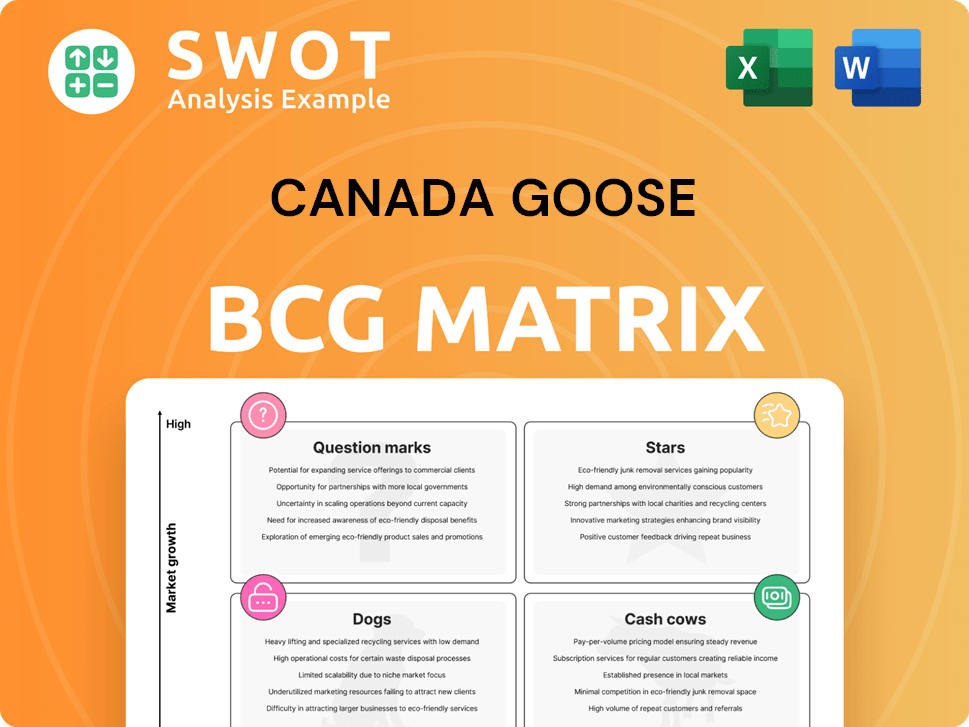

Canada Goose Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canada Goose Bundle

What is included in the product

Tailored analysis for Canada Goose's portfolio across BCG Matrix quadrants, suggesting investment strategies.

Easily switch color palettes for brand alignment, ensuring consistent visuals across all your Canada Goose BCG presentations.

What You’re Viewing Is Included

Canada Goose BCG Matrix

The BCG Matrix preview mirrors the complete Canada Goose analysis you'll receive. Purchase grants immediate access to the full, editable report, ready for your strategic planning.

BCG Matrix Template

Canada Goose thrives in the luxury outerwear market, but how does its product portfolio truly stack up? This quick look explores a simplified version of the Canada Goose BCG Matrix. Some products are stars with high growth and market share, like iconic parkas. Others may be cash cows, generating steady revenue. This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Canada Goose's iconic parkas, like the Expedition Parka, are ''Stars'' in the BCG Matrix. These heavy down parkas are popular for their quality. In 2024, Canada Goose reported a revenue of $1.5 billion CAD, with parkas being a key driver. Their durability and functionality make them top choices in cold regions.

The Asia-Pacific market, especially China, is a 'Star' for Canada Goose, showing great growth. In fiscal year 2024, APAC sales grew by 47.7% year-over-year, with China leading the way. This growth is fueled by the region's increasing wealth and desire for luxury brands. The brand's success in APAC is key for future expansion.

Canada Goose's DTC expansion is a 'Star' strategy. The company focuses on e-commerce and owned retail stores. This boosts customer engagement and profit margins. In fiscal year 2024, DTC revenue grew, representing a significant portion of total sales. DTC allows better control over brand experience and quick market adaptation.

Brand Collaborations

Brand collaborations are a key strategy for Canada Goose, injecting fresh appeal and reaching new audiences. Partnerships like the one with Haider Ackermann and the Snow Goose collection keep the brand relevant. These collaborations introduce new designs and generate buzz, enhancing brand visibility. This positions collaborations as a strong marketing move, driving brand evolution.

- In 2023, Canada Goose's collaborations contributed significantly to its revenue growth.

- Collaborations help target a younger, fashion-conscious demographic.

- Partnerships introduce innovative designs and limited-edition products.

