BlackBerry Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BlackBerry Bundle

What is included in the product

Strategic overview of BlackBerry's portfolio via BCG Matrix quadrants, revealing optimal investment, hold, or divest strategies.

Printable summary optimized for A4 and mobile PDFs, eliminating the hassle of complex data for quick referencing.

Preview = Final Product

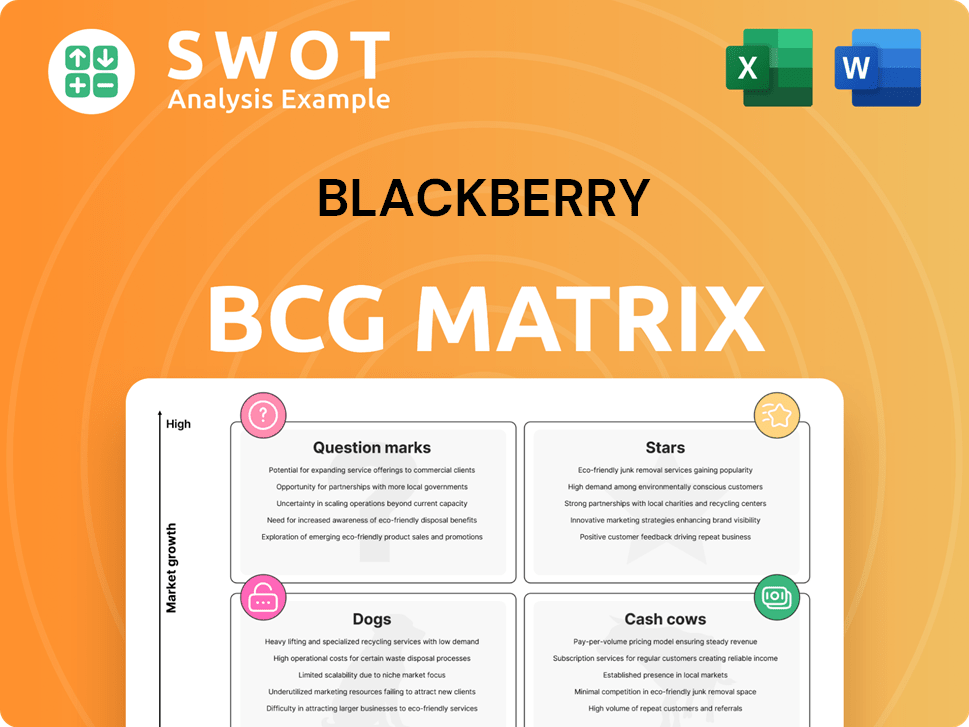

BlackBerry BCG Matrix

The displayed preview is the exact BlackBerry BCG Matrix report you'll download post-purchase. It's a ready-to-use analysis, providing strategic insights without any hidden changes or edits needed.

BCG Matrix Template

BlackBerry's BCG Matrix paints a picture of its product portfolio. This snapshot reveals how its products are positioned in the market. Some likely shine as Stars, while others might be Cash Cows. Question Marks and Dogs also play their role. This is just a glimpse of the strategic landscape. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

QNX, BlackBerry's embedded operating system, shines as a Star within the BCG Matrix. Its strong market share is evident in the automotive industry, a rapidly expanding sector. As of late 2023, QNX powers over 255 million vehicles worldwide. This dominant position, coupled with continuous advancements, solidifies QNX's status as a Star.

BlackBerry's secure communication products, especially for government sectors, are a "Star" in its BCG Matrix. Demand for secure solutions is rising amid cyber threats, fueling growth. In 2024, the cybersecurity market is projected to reach $262.4 billion. Innovation will sustain its market position. BlackBerry's focus on secure communications aligns with this growth trend.

BlackBerry IVY, a cloud-connected platform, shows star potential. It's gaining traction through partnerships and production vehicle integrations. IVY standardizes vehicle data, enabling edge AI processing for growth. BlackBerry's Q3 2024 software revenue increased by 11% YoY, signaling positive momentum. Continued adoption is crucial for sustained success.

Cybersecurity Solutions for Critical Infrastructure

BlackBerry's cybersecurity solutions are thriving, particularly in critical infrastructure protection, a "star" in its portfolio. They successfully defended against approximately 600,000 attacks in Q3 2024, demonstrating strong market performance. The rising threat of sophisticated cyberattacks fuels the need for advanced security, making this a high-growth area. Continued investment in AI-driven solutions is crucial for maintaining this success.

- BlackBerry's cybersecurity revenue in Q3 2024 was $127 million.

- The cybersecurity market is projected to reach $345.7 billion by 2026.

