BP Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BP Bundle

What is included in the product

Clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs

Simplified view, instantly classifying business units, saving time on complex strategic analysis.

What You See Is What You Get

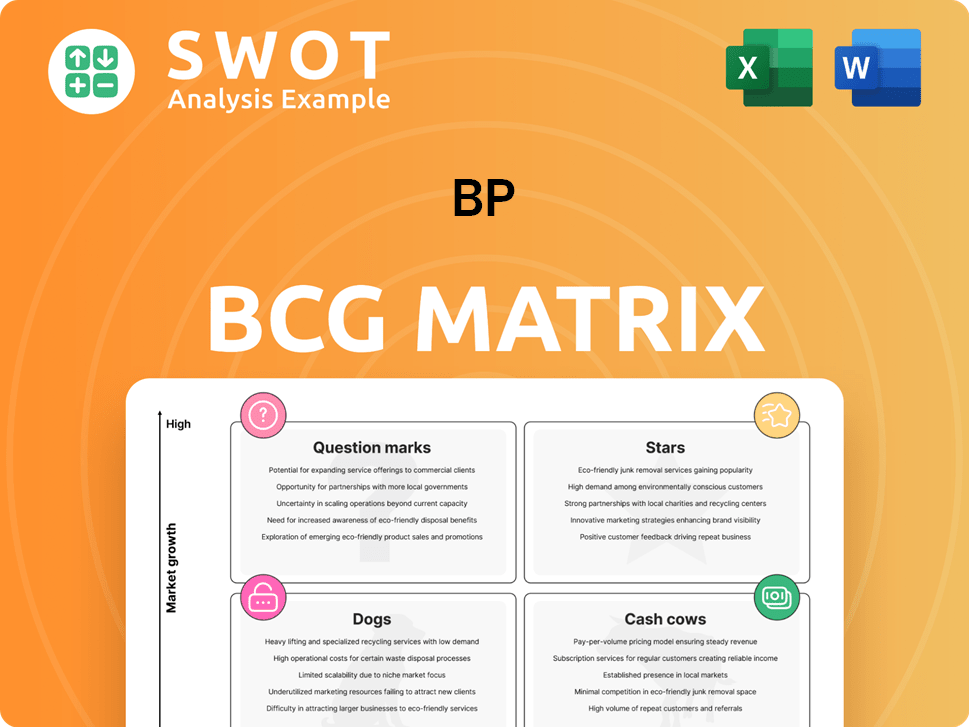

BP BCG Matrix

The preview you're experiencing is the complete BCG Matrix report you'll own. Obtain the final, fully formatted document ready for your strategic initiatives—no content changes.

BCG Matrix Template

Understanding a company's product portfolio is crucial for success. The BCG Matrix categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering strategic insights. This helps identify strengths, weaknesses, and opportunities for growth and investment. This snippet only scratches the surface of our detailed analysis.

Dive deeper into this company's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

BP is significantly boosting its upstream oil & gas investments, aiming for around $10 billion annually. This strategy is designed to enhance its portfolio and boost production. The company plans to launch 10 major projects by 2027. By 2030, BP targets an additional 8-10 projects, focusing on continued oil and gas demand.

BP's US Onshore is a star. Production in 2024 topped 430 mboed. They aim for a 7% CAGR through the decade. This could reach over 650 mboed by 2030. Liquids growth is key after Permian Basin system starts.

BP is investing heavily in Gulf of Mexico deepwater projects, exemplified by the Kaskida project. These ventures, targeting fields like Kaskida, are anticipated to yield around 80,000 barrels daily by 2029. BP's strategic move leverages advanced technologies, including 20K technology, to boost extraction efficiency. This strategy aims to capitalize on the vast reserves already identified within the region.

Biofuels Expansion

BP is strategically expanding its biofuel operations, notably in Brazil via BP Bunge Bioenergia. This move highlights a focus on growth markets and integrated positions within the energy sector. The company is targeting the rising demand for biofuels and sustainable energy, aiming for a leading role. In 2024, BP Bunge Bioenergia increased its ethanol production by 15%, reflecting this commitment.

- BP's biofuel investments are concentrated in regions like Brazil.

- The company aims to capitalize on the expanding biofuel market.

- BP is positioning itself as a key player in sustainable energy.

- BP Bunge Bioenergia increased ethanol production in 2024.

