Bridgestone Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bridgestone Bundle

What is included in the product

Bridgestone's BCG matrix provides insights for strategic decisions across its product portfolio.

Concise quadrants streamline strategic decisions for focus and resource allocation.

Delivered as Shown

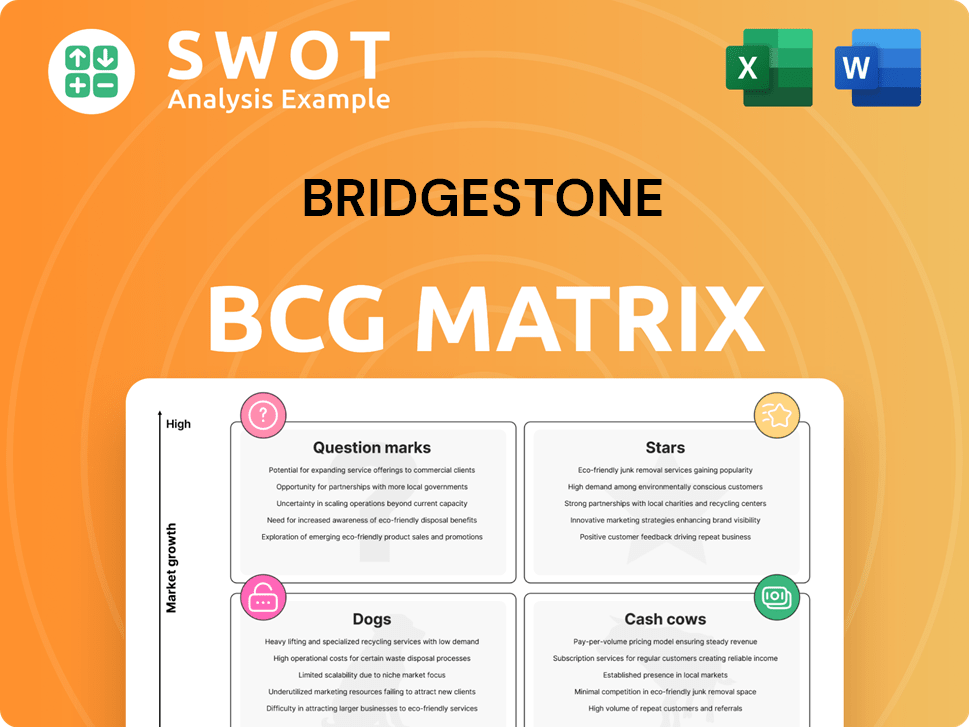

Bridgestone BCG Matrix

The displayed Bridgestone BCG Matrix is the very document you'll gain access to upon purchase. Receive the complete, editable file—ready for analysis and strategic planning, with all data points and visualizations included.

BCG Matrix Template

Bridgestone, the tire giant, faces a dynamic market. Its BCG Matrix highlights product positions: Stars, Cash Cows, Dogs, and Question Marks. This framework visualizes growth potential and resource allocation needs. Understand which products drive revenue and which require strategic shifts.

Dive deeper into Bridgestone’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Bridgestone's ENLITEN technology is a rising star, with plans to be in 170 car models by 2025, a significant jump from 117 in 2024. This technology is a key focus for premium and electric vehicles, where it's expected to drive growth. The company is betting on "ultimate customization" through ENLITEN, especially for prestige OEMs.

Bridgestone's High Rim Diameter (HRD) tires, particularly those 20 inches and above, are a key focus. Sales in North America saw substantial growth in 2024, reflecting their premium status. The company aims to boost sales of these larger tires, targeting a rise from 13% to 15% of sales in the second half of 2024 in North America and Europe. This strategy enhances the sales mix.

Bridgestone's mining solutions are a "Stars" segment, expanding with digital tech integration. This includes AI-driven data analytics. The MASTERCORE series, with ultra-high durability, is in about 100 mines globally since 2020. By integrating digital technologies, Bridgestone aims to evolve and expand its mining solutions.

Sustainable and Eco-Friendly Initiatives

Bridgestone's "Stars" category highlights its robust sustainability efforts, central to its strategy. The company targets 100% sustainable raw materials for tires by 2050. Bridgestone is investing in butadiene production from ethanol, with 2024 investments reaching $100 million. Moreover, it partners on closed-loop tire recycling.

- 100% sustainable raw materials goal by 2050.

- $100 million in 2024 for butadiene from ethanol.

- Partnerships for closed-loop tire recycling.

