Bloomberg PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bloomberg Bundle

What is included in the product

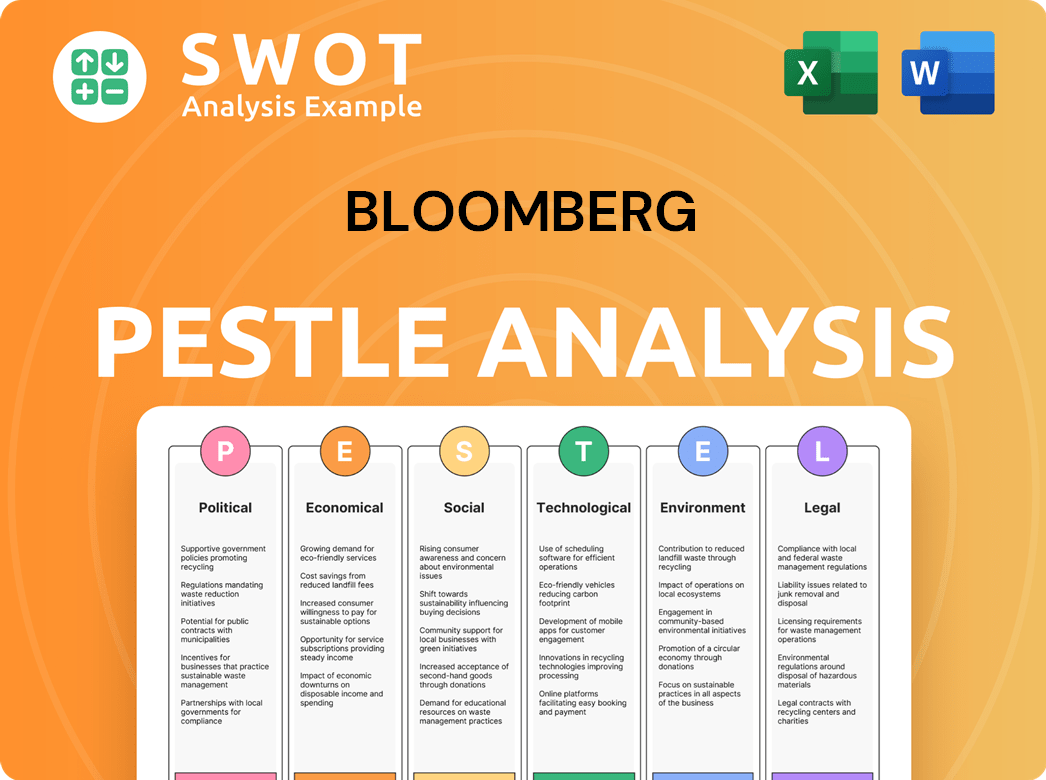

The Bloomberg PESTLE Analysis examines macro-environmental influences across six factors.

Quickly highlights key drivers with concise summaries and easily digestible graphics.

Preview Before You Purchase

Bloomberg PESTLE Analysis

The Bloomberg PESTLE Analysis preview demonstrates the complete document. The insights, formatting, and data within the preview are identical.

The content, structure, and design here mirror what you download immediately.

This is the real, final product, ready after purchase. No hidden content!

PESTLE Analysis Template

Our PESTLE analysis of Bloomberg provides a comprehensive overview of external factors. This crucial report examines political, economic, social, technological, legal, and environmental influences. You'll gain insights into Bloomberg's operating environment and how to navigate its complexities. Make data-driven decisions and understand industry-specific implications. Don't get left behind – download the full, in-depth PESTLE analysis now!

Political factors

Bloomberg faces stringent government regulations globally, significantly impacting its operations. Compliance with data privacy laws like GDPR and financial reporting standards is essential. The SEC's data tagging tech aims for faster reviews in 2024. Bloomberg Law offers analysis on these evolving regulatory landscapes, crucial for staying compliant. Bloomberg's legal and compliance costs are substantial, reflecting the importance of regulatory adherence.

Geopolitical stability significantly impacts financial markets, influencing investment decisions and market trends. Bloomberg's tools are crucial for navigating volatility from global events. Elevated tensions often drive demand for real-time data, like in 2024 when geopolitical risks affected various sectors. For instance, the Russia-Ukraine conflict caused significant market fluctuations. Increased geopolitical stress can lead to volatility in financial assets.

