Calumet Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calumet Bundle

What is included in the product

Strategic review of Calumet's business units in the BCG Matrix.

Printable summary optimized for A4 and mobile PDFs, allowing concise strategic insights.

Preview = Final Product

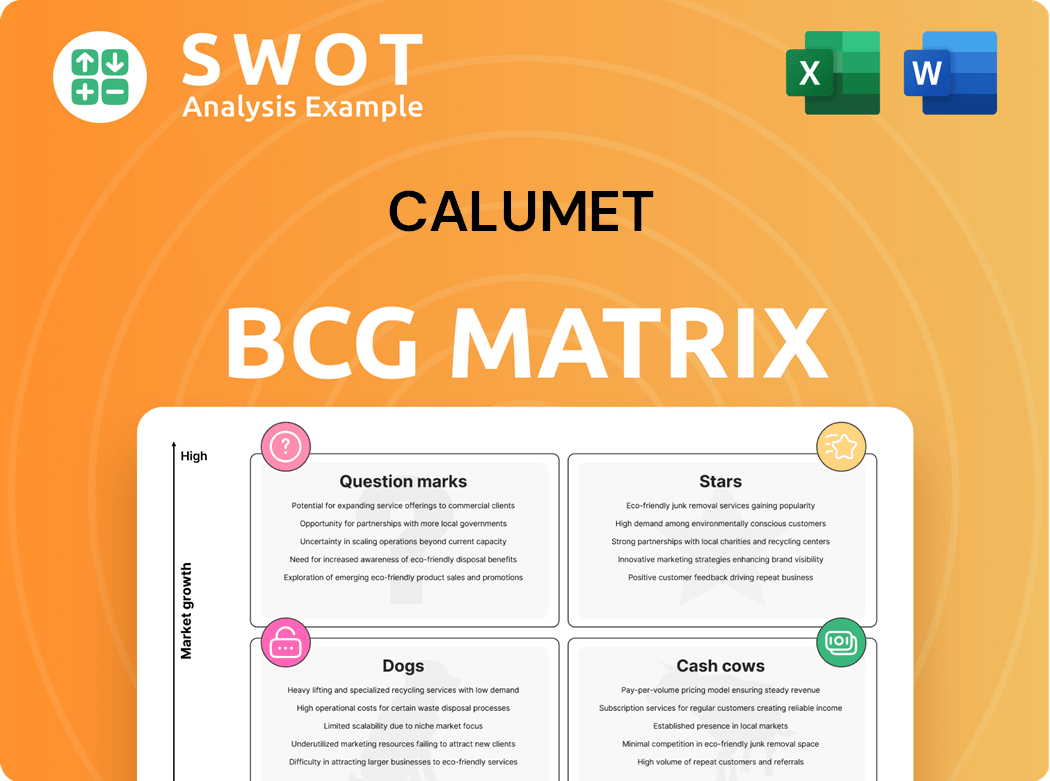

Calumet BCG Matrix

The Calumet BCG Matrix you're previewing is the same file you'll receive immediately after purchase. It's a comprehensive, ready-to-use strategic tool. No extra steps – download and analyze.

BCG Matrix Template

Explore Calumet’s product portfolio with a glimpse into its BCG Matrix! See how its offerings are classified: Stars, Cash Cows, Dogs, or Question Marks. This preview provides a snapshot, but the full analysis offers much more.

The complete BCG Matrix unlocks detailed quadrant breakdowns, strategic recommendations, and insightful commentary. Understand Calumet's market position and make informed decisions.

Unlock the full report now! Gain access to data-driven insights and a roadmap for smarter investment and product choices. Your strategic advantage awaits.

Stars

Calumet's strategic shift to Sustainable Aviation Fuel (SAF) through Montana Renewables (MRL) designates it as a Star within the BCG Matrix. MRL currently leads the SAF market in North America. The company's investment in MaxSAF expansion, facilitated by a Department of Energy loan, boosts its growth. Calumet's SAF production capacity is expected to reach 270 million gallons per year.

The Specialty Products and Solutions (SPS) segment at Calumet is a "Star" in the BCG Matrix, reflecting its strong market position. In 2024, SPS achieved record sales volume, driven by a 7% year-over-year volume increase. The commercial team's sales performance was exceptional, maximizing the existing portfolio. SPS has consistently posted positive EBITDA, even amid market challenges.

Calumet's choice to keep and expand the consumer Royal Purple business, despite selling the industrial side, highlights a strategic move into a promising area. Performance Brands saw a 22% volume increase, generating $51 million in adjusted EBITDA. This strong financial performance indicates significant growth potential for the consumer products. Therefore, Royal Purple Consumer Products is likely to be a Star.

