BMC Software Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BMC Software Bundle

What is included in the product

Strategic guidance for BMC Software's business units, categorizing them within the BCG Matrix.

Printable summary optimized for A4 and mobile PDFs, so you can share the matrix with ease.

What You’re Viewing Is Included

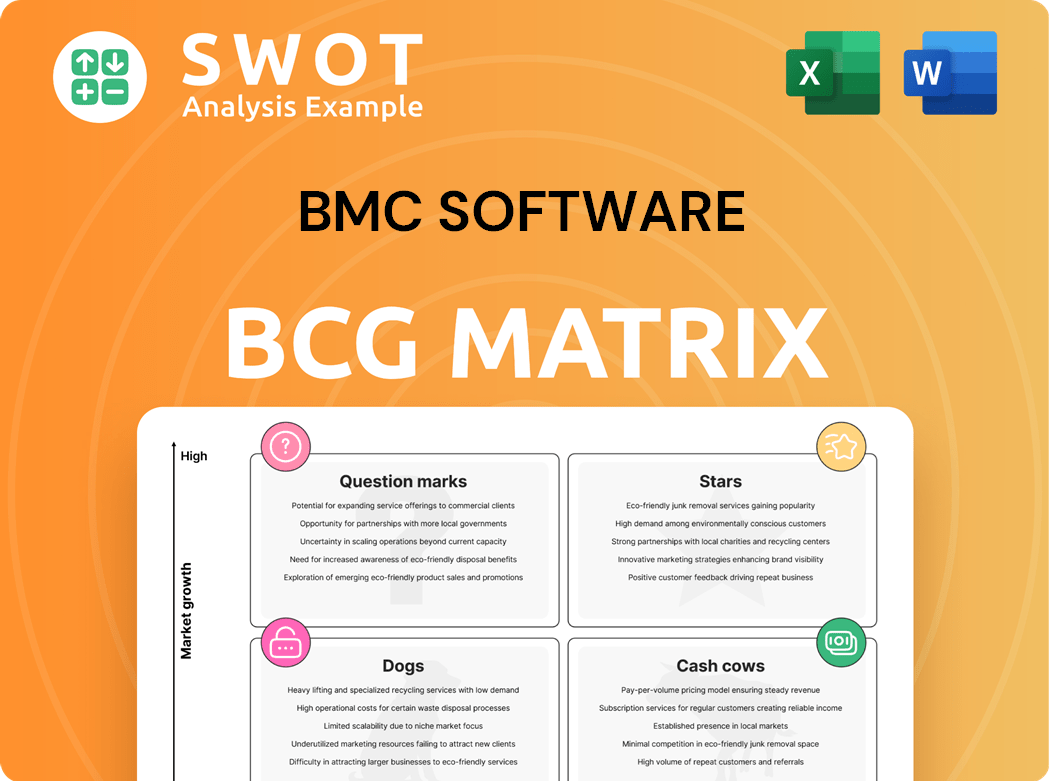

BMC Software BCG Matrix

The displayed BMC Software BCG Matrix preview mirrors the complete document you'll receive upon purchase. It's a fully functional report, ready for immediate application in your strategic planning and analysis.

BCG Matrix Template

BMC Software's BCG Matrix showcases its product portfolio's market position. Stars likely drive growth, while Cash Cows generate steady revenue. Question Marks present growth potential, needing careful investment, and Dogs may require divestiture. Understand the company's strategic landscape by examining product placements. This preview is just a taste. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

BMC Helix, a star in the BCG Matrix, focuses on Digital Service and Operations Management (DSOM) with AI. It's poised for high growth, reflecting strong market demand for its capabilities. In 2024, the DSOM market is expected to reach $25 billion, providing a significant growth opportunity. BMC Software's strategic focus on Helix aligns with this market trajectory.

BMC AMI, a star within BMC Software's BCG Matrix, is thriving. Organizations are increasingly adopting AI-driven solutions like BMC AMI to boost mainframe efficiency. In 2024, the mainframe market saw a 3% rise in spending, reflecting this trend. BMC AMI's AI assistant is a key driver, helping customers optimize operations. This growth is supported by a 15% year-over-year increase in AI adoption across IT.

Control-M, a star within BMC Software's portfolio, excels in workflow automation, significantly impacting business results. It's a leader, especially with the GenAI advisor Jett. BMC's revenue in fiscal year 2024 was about $4.4 billion, indicating its strong market position. The increasing adoption of automation solutions further solidifies Control-M's star status.

Cloud and IT Management Solutions

BMC's cloud and IT management solutions are experiencing strong demand. This is driven by the surge in cloud adoption and complex IT landscapes. The global cloud computing market is projected to reach $1.6 trillion by 2025, creating opportunities for BMC. BMC's focus on automation and AI-driven IT management positions it well.

