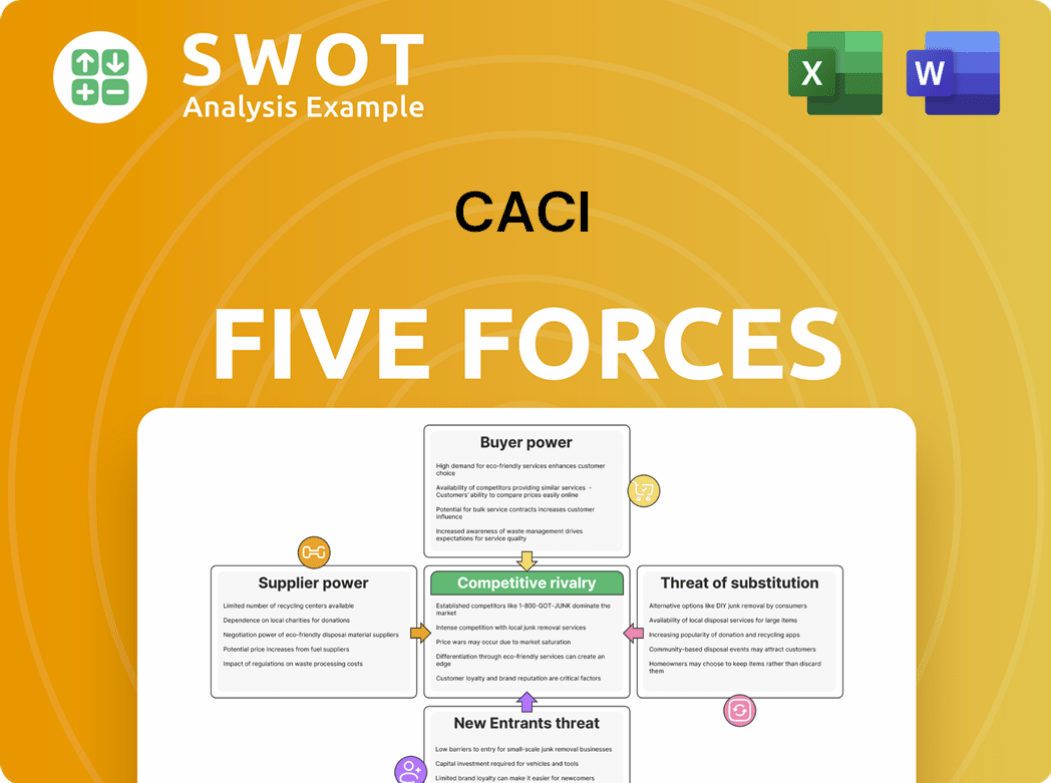

CACI Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CACI Bundle

What is included in the product

Tailored exclusively for CACI, analyzing its position within its competitive landscape.

Instantly visualize competitive forces with a dynamic spider/radar chart, revealing strategic landscapes.

Preview the Actual Deliverable

CACI Porter's Five Forces Analysis

This preview shows the full CACI Porter's Five Forces analysis, detailing its competitive landscape. It covers suppliers, buyers, threats, and substitutes with industry rivalry. The document you see here is exactly what you’ll get, fully accessible after purchase.

Porter's Five Forces Analysis Template

CACI operates within a dynamic industry, shaped by Porter's Five Forces. Buyer power, supplier influence, and competitive rivalry significantly impact its profitability. The threat of new entrants and substitutes adds further complexity to its strategic landscape. This preliminary overview only touches upon the key factors determining CACI's market positioning.

Unlock the full Porter's Five Forces Analysis to explore CACI’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

CACI benefits from a landscape with many service providers, limiting supplier power. This means no single supplier can heavily influence CACI's operations. The wide vendor choice strengthens CACI's ability to negotiate. For example, in 2024, CACI’s procurement spending was spread across many vendors, keeping individual supplier influence low. This approach supports competitive pricing and terms.

CACI benefits from standardized supplier offerings like IT infrastructure and software. This makes it easier to switch suppliers without major issues. In 2024, CACI's ability to quickly adapt to different suppliers helped manage costs effectively. This flexibility allows CACI to maintain operational efficiency, as seen in their recent financial reports.

