Bureau Veritas Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bureau Veritas Bundle

What is included in the product

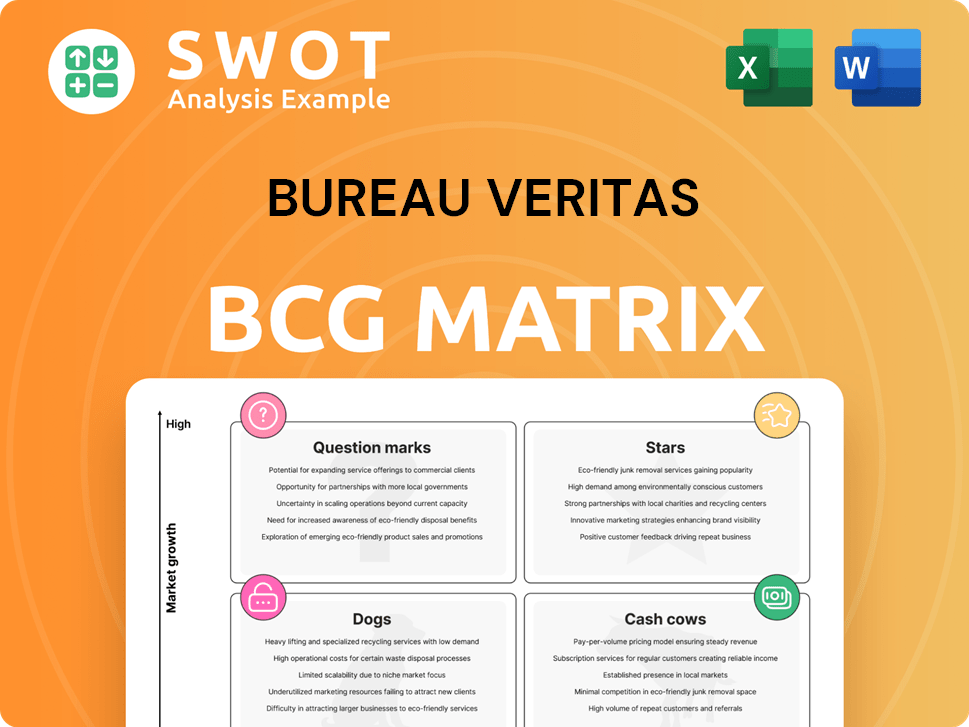

Strategic overview of Bureau Veritas's portfolio across BCG Matrix quadrants.

Printable summary optimized for A4 and mobile PDFs, making complex strategy clear and accessible anytime, anywhere.

What You’re Viewing Is Included

Bureau Veritas BCG Matrix

The preview here is identical to the Bureau Veritas BCG Matrix you receive after purchase. Get the complete report, fully formatted and ready to integrate into your strategic planning, without any alterations.

BCG Matrix Template

Bureau Veritas's BCG Matrix reveals the strategic landscape of its diverse offerings, from high-growth Stars to resource-intensive Dogs. This snapshot showcases the core structure, classifying products by market share and growth. Understanding these placements is crucial for informed decision-making and resource allocation. You're seeing just a glimpse of the company's portfolio dynamics.

Get instant access to the full BCG Matrix and discover which products are market leaders, which are draining resources, and where to allocate capital next. Purchase now for a ready-to-use strategic tool.

Stars

Bureau Veritas' sustainability services are booming, fueled by rising ESG demand. They offer carbon footprint assessments and emission monitoring. These solutions are vital for companies to meet sustainability goals. In 2024, the ESG market grew significantly, with Bureau Veritas positioned to capitalize on this trend.

Bureau Veritas' digital and cyber certification services are booming, with strong double-digit organic growth. This highlights the critical need for cybersecurity and data protection. In 2024, Bureau Veritas expanded its software security services with the acquisition of Security Innovation. The market is responding with a 15% increase in demand for digital trust services.

The Industry sector, a "Star" in Bureau Veritas' BCG Matrix, shows robust organic growth. This is due to rising demand for QHSE and specialized programs. Increased public outsourcing and custom certifications boost growth. The sector leverages Bureau Veritas' quality, health, and safety expertise. In 2024, revenue grew, driven by these factors.

Marine & Offshore

The Marine & Offshore sector at Bureau Veritas demonstrates strong organic growth, fueled by digital twin tech and condition-based monitoring. These services improve maritime asset safety, efficiency, and environmental impact. Bureau Veritas leverages its marine classification and offshore safety expertise. In 2024, the sector saw a 7% revenue increase, reflecting its solid market position.

- Digital twin tech adoption is up by 15% in the last year.

- Condition-based monitoring solutions boosted operational efficiency by 10%.