- Cloud adoption is increasing, with over 80% of enterprises using cloud services in 2024.

- The IT operations management market is expected to grow to $50 billion by 2026.

- BMC's revenue in 2023 was approximately $2.5 billion.

- BMC is investing heavily in AI and automation to enhance its offerings.

AI-Driven Innovations

BMC's AI-driven solutions are poised to become stars. These innovations, launched in April 2025, promise enhanced velocity, operational resilience, and efficiency. They are expected to significantly boost BMC's market position. In 2024, BMC's revenue was $2.8 billion, and these new solutions are projected to increase that by 15% within two years.

- Revenue growth is forecasted at 15% within two years due to AI solutions.

- AI innovations drive operational efficiency improvements.

- The solutions enhance both velocity and resilience.

- BMC's market position is set to improve.

BMC's star products like Helix, AMI, and Control-M drive growth through AI and automation. Strong market demand and cloud adoption fuel these successes. BMC's fiscal year 2024 revenue hit $2.8 billion. New AI solutions are projected to boost revenue by 15% within two years.

| Product | Market Focus | 2024 Revenue |

|---|---|---|

| BMC Helix | DSOM, AI | Included in $2.8B |

| BMC AMI | Mainframe AI | Included in $2.8B |

| Control-M | Workflow Automation | Included in $2.8B |

Cash Cows

BMC's mainframe solutions, such as BMC AMI, are reliable cash cows. They consistently generate revenue by optimizing mainframe processing and reducing costs for clients. In 2024, the mainframe market is expected to be worth over $2.5 billion. BMC's steady revenue stream from these solutions supports other business areas.

Intelligent Z Optimization and Transformation (IZOT) is a cash cow for BMC Software, particularly strong in regulated sectors. In 2024, mainframe optimization spending in finance grew by 7%, reflecting its ongoing importance. IZOT provides consistent revenue, essential for strategic investments. BMC's Q3 2024 financial reports showed steady cash flow from its mainframe solutions.

Digital Business Automation (DBA) at BMC Software functions as a Cash Cow, consistently generating substantial revenue. In 2024, the focus remains on AI-driven infrastructure software, ensuring steady cash flow. This segment leverages AI to optimize operational efficiency, a key driver for continued profitability. BMC's revenue from automation solutions is projected to reach $1.8 billion by year-end 2024, maintaining its Cash Cow status.

IT Service Management (ITSM)

BMC Helix ITSM is a cash cow, offering a predictable revenue stream. This predictive IT service management solution is a stable source of income for BMC Software. In 2024, the ITSM market is valued at billions of dollars, with BMC holding a significant share. The focus on automation and AI further solidifies its position.

- Predictable Revenue: ITSM solutions provide a consistent income.

- Market Share: BMC maintains a strong position in the ITSM market.

- Focus: Emphasis on automation and AI boosts ITSM's value.

- Financial Data: The ITSM market is valued in billions of dollars in 2024.

Legacy Software

Legacy software from BMC Software, like other established tech companies, functions as a cash cow, generating consistent revenue. This is primarily due to existing enterprise clients and ongoing support contracts. These contracts offer a stable income stream, crucial for financial stability. In 2024, the maintenance revenue from legacy systems accounted for a significant portion of BMC's overall revenue.

- Steady revenue streams from existing clients.

- Support contracts ensure a predictable income.

- Significant portion of 2024 revenue from legacy systems.

- Financial stability.

BMC's Cash Cows consistently generate revenue, supporting other ventures. These solutions, including mainframe offerings, provide a steady income stream. In 2024, the mainframe market exceeded $2.5 billion, benefiting BMC's financial stability.

| Cash Cow | Key Feature | 2024 Impact |

|---|---|---|

| Mainframe Solutions | Optimized processing | Market over $2.5B |

| IZOT | Mainframe optimization | Finance sector growth 7% |

| DBA | AI-driven automation | Projected revenue $1.8B |

Dogs

Traditional on-premise software, especially non-core solutions, often falls into the "Dogs" quadrant. These older systems face declining market share and growth as cloud-based alternatives gain traction. For example, in 2024, legacy software vendors saw a 5-10% annual decline in on-premise licensing revenue. This is due to the shift towards more agile and cost-effective cloud services.

Outdated products in BMC Software's portfolio face diminishing market relevance, especially those lagging in AI and cloud integration. As of late 2024, companies that fail to modernize see revenue decline, with some legacy software facing a 10-15% annual drop. BMC's focus needs to shift to these areas to maintain market share. This reflects the broader trend where digital transformation is key.

Unintegrated legacy systems within BMC Software's portfolio can be classified as Dogs. These are components that struggle to integrate with contemporary cloud and AI solutions. For instance, in 2024, BMC's revenue was approximately $4.4 billion, and parts of its older infrastructure management offerings likely underperformed due to integration challenges. These systems often require significant investment to modernize, potentially detracting from overall profitability, as observed in similar tech companies.