- These strategies elevate brand perception.

Eyewear Collection

Canada Goose's Eyewear Collection, launched with Marchon Eyewear, is a strategic move to broaden its product range. This venture into eyewear prioritizes comfort, style, and performance, aiming to capture a share of the growing premium eyewear market. The collection has the potential to achieve 'Star' status, fueled by the brand's strong reputation.

- Partnership with Marchon Eyewear.

- Focus on comfort, style, and performance.

- Potential for high growth.

- Expansion into a new product category.

Canada Goose’s 'Stars' include parkas, the Asia-Pacific market, and DTC expansion. In 2024, DTC revenue significantly grew, boosting profit margins. Collaborations and eyewear launches also aim for 'Star' status, driving innovation.

| Category | Details | 2024 Data |

|---|---|---|

| Parkas | Iconic, high-quality products | Key revenue driver ($1.5B CAD) |

| Asia-Pacific | High-growth market, especially China | APAC sales grew by 47.7% YoY |

| DTC Expansion | E-commerce and owned retail | Significant revenue growth |

Cash Cows

Canada Goose's non-heavyweight down collection, like lightweight jackets, is a 'Cash Cow.' This segment's sales hit 46% of total revenue in fiscal 2024. It rose from 43% in fiscal 2023, showing impressive growth. Expansion into warmer-weather apparel boosted revenue, especially in Asia.

Canada Goose's dedication to Canadian manufacturing and quality boosts brand recognition. This focus on durability and performance enables premium pricing. In fiscal year 2024, Canada Goose's revenue reached $1.2 billion, demonstrating its strong market position. This makes it a 'Cash Cow' due to reliable revenue generation.

Canada Goose is strategically expanding its global retail presence. They are opening new stores while also converting temporary locations into permanent ones. By Q2 2025, the brand plans to have 72 permanent stores. This growth reinforces its market position and enhances customer engagement. The expansion supports its 'Cash Cow' status.

Sustainable Impact Strategy

Canada Goose's dedication to sustainability, including its net-zero emissions target by 2025, is a key strategy. This focus on environmental responsibility appeals to consumers. In 2024, the company highlighted its use of preferred materials. This commitment strengthens its brand and supports its position as a 'Cash Cow'.

- Net-zero emissions target by 2025.

- Use of preferred fibers and materials.

- Attracts and retains environmentally conscious consumers.

- Enhances long-term profitability.

Pricing Increases

Canada Goose strategically implemented mid-single-digit percentage pricing increases during fiscal year 2024, boosting revenue. This pricing strategy supports profitability and reinforces brand value, solidifying its 'Cash Cow' status in luxury outerwear. Managing price elasticity of demand is vital for this approach. The company's revenue reached $1.46 billion in fiscal year 2024, reflecting effective pricing.

- Mid-single-digit price increases drove revenue growth.

- Maintained profitability and brand value.

- Positioned as a 'Cash Cow' in the market.

- Revenue for fiscal year 2024 was $1.46 billion.

Canada Goose's 'Cash Cow' status is solidified by strong financial performance and strategic initiatives. Revenue for fiscal year 2024 reached $1.46 billion, driven by effective pricing strategies. Expansion into warmer-weather apparel, which hit 46% of total revenue in fiscal 2024, also boosts revenue. The company's commitment to sustainability further strengthens its brand and position.

| Financial Metric | Fiscal Year 2024 | Notes |

|---|---|---|

| Total Revenue | $1.46 Billion | Reflects effective pricing and expansion. |

| Lightweight Apparel % | 46% of Total | Increased from 43% in fiscal 2023. |

| Store Count (Planned) | 72 (by Q2 2025) | Permanent locations enhance engagement. |

Dogs

Canada Goose's wholesale channel, a key part of its BCG Matrix, is facing challenges. Revenue decreased by 41.7% year-over-year. This decline is due to the shift towards direct-to-consumer sales. The wholesale channel may be a 'Dog' needing strategic review.

U.S. tariffs on Canadian imports could squeeze Canada Goose's U.S. profits. In 2024, the U.S. accounted for a large part of the brand's sales, making it vulnerable. Higher costs from tariffs could turn this key market into a 'Dog' in their BCG matrix. Strategies to offset these tariffs are crucial.

Canada Goose heavily depends on China, a risky move given China's slowing economy. A large chunk of Canada Goose's stores and sales are in Mainland China, making it vulnerable. In 2024, China's economic growth slowed, impacting luxury brands. This over-reliance suggests China could be a 'Dog' in their portfolio.

