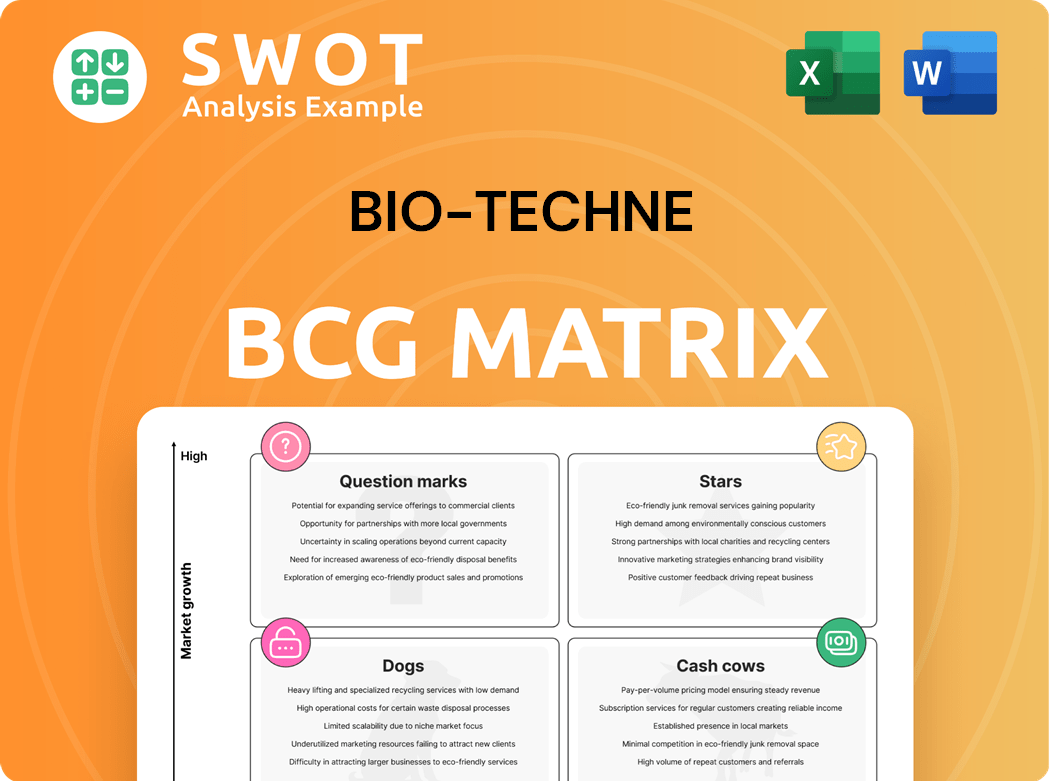

Bio-Techne Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bio-Techne Bundle

What is included in the product

Analysis of Bio-Techne's portfolio across BCG Matrix quadrants, showing strategic recommendations.

Export-ready design for quick drag-and-drop into PowerPoint. Quickly and easily integrate data into presentations.

What You’re Viewing Is Included

Bio-Techne BCG Matrix

The BCG Matrix preview mirrors the complete document you'll receive after purchase. Get the full, professionally formatted analysis ready to integrate into your strategic planning, with no hidden content.

BCG Matrix Template

The Bio-Techne BCG Matrix offers a glimpse into their product portfolio's competitive landscape. See how key products are categorized as Stars, Cash Cows, Dogs, or Question Marks. This initial view can help you understand the company's market position. Discover strategic opportunities for growth and resource allocation. Purchase the full BCG Matrix for a comprehensive breakdown and actionable insights!

Stars

Bio-Techne's cell and gene therapy solutions are thriving, especially in GMP reagents. This segment gains from the biopharma sector's recovery. In Q1 2024, Bio-Techne's revenue reached $119.4 million, up 7% organically. Their focus on this area sets them up for growth and distinctiveness.

Bio-Techne's spatial biology products show strong adoption, boosting Diagnostics & Spatial Biology revenue. Lunaphore's acquisition in June 2023 enhanced its market entry. The total addressable market (TAM) for spatial biology exceeds $8.0 billion, growing at about 20%. In fiscal year 2024, Bio-Techne's Diagnostics and Spatial Biology segment generated approximately $300 million in revenue.

Protein analysis consumables are experiencing significant growth, with high-teens percentage increases, reflecting robust market demand. Bio-Techne leverages its expertise in protein and antibody production. This core strength is crucial, as these are fundamental materials for the biotech sector. The company's strategic focus on its core competencies drives this positive trajectory.

