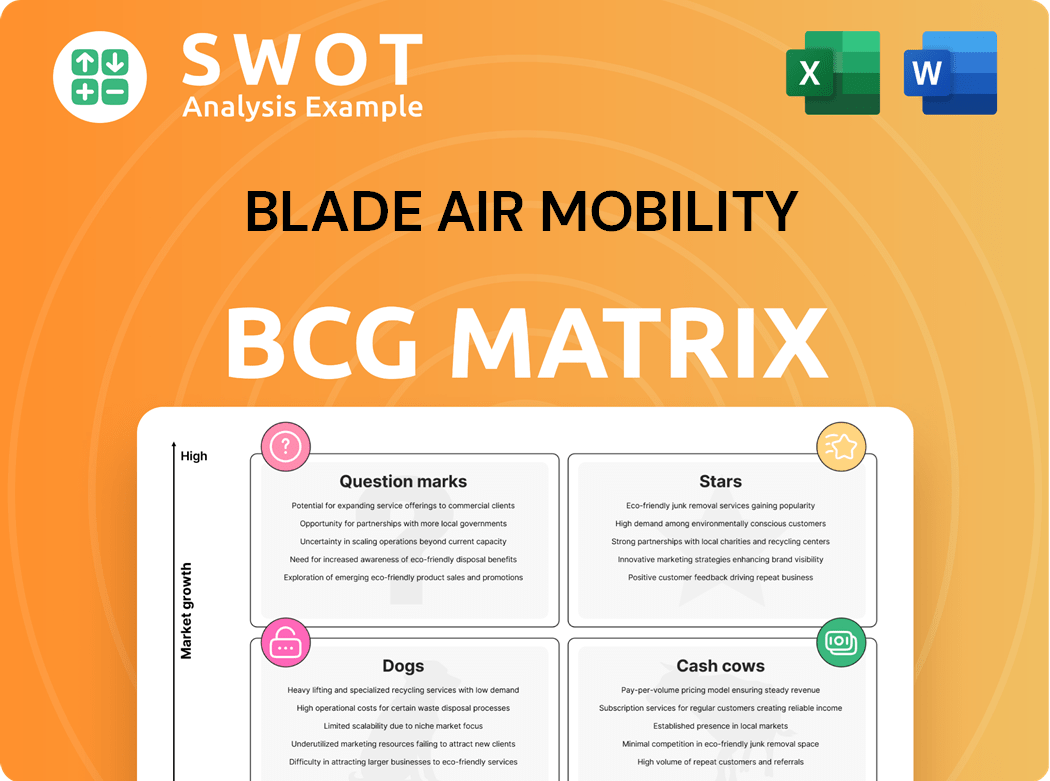

Blade Air Mobility Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Blade Air Mobility Bundle

What is included in the product

Tailored analysis for Blade's product portfolio, revealing strategic investment, holding, or divestment decisions.

Clean and optimized layout for sharing or printing, the Blade Air Mobility BCG Matrix.

Full Transparency, Always

Blade Air Mobility BCG Matrix

The preview showcases the complete Blade Air Mobility BCG Matrix report you'll receive. Upon purchase, the identical, fully functional document is instantly yours. Ready for strategic planning, this professionally crafted file awaits download. No alterations or incomplete sections—just the finished analysis. This is the same document to download and use.

BCG Matrix Template

Blade Air Mobility's BCG Matrix offers a snapshot of its diverse offerings, from short-hop flights to aircraft sales. The matrix highlights which areas drive revenue and which might need reevaluation. Identify market stars with high growth potential and cash cows generating consistent profits. Recognize potential dogs and question marks needing strategic attention.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Blade's medical transport, especially organ transport, is a Star. This sector shows strong revenue growth and profit, fueled by rising transplant numbers and partnerships. In Q3 2024, medical transport revenue increased by 25%. Blade's leadership in this market needs continued investment to stay ahead.

Blade's urban air mobility services are successful in New York and Southern Europe, where they have a strong market share. The company provides convenient alternatives to traffic. Investments in infrastructure and technology are important for future growth. In 2024, Blade saw its revenue increase, showing strong demand.

Blade's strategic partnerships, like the one with Skyports Infrastructure, are key. This collaboration offers flights between Downtown Manhattan and JFK. These alliances help expand services and improve customer experience. In 2024, Blade's partnerships are vital for growth and market reach.

EVA Transition

Blade's EVA transition is a compelling Star in its BCG Matrix. This move to electric aircraft offers potential for lower operating expenses and environmental benefits. The company's investments in EVA infrastructure are key for future growth, including strategic partnerships. The transition to EVA is expected to significantly reduce noise pollution, which can attract new customers.

