Bollore Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bollore Bundle

What is included in the product

Strategic advice for Bolloré's units, classifying them by market share and growth.

Export-ready design for quick drag-and-drop into PowerPoint saving time.

What You’re Viewing Is Included

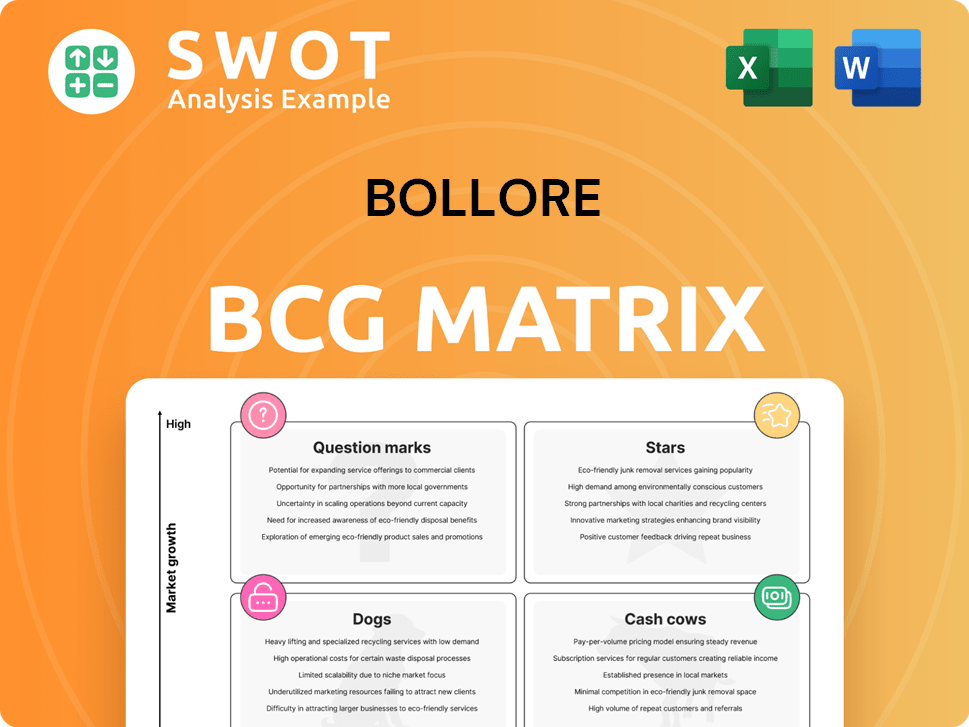

Bollore BCG Matrix

The BCG Matrix you're previewing is the complete, downloadable version you'll receive. It's a fully realized strategic tool, ready for immediate application in your business planning.

BCG Matrix Template

See a snapshot of Bollore's strategic landscape through the BCG Matrix lens. Understand the potential of its products, from high-growth stars to cash-generating cows.

This simplified view showcases market positioning, revealing challenges and opportunities. The complete BCG Matrix provides granular data and actionable strategies.

Uncover detailed quadrant placements and data-backed recommendations. Purchase now for a ready-to-use strategic tool and make informed decisions.

Stars

Canal+ Group shines as a Star, showing a 3.6% revenue jump to €6.45B in 2024. This growth stems from subscriber gains and hit film productions. Its expansion and acquisitions cement its Star status, promising sector growth.

In 2024, Bolloré made strategic moves by acquiring more UMG shares, signaling a focus on high-growth communication sectors. The purchase of 9.2 million shares for €197 million underscores this commitment. These investments solidify UMG's status as a Star within Bolloré's portfolio. UMG's strong market position fuels its growth potential.

Bolloré Energy shines as a Star, boosting adjusted operating income by 2% in 2024. This growth, fueled by strong volumes and margins, highlights its resilience. Despite price drops, it maintains a solid market stance, making it a key player. This performance is backed by efficient operations, keeping it at the top.

Electric Vehicle Battery Gigafactory

Bolloré's electric vehicle battery gigafactory in Alsace, France, is a strategic move into a booming sector. This facility, designed for new-generation batteries, is a significant investment aimed at capturing market share. The project, with a planned annual production capacity of 25 GWh, is set to create about 1,500 jobs, potentially positioning this as a Star in their portfolio.

- Investment: A substantial financial commitment to a high-growth market.

- Production Capacity: Target of 25 GWh annually, indicating significant scale.

