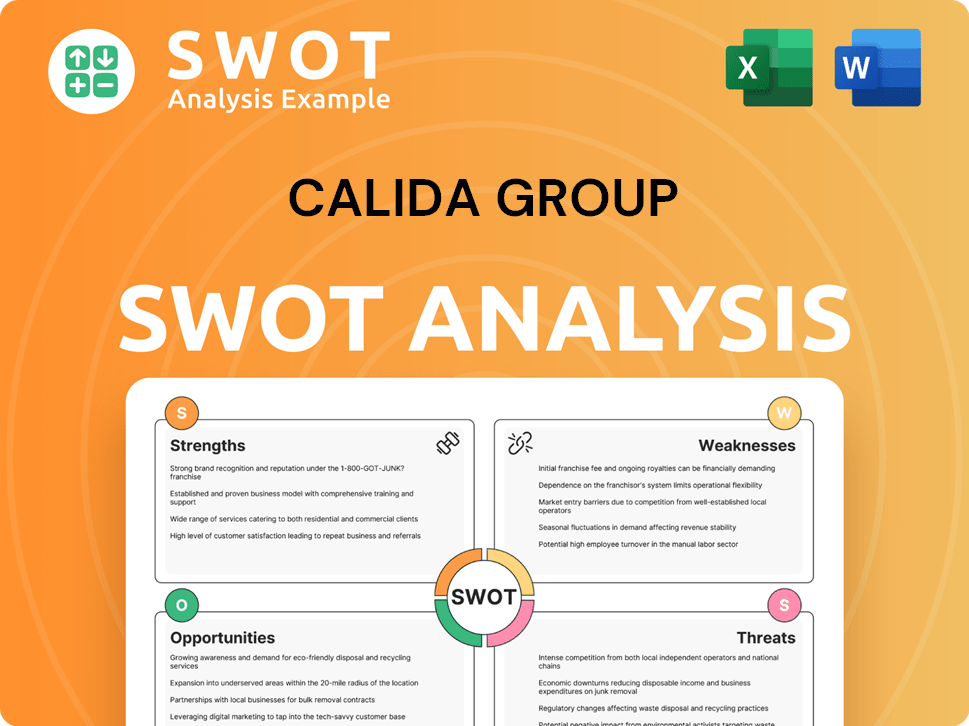

CALIDA Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CALIDA Group Bundle

What is included in the product

Analyzes CALIDA Group’s competitive position through key internal and external factors.

Provides a simple, high-level SWOT template for fast decision-making.

Full Version Awaits

CALIDA Group SWOT Analysis

This is a real preview of the SWOT analysis you'll download. Every strength, weakness, opportunity & threat shown is from the complete document.

SWOT Analysis Template

The CALIDA Group faces both enticing opportunities and significant threats in its dynamic market. Key strengths include its strong brand reputation and innovative product lines. However, vulnerabilities like supply chain dependencies require careful navigation. We've touched on the surface here—explore the comprehensive SWOT analysis for deeper dives.

Strengths

CALIDA Group benefits from the strong presence of its core brands, CALIDA and AUBADE, which hold established international market positions. These brands serve as a reliable base for the group's financial performance. In 2024, CALIDA reported stable sales, with the brands contributing significantly. These brands are also poised for future growth, offering attractive development prospects, with AUBADE's sales increasing by 7% in the first half of 2024.

CALIDA Group's strength lies in its focus on core textile businesses. The strategic shift towards bodywear, sleepwear, and lingerie enhances market concentration. This allows for operational optimization, boosting efficiency. In 2024, the premium underwear market is projected to reach $40 billion. This focus should drive growth.

CALIDA Group's e-commerce channel is a significant strength. Online sales have grown steadily, with the e-commerce share rising in 2024. This channel is a stable driver, supporting international expansion for brands like AUBADE. Investments in technology have boosted direct-to-consumer and e-commerce sales. In 2024, the e-commerce segment increased by 15%.

Robust Financial Position

CALIDA Group's strengths include its strong financial position, highlighted by increased net liquidity and a debt-free status in 2024. This stems from the profitable sale of Lafuma Mobilier and share buybacks. These buybacks are designed to boost earnings per share and stabilize the shareholder structure. The robust balance sheet offers significant financial flexibility for future ventures.

- Net liquidity increased following strategic moves.

- Debt-free status ensures financial stability.

- Share buybacks enhance shareholder value.

Commitment to Sustainability

CALIDA Group strongly emphasizes sustainability, making it a core value across all brands. They aim to lead the underwear sector in sustainability, focusing on eco-friendly product development. This involves creating recyclable, durable, and resource-efficient items, alongside efforts to improve traceability and lessen their carbon footprint. In 2024, CALIDA reported a 15% reduction in water usage during production.