- Operational costs could be reduced by up to 40% with EVA compared to traditional helicopters.

- Blade has secured partnerships with several EVA manufacturers, including Beta Technologies.

- EVA adoption aligns with the growing demand for sustainable transportation options.

- The global eVTOL market is projected to reach $24.8 billion by 2030.

Technology Platform

Blade's technology platform is a Star, providing real-time tracking and customer management. This platform supports scalability and operational efficiency, crucial for growth. The company's investment in its platform has been consistent, with technology and development costs reaching $3.3 million in Q3 2024. This focus helps maintain a competitive edge.

- Blade's tech platform supports real-time tracking and customer management.

- It enables scalability and operational efficiency.

- Investment in the platform reached $3.3M in Q3 2024.

- This technology is key to competitive advantage.

Blade's medical transport, urban air mobility, strategic partnerships, EVA transition, and technology platform are Stars. These segments show strong growth, profitability, and market leadership. They are critical for Blade's success and require continuous investment.

| Segment | Key Features | Financial Data (Q3 2024) |

|---|---|---|

| Medical Transport | Organ transport, partnerships | Revenue +25% |

| Urban Air Mobility | Strong market share, convenient services | Revenue increased |

| Strategic Partnerships | Downtown Manhattan to JFK flights, collaborations | Vital for growth |

| EVA Transition | Electric aircraft, lower costs, environmental benefits | Operational costs could be reduced by up to 40% |

| Technology Platform | Real-time tracking, customer management | Technology and development costs reaching $3.3 million |

Cash Cows

Blade's helicopter transfers, especially between Manhattan and JFK/Newark, are cash cows. They operate in mature markets, generating consistent revenue. In 2024, these routes likely saw stable demand. Optimize pricing and manage costs for profitability.

Blade's fixed-wing charter services, serving corporate and private clients, represent a "Cash Cow" in its BCG Matrix. These services generate consistent revenue with high client retention, indicating a stable income source. The market is well-established, reducing promotional investment needs, and focusing on service quality and client relations is key. In Q3 2024, Blade reported a 15% increase in fixed-wing flight hours.

Blade's inter-city services, especially in the Northeast, are Cash Cows. These routes have strong market positions and steady ridership, ensuring consistent revenue. In 2024, the Northeast corridor saw approximately 15,000 passenger trips monthly. Focusing on efficient routes and cost management is crucial for maximizing profits from these established connections.

European Operations

Blade's European helicopter passenger service, especially in Southern Europe, operates as a cash cow due to its established market position. These routes see consistent demand from both tourists and business travelers, ensuring steady revenue. The focus should be on maintaining operational efficiency and controlling costs to maximize cash flow. Blade's European operations generated approximately $10.5 million in revenue in 2023.

- Established market position in Southern Europe.

- Consistent demand from tourists and business travelers.

- Focus on operational efficiency.

- 2023 revenue of approximately $10.5 million.

Partnerships with Existing Helicopter Operators

Blade's partnerships with existing helicopter operators are key to its cash flow, supporting its asset-light model. This approach minimizes capital spending, boosting financial health. Continuously assess these partnerships for optimal terms and high service standards.

- Blade's model reduces capital needs, improving cash flow.

- Partnership terms must be regularly reviewed and optimized.

- Maintaining service quality is a priority.

- This strategy has helped Blade maintain operational efficiency.

Blade's cash cows are its strongest revenue generators. These include established routes like Manhattan to JFK/Newark and inter-city services. Focus on efficiency and cost management to maximize profits. Partnerships also contribute significantly to cash flow.

| Cash Cow | Revenue Stream | Key Strategy |

|---|---|---|

| Helicopter Transfers | Consistent demand | Optimize pricing |

| Fixed-wing Charter | High client retention | Service quality |

| Inter-city Services | Steady ridership | Cost management |

Dogs

Blade Air Mobility's discontinued Canadian operations are classified as a Dog in the BCG Matrix. The company exited the Canadian market due to underperformance. This strategic move helps avoid further investment in unprofitable ventures. Focusing on more lucrative markets is key for Blade's financial health. As of 2024, Blade's revenue is approximately $300 million.

Traditional helicopter charter services, facing declining market relevance, align with the "Dog" quadrant of the BCG Matrix. These services encounter rising competition and changing consumer preferences, impacting profitability. For instance, in 2024, the segment saw a 7% decrease in bookings compared to the previous year. Minimize investment in this area. Explore transitioning these services to more sustainable and profitable alternatives.

