Cadence Design Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cadence Design Bundle

What is included in the product

Tailored analysis for Cadence's product portfolio across the BCG Matrix.

Easily switch color palettes for brand alignment; ensuring Cadence BCG Matrix stays on-brand.

Full Transparency, Always

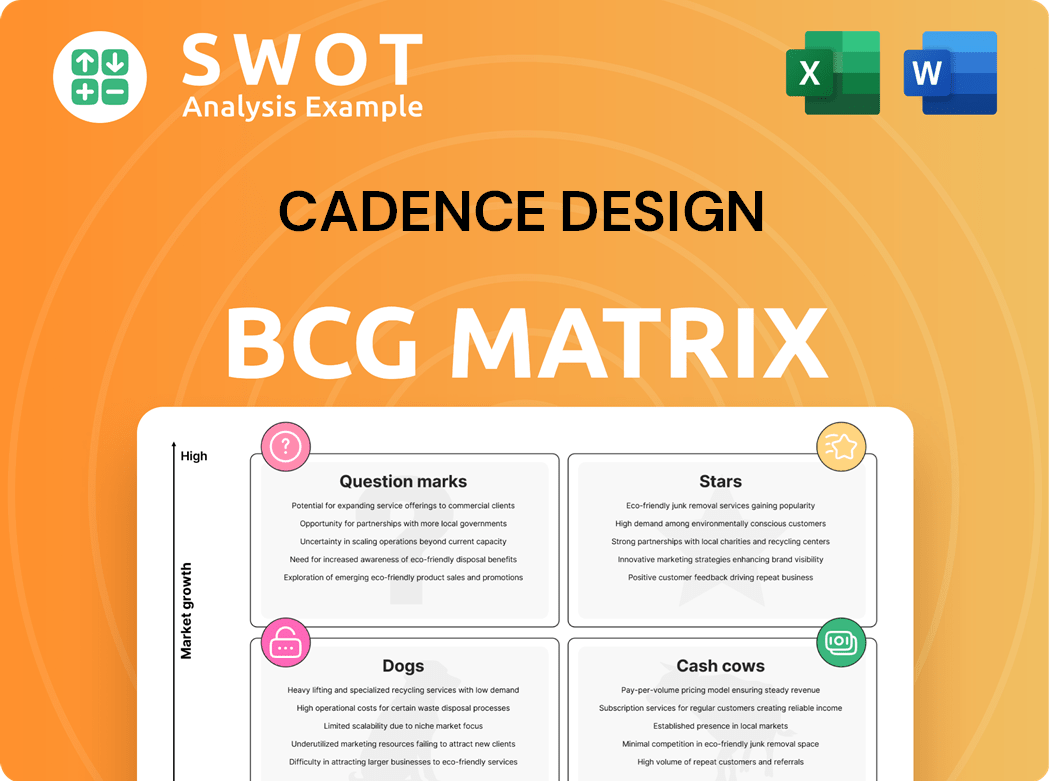

Cadence Design BCG Matrix

The preview displays the full Cadence Design BCG Matrix you'll receive post-purchase. It's a complete, ready-to-use document, offering strategic insights and detailed analysis without any watermarks or demo content. You'll download this exact report for immediate use in your strategic planning or presentations. This purchase grants you the ability to edit, print, and integrate this comprehensive tool seamlessly.

BCG Matrix Template

Cadence Design Systems faces a dynamic landscape. This brief overview hints at product placements within the BCG Matrix quadrants. See potential Stars, Cash Cows, Question Marks, and Dogs. The full matrix provides detailed quadrant analysis. It unveils strategic recommendations for informed decision-making. Get the full BCG Matrix report for actionable insights.

Stars

Cadence's AI-driven EDA tools, including Cerebrus and Verisium SimAI, are rapidly gaining traction. These tools boost efficiency and design quality, crucial for IC design. In 2024, Cadence saw a revenue increase, with AI solutions playing a key role. The strong market adoption of these AI-powered tools makes them stars in Cadence's business portfolio.

The System Design & Analysis segment at Cadence Design Systems, a key component of its BCG Matrix, experienced remarkable growth, surging past 40% in 2024. This impressive performance, fueled by AI-driven optimization tools, highlights Cadence's strategic focus on innovation. The segment's strong contribution solidifies its star status, significantly boosting the company's revenue and market dominance. In 2024, Cadence reported revenues of $4.02 billion, a 15% increase from 2023, with significant contributions from this segment.

Cadence's hardware business, including Palladium Z3 and Protium X3, boomed in 2024. They achieved record results, with Q4 being the strongest. These systems are vital for design verification, meeting growing industry demands. Strong demand positions them as key performers, reflecting their success.