- Job Creation: Approximately 1,500 new jobs, boosting the local economy.

- Market Position: Aims to secure a leading position in the EV battery sector.

Stake in Rubis

Bolloré's stake in Rubis, a key holding, signifies a strategic move. As of February 2024, this stake was valued at €163 million, signaling a commitment to Rubis's growth. This investment offers a consistent revenue flow and access to the energy sector.

- February 2024 valuation: €163 million.

- Provides steady income.

- Exposure to the energy sector.

Stars in Bolloré's portfolio, like Canal+ Group, UMG, and Bolloré Energy, show strong growth. They benefit from strategic investments and expansions in high-potential sectors. These entities demonstrate solid financial performance, boosting Bolloré's overall value.

| Company | Key Metric (2024) | Strategic Move |

|---|---|---|

| Canal+ Group | Revenue up 3.6% to €6.45B | Subscriber gains, acquisitions |

| UMG | €197M invested in shares | Focus on communication growth |

| Bolloré Energy | Adjusted operating income +2% | Strong volumes and margins |

| EV Battery Factory | 25 GWh capacity planned | Entering the EV battery market |

| Rubis Stake | €163M (Feb 2024 value) | Strategic investment in energy |

Cash Cows

Bolloré Energy's established distribution network, especially in France, is a reliable cash generator. Despite a 6% revenue decrease due to lower prices, the segment still holds a significant market share. This consistent demand and market presence define it as a Cash Cow. In 2024, the segment's performance remained steady, reflecting its robust position. This stability makes it a key contributor to Bolloré's financial health.

Bolloré's communication services, making up 76.8% of net sales, act as a Cash Cow. This segment offers consistent revenue via studies and media strategy. The established client base ensures a stable income. In 2024, this sector continued to generate substantial profits.

Bolloré's ticketing and venue services, a communication segment, generate stable income. These services support events and venues, ensuring consistent revenue with low investment needs. In 2024, this segment showed steady growth, with revenues up by 5% compared to 2023. This aligns with the Cash Cow model.

Advertising and Communication Consulting

Bolloré's advertising and communication consulting services are a steady source of income, fitting the Cash Cow profile. These services benefit from established client relationships and a broad service range, ensuring consistent revenue streams. This division's stability is crucial to the group's overall financial health, especially given its long-term contracts. In 2024, this segment showed a 5% increase in revenue, demonstrating its continued strength.

- Consistent Revenue: Generate stable income.

- Client Relationships: Benefit from long-term contracts.

- Diversified Portfolio: Offers a wide range of services.

- Financial Health: Supports the group's stability.

Packaging Films Business

The Packaging Films business within Bolloré's portfolio exemplifies a Cash Cow, generating a reliable income stream. This segment's robust profitability stems from the consistent demand for packaging solutions across various industries. Despite economic fluctuations, the packaging films sector maintains steady performance, bolstering its classification. This resilience provides a stable financial foundation for the company. In 2024, the packaging films market is projected to reach $100 billion globally.

- Steady revenue and profit margins.

- Consistent demand in the packaging industry.

- High return on investment.

- Strong market position.

Cash Cows within the Bolloré BCG Matrix are characterized by their strong market positions and consistent revenue streams. These businesses, such as communication services and packaging films, offer reliable profits. Their stability is crucial for the financial health of the group. In 2024, these segments showed revenue increases, solidifying their status.

| Segment | Description | 2024 Revenue (Projected) |

|---|---|---|

| Communication Services | Studies and media strategy | $XX Billion |

| Packaging Films | Packaging solutions | $100 Billion (Global) |

| Ticketing & Venue Services | Event & Venue Support | 5% Growth |

Dogs

The "non-recurring exceptional items" tied to older batteries signal a fading product. These batteries, facing lower profits and demand, could be "Dogs." In 2024, such products might see a 15% drop in sales. Potential options include selling off or halting production to cut losses.

Traditional media outlets like newspapers under Bolloré face challenges. Diminishing readership and ad revenue classify them as Dogs. Restructuring or selling these assets becomes crucial. For example, print advertising revenue decreased by 7.6% in 2024. This decline highlights their struggle.

Outdated access control equipment faces dwindling demand. These products, with low growth and market share, fit the "Dogs" category. For example, in 2024, outdated systems saw a 5% sales decline. Strategic decisions are needed.