- BlackBerry's AI-driven CylancePROTECT solution saw a 20% increase in adoption in 2024.

Strategic Partnerships

BlackBerry's strategic alliances, such as those with Microsoft and Amazon, are critical to its star status. These collaborations amplify BlackBerry's product offerings and broaden its market presence. For instance, in 2024, BlackBerry's partnership with Amazon Web Services (AWS) expanded, integrating its cybersecurity solutions. This strategic focus is paying off.

- Partnerships with Microsoft and Amazon enhance product offerings.

- These partnerships provide access to new markets and technologies.

- BlackBerry's cybersecurity solutions are expanding with AWS integration.

- Expanding these partnerships will be beneficial for growth.

BlackBerry's Stars include QNX, secure communications, IVY, and cybersecurity solutions. These segments enjoy high market share within growing markets. Strong performance is supported by strategic partnerships and AI-driven solutions.

| Star Segment | Market Position | Key Drivers (2024) |

|---|---|---|

| QNX | Dominant in Automotive | 255M+ vehicles worldwide, Industry growth |

| Secure Comm. | Leading in Government | $262.4B Cybersecurity mkt, Rising cyber threats |

| BlackBerry IVY | Growing, cloud-connected | Partnerships, edge AI processing, 11% YoY growth |

| Cybersecurity | Strong in Critical Infrastructure | 600k attacks defended, AI-driven solutions, $127M revenue |

Cash Cows

QNX Royalties represent a Cash Cow for BlackBerry, producing steady income from embedded systems in cars. It holds a significant market share within a stable sector. The company's royalty backlog reached $865 million by the end of fiscal year 2025, indicating reliable cash flow. Maintaining QNX's reputation for safety is vital for its continued success.

BlackBerry's secure communication products are Cash Cows, especially within the government sector. They generate steady revenue due to consistent demand for secure solutions. This market presence is crucial; focusing on maintaining it is key. In Q3 2024, BlackBerry's cybersecurity revenue was $129 million, showing its strong position.

BlackBerry's licensing and IP portfolio acts like a cash cow, generating consistent revenue with low overhead. The company's vast portfolio, including roughly 38,000 patents and applications globally, is key. In 2024, BlackBerry's licensing revenue was a significant portion of its total income. Strategic licensing agreements and active management are crucial for maximizing this revenue stream.

AtHoc Crisis Communication Platform

BlackBerry's AtHoc crisis communication platform is a strong cash cow, providing consistent revenue. Organizations worldwide rely on AtHoc, making it a dependable income source. The rising frequency of emergencies ensures continued demand, supporting its cash-generating ability. Investing in AtHoc can boost efficiency and further increase cash flow, solidifying its value.

- AtHoc's revenue contributed significantly to BlackBerry's overall revenue in 2024.

- The platform boasts a high customer retention rate, ensuring steady income.

- Ongoing developments and integrations with other platforms continue to enhance its appeal.

- The platform's ability to handle critical communications during crises drives demand.

Embedded Systems

BlackBerry's QNX is a core cash cow, providing operating systems for embedded systems, including automotive. QNX's reliability and security make it a trusted choice. Investing in QNX maintains its strong market position and revenue stream. The company can passively benefit from QNX's established success. In 2024, BlackBerry's cybersecurity revenue was $155 million.

- QNX is a leading operating system for embedded systems.

- BlackBerry's QNX is highly regarded for its security.

- Investment focuses on maintaining QNX's market share.

- QNX generates a consistent revenue stream for BlackBerry.

Cash Cows like QNX, secure communications, and licensing generate stable revenue for BlackBerry. They command significant market share, particularly in sectors with consistent demand. Focus on maintaining these areas is key to BlackBerry's financial health.

| Cash Cow | 2024 Revenue (Approx.) | Key Features |

|---|---|---|

| QNX Royalties | $155M (Cybersecurity) | Embedded systems, automotive, steady income |

| Secure Comm. | $129M (Q3 Cybersecurity) | Govt sector, secure solutions, consistent demand |

| Licensing/IP | Significant Portion | Low overhead, 38,000 patents, consistent revenue |

Dogs

BlackBerry's legacy smartphone business is a Dog, with a low market share in a low-growth market. The consumer smartphone business is defunct; there were no new models released in 2024. Divesting from this area is strategically sound, as BlackBerry's revenue from its mobile phone business was negligible in the last financial reports.

Cylance, BlackBerry's endpoint security asset, was divested to Arctic Wolf. The sale occurred due to its unprofitability and shrinking market share, creating a financial burden. This strategic move helped BlackBerry reduce losses. The deal, finalized in 2024, reflects a shift in focus.