IP Business (AI HPC Protocols)

Cadence's IP business is shining, particularly in AI and high-performance computing. It saw a robust 28% year-over-year growth in Q4, driven by strong demand. Cadence's solutions for HBM, DDR, PCIe, and UCIe are key drivers. This stellar performance firmly positions IP as a star in Cadence's portfolio.

- 28% year-over-year growth in Q4.

- Driven by demand for AI HPC protocols.

- Solutions include HBM, DDR, PCIe, and UCIe.

- Key driver in Cadence's portfolio.

Core EDA Portfolio

Cadence's Core EDA portfolio, which includes digital, custom/analog, and verification tools, is a star. These tools are central to Cadence's offerings. In Q4 2024, the portfolio saw a 15% year-over-year increase. This growth highlights its essential role and strong demand.

- Core EDA tools are crucial for Cadence's business.

- The portfolio's growth contributes significantly to revenue.

- High demand supports its star status.

- Cadence maintains market leadership with these tools.

Cadence's stars are high-growth, high-share businesses. They are key revenue drivers. Cadence's IP and Core EDA are stars. They are essential for market leadership.

| Star Category | Performance Metric (2024) | Key Driver |

|---|---|---|

| AI-Driven EDA | Revenue Growth | Efficiency, Design Quality |

| System Design & Analysis | 40%+ Growth | AI-Driven Optimization |

| Hardware (Palladium, Protium) | Record Results in Q4 | Design Verification |

| IP Business | 28% YoY Growth in Q4 | AI and HPC protocols (HBM, DDR, PCIe, UCIe) |

| Core EDA Portfolio | 15% YoY increase in Q4 | Digital, Custom/Analog, Verification tools |

Cash Cows

Cadence's Custom IC Design and Simulation tools, a cash cow, hold a strong market position. They serve the mature analog and mixed-signal IC design market. These tools consistently generate revenue with minimal promotional investment. In 2024, Cadence reported robust growth in its custom IC segment, reflecting its stable market presence.

Cadence's Digital Implementation and Signoff tools are cash cows, vital for digital IC back-end design. These tools have a strong customer base and a mature market, generating consistent revenue. In 2024, the EDA market, where Cadence thrives, was valued at approximately $14.7 billion. They require less marketing and infrastructure spending, boosting profitability.

Cadence's Verification IP (VIP) is a cash cow due to its consistent demand in IC design. This ensures the correctness and reliability of designs. The VIP products generate predictable revenue with limited investment needs. Cadence's revenue in Q4 2023 was $1.07 billion, showing strong financial performance.

PCB Design Tools (OrCAD and Allegro)

Cadence's OrCAD and Allegro PCB design tools are cash cows, dominating the PCB design market. These tools support diverse applications, from smartphones to cars. The PCB design market's maturity ensures consistent demand, generating steady revenue. In 2024, the PCB design software market was valued at $3.5 billion, reflecting stable growth.

- Market share: Cadence holds a significant market share in PCB design tools.

- Revenue: These tools contribute a substantial portion of Cadence's overall revenue.

- Customer base: They have a large, established customer base across various industries.

- Investment: Minimal marketing investment is needed due to their established reputation.

Legacy EDA Tools

Legacy EDA tools, like those from Cadence, represent cash cows due to their established market presence. These older tools cater to specific needs, maintaining a loyal customer base. They generate revenue with minimal development or marketing costs. Cadence likely benefits from these tools, ensuring financial stability.

- Cadence's revenue in 2024 was approximately $4.0 billion.

- These tools often have high-profit margins.

- They require less R&D investment.

- Customer support is the main cost.

Cadence's cash cows, like Custom IC and Digital Implementation tools, secure consistent revenue. They dominate mature markets, requiring minimal marketing. Revenue in 2024 was about $4.0 billion, showing financial stability.

| Cash Cow | Market Position | Revenue Contribution (2024) |

|---|---|---|

| Custom IC Design | Strong, mature market | Significant, stable |

| Digital Implementation | Dominant, established | High, consistent |

| Verification IP | Consistent demand | Predictable |

Dogs

Declining hardware products within Cadence's portfolio, like older emulation or prototyping systems, might be classified as "dogs." These face low growth, potentially nearing end-of-life. Such products, generating minimal revenue, could lead to reduced investments. In 2024, Cadence's hardware revenue was approximately $400 million. Divesting these could be a strategic move.

Some niche or outdated software tools within Cadence's portfolio might be considered dogs. These tools serve specialized applications that are less in demand. They require minimal upkeep but don't drive significant revenue growth. For instance, in 2024, certain legacy products might have seen a revenue contribution below 1% of Cadence's total annual revenue of $4.03 billion.

Products facing intense competition, like some Cadence offerings against Synopsys, often end up as dogs. These products might show low market share and restricted growth. For instance, if a specific product's revenue growth is under 5% annually, and its market share is less than 10%, it fits this category. Cadence must decide to invest more or divest these underperforming products.