Bloomberg Philanthropies collaborates with governments, notably through the Mayors Challenge, fostering innovation in public services. This initiative goes beyond regulatory compliance, focusing on data-driven improvements. The 2024-2025 Mayors Challenge aims to enhance urban life globally. In 2024, the challenge awarded $5 million in prizes.

Trade Policies and Tariffs

Changes in trade policies and tariffs significantly impact global economic activity and market sentiment. Bloomberg provides data and news to help clients understand these shifts. For example, in 2024, the US-China trade tensions continue to be a key focus. Bloomberg News reports on the effects of tariffs on businesses and the economy, offering insights for investment decisions.

- US tariffs on Chinese goods affected $360 billion in trade by 2024.

- Bloomberg tracks real-time tariff updates.

- Trade policy changes influence currency values.

Political Influence and Advocacy

Bloomberg, as a key financial data provider, actively engages in political advocacy. This includes lobbying for policies impacting financial regulations, data access, and technological advancements. Michael Bloomberg's political and philanthropic roles shape public opinion and policy debates. In 2024, Bloomberg spent approximately $4.8 million on lobbying efforts. Bloomberg has advocated for enhanced corporate sustainability disclosures.

- Advocacy for financial industry policies.

- Lobbying efforts exceeding $4 million annually.

- Promotion of improved sustainability disclosures.

Political factors heavily influence Bloomberg's operations through regulations and trade policies. Government compliance, like GDPR, incurs significant costs. Geopolitical events drive real-time data demand, affecting investment decisions. Bloomberg engages in political advocacy, spending millions on lobbying to shape financial regulations.

| Political Factor | Impact | Data (2024-2025) | |

|---|---|---|---|

| Regulations | Compliance costs | SEC data tagging for faster reviews, Bloomberg's legal costs. | |

| Geopolitics | Market volatility | Russia-Ukraine conflict's market effects, increased demand for real-time data during heightened tensions. | |

| Trade Policy | Economic activity, currency values | US tariffs on Chinese goods affected $360B in trade by 2024; Bloomberg tracks real-time tariff updates. | |

| Advocacy | Policy Influence | Bloomberg spent ~$4.8M on lobbying in 2024, promoting sustainability disclosures. |

Economic factors

Bloomberg's success is closely tied to global economic health. Strong economic periods boost financial markets, increasing demand for its services. The financial data and infrastructure sector has grown significantly. In 2024, the global financial data market was valued at approximately $35 billion. Projections suggest continued expansion through 2025.

Market volatility and trading volume significantly impact Bloomberg Terminal usage. Increased volatility, like the 2024-2025 period's fluctuations, boosts demand for real-time data. Higher trading volumes, seen with the S&P 500's activity, drive up the need for Bloomberg's services. Geopolitical events and economic uncertainty, for example, the 2024 US elections, amplify volatility, making Bloomberg crucial for informed decisions.

Bloomberg faces stiff competition from Refinitiv (LSEG Data & Analytics) and S&P Capital IQ. Refinitiv held about 23% of the market share in 2024, while Bloomberg's terminal boasted a significant presence. Pricing strategies of competitors impact Bloomberg's revenue. Bloomberg Terminal's high market share is a crucial economic factor.

Currency Exchange Rates

As a global entity, Bloomberg faces currency exchange rate risks, affecting revenue and costs. Currency fluctuations can significantly alter financial outcomes. For example, a stronger US dollar could reduce the value of Bloomberg's international revenue. These changes are a key economic factor for any multinational. In 2024, the EUR/USD exchange rate fluctuated, impacting European revenue streams.

- Currency volatility directly impacts profitability.

- Exchange rate movements require hedging strategies.

- Major currencies like USD, EUR, and JPY are key.

- Bloomberg monitors exchange rates closely.

Inflation and Interest Rates

Inflation and interest rates are critical economic factors. Central bank policies directly affect borrowing costs and investment decisions. These, in turn, influence the financial markets. High interest rates impacted direct lending returns in 2024.

- The Federal Reserve held rates steady in May 2024, but future cuts are expected.

