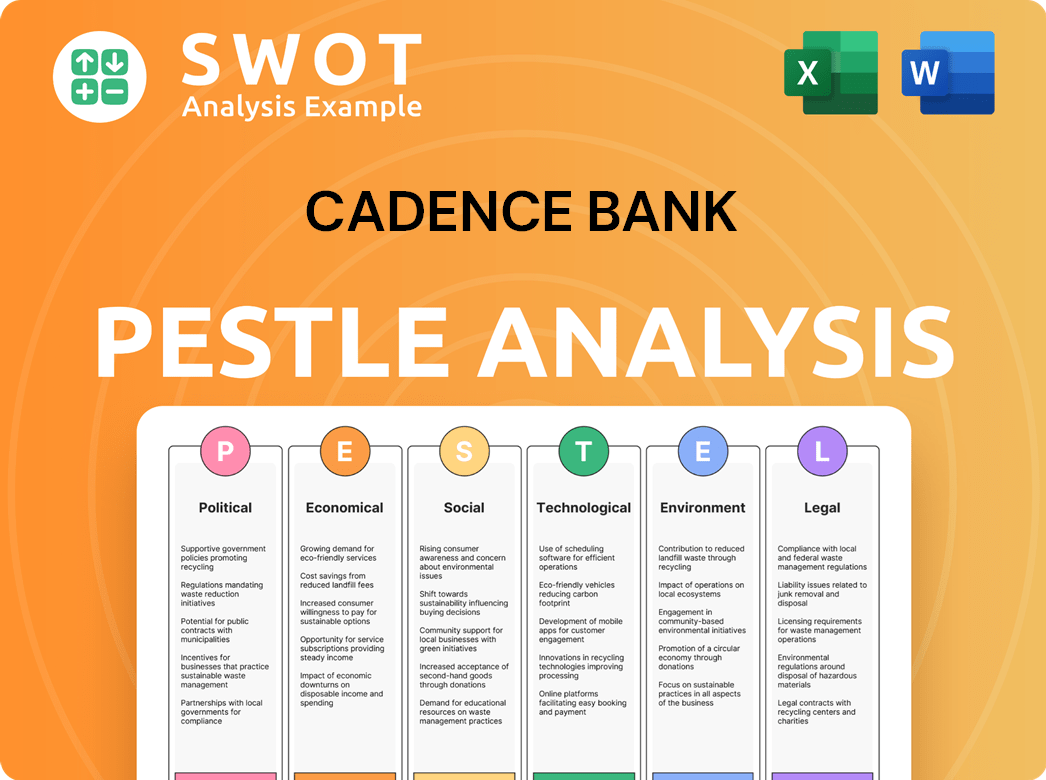

Cadence Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cadence Bank Bundle

What is included in the product

Assesses how external macro factors affect Cadence Bank across six dimensions. Each section offers reliable insights and trend evaluations.

Helps support discussions on external risk and market positioning during planning sessions.

Same Document Delivered

Cadence Bank PESTLE Analysis

Preview Cadence Bank PESTLE analysis! This is the same comprehensive document you get after purchasing. All content and format you see here is included. No changes or alterations; the file is ready. Start using it right away.

PESTLE Analysis Template

Explore Cadence Bank’s external landscape with our expert PESTLE analysis. Understand the impact of political factors on its strategies. Identify economic trends influencing its financial performance. Analyze how social and technological shifts shape its future. Gain insights into regulatory compliance and environmental sustainability. Download the complete version now for actionable intelligence and strategic advantage.

Political factors

Cadence Bank faces a heavily regulated banking sector at federal and state levels. Regulatory shifts, like capital or consumer protection rules, directly influence its profitability. The current environment includes potential deregulation, creating operational complexities. For example, the FDIC's 2024 assessment changes impact bank capital requirements. Increased state-level regulations add to the dynamic landscape.

The Federal Reserve's monetary policies, especially interest rate decisions, significantly impact Cadence Bank. In 2024, the Fed held rates steady, influencing the bank's net interest margin. Any rate cuts or easing in 2025 will affect Cadence's financial performance. For example, a 25 bps rate cut could shift profitability.