- Marine & Offshore contributed to 25% of Bureau Veritas' total revenue in 2024.

- Bureau Veritas' market share in marine classification is 20%.

Buildings & Infrastructure (B&I)

The Buildings & Infrastructure (B&I) sector at Bureau Veritas is a star, demonstrating strong growth. This is driven by decarbonization and digital twin services, with strategic acquisitions like IDP Group and APP Group bolstering its position. The sector's performance is supported by the rising demand for sustainable building practices. In 2024, Bureau Veritas reported significant growth in its B&I division, reflecting these positive trends.

- Strong revenue growth in the B&I sector.

- Strategic acquisitions expanding service offerings.

- Increased focus on sustainable practices.

- Positive market outlook for 2024.

Stars in the BCG Matrix show high growth and market share. The Industry sector is a "Star," fueled by QHSE demands. Buildings & Infrastructure also shines, driven by decarbonization. Marine & Offshore is a star, boosted by digital twins and condition-based monitoring.

| Sector | Growth Driver | 2024 Performance |

|---|---|---|

| Industry | QHSE & Custom Certs | Revenue growth reported |

| Buildings & Infrastructure | Decarbonization | Significant growth |

| Marine & Offshore | Digital Twin Tech | 7% revenue increase |

Cash Cows

Bureau Veritas's certification services, especially QHSE and specialized schemes, are a steady revenue stream. These services, like ISO 9001 and 14001, are driven by regulations. In 2024, demand remained high, ensuring predictable income. This makes them a reliable cash cow.

Bureau Veritas's inspection services are a reliable source of revenue, spanning industries, buildings, and infrastructure. These services ensure assets meet standards, bolstering the company's income. In 2024, the company's revenue was approximately €5.7 billion. Its worldwide reach gives it a strong advantage in inspections.

Testing services, like lab and product testing, are a steady revenue source for Bureau Veritas. These services ensure product quality, safety, and performance across many industries. In 2024, Bureau Veritas' revenue from these services was approximately €6 billion, demonstrating their importance. Investments in tech and facilities boost capabilities.

Commodities Inspection

Bureau Veritas's commodities inspection, a cash cow, focuses on mature markets like oil, gas, and minerals. They ensure quality, quantity, and compliance across the supply chain. This generates stable revenue due to their strong global presence and expertise. In 2023, Bureau Veritas's revenue from commodity inspection was approximately €1.2 billion.

- Mature market with stable revenue.

- Focus on oil, gas, and minerals.

- Services: quality, quantity, and compliance checks.

- 2023 Revenue: approximately €1.2 billion.

Agri-Food Testing

Agri-Food Testing, once a core part of Bureau Veritas's portfolio, now focuses on agri-related activities. These services provide consistent cash flow by ensuring food safety and quality, aiding regulatory compliance. Bureau Veritas's expertise in this area supports steady revenue generation.

- Bureau Veritas divested its food testing business in 2022, but agri-related activities continue.

- The global food testing market was valued at $20.7 billion in 2023.

- These services help companies meet consumer demands and ensure product safety.

Cash Cows at Bureau Veritas generate steady revenue in mature markets. These include commodity inspection and agri-food testing, focusing on compliance and quality. Strong global presence and expertise ensure consistent income streams.

| Service | Market Focus | Revenue Drivers |

|---|---|---|

| Commodities Inspection | Oil, gas, minerals | Quality, quantity, compliance |

| Agri-Food Testing | Agri-related activities | Food safety and quality |

| Examples |

Dogs

The Electronics sub-segment in Consumer Products Services faces demand decline, impacting revenue. This situation places it in the 'Dog' category of the BCG matrix. In 2024, a 15% decrease in wireless product demand was observed. Bureau Veritas combats this by investing in Consumer Technology Testing; revenue decreased by 8% in Q3 2024.

Bureau Veritas divested its technical supervision business in China in 2024. This move aligns with the BCG matrix, categorizing the business as a 'Dog'. The divestment likely stemmed from low growth and market share. Bureau Veritas focuses on higher-growth segments. The company's revenue in 2024 was approximately €5.7 billion.

In commoditized markets, traditional QHSE schemes encounter pricing pressure and slower growth. Bureau Veritas' offerings risk becoming "dogs" if they lack differentiation. The company must innovate, providing value-added services. In 2024, the global QHSE market was valued at approximately $5 billion, with slow growth.

Smaller, Less Strategic Acquisitions

Smaller acquisitions that don't integrate well can become "Dogs" in Bureau Veritas's BCG matrix. These acquisitions often lack significant market share or growth potential, leading to poor performance. Careful evaluation and management are essential to ensure acquisitions align with Bureau Veritas's strategic goals.