- Sustainability is a core value.

- Focus on eco-friendly products.

- Aim to reduce carbon footprint.

- 15% reduction in water usage (2024).

CALIDA Group’s strengths are its leading brands like CALIDA and AUBADE, which saw a 7% sales increase for AUBADE in 2024, driving growth. The company’s focus on core textile businesses boosts operational efficiency. Strong e-commerce performance, up 15% in 2024, enhances market reach. Financial stability is ensured by increased net liquidity and a debt-free status.

| Strength | Details | 2024 Data |

|---|---|---|

| Brand Power | Established market position, core brands | AUBADE sales up 7% |

| Strategic Focus | Focus on bodywear & lingerie | Premium underwear market ~$40B |

| E-commerce | Growing online presence | E-commerce up 15% |

Weaknesses

The CALIDA Group faced a decline in currency-adjusted sales during 2024. This downturn was influenced by a tough market and cautious consumer behavior. Consequently, the company saw a reduction in its adjusted operating profit. The EBIT margin also decreased due to the lower sales figures.

The COSABELLA brand faced a substantial sales downturn in 2024, necessitating a strategic overhaul. This repositioning demands significant restructuring across all areas. The rebuilding phase for COSABELLA is projected to extend for an indefinite period. CALIDA Group's report indicated a 15% sales decrease for COSABELLA in 2024, impacting overall profitability.

Weak sales in physical stores reflect dampened consumer confidence. This was evident in Q4 2024, especially in key markets. Though online sales are rising, retail and wholesale remain vital. In 2024, brick-and-mortar sales declined by 7%.

Impact on Specific Brands

CALIDA Group faced brand-specific challenges, notably impacting CALIDA and AUBADE. CALIDA experienced a downturn in the fourth quarter of 2024, affecting overall performance. AUBADE also saw a sales decrease. However, AUBADE is poised to rebound, anticipating improved consumer sentiment within the French market. This strategic positioning suggests a focus on recovery and growth.

- CALIDA brand decline in Q4 2024.

- AUBADE sales decrease.

- Anticipated recovery in the French market for AUBADE.

Resource Intensive Repositioning

The ongoing repositioning of the COSABELLA brand demands significant resources from the CALIDA Group. This strategic realignment consumes financial and personnel assets, impacting overall profitability. Transforming COSABELLA into a competitive brand requires further investments over several years. The shift has affected the company’s financial performance in 2023, as shown in the annual report.

- COSABELLA's repositioning absorbed significant capital in 2023.

- The restructuring plan includes marketing and operational investments.

- CALIDA Group expects continued investment in COSABELLA in 2024 and 2025.

Weaknesses for CALIDA Group include currency-adjusted sales declines, impacting profitability and EBIT margins. The COSABELLA brand's restructuring demands significant resources, affecting short-term performance. Declining brick-and-mortar sales further highlight areas needing improvement, and the CALIDA brand has faced challenges, and the AUBADE brand saw sales decrease.

| Weakness | Impact | Data (2024) |

|---|---|---|

| Sales Decline | Reduced profitability | Overall sales decline in 2024, brick and mortar declined 7% |

| COSABELLA Repositioning | Resource intensive | 15% sales decrease for COSABELLA |

| Brand Challenges | Reduced market share | CALIDA in Q4 2024, AUBADE Sales Decrease |

Opportunities

The CALIDA Group's strategic realignment, emphasizing textiles and brands such as CALIDA, AUBADE, and COSABELLA, presents substantial growth prospects. Management changes aim to bolster established brands and unlock COSABELLA's potential. In 2024, the textile market is projected to grow by 3-5%. This strategic shift positions CALIDA for increased market share and profitability.

The continuous rise in e-commerce offers CALIDA Group a chance to boost international growth. In 2024, online sales' portion of total sales grew, indicating strong potential. Investments in direct-to-consumer and e-commerce tech have already shown success. Migrating e-commerce platforms can further support the direct-to-consumer business, mirroring AUBADE's strategy.

A rebound in consumer sentiment within key markets could boost CALIDA's sales. This is especially true for AUBADE in France. In 2024, French consumer confidence saw slight improvements. Increased confidence often drives higher spending on luxury items. For example, in Q1 2024, luxury sales in France saw a 3% increase.

Integration of COSABELLA Operations

The CALIDA Group's integration of COSABELLA operations, starting May 2025, presents a strategic opportunity. This move allows for enhanced control over COSABELLA's non-US market operations, optimizing product development and supply chain efficiencies. The goal is to align COSABELLA's offerings with its core brand identity by 2026, potentially boosting sales. This strategic shift is expected to contribute positively to CALIDA's overall financial performance.