Political stability, both domestically and globally, significantly influences financial markets, affecting Cadence Bank. Geopolitical events, like the ongoing conflicts, introduce market volatility. Banks must adeptly navigate these uncertainties. The U.S. political landscape, with the upcoming 2024 elections, also adds to the complexity. Recent data shows a 15% increase in market volatility due to geopolitical factors.

Government Spending and Fiscal Policy

Government spending and fiscal policies significantly impact Cadence Bank. Increased government spending can boost economic activity. Tax policy changes indirectly affect the bank's business. For example, the U.S. federal debt reached $34.68 trillion by early 2024. Changes in tax rates affect consumer spending.

- Federal debt: $34.68 trillion (early 2024).

- Fiscal policy changes affect economic activity.

- Tax rate adjustments influence consumer behavior.

Industry-Specific Political Issues

Political factors significantly influence Cadence Bank's operations. Discussions around bank mergers and acquisitions, alongside heightened focus on non-financial risks such as security, directly affect the bank's strategic decisions. Regulatory scrutiny, particularly regarding operational resilience and third-party risk management, adds another layer of political influence. For example, in 2024, the Federal Reserve and other agencies increased their focus on cybersecurity and third-party vendor risks, impacting bank compliance costs.

- Increased regulatory compliance costs due to evolving cybersecurity standards.

- Potential impacts on M&A activity due to increased regulatory hurdles.

- Heightened focus on data privacy and consumer protection regulations.

Cadence Bank navigates a landscape shaped by government spending and tax policies; with U.S. federal debt at $34.68 trillion early 2024, the bank is affected. Regulatory focus increases on non-financial risks. Increased focus on cybersecurity impacts compliance costs.

| Aspect | Details | Impact on Cadence Bank |

|---|---|---|

| Regulatory Scrutiny | Focus on cybersecurity, third-party vendor risk. | Increased compliance costs |

| Fiscal Policy | Federal debt $34.68T (early 2024). | Indirect impact on consumer behavior, M&A activity |

| Political Stability | Geopolitical events, 2024 U.S. elections | Market volatility, strategic decisions |

Economic factors

Cadence Bank's success heavily relies on the economic vitality of the Southeast. This area's GDP growth, employment figures, and consumer spending directly affect the bank. In 2024, the Southeast's GDP is projected to grow by 3.5%. Strong job growth and increased consumer spending signal a positive outlook for Cadence Bank.

The Federal Reserve's decisions on interest rates directly affect Cadence Bank's financial performance. As of early 2024, the Fed has maintained a high-interest rate environment to combat inflation, which impacts Cadence's net interest margin. In 2023, the average interest rate on commercial and industrial loans was around 6%, reflecting the influence of monetary policy. Changes in interest rates can alter the bank's profitability by affecting borrowing costs and loan yields.

Inflation rates significantly influence consumer and business purchasing power, shaping spending and investment strategies. Elevated inflation can increase operational costs for Cadence Bank, potentially affecting its profitability. The Federal Reserve's target inflation rate is 2%, but in 2024, it fluctuated. For example, the Consumer Price Index (CPI) rose 3.5% in March 2024. Persistent inflation can also strain the financial well-being of Cadence Bank's customers.

Unemployment Rates

Unemployment rates are a crucial economic factor for Cadence Bank. High unemployment can increase loan defaults, impacting the bank's financial health. The bank's operational areas' economic stability is directly tied to employment levels, affecting both consumer and business credit demand. Rising joblessness often leads to increased credit losses for the bank. As of early 2024, the national unemployment rate was around 3.9%, showcasing a stable, yet sensitive, economic environment.

- Loan Repayment: Higher unemployment reduces the ability of individuals to repay their loans.

- Credit Demand: Businesses may reduce their demand for credit during economic downturns.

- Financial Performance: The bank's profitability is affected by the credit quality of its loan portfolio.

- Economic Conditions: A strong economy with low unemployment supports the bank's overall financial stability.

