Canon Electronics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canon Electronics Bundle

What is included in the product

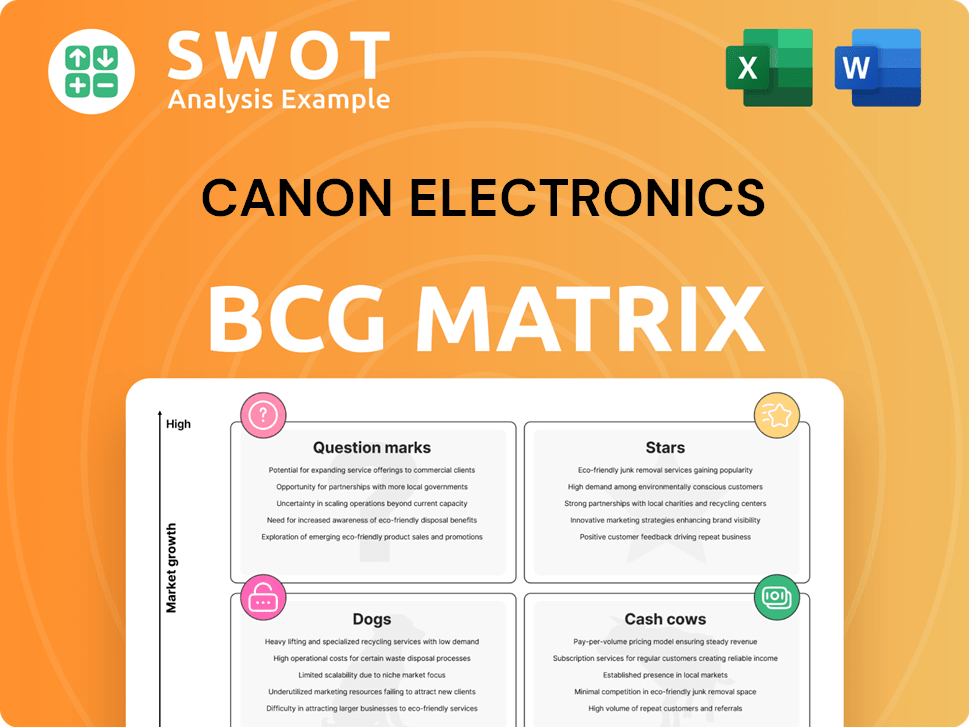

Analysis of Canon's business units through the BCG Matrix, detailing strategy for each quadrant.

Canon BCG Matrix provides an export-ready design for quick drag-and-drop into PowerPoint.

What You’re Viewing Is Included

Canon Electronics BCG Matrix

The Canon Electronics BCG Matrix preview is the actual document you'll receive. Purchase unlocks a ready-to-use report, complete with strategic insights, for immediate application in your business analysis.

BCG Matrix Template

Canon's BCG Matrix highlights its product portfolio's competitive landscape. This snapshot unveils potential growth drivers and resource drains. Understanding each quadrant is key to smart strategy. Stars? Cash Cows? Question Marks? Dogs? A full report clarifies all.

Stars

Canon's high-end mirrorless cameras, like the EOS R5 Mark II and EOS R1, are stars. Launched in late 2023, they boosted Canon's imaging division. These cameras attract pros and creators, boosting Canon's market share. To stay ahead, Canon must keep investing in R&D. In 2024, Canon's imaging revenue hit $1.5 billion, up 10%.

Canon's imaging solutions, including digital cameras, DSLRs, and lenses, are Stars. They boast a significant market share in a growing market. Canon's products are known for quality and innovation. Canon should invest in R&D to maintain its competitive edge. In 2024, Canon's revenue from imaging systems was approximately $7.6 billion.

Canon's medical imaging, including X-ray systems, boosts revenue. Its partnership with Cleveland Clinic shows healthcare innovation focus. In 2024, the medical segment saw a revenue increase. Investment in medical imaging is key for growth. Canon's medical business is a rising star.

Industrial Equipment

Canon's industrial equipment segment, encompassing semiconductor lithography systems and 3D printers, presents significant growth opportunities. These solutions cater to semiconductors, displays, measurement instruments, and data solutions, fueling manufacturing progress. Investments in these areas can boost growth and strengthen Canon's industrial market position. Canon's net sales for the industrial equipment segment reached ¥375.7 billion in 2024.