Renewable Natural Gas (RNG)

BP's bioenergy business, particularly Archaea Energy, shines as a Star in its portfolio. Archaea, with nine new RNG plants started in 2024, converts waste emissions into lower-carbon fuel. It boosts BP's low-carbon energy offerings. Archaea's position as the biggest and fastest-growing RNG producer in the US signals strong future growth.

- BP acquired Archaea Energy for approximately $4.1 billion in late 2022.

- Archaea's RNG production capacity is expected to significantly increase in the coming years due to ongoing plant developments.

- RNG projects are supported by government incentives, enhancing their financial viability.

- The RNG market is projected to grow substantially, driven by the need for sustainable fuel alternatives.

In the BP BCG matrix, Stars represent high-growth, high-market-share business units. BP's US Onshore and Archaea Energy exemplify this, showing strong growth potential. These segments, like US Onshore aiming for 7% CAGR, drive overall company value. Archaea's expansion through new plants further solidifies its Star status.

| Segment | Market Share | Growth Rate (2024) |

|---|---|---|

| US Onshore | High | 7% CAGR |

| Archaea Energy | Leading | Significant |

| Biofuels (Brazil) | Growing | 15% (Ethanol) |

Cash Cows

BP's downstream operations, including refining and marketing, are a cash cow due to their substantial market share and extensive global network. In 2024, BP's refining throughput was 1,394 kb/d. Europe represented 56% of this, and the United States represented 44%. These operations consistently generate robust cash flow.

BP's global service station network is a cash cow, providing consistent revenue. By the end of 2024, BP had 2,950 strategic convenience sites, showcasing ongoing investment. This extensive network supports strong market presence. It generates steady sales volumes, contributing reliably to BP's financials.

BP's aviation fuel business is a cash cow, supplying jet fuel globally. It profits from long-term contracts and high entry barriers. Despite decarbonization pressures, demand for air travel keeps the business strong. In 2024, jet fuel sales contributed significantly to BP's revenue. This segment's stability provides consistent cash flow for BP.

Industrial Lubricants (Castrol)

BP is strategically reviewing Castrol, its industrial lubricants business, to boost growth and value. Castrol aims to expand its market share, particularly in industrial applications. The company is exploring diversification into data center fluids to seize new opportunities. In 2024, Castrol's revenue was approximately $14 billion.

- Castrol is a significant cash generator for BP.

- Industrial lubricants are a key focus for growth.

- Data center fluids represent a new market opportunity.

- Revenue in 2024 was roughly $14 billion.

Integrated Supply Chain

BP's integrated supply chain, spanning exploration, production, refining, and distribution, is a Cash Cow within the BCG Matrix. This integration gives BP a significant competitive edge by enabling cost management and operational optimization. The company's approach allows for value capture and market position maintenance. For example, in 2024, BP's downstream segment, which includes refining and marketing, contributed significantly to overall profits.

- Integration optimizes costs across the value chain.

- BP can capture more value compared to non-integrated competitors.

- Downstream operations significantly boost overall profitability.

- Strategic supply chain management supports market stability.

Cash cows in BP's portfolio, like refining and service stations, generate steady profits due to their strong market positions. They offer reliable returns and consistent cash flow. In 2024, BP's refining throughput was 1,394 kb/d, and the company had 2,950 strategic convenience sites, which are key contributors. These segments are crucial for financial stability.

| Segment | Description | 2024 Data |

|---|---|---|

| Refining & Marketing | Downstream operations | 1,394 kb/d refining throughput |

| Service Stations | Global network | 2,950 strategic sites |

| Aviation Fuel | Jet fuel supply | Significant revenue contribution |

Dogs

BP's divestments in Egypt and Trinidad, concluded in 2024, have reduced its upstream production. These moves, involving approximately 90,000 barrels of oil equivalent daily, signal a strategic portfolio adjustment. This shift is expected to lower reported upstream production for Q1 2025. The company is optimizing its asset base.

In 2024, BP divested its 1.3 GW US onshore wind business. This strategic move reflects a shift in focus. The decision aligns with reducing renewable energy capital expenditure. BP aims to concentrate on higher-yielding ventures. This reevaluation of the renewable energy portfolio is ongoing.

BP is evaluating the Gelsenkirchen refinery, potentially signaling it’s a Dog in the BCG Matrix. This means it might not be performing well financially. The review aims to improve its downstream portfolio. In 2024, BP's refining margins have faced pressure. The strategic shift focuses on more profitable assets.