Commercial Real Estate Market Conditions

Cadence Bank's financial health is intertwined with the commercial real estate market. Regional banks like Cadence have significant exposure to commercial real estate loans. A downturn, especially in office spaces, could lead to loan defaults and impact the bank's financial stability.

- Office vacancy rates have risen, nearing pre-pandemic levels in some major markets by early 2024.

- Commercial mortgage-backed securities (CMBS) delinquency rates are increasing, signaling potential distress.

- Cadence Bank's Q1 2024 earnings reported a slight increase in provisions for credit losses, reflecting the economic uncertainty.

Economic factors significantly influence Cadence Bank's performance, particularly in the Southeast, where its primary operations are based. The projected GDP growth for the Southeast is about 3.5% in 2024. Key variables impacting Cadence Bank are inflation, interest rates, and unemployment rates; all affecting loan repayment and credit demand.

| Economic Indicator | Data |

|---|---|

| GDP Growth (Southeast, 2024) | 3.5% (Projected) |

| Federal Reserve Interest Rate (Early 2024) | High, aiming to combat inflation |

| Unemployment Rate (National, early 2024) | 3.9% |

Sociological factors

The Southeast's population is changing, with migration and age shifts impacting Cadence Bank. Younger populations may boost demand for digital banking. For example, in 2024, the Southeast saw a 1.2% population increase, with millennials driving digital banking use. This growth affects loan products and branch locations.

Customer preferences are rapidly changing, with digital banking becoming the norm. Cadence Bank must adjust to personalized financial experiences. According to the 2024 Deloitte Digital Banking Trends report, 73% of consumers prefer digital banking. Customer-centric models are vital for success. Cadence must prioritize these shifts.

Cadence Bank's community involvement, especially in the Southeast, shapes its reputation and customer loyalty. Strong community engagement, including financial literacy programs, boosts its image. In 2024, banks with robust community investment saw a 10% increase in customer retention. Financial inclusion efforts are crucial.

Workforce Demographics and Talent Acquisition

Cadence Bank's success hinges on its workforce demographics and talent acquisition strategies. Societal shifts influence the availability of skilled banking professionals. A diverse and engaged workforce is crucial for business success, reflecting broader societal values. According to the Bureau of Labor Statistics, the finance and insurance sector employed about 6.1 million people as of May 2024. This includes a broad range of roles essential for Cadence Bank's operations.

- The financial services sector is experiencing an increase in remote work options, which changes talent acquisition dynamics.

- Diversity and inclusion initiatives are becoming increasingly important for attracting and retaining talent.

- The aging workforce in banking presents challenges and opportunities related to knowledge transfer and succession planning.

- Competition for skilled professionals is intense, requiring competitive compensation and benefits packages.

Socioeconomic Trends

Cadence Bank's strategies are significantly shaped by socioeconomic trends, including income inequality and the reach of financial services within underserved communities. These factors directly impact its financial inclusion and community development initiatives, reflecting a broader societal shift towards equitable access. In 2024, the FDIC reported that approximately 5.4% of U.S. households were unbanked. Cadence Bank's focus on these areas aligns with its community-focused mission. This strategic alignment is crucial for sustainable growth.

- Unbanked Households: Approximately 5.4% of U.S. households in 2024.

- Financial Inclusion Initiatives: Cadence Bank's strategic focus.

- Community Development: A key area of Cadence Bank's strategic emphasis.

- Societal Shift: Towards equitable financial service access.

Cadence Bank navigates shifting demographics impacting digital banking. Customer preference trends show digital banking is preferred by a significant majority. Community engagement and financial inclusion efforts directly affect reputation and customer loyalty.

| Sociological Factor | Impact | 2024/2025 Data Point |

|---|---|---|

| Demographic Shifts | Impacts branch use, digital adoption. | Southeast pop. grew 1.2% (2024). |

| Customer Preferences | Need for personalized banking. | 73% prefer digital banking (2024). |

| Community Involvement | Enhances brand & loyalty. | 10% rise in customer retention. |

Technological factors

Digital banking adoption is surging; in 2024, about 60% of U.S. adults regularly used mobile banking. Cadence Bank must boost its digital platforms. Investment in mobile apps and online services is crucial. Virtual IBANs could streamline transactions.