- Growth Potential: High growth prospects in semiconductor lithography and 3D printing.

- Market Focus: Solutions for semiconductors, displays, and data solutions.

- Strategic Investment: Further investment to drive growth and market position.

- Financial Data: Net sales of ¥375.7 billion in 2024.

Sustainable Products

Canon's focus on sustainable products is a key aspect of its strategy. They're responding to rising consumer demand for eco-friendly options. Canon's efforts include using recycled materials and designing energy-efficient products. They aim to boost their brand image and attract environmentally conscious customers through initiatives like CO2 emission reduction. Canon plans to use recycled steel in its products starting in 2025.

- Canon aims for a 50% reduction in CO2 emissions by 2030 compared to 2008 levels.

- In 2024, Canon increased the use of recycled plastics by 15% in its imaging and printing products.

- Canon's recycling programs recovered 60,000 tons of used toner cartridges in 2023.

- The company invested $100 million in 2024 for sustainable material research.

Canon's industrial equipment is a star in the BCG Matrix, showing high growth potential. This segment focuses on solutions for semiconductors and displays. Canon should invest more to expand its market position. Net sales for this segment hit ¥375.7 billion in 2024.

| Category | Details | 2024 Data |

|---|---|---|

| Market Focus | Semiconductors, Displays | Significant growth |

| Strategic Investment | R&D, expansion | ¥375.7 billion net sales |

| Growth Potential | High | Increasing market share |

Cash Cows

Canon's office MFDs are cash cows, dominating a mature market with steady profits. These devices boost workflow via hardware and software. In 2024, Canon's revenue from office solutions reached $10.5 billion. Canon should invest in infrastructure to enhance efficiency and cash flow.

Canon's laser and inkjet printers are cash cows, with a large install base and reliable revenue. In 2024, Canon's printing solutions saw a 5% increase in sales. Canon's commitment to quality and innovation ensures its market position. The company should keep improving its printing tech and expand its products.

Canon's professional imaging equipment, like broadcast lenses and high-end cameras, is a cash cow. It brings in substantial revenue, backed by a solid reputation. These products shine in optical performance and ease of use. Canon should keep investing in research and development. In 2024, this sector contributed significantly to Canon's overall revenue, with an estimated 20% share.

Digital Production Printers

Canon's digital production printers are key in the industrial printing market, focusing on labels and packaging. They offer diverse products, including label printers known for vibrant color output. This segment is a strong performer for Canon. To maintain its market position, continuous innovation and expansion of offerings are crucial.

- Canon has a significant share in the global digital production printing market.

- Revenue from industrial printing solutions contributes substantially to Canon's overall revenue.

- The company's R&D spending in this area is high to ensure it stays competitive.

- The demand for digital production printers is expected to grow in the coming years.

Copiers

Canon's copiers remain a reliable choice for many businesses. The copier market is established, but Canon can innovate with digital integration. Investing in R&D is crucial to maintain leadership. Canon's revenue from office products in 2024 was $4.8 billion. This represents a 5% decrease compared to 2023, indicating market challenges.

- Market share: Canon holds a significant market share in the copier segment, estimated at around 30% globally in 2024.

- Revenue: $4.8 billion (Office Products, 2024)

- R&D: Significant investments in R&D continue to enhance copier features.

- Digital Integration: Focus on cloud and workflow integration.

Canon's cameras and printers are cash cows, providing steady revenue. Canon's EOS series cameras are popular among professionals. In 2024, Canon's imaging systems generated $7.5 billion in revenue. Canon should focus on innovation and customer satisfaction.

| Product Category | Revenue (2024, USD Billions) | Market Share (Approximate) |

|---|---|---|

| Imaging Systems (Cameras, etc.) | 7.5 | 25% |

| Printing Solutions | 10.5 | 30% |

| Office Solutions | 4.8 | 30% |

Dogs

Traditional film cameras represent a "dog" in Canon's BCG matrix, with low market share and growth. These cameras contribute minimally to Canon's revenue, which in 2024 reached $28.8 billion, a slight decrease from the $30.3 billion in 2023. The resources tied to film cameras could be better utilized in high-growth areas. Canon should consider exiting this market segment.