- Inflation in the US was around 3.3% in April 2024, still above the Fed's 2% target.

- Direct lending returns in 2024 have been influenced by elevated rates.

Bloomberg thrives with a robust global economy. In 2024, the financial data market hit about $35 billion, forecasting continuous growth through 2025. High trading volumes and volatility boost Terminal usage. Increased currency risks and rates need hedging.

| Economic Factor | Impact on Bloomberg | 2024/2025 Data Points |

|---|---|---|

| Economic Growth | Increases demand for services | Global financial data market at ~$35B in 2024, with expansion anticipated in 2025. |

| Market Volatility | Drives real-time data usage | S&P 500 volatility fluctuations increased Terminal demand. US Elections in 2024 influenced it. |

| Currency Exchange | Affects revenue and costs | EUR/USD exchange fluctuations altered European revenues in 2024; rates impact. |

| Inflation/Interest Rates | Influences borrowing, investment | US inflation about 3.3% in April 2024, Federal Reserve steady in May 2024, expect cuts |

Sociological factors

The demand for financial literacy is surging across the board. Bloomberg addresses this with services like the Terminal, crucial for education. Universities utilize the Terminal for training, with over 250,000 students gaining experience annually in 2024. Bloomberg also runs trading challenges. These initiatives boost financial education.

Attracting top talent is crucial. Bloomberg's workplace culture and diversity efforts impact recruitment. In 2024, tech and finance saw high demand. Bloomberg Law analyzes labor issues, aiding in talent strategies. Employee well-being programs boost retention.

Bloomberg continuously adapts its offerings to reflect the shifting needs of financial professionals. User demographics and work habits drive the demand for integrated, user-friendly interfaces. The buy-side segment's growth influences financial data industry trends. In 2024, the buy-side accounted for approximately 40% of Bloomberg's terminal users, signaling its significant influence.

Public Perception and Trust

Bloomberg's standing as a reliable financial information source significantly impacts its brand and customer trust. Maintaining journalistic integrity and data accuracy is paramount for sustaining this trust. Bloomberg strives to be the most trusted information network globally for financial professionals. The company's reputation is built on providing dependable and accurate data. In 2024, Bloomberg's market share in the financial data and analytics sector was approximately 33%, reflecting strong customer confidence.

- Bloomberg's brand value in 2024 was estimated at $25 billion.

- Customer satisfaction scores for Bloomberg terminals consistently remain above 85%.

- Bloomberg employs over 2,700 journalists and analysts globally.

- Bloomberg's revenue in 2024 reached $13.3 billion.

Social Responsibility and Community Engagement

Bloomberg demonstrates strong social responsibility, impacting its community and stakeholders. The company's commitment includes initiatives via Bloomberg Philanthropies. In 2023, Bloomberg's annual giving totaled $3 billion, reflecting a significant investment in societal well-being. This commitment enhances Bloomberg's reputation and relationships.

- Bloomberg Philanthropies focuses on public health, education, and the arts.

- The $3 billion in annual giving for 2023 highlights its social impact.

- Social responsibility positively influences stakeholder relationships.

Financial literacy programs expand through services like Bloomberg Terminal. In 2024, over 250,000 students used the Terminal for financial education. These efforts boost the knowledge of individuals and professionals, making financial insights accessible to many.

Bloomberg focuses on workforce diversity to draw in top talent and stay ahead. The labor market experienced shifts in 2024. Employee well-being efforts aim at retaining people, impacting Bloomberg's competitive edge.

Bloomberg's solid reputation comes from trust built through dependable data. In 2024, its market share in the sector was roughly 33%, a sign of client confidence. Initiatives such as giving through Bloomberg Philanthropies reflects an investment in society.

| Factor | Details | Impact |

|---|---|---|

| Financial Literacy | 250K+ students on Terminal | Increases skills, drives usage |

| Talent Management | Workplace diversity programs | Improves retention rates |

| Social Responsibility | $3B annual giving (2023) | Enhances brand, builds trust |

Technological factors

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing finance, including at Bloomberg. These technologies boost data processing and improve analytical capabilities. Bloomberg uses AI to refine financial data and create actionable insights. For example, in Q1 2024, AI-driven tools increased data processing speeds by 20%.