Cybersecurity threats are escalating with tech advancements, posing significant risks to Cadence Bank. In 2024, the financial sector saw a 28% rise in cyberattacks. Cadence Bank needs to bolster its defenses, investing in updated security systems.

Cadence Bank is navigating the evolving technological landscape. The rise of fintech and AI integration offers chances for personalized services, fraud detection, and operational gains. However, this requires careful execution and compliance with regulations. In 2024, the fintech market is projected to reach $170 billion, signaling significant industry disruption.

Technological Infrastructure and Modernization

Cadence Bank must continually update its technological infrastructure to stay competitive. This involves supporting digital services and boosting operational efficiency. Investing in cloud computing and data infrastructure is crucial for future growth. Cadence Bank's IT spending in 2024 reached $350 million, reflecting its commitment. The bank aims to increase this to $400 million by 2025 to support innovations.

- IT spending in 2024: $350 million.

- Target IT spending in 2025: $400 million.

Automation and Operational Efficiency

Cadence Bank leverages technology to automate banking functions, enhancing efficiency. Automation streamlines processes like loan origination and customer service. This leads to cost reduction and improved customer satisfaction. In 2024, banks saw a 15% increase in automation adoption.

- Automation reduces operational costs by up to 20%.

- Customer satisfaction scores improve by 10% due to faster service.

- Loan processing times are cut by 30% with automation.

Cadence Bank is significantly investing in technology, planning a $400 million IT budget for 2025. Cybersecurity enhancements and fintech integrations are crucial for their operations.

Automation is set to reduce operational costs, with adoption rates increasing in the banking sector.

Focusing on digital platforms and infrastructure upgrades positions Cadence Bank for competitive advantages in a fast-changing market, like other US banks such as Bank of America, which invested $15.6 billion in tech in 2024.

| Factor | Details | Impact |

|---|---|---|

| Digital Banking | 60% US adults use mobile banking in 2024 | Requires investment in digital platforms |

| Cybersecurity | 28% rise in cyberattacks in 2024 | Needs robust security investments |

| Fintech & AI | Fintech market projected $170B in 2024 | Opportunity for service personalization |

Legal factors

Cadence Bank faces stringent federal and state banking regulations. Maintaining compliance with laws like the Dodd-Frank Act and capital requirements is crucial. These regulations impact lending practices, risk management, and financial reporting. For 2024, banks must meet higher capital standards. Cadence Bank's legal team ensures adherence to evolving compliance standards.

Cadence Bank must adhere to stringent Anti-Money Laundering (AML) and counter-terrorism financing regulations. These require comprehensive programs and procedures to prevent financial crimes. In 2024, regulatory changes and increased enforcement are expected. Banks must invest in updated compliance systems. The Financial Crimes Enforcement Network (FinCEN) issued over $100 million in penalties in 2024 for AML violations.

Consumer protection laws, crucial for Cadence Bank, govern lending, disclosures, and privacy, directly affecting retail customer interactions. The Consumer Financial Protection Bureau (CFPB) enforces these rules, impacting bank operations significantly. In 2024, the CFPB continued its focus on fair lending and data privacy. For example, in Q1 2024, the CFPB issued consent orders against several financial institutions for violations.

Data Privacy and Security Regulations

Data privacy and security are increasingly critical, with regulations like GDPR and state-level laws mandating robust data protection. These regulations force banks to adopt stringent data handling practices to safeguard customer information. In 2024, data breaches cost the financial sector an average of $5.9 million per incident, highlighting the financial impact of non-compliance. Cadence Bank must invest in compliance to avoid penalties and maintain customer trust.

- GDPR and CCPA compliance are crucial.

- Data breach costs average $5.9 million.

- Stringent data handling is essential.

- Customer trust depends on security.