- Continued inclusion in ESG indexes.

Motorsport Tires

Bridgestone's motorsport activities, a "Star" in its BCG Matrix, showcase its commitment to innovation. The company uses racing to test and enhance tire technology under pressure. This approach helps improve tires for everyday use, connecting motorsport advancements to broader product development. Bridgestone's dedication to motorsports continues, reinforcing its role as a leading tire manufacturer.

- Bridgestone has a significant presence in Formula 1, with its tires used by various teams.

- Motorsport activities contribute to roughly 5% of Bridgestone's total revenue.

- The company invests approximately $150 million annually in motorsport-related research and development.

- Bridgestone supports over 100 racing events globally each year.

Bridgestone's "Stars" include mining solutions, with AI integration, and motorsport activities. Their sustainability efforts focus on sustainable materials by 2050. Investments in butadiene from ethanol reached $100 million in 2024, and they support closed-loop tire recycling.

| Feature | Details | Data |

|---|---|---|

| Mining Solutions | AI integration, MASTERCORE series | 100 mines globally by 2020 |

| Sustainability | Sustainable raw materials goal | $100M in 2024 for butadiene |

| Motorsport | F1 presence, innovation | 5% of revenue |

Cash Cows

Bridgestone's premium passenger car tires are a cash cow, particularly in North America. In 2024, premium Bridgestone tire sales saw an increase. The company focuses on boosting sales volume and market share in this sector. Bridgestone aims to deliver sustainable solutions through its premium tire business.

Bridgestone's TBR tire business remains active despite the LaVergne plant closure. The company is strategically integrating retread, mobility solutions, and maintenance services to boost its fleet business. This approach aims to strengthen the TB-REP business by creating customer success structures. In 2024, Bridgestone's focus on fleet solutions is expected to contribute significantly to its revenue, aligning with market demands for integrated services.

Bridgestone's Original Equipment (OE) tire sales are a cash cow, fueled by strong ties with automakers. In the first half of 2024, tires 20 inches and larger made up 27% of OE sales in North America and Europe combined. The goal is to hit 30% in the second half of the year. Tires in 18- and 19-inch sizes accounted for 39% of sales, aiming for 40% in the same period.

Replacement Tire Market

Bridgestone firmly plants its feet in the replacement tire market. They aim to increase sales of 20-inch+ tires in North America and Europe. The goal is to boost sales from 13% to 15% in the latter half of 2024. This strategy focuses on a profitable segment.

- Market Focus: Replacement tire segment.

- Growth Target: Increase sales of larger tires.

- Geographic Scope: North America and Europe.

- Sales Goal: 13% to 15% growth by late 2024.

Global Presence and Distribution Network

Bridgestone's extensive global footprint supports its "Cash Cow" status. The company's robust distribution network and manufacturing plants, totaling around 180 facilities across 24 countries, ensure market reach. This widespread presence enables Bridgestone to meet diverse regional demands efficiently.

- 24% of Bridgestone's revenue comes from Japan.

- 45% from the Americas.

- 13% from China and Asia Pacific.

Bridgestone's cash cows include premium tires, OE sales, and the replacement tire market. Their strategic focus is on high-margin products. In 2024, expansion in large tire sales targets strong revenue streams. The global presence supports market reach and financial stability.

| Category | Segment | Focus |

|---|---|---|

| Premium Tires | Passenger Cars | Sales Volume & Market Share |

| OE Tires | Automakers | 20"+ tire sales |

| Replacement Tires | North America, Europe | 13%-15% growth in 20"+ tires by late 2024 |

Dogs

Bridgestone is actively shifting away from commodity tires, a key strategy in its BCG Matrix. This move towards premium tires aims to boost its sales mix and profitability. In 2024, the company is evaluating its portfolio, focusing on regional, product, and channel profitability. For example, in Q3 2024, Bridgestone's net sales were 1,097.7 billion yen.

Bridgestone's restructuring efforts in Latin America, involving cost cuts and workforce reductions, reflect a strategic shift. In 2023, Bridgestone's Americas segment saw a decrease in sales. The closure of the Lanklaar plant in Belgium in 2024 and the consolidation into Poland are part of this streamlining. These actions aim to improve efficiency and profitability in challenging markets.

Bridgestone's bias tires are categorized as "Dogs" in the BCG matrix due to declining demand and profitability. The closure of the Port Elizabeth plant in 2020 reflects this strategic shift. The company plans to optimize production, focusing on North America and Europe from the second half of 2024. To improve financial performance, Bridgestone aims to cut inventory costs and enhance its cash conversion cycle, aligning with cost reduction strategies.