Unprofitable routes for Blade Air Mobility represent areas where financial losses are consistently incurred. These routes, failing to generate sufficient revenue to cover operational costs, negatively impact overall profitability. In 2024, analyzing route performance is crucial, with a focus on discontinuing or restructuring underperforming segments. This could involve reevaluating pricing, adjusting schedules, or even terminating routes that consistently drain resources.

High-Cost Marketing Campaigns with Low ROI

In the context of Blade Air Mobility's BCG Matrix, "Dogs" represent high-cost marketing campaigns with low returns. These initiatives drain resources without significant revenue or brand impact. For example, a 2024 study showed that 30% of marketing spend is wasted due to poor targeting. Re-evaluating strategies is crucial.

- Ineffective campaigns consume resources.

- Focus on targeted, cost-effective approaches.

- Poor ROI leads to wasted budget.

- Re-evaluate and adjust marketing strategies.

Underutilized Assets

Dogs in the BCG matrix for Blade Air Mobility represent underperforming assets, such as aircraft or infrastructure, that aren't generating enough revenue. These assets consume capital without delivering sufficient returns, impacting overall operational efficiency. In 2024, Blade faced challenges with aircraft utilization rates, which were below optimal levels. To improve, Blade must consider strategic divestment or repurposing these assets.

- Inefficient Aircraft Utilization: In 2024, some of Blade's aircraft experienced low flight hours, indicating underutilization.

- High Maintenance Costs: Underutilized aircraft can still incur significant maintenance expenses, further straining resources.

- Market Demand: Blade's market analysis showed certain routes or aircraft types had lower demand, contributing to underperformance.

- Strategic Options: Divestiture or repurposing of underperforming assets will improve the company's financial performance.

Blade Air Mobility's "Dogs" include unprofitable segments like discontinued operations and underperforming assets. These areas drain resources and diminish overall profitability. In 2024, focusing on high-growth markets is crucial for Blade's financial health, which shows a $300 million revenue.

| Category | Description | Impact |

|---|---|---|

| Underperforming Routes | Routes with low passenger volume or high operating costs. | Reduced revenue, increased costs. |

| Ineffective Marketing | Campaigns with low ROI, poor targeting. | Wasted budget, minimal impact. |

| Underutilized Assets | Aircraft or infrastructure not generating enough revenue. | High maintenance costs, low returns. |

Question Marks

Blade's EVA integration is a Question Mark. The switch to EVA promises lower costs and eco-friendliness, but demands major infrastructure investments. Securing regulatory approvals and fostering technological advancements are crucial. Feasibility studies and pilot programs will guide investment choices. In 2024, the eVTOL market is projected to reach $1.7 billion.

Blade Air Mobility's foray into new markets like European routes or expanded cargo services, classifies it as a Question Mark. These initiatives hold high growth potential but face risks. For example, Blade's revenue in Q3 2023 was $100.9 million, demonstrating the need for strategic market analysis. Pilot programs are crucial to mitigate risk.

The organ matching service is a Question Mark for Blade Air Mobility. It needs heavy investment in tech and partnerships. Success hinges on growth and profitability. This segment could boost hospital services and market share. Evaluate the service's performance to guide future investments.

European Restructuring

The European restructuring is a "Question Mark" in Blade Air Mobility's BCG matrix. This initiative aims to boost profitability and streamline operations, but it faces integration and market risks. Successful execution is vital, as indicated by the 2024 financial reports; Blade reported a loss of $25 million in Europe. Monitor the restructuring's progress and adapt strategies accordingly.

- Restructuring aims to enhance profitability.

- Integration and market acceptance pose risks.

- 2024 European losses totaled $25 million.

- Adaptation is key for successful implementation.

Critical Time Cargo Expansion

Venturing into critical time cargo transport classifies as a Question Mark in Blade Air Mobility's BCG Matrix. This expansion could open new revenue streams, utilizing their current setup. However, it demands specific skills and regulatory clearances. Blade must carefully assess the market and run pilot programs before investing.

- Expansion into critical time cargo is a Question Mark.

- Potential to diversify revenue streams.

- Requires specialized expertise.

- Needs thorough market research.

Blade Air Mobility's Question Marks involve high-potential but risky ventures. These initiatives need careful evaluation due to market uncertainties. Successful strategies and adapting to challenges are key for growth. Blade's strategic moves require diligent monitoring and nimble adjustments.

| Aspect | Description | Impact |

|---|---|---|

| Market Entry | New routes, services. | High growth, high risk. |

| Strategic Moves | Cargo transport, organ matching. | Revenue boost potential. |

| Financial Planning | Europe restructuring, expansion plans. | Requires precise forecasting. |

BCG Matrix Data Sources

Blade Air Mobility's BCG Matrix relies on market research, financial reports, competitor analyses, and expert evaluations for dependable, insightful positioning.