Strategic Shift to Renewables

Calumet's strategic pivot towards renewables, highlighted by the Montana Renewables facility, targets a burgeoning market. Converting Great Falls assets into a green diesel facility underscores their commitment to renewable energy. This shift is expected to substantially boost gross margins. Calumet's actions align with the rising demand for sustainable fuels.

- Montana Renewables facility focuses on renewable diesel production.

- Great Falls conversion enhances renewable energy capacity.

- Renewable diesel market expected to grow significantly by 2024.

- Gross margin improvements are a key financial goal.

DOE Loan Funding

The DOE loan funding, initiated in February 2025, offers a key financial lift for Calumet. This funding is projected to cut annual debt servicing expenses by $79 million starting in 2025. This financial relief strengthens the company's position. The firm's strategic direction, combined with its ability to secure favorable financing, bolsters long-term stock value.

- Loan Amount: Undisclosed, but impactful.

- Debt Servicing Savings: $79 million annually.

- Start Date: February 2025 (initial funds).

- Strategic Impact: Enhances financial flexibility.

Calumet's "Stars" are thriving segments like Montana Renewables (SAF) and Specialty Products. Royal Purple Consumer also shows strong growth. These segments drive sales and positive EBITDA, achieving record volumes in 2024.

| Segment | Key Metric (2024) | Strategic Significance |

|---|---|---|

| MRL (SAF) | Leading SAF Market in North America | High growth potential, DOE loan |

| SPS | 7% YoY Volume Increase | Strong market position, record sales |

| Royal Purple | 22% Volume Increase | Consumer growth, high EBITDA |

Cash Cows

Calumet's specialty base oils and waxes are a cornerstone of its business, generating reliable revenue. The company is a key independent producer in this segment. It creates and sells specialty branded products for consumer and industrial markets. In 2024, this segment contributed significantly to Calumet's overall revenue, accounting for approximately 40% of total sales.

Solvents are a key component of Calumet's specialty hydrocarbon offerings, ensuring a steady cash flow. Calumet's business includes crude oil refining, blending, and terminal operations. In 2023, Calumet reported revenues of $3.5 billion, with specialty products contributing a significant portion. These solvents cater to established markets, providing operational stability.

Calumet's Performance Brands, including Royal Purple, Bel-Ray, and TruFuel, are key cash cows. These brands generate significant revenue through high-performance products. In 2024, about 90% of Calumet's revenues came from the U.S. While not perfectly correlated, GDP growth serves as a useful indicator for volume growth projections.

Strategic Asset Base

Calumet's strategic asset base includes 12 manufacturing facilities in North America, focusing on specialty products. These facilities handle crude oil and specialty hydrocarbon refining, blending, and terminal operations. Higher capacity utilization at MRL could boost Calumet's margins, even with refining margin moderation from 2022. The company's total revenue in 2023 was approximately $3.4 billion.

- Calumet operates 12 facilities.

- Focus on specialty products.

- 2023 Revenue: ~$3.4B.

- MRL capacity impacts margins.

Strong Sales Volume

Calumet's strong sales volume helped navigate a tough market, even with softer demand and higher global inventories, mirroring conditions last seen over five years ago. In similar past environments, specialty margins were around $20 per barrel lower. This demonstrates the resilience of their sales strategies. The company's ability to maintain volumes is a key factor in its cash generation.

- Sales volume performance offset weakened commodity environment.

- Demand softened, and global inventories increased.

- Specialty margins were ~$20/barrel lower in similar past environments.

- Strong sales are crucial for cash generation.

Calumet's cash cows, like Royal Purple, Bel-Ray, and TruFuel, are high-performance products. These brands consistently generate substantial revenue. In 2024, specialty product sales drove approximately 40% of total sales, demonstrating their financial significance.

| Metric | Value (2024 est.) |

|---|---|

| Specialty Product Sales Contribution | ~40% of Total Sales |

| Revenue from U.S. | ~90% |

| 2023 Revenue | ~$3.4B |

Dogs

Calumet sold Royal Purple's industrial assets for $110M in 2024. This move suggests the industrial segment underperformed compared to its consumer counterpart. The consumer business and the Texas production facility remain with Calumet. This strategic shift allows focus on a potentially more profitable consumer market. This decision reflects a focus on core competencies and maximizing returns.