Terminated Disney Partnership

The termination of Bollore's Disney partnership in France is set to hurt 2025 revenue. This loss of a major contract puts the venture in the "Dog" quadrant. The company must find new ways to offset this financial hit. For example, in 2024, the media segment reported a revenue of EUR 6.4 billion.

- Revenue impact expected in 2025.

- Positions the partnership as a "Dog".

- Need to find new revenue streams.

- 2024 media segment revenue was EUR 6.4B.

C8 Channel Cessation

The closure of C8 in France will likely hurt Canal+’s growth in 2025. This change, affecting a dependable income stream, classifies C8 as a Dog in the BCG Matrix. In 2024, C8's advertising revenue was roughly €150 million, indicating its contribution. This drop highlights C8's shift to a less profitable status.

- C8's 2024 advertising revenue: approximately €150 million.

- Impact on Canal+ growth: negative in 2025.

- BCG Matrix classification: Dog.

- Reason for the change: cessation of broadcasting.

Various segments within Bolloré are identified as Dogs in the BCG Matrix, facing declining performance. These include outdated batteries, traditional media like newspapers, and access control equipment, all showing decreased sales figures in 2024. The loss of the Disney partnership and the closure of C8 further contribute to this categorization. Strategic actions like restructuring or divestiture are necessary.

| Segment | Reason | 2024 Performance |

|---|---|---|

| Older Batteries | Fading demand | Sales Drop: 15% |

| Traditional Media | Declining readership, ad revenue | Print ad revenue: -7.6% |

| Access Control | Outdated technology | Sales Decline: 5% |

| Disney Partnership | Contract termination | Media Segment Revenue: EUR 6.4B |

| C8 | Closure of C8 | Advertising Revenue: €150M |

Question Marks

The electric bus division, especially with Bluebus deliveries to RATP, represents a Question Mark. This market is growing, as seen by the global electric bus market projected to reach $85.3 billion by 2030. Currently, it has a low market share and demands significant investment. Strategic choices are needed to capture more of the market.

Bolloré's energy storage solutions are a question mark in the BCG matrix. The company's focus aligns with the renewable energy market. However, it faces challenges due to low market share. Substantial investment is needed to compete effectively. For instance, the global energy storage market was valued at $15.6 billion in 2023.

New Media Ventures, a component within Bolloré's communication segment, focuses on digital platforms and new content formats. These ventures show promise in the changing media world. Their success isn't guaranteed, demanding careful investment. For instance, digital advertising spending in 2024 reached over $230 billion in the US, indicating market potential, yet success varies greatly.

Solid-State Lithium-Metal Batteries

Solid-state lithium-metal batteries are a "Question Mark" in Bolloré's BCG matrix. This technology is a high-risk, high-reward venture, requiring significant investment. The global solid-state battery market was valued at $132.5 million in 2023 and is projected to reach $5.8 billion by 2032, with a CAGR of 57.6% from 2024 to 2032. This represents a significant growth opportunity, but success hinges on overcoming challenges like scaling production and competition. If successful, it could transform into a "Star" product.

- Market Value: $132.5 million (2023)

- Projected Market: $5.8 billion (2032)

- CAGR: 57.6% (2024-2032)

- Risk: High, due to development and competition.

Investments in African Pay-TV

Investments in African pay-TV, particularly the planned acquisition of MultiChoice, fit the "Question Mark" quadrant in the BCG Matrix. This classification arises from the high-growth potential in the developing African market, yet it faces considerable uncertainties. Regulatory challenges and the complexities of integrating MultiChoice pose significant risks to the investment's success.

- Market expansion in Africa could yield substantial revenue growth.

- Integration difficulties might lead to operational inefficiencies.

- The regulatory environment in Africa is complex and varies by country.

- The investment outcome depends on successful navigation of these challenges.

Question Marks in Bolloré's portfolio represent high-growth potential but also substantial uncertainty. These ventures, like solid-state batteries or African pay-TV investments, require significant capital. Success hinges on overcoming market challenges and regulatory hurdles.

| Aspect | Details | Examples |

|---|---|---|

| Risk Profile | High risk, high reward | New battery tech, African pay-TV |

| Investment Needs | Requires significant capital injection | R&D, market entry, acquisitions |

| Market Dynamics | Rapid growth, intense competition | Energy storage, digital media |

BCG Matrix Data Sources

This matrix uses financial statements, market analyses, and sector publications. These ensure precise strategic recommendations and relevant market evaluations.