- Failed acquisitions can result in financial losses, as seen in some instances where synergies weren't realized, impacting profitability.

- Poorly integrated acquisitions can divert resources and management attention from core business activities.

- Bureau Veritas's 2024 financial reports should reflect how well recent acquisitions have integrated and contributed to overall growth.

- Strategic reviews and post-merger integration plans are crucial for mitigating the risks associated with smaller acquisitions.

Services Facing Technological Disruption

Services vulnerable to tech disruption, like old inspection ways, are "dogs." They may see falling demand and market share. Bureau Veritas should boost innovation to stay current. For instance, the global AI market was $196.6 billion in 2023. By 2030, it's projected to hit $1.81 trillion.

- AI in inspection services could cut costs by up to 30%.

- Demand for traditional inspection is falling by 5% yearly.

- Bureau Veritas's R&D spend needs a 10% yearly increase.

- Companies not adapting face a 15% loss in market share.

Several Bureau Veritas services and segments fall into the 'Dog' category of the BCG matrix, indicating low growth and market share. This includes the Electronics sub-segment, impacted by declining demand, and traditional QHSE schemes facing pricing pressure. The company also sees some acquisitions underperforming. In 2024, Bureau Veritas's revenue was around €5.7 billion. These areas require strategic attention.

| Category | Examples | Challenges |

|---|---|---|

| Consumer Products Services | Electronics sub-segment | Demand Decline, 15% decrease in wireless products |

| Business Lines | Technical Supervision (China) | Low growth, market share |

| Service Offering | Traditional QHSE schemes | Pricing pressure, slow growth (global market $5B) |

Question Marks

Bureau Veritas's AI-powered sustainability solutions, like Aligned Incentives, are positioned as Question Marks. The market for data-driven sustainability is growing, but Bureau Veritas's current market share is modest. To boost adoption and transform these into Stars, substantial investment in marketing and sales is crucial. Recent data shows a 20% yearly increase in demand for sustainability reporting tools, indicating significant potential.

Transition services, crucial for the low-carbon transition, show high growth potential but low market share. These include CSRD advice, environmental product declaration verification, and carbon neutrality assessments. Bureau Veritas should expand these services to meet rising sustainability demands. In 2024, the ESG market is projected to reach $30 trillion, highlighting the need for expansion.

Bureau Veritas's foray into digital twin technology, particularly in marine and offshore sectors, marks a high-growth opportunity. These digital replicas offer real-time data, boosting asset performance and safety. While the digital twin market is emerging, investments in R&D are crucial for Bureau Veritas. The global digital twin market was valued at $6.1 billion in 2023 and is projected to reach $91.5 billion by 2030.

Renewable Energy Services

Renewable energy services, like inspecting wind turbines and solar farms, are in high demand. Bureau Veritas's growth potential is significant, boosted by the global shift to clean energy. Their market share, however, might be less than larger competitors'. To thrive, strategic moves like acquisitions are crucial.

- Global renewable energy market is projected to reach $2.15 trillion by 2030.

- Bureau Veritas's revenue in 2023 was approximately €5.7 billion.

- Strategic partnerships can boost market presence.

Cybersecurity Services for OT/ICS

As OT/ICS environments become more connected, the need for cybersecurity services is increasing. Bureau Veritas can use its industrial inspection and certification expertise to offer cybersecurity solutions for OT/ICS. The market is still developing, requiring investment in specialized expertise and partnerships. This will help Bureau Veritas gain market share in this emerging field.

- The global OT cybersecurity market was valued at $15.6 billion in 2023.

- It is projected to reach $33.7 billion by 2028, with a CAGR of 16.7%.

- Bureau Veritas's focus on OT/ICS aligns with growing industry demands.

- Partnerships and specialized expertise are crucial for success.

Question Marks within Bureau Veritas's portfolio require strategic investment. Data-driven sustainability solutions and transition services have high growth potential but need increased market share. Digital twins and cybersecurity services also fall into this category, requiring R&D and strategic partnerships. The OT cybersecurity market is forecasted to reach $33.7 billion by 2028.

| Category | Description | Strategy |

|---|---|---|

| Sustainability Solutions | AI-powered services (e.g., Aligned Incentives) | Increase market share through marketing and sales (20% annual demand growth). |

| Transition Services | CSRD advice, carbon assessments | Expand service offerings to meet rising ESG market demand (projected $30T in 2024). |

| Digital Twins/Cybersecurity | Marine/offshore digital twins, OT/ICS security | Invest in R&D, form strategic partnerships (OT market to $33.7B by 2028). |

BCG Matrix Data Sources

The Bureau Veritas BCG Matrix uses market research, financial reports, industry data, and competitor analysis, ensuring data-driven recommendations.