Geographically Underperforming Products (China Decline)

Geographically underperforming products, like those facing revenue declines in China, are categorized as Dogs within the BCG Matrix. Cadence Design experienced a decrease in revenue from China, especially in hardware and IP offerings, signaling strategic challenges. This situation necessitates a reevaluation of strategies and a possible reduction in investments within those specific geographic areas to improve performance.

- China's share of Cadence's total revenue in 2024 was approximately 10%, a decrease from 12% in 2023.

- Hardware and IP revenue in China decreased by 15% in 2024.

- Cadence's overall revenue growth in 2024 was around 10%, but China's growth was only 2%.

Products with Limited AI Integration

Products with limited AI integration can be "dogs" in Cadence's BCG matrix. These offerings may struggle to compete as the market increasingly demands AI-driven solutions. Without AI enhancements, attracting new customers and retaining current ones becomes challenging. For example, in 2024, companies with AI-integrated EDA tools saw a 15% increase in market share. Cadence should evaluate upgrading or potentially discontinuing these products.

- Market shift: The EDA market is rapidly adopting AI.

- Competitive disadvantage: Lack of AI integration hinders competitiveness.

- Financial impact: AI-lacking products may see decreased revenue.

- Strategic action: Cadence should prioritize AI upgrades or phase-outs.

Dogs within Cadence’s portfolio represent underperforming products, facing low growth and potentially near end-of-life. These can include declining hardware, niche software, and offerings in competitive markets, like those against Synopsys, impacting revenue. The need for reduced investments or divestment is highlighted.

| Category | Characteristics | Examples (2024 Data) |

|---|---|---|

| Hardware Products | Low growth, nearing EOL. | ~$400M revenue, potential divestment. |

| Software Tools | Outdated, niche applications. | <1% revenue of $4.03B total annual revenue. |

| Competitive Products | Low market share, restricted growth. | <5% revenue growth, <10% market share. |

Question Marks

Cadence's cloud-based EDA solutions are question marks because their market share is uncertain, yet growth potential is high. The EDA industry is shifting towards the cloud, requiring significant investment from Cadence. As of Q3 2024, Cadence reported a 13% revenue increase, with cloud solutions contributing significantly. Success hinges on market share acquisition, determining if they become stars or dogs.

AI-driven Design Agents, like those on Cadence's JedAI platform, are question marks. They're new, so their market success is uncertain. They could change chip design, but need investment and market acceptance. Cadence's 2024 revenue was about $4 billion; investing wisely is key.

Cadence's move into life sciences is a question mark in its BCG Matrix. The life sciences market offers high growth but is also competitive. Cadence must invest strategically to understand this market and secure its position. Success depends on market adoption; the life science market was valued at $3.2 trillion in 2023.

Millennium Enterprise Multiphysics Platform

The Cadence Millennium Enterprise Multiphysics Platform, introduced in February 2024, currently sits as a question mark within Cadence's BCG Matrix. This platform is designed for intricate multiphysics simulations, a rapidly growing area. Its market share and customer uptake are still uncertain, necessitating strategic investment. In 2024, the simulation software market was valued at approximately $7.5 billion.

- Launched in February 2024.

- Targets complex multiphysics simulations.

- Market share and adoption are yet to be determined.

- Strategic investment is crucial.

Secure-IC Embedded Security IP

Following the January 2025 acquisition of Secure-IC, the embedded security IP platform fits the question mark category within Cadence's BCG Matrix. The industry's focus on security is growing, but integrating Secure-IC's offerings into Cadence's existing portfolio presents uncertainties. Success hinges on how well Secure-IC aligns strategically and positions itself in the market. The potential is there, but it requires careful execution and market validation.

- Market growth in cybersecurity is projected to reach $345.7 billion in 2024.

- Cadence's revenue in Q3 2023 was $1.03 billion.

- The success of the integration of Secure-IC will impact Cadence's future market share.

- Strategic alignment is key to leveraging Secure-IC's technology within Cadence's portfolio.

Cadence's cloud EDA solutions, AI-driven design agents, and life sciences venture are question marks due to uncertain market shares but high growth potential. The recently launched Millennium Enterprise Platform and the Secure-IC acquisition also fall into this category. Strategic investment is critical for these initiatives' future success, especially given the competitive market landscape.

| Initiative | Market Growth Potential | Strategic Considerations |

|---|---|---|

| Cloud EDA | High | Market share acquisition |

| AI-driven Design | High | Investment and market acceptance |

| Life Sciences | High | Strategic market entry and adoption |

| Millennium Platform | High | Customer uptake and strategic investment |

| Secure-IC Acquisition | High | Strategic alignment and market validation |

BCG Matrix Data Sources

Our Cadence Design BCG Matrix is fueled by financial reports, market research, industry analysis, and expert opinions for strategic rigor.