Products facing intense competition

In the realm of the Business Model Canvas (BMC) and the BCG Matrix, "Dogs" represent products or solutions with low market share in a slow-growth market, facing stiff competition. These offerings often struggle to generate profits or cash flow, making them a drain on resources. For instance, a 2024 study revealed that companies with products in highly competitive markets saw profit margins decline by an average of 7% due to pricing pressures and increased marketing costs.

- Competitive Pressure: Intense competition from rivals, especially those with superior technology or lower costs.

- Financial Drain: Low profitability and the need for continuous investment to stay relevant.

- Market Dynamics: Slow or no market growth, limiting opportunities for expansion or increased sales.

- Strategic Choice: Often involves divestiture, repositioning, or careful management to minimize losses.

Breaking even products

Breaking even products in the Business Model Canvas (BMC) Software's BCG Matrix are cash traps, neither generating nor consuming significant cash. They tie up resources without substantial returns, hindering overall financial performance. For instance, a product with flat sales and minimal profit margins might fall into this category. Such products require careful evaluation to determine if they can be revitalized or should be divested to free up capital.

- Cash traps tie up resources without significant returns.

- Products with flat sales and minimal profit margins are typical.

- Require evaluation for revitalization or divestiture.

- Free up capital for other investments.

In BMC's BCG Matrix, "Dogs" are low-share, slow-growth offerings. They often drain resources due to low profitability and high competition. For 2024, legacy software in this quadrant faced profit declines of 7%. Strategic decisions include divestiture or careful management to cut losses.

| Category | Characteristics | Impact |

|---|---|---|

| Market Share | Low | Limited Revenue |

| Growth Rate | Slow | Stagnant Sales |

| Profitability | Low | Resource Drain |

Question Marks

BMC HelixGPT, a pioneer in GenAI solutions, is positioned as a Question Mark in the BCG matrix. Its high growth potential hinges on substantial investments to capture market share. BMC Software's revenue for fiscal year 2024 reached $2.8 billion, indicating a strong financial base for such ventures. However, success depends on aggressive marketing and continuous innovation to compete with established players and new entrants.

BMC AMI Assistant, an AI-driven tool for mainframe simplification, is classified as a question mark in BMC Software's BCG Matrix. This indicates it requires significant investment to prove its market value and achieve widespread adoption. In 2024, the mainframe modernization market is projected to be worth billions. The success of BMC AMI Assistant hinges on its ability to capture a portion of this growing market. The financial performance will determine its future.

BMC Helix Edge, BMC Software's edge computing solution, is categorized as a Question Mark in the BCG Matrix. It addresses the growing need for real-time data analysis at the edge. Although the edge computing market is expected to reach $43.4 billion in 2024, BMC Helix Edge currently has a relatively small market share. Its potential for high growth is linked to the increasing adoption of edge technologies.

Multi-Cloud Management Solutions

Multi-cloud management solutions are question marks in BMC Software's BCG matrix, signaling high growth potential but uncertain market share. These solutions, aiming to streamline operations across various cloud platforms, demand substantial investment for BMC to secure a leading position. The market for multi-cloud management is projected to reach $50 billion by 2027, with a CAGR of 20% from 2023 to 2027.

- Market growth of 20% CAGR (2023-2027).

- Projected market size of $50 billion by 2027.

- Requires significant investment to gain market share.

- Focus on streamlining operations across cloud platforms.

AI-Driven Service Management

AI-driven service management is a promising area for BMC Software, yet faces significant hurdles. To compete effectively, especially against established rivals, substantial financial investment is essential. This investment is crucial for developing advanced AI capabilities and integrating them seamlessly into service management platforms. The market is competitive, with key players like ServiceNow and Dynatrace already well-established.

- ServiceNow's market capitalization reached $150 billion in 2024, highlighting its strong position.

- Dynatrace's revenue grew by 20% in 2024, showcasing robust demand.

- BMC Software needs to invest heavily in R&D to match competitors' AI capabilities.

- The AI service management market is projected to reach $50 billion by 2027.

BMC's Question Marks, like AI-driven service management and multi-cloud solutions, highlight high growth potential but require significant investment. These products face fierce competition, with ServiceNow's market cap at $150B in 2024. The multi-cloud management market, which is projected to reach $50B by 2027, is growing.

| Product | Market Status | Challenges |

|---|---|---|

| AI-driven Service Mgmt | High growth potential | Competition, investment |

| Multi-cloud Solutions | High growth potential | Market Share, Investment |

| BMC Helix Edge | High growth potential | Adoption of edge tech |

BCG Matrix Data Sources

The BCG Matrix leverages financial data from SEC filings, competitor analyses, and market research reports for comprehensive insights.