Calumet's fuels segment, including gasoline, diesel, and jet fuel, has struggled due to negative crack spreads and weak pricing. This environment is projected to continue into 2024. Strong production helped offset some challenges. In Q3 2023, Calumet's fuels segment saw a decline in revenue.

Calumet's "Dogs" status reflects challenges in refining margins. Moderation from 2022's peak hurt performance. Unexpected outages and a slower MRL facility startup worsened 2023 credit metrics. For example, in Q3 2023, adjusted EBITDA was $52.7 million, down from $245.3 million the previous year.

Legacy MLP Structure (Converted)

Calumet's transition from an MLP to a C-Corporation is a significant strategic move. This change aims to broaden its investor base. The MLP structure may have limited access to certain institutional investors. By converting, Calumet hopes to increase its stock's appeal.

- Calumet's stock price performance in 2024.

- Impact on trading volumes.

- Institutional investor interest.

- Future dividend policy.

Debt and Refinancing Risk

Calumet Specialty Products Partners faces substantial debt and refinancing risks, solidifying its position as a "Dog" in the BCG matrix. The company is currently managing its $364 million in outstanding April 2025 notes, increasing refinancing risk. This risk is heightened due to tight liquidity and operational delays experienced in 2023.

- April 2025 notes: $364 million outstanding.

- Operational delays in 2023 impacted liquidity.

- Refinancing risk remains elevated.

Calumet's "Dogs" status highlights significant financial challenges.

Refining margin pressures and operational setbacks have hurt profitability in 2024.

High debt and refinancing risks further define Calumet's position.

| Metric | Q3 2022 | Q3 2023 | Change |

|---|---|---|---|

| Adjusted EBITDA ($M) | $245.3 | $52.7 | -78.5% |

| April 2025 Notes Outstanding ($M) | - | $364 | N/A |

| Royal Purple Industrial Assets Sale ($M) | - | $110 | N/A |

Question Marks

Calumet is significantly investing in Sustainable Aviation Fuel (SAF) production with its MaxSAF project. The company anticipates spending $40 million to $60 million on MaxSAF in 2025. A substantial portion, 45%, or $18 million to $27 million, will come from MRL's operating cash flow. The remainder will be covered by the next phase of the DOE loan, facilitating the expansion.

The renewable diesel (RD) market's recovery is crucial for Calumet. MRL's EBITDA hinges on this rebound. Operations are derisked, and the DOE loan is funded. Monetization of MRL awaits the RD market's revival. In Q3 2023, MRL's EBITDA was -$10.8M, highlighting the need for RD market improvement.

Calumet's Montana Renewables, with its derisked operations and DOE loan, faces monetization challenges. Monetizing a portion awaits the recovery of the renewable diesel (RD) market. The separation of Montana Renewables from Calumet Specialties is crucial for valuation. In 2024, RD market volatility impacted valuations, making monetization complex.

Feedstock Flexibility

Feedstock flexibility is a key factor for Calumet's Montano Renewables. Switching to PTC from BTC will enhance this flexibility. This benefits end market and product diversity, vital for competitive advantage. However, the industry is awaiting regulatory clarity. Despite challenges, Calumet's geographic and cost advantages have enabled positive EBITDA.

- PTC (Production Tax Credit) could significantly impact profitability.

- BTC (Bitcoin) is not related to Calumet's strategy.

- Montano Renewables focuses on renewable fuels.

- Calumet's EBITDA performance reflects its strategic advantages.

MRL Operations

Calumet's MRL operations faced operational setbacks until December 2023. This recent facility's long-term performance is still uncertain. The company anticipates earnings growth as operations stabilize. They also expect increased offtake for sustainable aviation fuel (SAF) products.

- MRL facility restart occurred in early December 2023.

- Uncertainty surrounds the long-term performance of the new facility.

- Earnings growth is expected with sustained operations.

- Calumet anticipates increased SAF product offtake.

Calumet's question marks include SAF and RD projects. These projects require significant investment and face market uncertainties. The company is navigating market volatility and awaiting regulatory clarity for profitability. They are focused on operational stabilization and maximizing offtake.

| Category | Description | Impact |

|---|---|---|

| SAF Projects | MaxSAF investment: $40M-$60M in 2025 | Future revenue and market share. |

| RD Market | MRL EBITDA: -$10.8M (Q3 2023) | Impacts profitability and valuation. |

| Feedstock Flexibility | Switch to PTC | Enhances competitive advantage. |

BCG Matrix Data Sources

The Calumet BCG Matrix leverages diverse data sources: company financials, industry reports, market share data, and analyst projections.