Warm Weather Dependence

Canada Goose's main items, their heavy down parkas, are best for very cold weather. Sales depend heavily on winter, making the company sensitive to warm spells and changing customer needs. During warmer times, this seasonal nature puts these core products in the 'Dog' category. In fiscal year 2024, Canada Goose saw its revenue decrease, showing the impact of these seasonal shifts. This underscores the need to manage and diversify product offerings to offset weather-related risks.

- Heavy reliance on cold-weather sales.

- Vulnerable to warm weather and demand shifts.

- Core products categorized as 'Dog' in warmer seasons.

- Revenue fluctuations due to seasonal conditions.

Traditional Marketing Approaches

Relying on capsule collections and pop-up stores alone won't fix Canada Goose's issues. The company needs to tackle strategic weaknesses, such as its heavy reliance on the Chinese market, which saw a sales decrease in 2023. A marketing overhaul is crucial to improve performance. This includes diversifying markets and promotion strategies.

- 2023: China sales decreased, impacting overall revenue.

- Diversification: Expanding into new markets is essential.

- Marketing: Update strategies beyond pop-ups.

- Strategy: Address over-reliance on single markets.

Canada Goose faces 'Dog' status across several areas. The wholesale channel experienced a 41.7% year-over-year revenue decrease. Vulnerability includes U.S. tariffs impacting profits and over-reliance on the slowing Chinese market.

Core products, like heavy parkas, suffer from seasonal sales swings. Fiscal year 2024 revenue saw declines reflecting weather's impact. The shift requires diversification and strategic market adjustments to mitigate risks.

To combat these challenges, the company should diversify markets. In 2023, China sales dropped, and they require updated marketing efforts to boost performance.

| Area | Issue | Impact |

|---|---|---|

| Wholesale | Revenue decline | -41.7% YoY |

| U.S. Tariffs | Profit squeeze | Higher costs |

| China | Economic slowdown | Sales decrease (2023) |

Question Marks

Canada Goose's foray into eyewear is a 'Question Mark' in its BCG Matrix. This expansion diversifies its product line. Success depends on marketing and distribution. The eyewear market is highly competitive. Canada Goose's revenue in 2023 was $1.2 billion.

Venturing into rainwear, home goods, and luggage, Canada Goose faces "Question Mark" status. These non-core expansions require strategic market analysis and investment. The global luggage market, valued at $20.6 billion in 2024, presents a growth opportunity if Canada Goose can capture market share. Success hinges on effectively navigating competition and assessing consumer demand.

The push for sustainable materials is a 'Question Mark' for Canada Goose. Consumer demand for eco-friendly winter wear is growing. Canada Goose must meet expectations and communicate its sustainability efforts effectively. For example, the global market for sustainable textiles was valued at $36.1 billion in 2024.

Kind Fleece

Kind Fleece, Canada Goose's new sustainable fabric, currently sits in the Question Mark quadrant of the BCG Matrix. This innovative material, made from recycled wool and wood-based materials, is relatively new to the market. Significant investment is needed to assess its potential for high market share and profitability. The brand's revenue in 2023 reached $1.21 billion CAD, which may be impacted by the performance of Kind Fleece.

- New product, uncertain market performance.

- Requires substantial investment for growth.

- Potential for high market share is currently unknown.

- Impact on overall brand revenue is yet to be determined.

Reclaimed Fur

For Canada Goose, shifting to reclaimed fur is a 'Question Mark' in its BCG Matrix. This move necessitates new operational strategies and supply chain adjustments. The brand must showcase its dedication to animal welfare and clearly communicate the advantages of reclaimed fur to consumers. This transition could impact the brand's perception and market position.

- Operational changes and supply chain adjustments are key.

- Focus on demonstrating commitment to animal welfare.

- Effectively communicate the benefits of reclaimed fur to consumers.

- Impact on brand perception and market position.

Canada Goose's move into footwear is a 'Question Mark'. The footwear industry is highly competitive. Success depends on brand recognition and effective market entry. The global footwear market was valued at $425.2 billion in 2024.

| Challenge | Strategic Imperative | Market Context |

|---|---|---|

| Brand Recognition | Build strong brand reputation. | Footwear market size $425.2B (2024). |

| Competitive Landscape | Differentiate product offerings. | High competition within the industry. |

| Market Entry | Effective distribution channels. | Need to identify key consumer segments. |

BCG Matrix Data Sources

This Canada Goose BCG Matrix uses company financial data, market analysis, and competitive reports for accuracy.