BlackBerry's EMM solutions are in the "Dogs" quadrant of its BCG matrix, facing challenges. Intense competition from companies like Microsoft and VMware, coupled with decreasing market share, has significantly impacted this segment. The rise of cloud-based EMM and the shift in customer preferences have made it less attractive. In 2023, BlackBerry's software and services revenue saw a decrease, reflecting these challenges. Considering these factors, strategic alternatives or divestiture may be necessary for this part of the business.

Hardware

BlackBerry's hardware, once dominant with physical keyboard smartphones, now represents its "Dogs" quadrant. The company has moved away from hardware. This strategic pivot aims to capitalize on software opportunities.

- BlackBerry's hardware revenue decreased significantly by 2024.

- Focus is now on cybersecurity and IoT software.

- BlackBerry's hardware business was a small part of its overall revenue in 2024.

- The company's focus is on high-margin software services.

Patent Portfolio

BlackBerry's substantial patent portfolio, encompassing around 38,000 worldwide patents and applications, is a key asset. This large portfolio supports its licensing business, though maintaining it can be costly. The company's ability to monetize its intellectual property is a significant factor. In 2024, BlackBerry's patent licensing revenue was projected to contribute significantly to its overall financial performance.

- Patent portfolio supports licensing.

- Maintenance of patents can be costly.

- Monetization of IP is a key factor.

- Projected 2024 licensing revenue.

BlackBerry's "Dogs" include legacy hardware and EMM solutions.

These segments face low market share and growth, especially in 2024.

Strategic alternatives, including divestiture, are being considered.

| Segment | Market Share | 2024 Revenue Impact |

|---|---|---|

| Legacy Hardware | Negligible | Significant decrease |

| EMM Solutions | Decreasing | Contributed to overall software decline |

| Overall | Low | Strategic shift towards software |

Question Marks

QNX's expansion into medical, rail, aerospace, and defense offers high growth potential, though market share is currently low. QNX's safety reputation is key for growth in these sectors. In 2024, the global market for safety-critical systems was valued at $45 billion. Strategic investments and partnerships are essential for capturing this market.

BlackBerry IVY's new apps are a question mark in the BCG matrix, with high growth potential but uncertain market share. Success hinges on attracting developers to build valuable automotive solutions. BlackBerry invested $160 million in R&D in fiscal year 2024. Developer tools and ecosystem growth are key for future growth.

AI and machine learning in cybersecurity represent a "Question Mark" in BlackBerry's BCG Matrix, indicating high growth potential but a low market share. The cybersecurity market is projected to reach $345.4 billion by 2026. This is due to the increasing sophistication of cyber threats. BlackBerry can increase market share through strategic investments in R&D and acquisitions.

IoT Solutions Beyond Automotive

BlackBerry's foray into Industrial IoT (IIoT) presents a promising avenue for growth, extending beyond its automotive stronghold. This expansion demands substantial capital, yet the potential rewards are considerable. Differentiating through secure communication and data management is key. Targeted investments are crucial for success.

- IIoT market expected to reach $926.6 billion by 2024.

- BlackBerry's cybersecurity revenue grew 14% year-over-year in Q3 2024.

- Strategic partnerships are vital for IIoT market penetration.

- Focus on secure data transfer and device management solutions.

Integration with Cloud Platforms

BlackBerry's integration with cloud platforms, such as Microsoft Azure, is a significant opportunity for growth, demanding strategic alliances and development. This integration broadens BlackBerry's market reach and introduces new functionalities for its customers. Collaborative efforts are essential for sustaining this momentum. In 2024, cloud computing spending is projected to increase, highlighting the importance of this integration.

- BlackBerry has been actively collaborating with Microsoft to enhance its cloud-based offerings.

- Cloud integration allows BlackBerry to provide more comprehensive security solutions.

- This approach helps BlackBerry to adapt to the evolving needs of its enterprise customers.

- The move supports the growing demand for secure, cloud-based services.

BlackBerry's "Question Marks" in the BCG Matrix include AI in cybersecurity, IIoT expansion, and cloud integration. These areas offer high growth potential but require strategic investments to gain market share. Success depends on focused R&D, partnerships, and adapting to evolving market demands. Cybersecurity revenue grew 14% year-over-year in Q3 2024.

| Area | Potential | Strategy |

|---|---|---|

| AI in Cybersecurity | High growth | R&D, acquisitions |

| Industrial IoT | Substantial | Secure solutions, partnerships |

| Cloud Integration | Significant | Strategic alliances |

BCG Matrix Data Sources

BlackBerry's BCG Matrix leverages company filings, market research, and competitor analysis, providing actionable insights.