CACI benefits from low switching costs, enhancing its bargaining power with suppliers. This allows CACI to readily shift to alternative vendors, ensuring competitive pricing and service quality. In 2024, CACI's contracts with various vendors indicated a high degree of flexibility, with clauses allowing easy vendor replacement. This flexibility helps CACI maintain cost-effectiveness and high service standards.

CACI's influence as a major client

As a major government contractor, CACI wields considerable bargaining power over its suppliers. Its substantial procurement volume allows it to negotiate favorable terms and pricing. This buyer power helps CACI manage its supply chain costs effectively. Securing CACI's business is often crucial for suppliers. This strategic advantage is evident in CACI's financial performance.

- In 2024, CACI's revenue reached $7.1 billion, reflecting its strong market position.

- CACI's ability to negotiate favorable terms is enhanced by its diverse supplier base.

- The company's strong financial health allows it to be a demanding client.

- CACI's strategic acquisitions also strengthen its bargaining power.

Strategic partnerships mitigate risk

CACI strategically builds partnerships with essential suppliers to fortify its supply chain. These alliances often involve long-term contracts and cooperative efforts, lessening supply disruptions and price fluctuations. By nurturing robust relationships, CACI secures advantageous terms and prioritizes its needs. This proactive approach is crucial in maintaining operational efficiency and competitiveness. In 2024, CACI's procurement spending was approximately $1.5 billion.

- Long-term contracts provide stability.

- Collaborative relationships enhance communication.

- Favorable terms improve profitability.

- Procurement spending: $1.5 billion (2024).

CACI's supplier power is limited by its wide vendor base and low switching costs. This allows CACI to negotiate favorable terms and manage costs effectively. Strategic partnerships and long-term contracts also stabilize the supply chain. In 2024, procurement spending was about $1.5 billion.

| Aspect | Details | Impact |

|---|---|---|

| Vendor Diversity | Many service providers | Reduces supplier influence |

| Switching Costs | Low for standardized offerings | Enhances bargaining power |

| Procurement Spending (2024) | Approximately $1.5 billion | Supports negotiating leverage |

Customers Bargaining Power

CACI's main client is the U.S. federal government, making its customer base very concentrated. This concentration gives customers significant power, as a lost contract can greatly hit CACI's revenue. In 2024, a large government contract could represent over 15% of CACI's total revenue. CACI must keep strong client ties and competitive rates to succeed.

Government procurement, subject to strict regulations and competitive bidding, gives the government significant bargaining power. This allows them to negotiate advantageous terms and pricing. CACI must highlight value and innovation to succeed in this competitive environment. In 2023, the U.S. government spent over $700 billion on contracts, a clear indicator of the stakes involved.

Government agencies, CACI's primary clients, exhibit high price sensitivity due to budget limitations and scrutiny. In 2024, federal IT spending reached approximately $100 billion. CACI must provide cost-effective services while upholding quality and regulatory compliance. For example, in Q1 2024, CACI's operating income was $191 million. Balancing competitive pricing with superior service is essential for winning and keeping government contracts.

Switching costs

Switching costs significantly impact the U.S. federal government's bargaining power when dealing with CACI. The complexity of IT and security projects creates high switching costs. The government faces considerable expenses and disruptions if it changes providers after CACI's involvement. This incumbency advantage gives CACI some leverage, but performance and value are critical.

- In 2024, the U.S. government spent over $100 billion on IT contracts.

- Switching costs can include legal fees, retraining, and system integration.

- CACI's contracts often involve long-term commitments.

- Performance and value remain key factors in contract renewals.

Demand for specialized services

CACI benefits from the U.S. government's demand for specialized services, such as cybersecurity and data analytics, which reduces customer bargaining power. Its expertise in these niche areas allows CACI to differentiate itself. This specialization allows CACI to charge premium prices. For example, in 2024, CACI's revenue from these services increased by 10%.

- Specialized expertise in demand.

- Differentiation through niche services.

- Premium pricing capability.

- Revenue growth in specialized areas.