Discontinued Operations

Bridgestone's "Dogs" category includes discontinued operations like its US building materials and chemical products businesses, starting from 2021. These businesses are no longer part of the company's core operations. Consequently, financial reports focus on "continuing operations," excluding the revenue and expenses of these divested segments. This strategic move helps clarify the company's financial performance and future focus.

- Discontinued operations include the US building materials business, anti-vibration rubber business, and chemical products solutions business from 2021.

- Financial reporting emphasizes "continuing operations," excluding divested businesses.

- This strategic shift aims to clarify financial performance and future direction.

LaVergne Plant Closure

The LaVergne plant closure, announced in 2024, fits the "Dog" category in Bridgestone's BCG matrix, representing a business unit with low market share in a low-growth industry. This strategic move, set for July 31, 2025, aims to streamline operations and boost competitiveness. The closure affects roughly 700 employees, reflecting tough choices in a challenging market. Bridgestone's revenue in 2023 was approximately $32.8 billion, and this restructuring is part of managing costs.

- Closure date: July 31, 2025.

- Impact: Approximately 700 employees affected.

- Financial context: Part of strategic optimization.

- 2023 Revenue: ~$32.8 billion.

Bridgestone's "Dogs" are low-growth, low-share businesses. These include discontinued operations, like US building materials from 2021. Strategic decisions like the LaVergne plant closure, set for 2025, optimize resources.

| Aspect | Details |

|---|---|

| Discontinued Operations | US building materials, chemical products |

| LaVergne Plant Closure | July 31, 2025; 700 employees affected |

| 2023 Revenue | ~$32.8 billion |

Question Marks

Bridgestone, since 2019, is developing lunar tire tech. It showcased a new lunar tire prototype in 2024. This aligns with the 2024-2026 strategic plan. The goal is to innovate for extreme environments.

Bridgestone's "AirFree Concept" tires are a "Question Mark" in their BCG Matrix. This exploratory business leverages technology from the Mid Term Business Plan (2024-2026). The tires, without air, are designed for extreme conditions, like the lunar surface, and their use on Earth could create value. In 2024, Bridgestone invested $100M in R&D for innovative tire technologies.

Bridgestone is exploring sustainable synthetic rubber, focusing on non-fossil-based materials. The company is constructing a pilot plant to convert ethanol to butadiene, a key rubber component. This initiative aims to assess economic viability and reduce carbon emissions. Bridgestone's investment aligns with the growing demand for eco-friendly tires, with the global synthetic rubber market valued at $24.5 billion in 2024.

BATTLAX Motorcycle Tires

Bridgestone's BATTLAX motorcycle tires, like the SPORT TOURING T33 slated for January 2025, fall into the "Question Marks" quadrant of the BCG Matrix. These tires represent new products in a high-growth market, but their market share is initially uncertain. The T33 aims to capture market share by improving mileage by 47% compared to the T32. This positions Bridgestone to potentially gain traction in the sport touring tire segment.

- Launch date: January 2025

- Mileage improvement: 47% (T33 vs. T32)

- Market Position: High-growth, low-share

- Key feature: Enhanced dry handling

Mobility Solutions

Bridgestone's mobility solutions, classified as a "Question Mark" in the BCG Matrix, represent a segment with high growth potential but uncertain market share. This category includes the integration of digital technologies and services with tire products, such as AI-driven tire and vehicle data analytics. In the first half of 2024, Bridgestone reported that 30% of its revenue came from its solutions business. This indicates a significant investment in the future.

- Focus on integrating digital technology with tire products.

- Aim to expand mining solutions.

- Solutions business accounted for 30% of revenue in the first half of 2024.

- Represents high growth potential.

Bridgestone's "Question Marks" involve high-growth potential with uncertain market share. This includes ventures like airless tires and digital mobility solutions. The aim is to boost market presence and revenue streams. By 2024, 30% of its revenue came from solutions businesses.

| Initiative | Status | Market Position |

|---|---|---|

| AirFree Tires | Prototype showcased in 2024 | High-growth, low-share |

| BATTLAX T33 | Launch in January 2025 | High-growth, low-share |

| Mobility Solutions | 30% of revenue in 2024 | High-growth, low-share |

BCG Matrix Data Sources

Bridgestone's BCG Matrix utilizes financial data, market research, competitor analysis, and industry reports for robust insights.