Underperforming Exploration Assets

Underperforming exploration assets at BP, often categorized as "dogs" in the BCG matrix, face challenges due to limited potential or high development costs. BP has been actively reshaping its portfolio. This includes halting or delaying over 20 projects to focus on more profitable ventures. These assets drain resources without delivering substantial returns.

- BP's strategy involves focusing on core areas.

- Divestiture or decommissioning are options for these underperforming assets.

- The company is streamlining its operations in 2024.

- This leads to a more efficient allocation of capital.

Outdated Refining Technology

Refineries with outdated tech, like some of BP's, often struggle with environmental rules and high costs, fitting the "Dog" category in the BCG Matrix. BP's focus on cost cuts and efficiency improvements directly addresses these issues in its refining operations. These older facilities may find it hard to compete and make money. For example, BP's refining margins dipped in 2024 due to operational challenges.

- Outdated tech leads to higher operating costs.

- Environmental compliance becomes more expensive.

- Lower profitability compared to modern refineries.

- BP aims to improve these through upgrades.

Dogs represent underperforming business units, often with low market share in slow-growing markets. BP's assessment includes refinery challenges and underperforming exploration assets, showing potential Dogs. These assets face divestiture or restructuring. In 2024, BP focused on core areas and streamlining operations.

| Aspect | Dog Characteristics | BP's Actions (2024) |

|---|---|---|

| Market Share | Low | Divestments/Decommissioning |

| Growth Rate | Slow | Portfolio Optimization |

| Profitability | Low, Negative | Focus on Core Areas |

Question Marks

BP is strategically investing in hydrogen and CCS projects, viewing them as high-growth but uncertain return ventures. These projects face challenges such as slower policy implementation, technological advancements, and higher costs. The company has prioritized 5-7 projects for this decade. In 2024, BP made Final Investment Decisions (FID) on 4 projects, signaling a cautious approach.

BP is strategically investing in EV charging infrastructure, acknowledging the growth of electric vehicles. The profitability is still uncertain, but BP is making selective investments. They are using existing infrastructure, focusing on key markets to benefit from the shift to electric vehicles. In 2024, BP announced plans to expand its EV charging network, aiming for over 100,000 charge points globally by 2030.

BP is expanding biogas production, yet its market share and profitability are uncertain. The company is investing to boost production and cash flow, showing confidence in biogas's potential. BP seeks to drive action by improving projects and using current infrastructure. In 2024, BP's bioenergy investments reached $1.2 billion. Biogas production is part of BP's transition strategy.

Offshore Wind Joint Venture (JERA Nex bp)

BP's joint venture, JERA Nex bp, with JERA Co., Inc., is a question mark in its BCG matrix. This partnership combines BP's and JERA's resources to develop offshore wind projects. The joint venture aims to generate up to 13GW of net generating capacity, leveraging BP's expertise in offshore wind. This capital-light approach allows BP to share financial risks.

- Partnership aims for 13GW net capacity.

- Combines BP and JERA assets.

- Capital-light strategy.

- Focus on offshore wind.

Sustainable Aviation Fuel (SAF)

Sustainable Aviation Fuel (SAF) represents a "Question Mark" for BP within the BCG Matrix. BP is exploring SAF opportunities, but the market is still nascent. Investment in climate tech startups like CHOOOSE shows BP's commitment to aviation decarbonization.

The profitability and scalability of SAF are uncertain, posing challenges. The future growth potential remains unclear, making it a high-risk, high-reward venture.

- BP invested in SAF projects, with the global SAF market projected to reach $15.8 billion by 2030.

- SAF adoption is driven by environmental regulations and airline commitments.

- Challenges include high production costs and limited feedstock availability.

- BP's strategy involves partnerships and technology investments to scale SAF production.

BP views SAF as a "Question Mark" in its portfolio, facing uncertain profitability and growth. SAF's high production costs and limited feedstock present challenges.

However, BP is actively investing in SAF projects, aligning with environmental regulations. The global SAF market is expected to hit $15.8 billion by 2030.

BP leverages partnerships and tech investments to scale SAF production, aiming for decarbonization within aviation.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Projection | Global SAF Market | $15.8B by 2030 |

| BP Strategy | Investment Focus | Partnerships, Tech |

| Challenges | Production & Feedstock | High Costs, Limited Supply |

BCG Matrix Data Sources

The BCG Matrix is fueled by data from company financials, market research, and industry reports for comprehensive strategic analysis.