- Operational control enhances brand consistency.

- Supply chain optimization can reduce costs.

- Sales alignment boosts revenue potential.

- Product lineup reflects brand DNA by 2026.

Growth in Luxury Underwear Market

The global luxury underwear market is set for growth, presenting CALIDA Group with an opportunity. This expansion is fueled by evolving consumer tastes and product innovation. CALIDA's premium brands are well-positioned to capitalize on this trend, potentially boosting revenue. The luxury underwear market is expected to reach $4.5 billion by 2025.

- Market growth provides CALIDA Group with expansion possibilities.

- Consumer preferences and innovation drive demand.

- CALIDA's premium brands can benefit.

- The luxury underwear market is projected to hit $4.5B by 2025.

CALIDA Group can leverage textile market growth, projected at 3-5% in 2024. E-commerce expansion, mirroring AUBADE's success, presents further opportunities. Increased consumer spending in key markets boosts sales, particularly in luxury items where a 3% rise was seen in Q1 2024. Integration of COSABELLA boosts control, driving product alignment and supply chain efficiencies by May 2025.

| Opportunity | Details | Data |

|---|---|---|

| Textile Market Growth | Expansion of existing textile markets | Projected growth: 3-5% (2024) |

| E-commerce Expansion | Boosting international growth through online sales | Online sales share of total sales is growing (2024) |

| Consumer Spending Increase | Higher consumer confidence drives spending | Luxury sales in France: 3% increase (Q1 2024) |

| COSABELLA Integration | Streamlining operations and brand alignment | COSABELLA integration starting: May 2025 |

| Luxury Underwear Market Growth | Capitalizing on growing demand | Market forecast: $4.5B by 2025 |

Threats

Subdued consumer sentiment poses a threat to CALIDA Group. Weak consumer confidence has already affected sales, especially in physical stores. Economic instability could further curb spending on non-essentials. In 2024, retail sales in Europe saw a slight decrease, reflecting cautious consumer behavior. This trend may persist into 2025, impacting CALIDA.

The CALIDA Group faces stiff competition in the premium apparel market. Competitors include established international brands and local players. In 2024, the global apparel market was valued at approximately $1.7 trillion. This competitive pressure demands ongoing innovation. To thrive, CALIDA must adapt to changing consumer tastes and marketing trends.

CALIDA Group faces a claim for damages related to the LAFUMA MOBILIER sale, announced in March 2025. This legal challenge could lead to financial burdens, potentially affecting the company's profitability. The outcome could strain resources, impacting future investments. The group must allocate funds for legal defense and potential settlements.

Reliance on Retail and Wholesale

CALIDA Group heavily relies on retail and wholesale, even with online sales increasing. Slowdowns in these channels, influenced by weak consumer confidence, threaten growth. For instance, in 2023, retail and wholesale accounted for 65% of total sales. This dependence requires navigating challenges in these areas effectively. The group must adapt to shifting consumer behaviors to maintain profitability.

- Retail and wholesale channels are crucial for CALIDA's growth, despite online expansion.

- Poor performance in these channels, due to weak consumer sentiment, poses a threat.

- CALIDA needs to address challenges within its traditional distribution networks.

Need for Successful COSABELLA Repositioning

The successful repositioning of COSABELLA is vital for CALIDA Group's future. Failing to make it competitive by 2026 could lead to ongoing financial losses. This could strain resources and impact overall performance. The brand's alignment is key to its survival and group's success.

- COSABELLA's sales decreased by 10.7% in the first half of 2023.

- The repositioning aims to boost sales and market share by 2026.

- Ineffective changes could lead to further financial strain.

Consumer sentiment decline, evident in 2024 retail data, threatens CALIDA’s sales. Intense market competition from global and local brands challenges CALIDA. Legal claims from LAFUMA MOBILIER's sale present financial risks. Dependence on retail and wholesale channels and underperforming COSABELLA pose risks.

| Threat | Description | Impact |

|---|---|---|

| Economic Slowdown | Weak consumer spending due to economic instability. | Reduced sales in retail and wholesale. |

| Market Competition | Intense rivalry from established brands in the apparel market. | Pressure on pricing, margins, and market share. |

| Legal Challenges | Claim for damages related to the LAFUMA MOBILIER sale. | Potential financial burden and resource strain. |

| Distribution Reliance | High dependence on retail and wholesale channels. | Vulnerability to shifts in consumer behavior. |

| COSABELLA Repositioning | Risk associated with failure to make COSABELLA competitive by 2026. | Ongoing financial losses and strain on resources. |

SWOT Analysis Data Sources

This SWOT analysis leverages reliable financial data, market research, and expert analysis for an informed strategic overview.