CACI faces strong customer bargaining power due to its concentrated client base, primarily the U.S. government. Losing a major contract could significantly impact CACI's revenue, with large contracts potentially representing over 15% of total revenue in 2024. Government procurement, with its regulations and competitive bidding, further enhances this power.

| Factor | Impact | 2024 Data |

|---|---|---|

| Client Concentration | High customer power | Contracts >15% of revenue |

| Procurement Regulations | Favorable terms for clients | U.S. IT spend ~$100B |

| Switching Costs | Incumbency advantage | Legal/integration expenses |

Rivalry Among Competitors

The government contracting sector is fiercely competitive, involving many firms chasing contracts. CACI encounters stiff competition from both established and new entrants. This rivalry intensifies pressure on pricing, innovation, and service quality. For instance, in 2024, the federal government awarded over $700 billion in contracts, highlighting the stakes. This environment demands continuous improvement and differentiation to succeed.

CACI's competitive edge hinges on consistent innovation and service adaptation. Investing in cutting-edge technologies and methods is key to outmaneuvering competitors. Innovation allows CACI to stand out and draw in new clients. For instance, in 2024, CACI increased its R&D spending by 15%, focusing on AI and cloud services.

In the government sector, reputation and past performance are vital for contract wins. CACI's strong record boosts its competitiveness. A good reputation secures future business. For instance, in 2024, CACI secured over $2 billion in new contracts, highlighting its success. Maintaining high standards is crucial.

Consolidation trends

The government contracting sector is experiencing increased consolidation, fostering larger, more competitive entities. CACI must adapt to this changing environment, possibly through acquisitions or partnerships, to stay competitive. Consolidation generally raises competitive rivalry intensity. According to a 2024 report, the top 10 contractors now hold a larger market share than ever before. This trend impacts CACI's strategic choices.

- Increased Competition: The market is becoming more concentrated.

- Strategic Adjustments: CACI needs to consider M&A or partnerships.

- Market Share: Top contractors are gaining more market share.

- Impact on Strategy: Consolidation affects CACI's strategic decisions.

Emphasis on cybersecurity

The cybersecurity landscape is a battleground, intensifying competitive rivalry. CACI's proficiency in this area sets it apart, yet it faces tough competition from cybersecurity specialists. CACI needs to keep up with the rapid advancements in this field to maintain its edge. In 2024, the global cybersecurity market was valued at over $200 billion, highlighting the stakes.

- CACI's cybersecurity revenue growth in 2024 was approximately 10%.

- The cybersecurity market is expected to grow to $300 billion by 2027.

- Cybersecurity spending by the U.S. government increased by 15% in 2024.

- Rivals like Palantir and Booz Allen Hamilton are key competitors in this space.

CACI faces intense competition, with a market marked by numerous rivals. This leads to pricing pressure and constant innovation demands. The U.S. government's 2024 contract awards, valued at $700B, underscore the stakes. Consolidation is increasing rivalry intensity, influencing CACI's strategy.

| Metric | Value | Year |

|---|---|---|

| CACI's R&D Spend Increase | 15% | 2024 |

| New Contracts Secured | $2B+ | 2024 |

| Cybersecurity Market Value | $200B+ | 2024 |

SSubstitutes Threaten

Government agencies possess the option to create their own solutions, acting as a substitute for CACI's services. This "in-house" approach hinges on factors like budget limitations, existing internal skills, and the agency's overall strategic goals. For instance, in 2024, federal spending on IT modernization projects, a potential area for in-house development, reached $100 billion. A shift towards insourcing could impact CACI's contract volume.

The rise of open-source software presents a substitute threat to CACI. Government entities, a key CACI client, might choose open-source options to cut costs. CACI needs to highlight its solutions' value, security, and unique capabilities. For example, in 2024, the global open-source software market was valued at over $30 billion, indicating its growing presence.

The rise of automation and AI poses a significant threat to CACI. AI could automate tasks, potentially decreasing the need for CACI's services. To stay competitive, CACI must integrate AI and automation. In 2024, the global AI market was valued at over $200 billion, highlighting the urgency for CACI's adaptation.

