025) |

| Cybersecurity | Protect Data and Ensure Trust | $215 Billion in Cybersecurity Spending (2024) |

Legal factors

Bill.com navigates intricate financial regulations, crucial for its payment and financial reporting services. Compliance is key, especially with payment processing and data security laws. Any shifts in fintech regulations, as seen with evolving data privacy rules, demand platform and process adaptations. For instance, the implementation of new anti-money laundering (AML) regulations in 2024/2025 could necessitate significant system updates and increased compliance spending. This directly influences operational costs and platform functionality.

Bill.com faces growing scrutiny from data privacy laws globally. Compliance with GDPR and CCPA is crucial for protecting customer data. In 2024, GDPR fines reached €1.2 billion. Bill.com must adapt its data practices to meet these legal demands. This ensures customer trust and avoids hefty penalties.

Bill.com must comply with employment laws, including those on employee classification and safety. These regulations directly influence internal operations and client businesses. For instance, the US Department of Labor reported over 3.9 million workplace injuries and illnesses in 2022. Changes in employment laws require policy updates, potentially affecting Bill.com's workforce management services.

Contract Law and Partnerships

Bill.com's operations are heavily reliant on contracts with customers, partners, and vendors. These legal agreements are crucial for defining rights, responsibilities, and financial terms. Any alterations in contract law or legal disputes could affect Bill.com's business and expansion plans. Strong legal frameworks are essential for partnerships. In 2024, the global legal services market was valued at approximately $850 billion.

- Contract disputes can lead to financial losses and reputational damage.

- Partnership agreements must be carefully drafted to protect Bill.com's interests.

- Compliance with evolving contract laws is vital for sustained growth.

Tax Regulations and Reporting Requirements

Tax regulations and reporting changes, particularly those impacting small and medium-sized businesses (SMBs), are critical for Bill.com. The platform must adapt to evolving tax laws to remain compliant and user-friendly. This includes supporting features for tax filings like 1099 forms, ensuring accurate financial reporting. Failure to adapt could lead to penalties for users and impact platform usability.

- The IRS issued over 1.2 million penalties related to information returns in 2023, highlighting compliance importance.

- Bill.com's 1099 services handled over 1.5 million 1099 forms in 2024.

- The average penalty for incorrect 1099 filings can exceed $290 per form.

Bill.com confronts diverse legal challenges impacting operations, compliance, and expansion. Data privacy, employment, and contract laws necessitate careful navigation. Furthermore, tax regulations directly influence platform functionality and user experience.

| Legal Factor | Impact on Bill.com | 2024/2025 Data/Examples |

|---|---|---|

| Data Privacy | Compliance costs; Customer trust | GDPR fines hit €1.2B in 2024; 10% of SMBs suffered data breaches in 2024. |

| Employment Laws | Workforce management; Internal policies | US Dept. of Labor reported >3.9M workplace injuries in 2022; rising minimum wage costs. |

| Contract Law | Business relationships; Risk | Global legal services market valued at $850B in 2024; Contract disputes = financial loss. |

| Tax Regulations | Platform usability; Penalties | IRS issued >1.2M penalties on information returns in 2023; avg penalty for wrong 1099 filings is $290/form. |

Environmental factors

Bill.com facilitates a shift towards paperless operations, indirectly supporting environmental sustainability. By automating financial processes, it reduces the reliance on printing and physical document storage. This aligns with the growing emphasis on reducing paper waste and promoting eco-friendly practices. In 2024, the global paper and paperboard market was valued at approximately $400 billion, highlighting the potential impact of digital solutions.

Bill.com, as a cloud service, indirectly depends on data centers, which are energy-intensive. Data centers globally consumed about 2% of the world's electricity in 2023. This figure is projected to rise, potentially impacting Bill.com's operational costs. Efficiency in data processing and the adoption of green data center initiatives are crucial considerations for sustainability.

Corporate Social Responsibility (CSR) and sustainability reporting are becoming crucial for all businesses. Bill.com, as a tech company, faces rising expectations regarding environmental practices.

Investors increasingly favor companies with strong CSR profiles; in 2024, sustainable funds saw inflows of $4.3 billion. Transparency in environmental impact is vital.

Though Bill.com's direct footprint might be smaller, stakeholders want disclosure. Consider the 2023 global ESG investments, which reached $40.5 trillion.

This includes detailing energy use, carbon emissions, and waste management. Companies are measured on their eco-friendliness.

Failure to address these concerns can affect brand reputation and investor confidence; in 2025, expect even more scrutiny.

Remote Work and Reduced Commuting

Bill.com's support for remote work models can lessen environmental impact. This is achieved by lowering commute-related carbon emissions. Such actions support goals for better air quality. In 2024, remote work reduced U.S. commuting by 20%, cutting emissions. This trend is set to continue in 2025.

- Reduced commuting can significantly lower carbon footprints.

- Remote work models supported by platforms like Bill.com promote sustainability.

- Environmental benefits align with corporate social responsibility goals.

- Decreased traffic improves air quality in urban areas.

Regulatory Focus on Environmental Sustainability

Regulatory focus on environmental sustainability, while not directly impacting Bill.com, presents a broader trend. Businesses face increasing pressure to adopt sustainable practices. Awareness of environmental regulations is crucial for all companies. This includes understanding how sustainability can influence business operations.

- The global environmental services market is projected to reach $1.3 trillion by 2025.

- Companies are increasingly assessed on their ESG (Environmental, Social, and Governance) performance.

Bill.com indirectly fosters environmental sustainability by enabling paperless financial operations, with the 2024 paper market valued at $400 billion. The company relies on energy-intensive data centers, consuming around 2% of global electricity in 2023, which is set to increase. Remote work models, supported by Bill.com, contribute to a reduction in commute-related carbon emissions; in 2024, this decreased U.S. commuting by 20%.

| Factor | Impact on Bill.com | Data/Statistic |

|---|---|---|

| Paperless Operations | Reduces paper use | $400B (2024 paper market) |

| Data Centers | Energy consumption | 2% (2023 global electricity) |

| Remote Work | Lower carbon emissions | 20% (Reduction in U.S. commuting in 2024) |

PESTLE Analysis Data Sources

Bill.com's PESTLE leverages government data, financial reports, tech publications, and market analysis to assess all macro-environmental factors.