Bloomberg thrives on its ability to manage and analyze massive real-time financial data. Strong data management and analytical tools are vital for staying ahead. In 2024, Bloomberg processed over 100 terabytes of daily financial data. Its tech delivers data, news, and analytics innovatively.

Cybersecurity is crucial for financial data. Bloomberg Terminal and services must guard against threats to maintain trust. Data protection is key in the legal landscape. The global cybersecurity market is projected to reach $345.7 billion by 2026. In 2024, data breaches cost companies an average of $4.45 million.

Cloud Computing and Infrastructure

Bloomberg heavily relies on cloud computing and infrastructure for its global operations. This enables efficient and reliable service delivery to a wide user base. Cloud data platforms are crucial for optimizing data-driven financial operations. The cloud infrastructure market is projected to reach $1.6 trillion by 2025.

- Bloomberg leverages cloud services for data storage and processing.

- Cloud adoption enhances scalability and reduces operational costs.

- Investments in cloud tech support its global data distribution.

Evolution of Financial Technology (FinTech)

The FinTech landscape is rapidly changing, impacting financial tools and services. Bloomberg must adapt to include areas like embedded finance and DeFi. The global FinTech market is projected to surpass $340 billion by 2025, creating both opportunities and challenges. This requires innovation in trading platforms and data analytics to stay competitive.

- FinTech market expected to exceed $340 billion by 2025.

- Embedded finance and DeFi are key areas of growth.

- Bloomberg needs to integrate new technologies.

- Trading platforms are evolving rapidly.

Technological factors critically shape Bloomberg's operations. AI and ML enhance data processing and analytical capabilities, with AI tools boosting data speeds. Cloud computing and FinTech developments are pivotal. The global cloud market is expected to hit $1.6 trillion by 2025.

| Technology Area | Impact | 2024/2025 Data |

|---|---|---|

| AI/ML | Improved data analysis and efficiency. | 20% increase in data processing speed (Q1 2024) |

| Cloud Computing | Scalability and cost reduction for global operations. | Projected market size of $1.6 trillion by 2025 |

| FinTech | Adaptation and integration of new financial tools. | FinTech market expected to exceed $340 billion by 2025 |

Legal factors

Bloomberg must comply with data privacy laws like GDPR due to its handling of sensitive financial data. These regulations govern data collection, use, and storage. Failure to comply can lead to significant penalties and reputational damage. The global data privacy market is projected to reach $13.3 billion by 2025. Data breaches are a constant threat, with costs averaging $4.45 million per incident in 2023.

Bloomberg faces stringent financial regulations globally, impacting trading, reporting, and market surveillance. Compliance is crucial for its operations and reputation. Bloomberg Law offers insightful analysis on regulatory matters. For 2024, the SEC has increased scrutiny on data providers. The company must adapt to rapidly changing regulatory landscapes.

Bloomberg heavily relies on intellectual property to safeguard its competitive edge, particularly concerning its data, software, and analytical tools. The company actively pursues patents, copyrights, and trademarks to protect its proprietary assets. The increasing influence of generative AI has amplified the importance of intellectual property rights for companies like Bloomberg. In 2024, the global market for intellectual property rights reached approximately $280 billion.

Litigation and Legal Challenges

Bloomberg, as a major financial data provider, can encounter legal issues like contract disputes or intellectual property infringements. Knowing about potential lawsuits is key for stakeholders. For instance, in 2024, financial firms faced around 6,000 legal actions. Bloomberg itself has been involved in employment-related litigation. Monitoring such cases is crucial for assessing risks.

- Contract disputes can arise from data licensing agreements.

- Intellectual property challenges may involve data usage.

- Employment litigation includes discrimination claims.

- Regulatory investigations can lead to legal battles.

Regulatory Scrutiny of Financial Data Providers

Financial data providers like Bloomberg are under heightened regulatory pressure. This involves ensuring data quality, being transparent, and assessing their market impact. Bloomberg must prove its data and services are reliable amid this scrutiny. Regulatory demands and corporate practices will likely clash. In 2024, the SEC increased its focus on data vendors, including Bloomberg.

- SEC fines for data breaches and inaccuracies rose by 20% in 2024.