Diagnostics and Spatial Biology Segment

The Diagnostics and Spatial Biology segment shines as a "Star" within Bio-Techne's portfolio, demonstrating strong growth. This segment's success is fueled by its commercial strategies and investment choices. For the first quarter of fiscal 2025, net sales reached $83.2 million, a 14% increase compared to $72.8 million in the first quarter of fiscal 2024.

- Strong adoption of its product range contributes to the segment's growth.

- Strategic investments are key to expanding this segment.

- The segment shows solid financial performance.

- First quarter fiscal 2025 net sales were $83.2 million.

ExoDx Prostate Cancer Test

Bio-Techne's ExoDx prostate cancer test, acquired through Asuragen, is seeing strong growth. This exosome-based diagnostic is gaining rapid adoption. The test's commercialization is through the lab channel. Unit volume is increasing, showing market demand.

- In Q1 2024, Bio-Techne reported strong diagnostic revenue growth, reflecting ExoDx's positive impact.

- The acquisition of Asuragen strategically positioned Bio-Techne in the diagnostics market.

- ExoDx's adoption is supported by increasing awareness and clinical utility.

- Bio-Techne is expanding its lab channel to increase test accessibility.

The Diagnostics and Spatial Biology segment's high growth and market success define it as a "Star". Strong adoption and strategic investments fuel this segment. In Q1 2025, it reached $83.2 million. It is a key growth driver.

| Metric | Q1 2024 | Q1 2025 |

|---|---|---|

| Net Sales ($M) | $72.8 | $83.2 |

| Growth (%) | - | 14% |

| TAM (Spatial Biology) | $8.0B | - |

Cash Cows

Bio-Techne is a key provider of specialized proteins, antibodies, and reagents. These are vital for biotech and academic research. In 2024, Bio-Techne's antibody sales showed a steady growth. They have a strong market position due to their quality and wide product range. The company's revenue from these products is a significant portion of their total income.

Bio-Techne's blood chemistry and blood gas quality controls are a stable revenue source. These products are critical for in vitro diagnostics. In 2024, the Diagnostics and Spatial Biology segment, which includes these controls, saw consistent demand. This segment is a key part of Bio-Techne's revenue stream, providing essential products for medical testing.

Hematology instrument controls generate consistent revenue, similar to quality controls. These controls are within Bio-Techne's Diagnostics and Spatial Biology segment. This segment in 2024, includes hematology controls, quality controls, and reagents. The segment's revenue in fiscal year 2024 was approximately $350 million. These products support the in vitro diagnostic market.

RUO Reagents

RUO reagents at Bio-Techne are a stable cash cow, with low single-digit sales growth. These essential reagents support research, underpinning consistent performance. The company observed promising demand from smaller biotech firms. Bio-Techne's fiscal year 2024 revenue was $1.1 billion, a 6% increase, indicating solid growth.

- RUO sales growth is stable, reflecting market demand.

- Smaller biotech firms drive demand, supporting optimism.

- Bio-Techne's 2024 revenue growth was 6%, showing stability.

- These reagents are vital for ongoing research activities.

Protein Sciences Segment

The Protein Sciences segment is a cash cow for Bio-Techne, generating substantial revenue due to its strong market position. It offers specialized proteins, cytokines, and reagents to biotech and academic research. This segment consistently delivers high returns with established products and a loyal customer base. The Protein Sciences segment accounted for $213.8 million in revenue in the first quarter of fiscal year 2024, showing its significance.

- Revenue: $213.8 million in Q1 FY2024.

- Key Products: Cytokines, growth factors, immunoassays.

- Market Position: Leading supplier in its niche.

- Customer Base: Biotechnology and academic research.

Bio-Techne's cash cows consistently produce revenue with low growth. This includes RUO reagents and Protein Sciences. The company's steady performance is supported by robust market demand, particularly from smaller biotech firms. In Q1 FY2024, Protein Sciences reported $213.8 million in revenue.

| Cash Cows | Key Products | 2024 Performance |

|---|---|---|

| RUO Reagents | Reagents for research | Stable sales growth, supporting research |

| Protein Sciences | Proteins, cytokines, immunoassays | $213.8M Q1 FY2024 revenue |

| Blood Chemistry/Gas QC | In vitro diagnostics | Consistent demand |

Dogs

Legacy diagnostics at Bio-Techne may see market share decline, facing competition. These older products need careful management, potentially divestiture. Turnaround plans are often costly and ineffective. In 2024, Bio-Techne's diagnostic segment showed moderate growth, highlighting the need for strategic focus.

Products in competitive biotech markets face challenges. They often require substantial investment to stay relevant. They are typically cash traps. Bio-Techne's competitive products, such as certain immunoassay kits, illustrate this. For example, in 2024, the market saw many similar offerings, impacting profitability.