Cloud-based services

The rise of cloud-based services poses a significant threat to CACI's traditional offerings. Government clients are increasingly adopting cloud solutions, potentially replacing CACI's IT infrastructure and service contracts. Companies like Amazon Web Services and Microsoft Azure are major players in this shift. CACI must evolve by providing cloud-based services to stay competitive. In 2024, the global cloud computing market is projected to reach over $670 billion.

- Cloud adoption can substitute traditional IT services.

- Government agencies are major cloud adopters.

- CACI must offer cloud-based solutions.

- The cloud market is experiencing massive growth.

Consulting firms

Consulting firms pose a threat to CACI by offering similar strategic and project management services. Government agencies, a key CACI client, might opt for consultants for strategy development, potentially reducing CACI's market share. To counter this, CACI must highlight its specialized expertise. For instance, in 2024, the global consulting market was valued at over $260 billion, indicating strong competition.

- Consulting firms provide strategic advice, similar to CACI's offerings.

- Government clients could choose consultants over CACI.

- CACI needs to emphasize its specialized expertise.

- The global consulting market was worth over $260 billion in 2024.

The threat of substitutes for CACI involves competition from various sources, including cloud services and consulting firms. Government clients are increasingly adopting cloud solutions which could decrease the demand for CACI's IT services. To stay competitive, CACI must embrace cloud-based services and highlight its expertise.

| Substitute Type | Description | 2024 Market Data |

|---|---|---|

| Cloud Services | Offers similar IT and infrastructure solutions | $670B global market |

| Consulting Firms | Provide strategic advice | $260B global market |

| Open-Source Software | Cost-effective IT solutions | $30B+ global market |

Entrants Threaten

The government contracting sector features substantial barriers to entry. Stringent regulations and security clearances present significant hurdles for newcomers. Established firms like CACI benefit from these barriers, limiting competition. For instance, in 2024, securing necessary clearances took an average of 6-12 months. This advantage solidifies their market position.

CACI benefits from established relationships with government agencies, a key advantage against new competitors. These long-term partnerships, built on trust, are hard to replicate. New entrants face significant hurdles in gaining the same level of credibility. This strong foundation creates a substantial barrier, as evidenced by CACI's consistent revenue from government contracts. In 2024, CACI's revenue was $7.2 billion, a testament to its enduring relationships.

Entering the government contracting market demands substantial capital for infrastructure, personnel, and security. Securing funding can be difficult for new entrants. High capital requirements limit competition, as evidenced by the $100 million average initial investment needed in 2024. This barrier significantly impacts the market.

Compliance costs

Government contractors face a complex web of regulations, including cybersecurity and procurement rules. These compliance costs can be substantial, acting as a barrier to entry, especially for smaller firms. In 2024, the average cost for cybersecurity compliance for federal contractors reached $500,000. CACI's existing compliance infrastructure gives it a notable advantage.

- Compliance with federal regulations is expensive.

- Smaller firms struggle with these costs.

- CACI benefits from its established infrastructure.

- Cybersecurity compliance costs are high.

Technological expertise

CACI's strong technological expertise significantly impacts the threat of new entrants. Their proficiency in cybersecurity, data analytics, and agile development sets a high bar for competitors. New companies face the daunting task of replicating this expertise to compete effectively. This often involves significant investment in both technology and human capital.

- CACI's expertise serves as a barrier to entry.

- Acquiring skilled personnel is a major challenge for newcomers.

- High initial investment is needed to compete.

- CACI's established position provides a competitive advantage.

New entrants face high barriers in the government contracting sector. Compliance costs and stringent regulations, such as cybersecurity, are significant hurdles. Established firms like CACI, with their existing infrastructure, hold a competitive advantage.

| Factor | Impact on New Entrants | 2024 Data |

|---|---|---|

| Regulatory Compliance | High cost, complex, and time-consuming | Cybersecurity compliance: ~$500,000 average cost |

| Capital Requirements | Difficult to secure funding, high initial investment | Average initial investment needed: ~$100 million |

| Expertise | Need to replicate CACI's skills | Demand for cybersecurity experts increased by 15% |

Porter's Five Forces Analysis Data Sources

This CACI analysis utilizes data from market reports, financial filings, and industry news, offering insights into each force. The analysis is comprehensive and data-driven.