- Bloomberg's compliance costs increased by 15% due to new regulations.

- EU's Digital Markets Act (DMA) adds further compliance burdens.

Bloomberg is significantly influenced by global data privacy laws, like GDPR, given its handling of sensitive financial information. Compliance is critical; the data privacy market is projected to reach $13.3 billion by 2025. The SEC's increased scrutiny in 2024 highlights the growing importance of adherence to financial regulations.

Bloomberg depends heavily on its intellectual property for competitive advantage, particularly data and software. This need to protect its innovations is amplified by the rise of generative AI; the global market for intellectual property reached around $280 billion in 2024.

Legal challenges such as contract disputes and intellectual property infringements can arise, and it must continuously monitor and respond. Financial firms faced around 6,000 legal actions in 2024. In 2024, SEC fines for breaches increased by 20%.

| Legal Factor | Impact | 2024 Data |

|---|---|---|

| Data Privacy | Compliance costs, penalties | Data breach costs average $4.45M |

| Financial Regulations | Operational impacts, legal risks | SEC scrutiny increased on data providers |

| Intellectual Property | Competitive advantage protection | Global IP market approx. $280B |

Environmental factors

Climate change is significantly impacting financial markets, increasing demand for ESG data and analysis tools. Bloomberg offers solutions like climate scenario analysis and carbon footprinting. The 2023 Impact Report highlighted Bloomberg's climate change initiatives. In 2024, investors are increasingly using climate data to assess risks, with over $40 trillion in assets under management now considering ESG factors.

Environmental, Social, and Governance (ESG) factors are increasingly vital in investment strategies, pushing the need for dependable ESG data. Bloomberg has substantially improved its ESG data, leading the market in ESG analytics. They cover over 15,000 companies globally with ESG data, reflecting the growing importance of sustainability. In 2024, ESG assets reached $40.5 trillion.

Bloomberg's data centers and tech infrastructure's energy use is a key environmental factor. Energy efficiency and renewable energy sources are vital for sustainability. Bloomberg aims for net-zero carbon emissions and 100% renewable energy by 2025. In 2024, Bloomberg's efforts supported these goals. The company's investments in green initiatives are significant.

Supply Chain Environmental Impact

Bloomberg's supply chain, including Terminal and hardware manufacturing, faces environmental scrutiny. Sustainable sourcing and supply chain management are crucial. Bloomberg plans to calculate Scope 3 emissions from hardware production, enhancing transparency. This aligns with growing investor and regulatory demands for environmental accountability.

- Bloomberg's 2023 Environmental, Social, and Governance (ESG) report highlights supply chain sustainability efforts.

- The company is exploring options for reducing the carbon footprint of its hardware production.

- Bloomberg aims to improve data on supply chain emissions to inform reduction strategies.

Regulatory and Policy Changes Related to Environment

Evolving environmental regulations and policies, especially those on carbon emissions and sustainability reporting, significantly affect companies. Bloomberg offers regulatory data solutions for various environmental reporting standards, aiding in compliance. Bloomberg is broadening its regulatory data to include ISSB standards, reflecting the growing importance of these guidelines. The global green finance market is projected to reach $30 trillion by 2030, highlighting the financial impact of these changes.

- Bloomberg provides data on over 100,000 environmental regulations.

- The ISSB standards are expected to be adopted by over 70 countries by 2025.

- Companies face potential fines for non-compliance, which can range from thousands to millions of dollars.

Climate risks prompt financial market shifts, spurring ESG data demand, with over $40 trillion in assets prioritizing ESG. Bloomberg boosts ESG data, now covering 15,000+ companies globally and investing heavily in eco-friendly practices. Stricter environmental rules influence companies, leading to a $30 trillion green finance market by 2030, where regulatory data aids compliance.

| Aspect | Data Point | Impact |

|---|---|---|

| ESG Assets (2024) | $40.5 trillion | Investment focus shift |

| Companies with ESG Data | 15,000+ | Data Availability |

| Green Finance Market (2030) | $30 trillion projected | Financial Regulation Boost |

PESTLE Analysis Data Sources

The Bloomberg PESTLE Analysis integrates diverse data from economic indicators, government reports, and market research. This data is gathered from global sources.