Bio-Techne might sell businesses that don't boost growth or profit. The Fetal Bovine Serum business, sold in Q1 2024, is an example. Its sale cut segment revenue growth by 1%. In Q1 2024, Bio-Techne's total revenue was $123.7 million.

Products with Low Growth and Market Share

In the context of Bio-Techne's BCG matrix, "Dogs" represent product lines with both low growth and low market share. These offerings often generate minimal cash flow, barely covering their costs. Bio-Techne might consider divesting these products to allocate resources more effectively. Such strategic moves aim to boost overall profitability and focus on higher-potential areas.

- Low growth and market share indicates "Dogs".

- Often break even, consuming little cash.

- Divestiture is a possible strategic action.

- Focus on higher-potential products.

Struggling Spatial Biology Products

Dogs in Bio-Techne's BCG matrix represent spatial biology products that struggle. These underperforming products lack growth potential, making them candidates for divestiture. For instance, if a spatial biology assay's sales decline by over 10% in 2024, it might be a Dog. Bio-Techne might sell it to improve profitability.

- Definition: Underperforming spatial biology products with limited growth prospects.

- Action: Companies are advised to sell them.

- Financial Impact: Reduced profitability if kept.

- Example: Declining sales of a spatial biology assay.

Dogs are underperforming spatial biology products with low growth and market share, suitable for divestiture. These offerings generate minimal cash flow and can drag down profitability. In 2024, declining sales in a spatial biology assay are a Dog. Bio-Techne targets higher-potential areas.

| Category | Characteristics | Strategic Action |

|---|---|---|

| Dogs | Low growth, low market share, underperforming spatial biology products | Divestiture or sale to improve profitability |

| Financial Impact | Minimal cash flow, potential for reduced profitability | Focus on high-potential products |

| Example | Spatial biology assay with sales decline in 2024 | Target of sales |

Question Marks

New diagnostic assays represent a high-growth area for Bio-Techne, yet market acceptance is still uncertain. These assays require significant investment to establish a market presence. Bio-Techne's marketing strategy focuses on driving market adoption of these innovative products. In 2024, the diagnostic segment's revenue was approximately $100 million, reflecting its growth potential.

Emerging spatial biology technologies are question marks in Bio-Techne's BCG matrix. These novel technologies, like advanced imaging, are in early adoption phases. They require significant investment with uncertain returns. Despite high cash consumption, their impact is currently limited. For example, Bio-Techne's R&D spending in 2024 was around $100 million.

Bio-Techne's liquid biopsy products are in the "Question Mark" quadrant of the BCG matrix. They have high growth potential, especially with the $8 billion TAM and 20% growth in related markets. However, they face competition and need investment. In fiscal 2023, liquid biopsy represented 22% of Bio-Techne's sales.

Molecular Diagnostic Offerings

Molecular diagnostic offerings, still emerging, are categorized as question marks in Bio-Techne's BCG matrix. These offerings must rapidly capture market share to avoid becoming dogs. In 2024, Bio-Techne invested significantly in its molecular diagnostics, aiming for a 15% revenue growth in this segment. Failure to achieve this could lead to divestiture. The strategy involves aggressive marketing and strategic partnerships to boost visibility.

- Focus: Increase market share.

- Risk: Potential to become a dog.

- Strategy: Investment or sale.

- 2024 Goal: Achieve 15% revenue growth.

China Market Growth Initiatives

China's market growth initiatives for Bio-Techne are promising, yet uncertain due to regulatory shifts and market dynamics. These require careful investment and strategic execution to navigate the complexities. The Chinese market offers opportunities, supported by stimulus programs aimed at technological upgrades and an anticipated mid-single-digit growth. In 2024, China's GDP growth was around 5.2%, indicating a solid economic foundation for future growth.

- Regulatory changes can significantly impact market access and product approval timelines.

- Stimulus programs are designed to boost technological advancements.

- Mid-single-digit growth is expected for 2025.

- Careful investment and strategic execution are crucial for success.

Bio-Techne's diagnostic assays are high-growth, yet adoption is uncertain. Investments are needed to gain market presence, focusing on driving product adoption. In 2024, diagnostics brought $100M revenue.

| Category | Details | 2024 Metrics |

|---|---|---|

| Revenue Growth | Target for Diagnostics | 15% |

| R&D Spending | Spatial Biology Tech | $100M |

| China GDP | Economic Foundation | 5.2% |

BCG Matrix Data Sources

Our BCG Matrix is built using data from market reports, financial filings, competitor analyses, and expert opinions. This ensures accurate market assessments.