Legal and Litigation Risks

Cadence Bank faces legal and litigation risks from lending, compliance, and operational issues. These risks require careful legal management. In 2024, the financial services sector saw a 15% increase in litigation costs. Cadence Bank must navigate evolving regulations to minimize legal exposure. Maintaining strong compliance programs is crucial for risk mitigation.

- Lending disputes and regulatory compliance are primary legal concerns.

- Financial institutions are under scrutiny, increasing litigation probability.

- Operational failures can lead to lawsuits and penalties.

Cadence Bank must navigate strict banking regulations to ensure compliance, which impacts all of its practices, especially lending and capital requirements. They must comply with anti-money laundering rules and invest in compliance systems to prevent financial crimes. Consumer protection laws, such as those enforced by the CFPB, are also crucial. Cadence Bank has to manage legal risks related to lending disputes and operational failures.

| Regulation | Impact | 2024/2025 Data |

|---|---|---|

| Dodd-Frank Act | Lending, Risk Management | Compliance remains strict. |

| AML | Prevent Financial Crimes | FinCEN fines exceeded $100M in 2024. |

| Consumer Protection | Lending, Disclosures, Privacy | CFPB issued multiple consent orders. |

| Data Privacy | GDPR, State Laws | Data breaches cost ~$5.9M per incident in 2024. |

| Litigation Risks | Lending, Compliance, Ops | Financial sector saw a 15% rise in costs. |

Environmental factors

Cadence Bank, like all financial institutions, faces growing pressure to integrate environmental sustainability into its operations. This involves reducing its carbon footprint and ensuring lending practices align with environmental goals. In 2024, banks globally are increasingly assessed on their ESG (Environmental, Social, and Governance) performance, impacting investor confidence. For example, in 2024, the sustainable debt market reached over $1 trillion.

Cadence Bank, operating primarily in the southeastern U.S., faces climate change risks. Increased extreme weather events, like hurricanes, could damage assets and disrupt operations. These events cost the U.S. billions annually; in 2023, insured losses from severe storms totaled over $60 billion. Climate risks may also affect lending practices.

Cadence Bank, like all banks, faces indirect impacts from environmental regulations. These regulations primarily affect their clients and the sectors they finance. In 2024, environmental, social, and governance (ESG) factors are increasingly important. Banks must also comply with environmental impact reporting requirements. For example, the US banking sector's commitment to sustainable finance is growing, with investments in green initiatives.

Stakeholder Expectations on ESG

Stakeholders, including customers and investors, are now highly focused on Environmental, Social, and Governance (ESG) factors. Cadence Bank's ESG performance can significantly affect its reputation and relationships with investors. In 2024, ESG-focused assets under management reached approximately $40 trillion globally, reflecting this growing importance.

- Cadence Bank must meet these expectations to maintain and improve its market position.

- ESG considerations are becoming critical in investment decisions.

- Failure to address ESG concerns can lead to reputational damage.

Operational Environmental Footprint

Cadence Bank can show its commitment to the environment by managing its operational footprint. This includes reducing energy use in its branches and offices. For example, in 2024, many banks are investing in energy-efficient equipment. This also involves implementing recycling programs and reducing waste.

- In 2024, the financial sector saw a 15% increase in green building certifications for offices.

- Cadence Bank could reduce operational costs by up to 10% by implementing energy-efficient measures.

Environmental factors are increasingly critical for Cadence Bank. They influence operations through ESG demands, stakeholder expectations, and climate risks. Banks worldwide face increased environmental scrutiny, with the sustainable debt market exceeding $1 trillion by 2024. This includes reducing carbon footprints and ensuring lending practices support environmental sustainability.

| Aspect | Details | Impact on Cadence Bank |

|---|---|---|

| Climate Change | Increased extreme weather events | Potential asset damage, operational disruption. |

| ESG Focus | Growing importance among investors, customers | Affects reputation, market position, investment decisions. |

| Regulatory Impact | Compliance with environmental impact reporting | Direct influence on clients' operations and Cadence Bank's loan decisions. |

PESTLE Analysis Data Sources

This PESTLE Analysis relies on verified data from financial reports, legal frameworks, and market research. It utilizes government publications and industry analysis for accuracy.