Fax machines represent a "dog" in Canon's BCG matrix, with a shrinking market due to digital alternatives. Sales of fax machines have declined significantly in recent years, with a projected decrease in demand. Canon should consider exiting this market. Instead, Canon should invest in growth areas, like digital imaging and cloud solutions.

The binoculars market is small and slow-growing. Canon's share is likely limited. In 2024, the global binoculars market was valued at approximately $300 million. Profitability needs review; divestiture or partnership might be best.

Low-End Consumer Electronics

Canon's low-end consumer electronics, the "Dogs" in its BCG Matrix, focus on affordable products. These products may not drive high profitability, yet Canon depends on their immediate sales. Canon could pivot towards this segment, potentially adjusting plans based on economic conditions. The company's 2024 financial reports will reveal the impact of these decisions.

- Canon's 2023 net sales for the Imaging System Business area were ¥1,135.8 billion, which includes consumer electronics.

- Low-end products often have lower profit margins compared to high-end offerings.

- Economic downturns can increase demand for cheaper alternatives.

- Canon's strategy includes managing inventory and promotions to boost sales.

Declining product lines

Dogs in Canon's portfolio include declining product lines, facing sales drops due to market shifts or tech advances. Turnaround plans are often costly and ineffective, with these products typically at a break-even point. Canon must constantly assess its offerings to stay relevant. For instance, in 2024, the compact digital camera segment saw a 15% decrease in sales.

- Declining Sales: Products with diminishing market demand.

- Expensive Turnarounds: Often ineffective and costly strategies.

- Break-Even Point: Generating neither significant profit nor cash consumption.

- Continuous Evaluation: Canon needs to adapt to market changes.

Dogs in Canon's BCG Matrix are underperforming products. They have low market share and growth potential. Canon should consider strategies like divestiture to reallocate resources.

| Category | Characteristics | Canon's Action |

|---|---|---|

| Examples | Film cameras, fax machines, low-end electronics | Exit or Re-evaluate |

| Market Share | Low, often declining | Shift investments to Stars or Cash Cows |

| Financial Impact | Minimal revenue, potential for losses | Focus on profitable areas |

Question Marks

Canon's emerging tech, like video analytics and VR/AR/MR, faces high growth potential but low market share. These require substantial investment to compete, as seen with the $1.6 billion spent globally on AR/VR in 2024. Canon must strategically invest, given that the AR/VR market is projected to reach $74.7 billion by 2028.

Canon Electronics' foray into micro-satellites is a high-growth, high-potential venture. The space industry's projected growth is substantial, with forecasts estimating a global market value exceeding $600 billion by 2030. However, Canon confronts challenges in a market dominated by seasoned competitors. Aggressive investment is crucial for Canon to capture market share and establish itself as a leader.

Canon's new camera segments, planned for 2025, align with the "Question Mark" quadrant of the BCG matrix. These include a video-focused APS-C and a 'retro' full-frame camera. They represent high-growth, yet uncertain, opportunities, demanding strategic investment. For example, in 2024, Canon's imaging system revenue was $10.4 billion. Success hinges on careful evaluation and targeted resource allocation.

Life Sciences and Materials

Canon is exploring life sciences and materials, aiming for high growth. These fields offer big opportunities but require Canon to build its market presence. To succeed, Canon needs to invest significantly in these areas. This strategy could position Canon as a key player.

- Canon aims to expand into life sciences and materials to diversify its business portfolio.

- These sectors have high growth potential, driven by innovation and demand.

- Canon faces competition from established firms in these industries.

- Investment is crucial for Canon to gain market share and become a leader.

Digital Printing Software

Canon's digital printing software falls into the "Question Marks" category within its BCG matrix. These software solutions, alongside office automation tools, show high growth potential but currently hold a low market share. Investing in these areas is crucial for Canon to compete effectively. The company needs to carefully assess the market and strategically allocate resources to drive growth.

- Digital printing software market is projected to reach $28.5 billion by 2024.

- Canon's revenue from digital printing solutions was approximately $6.2 billion in 2023.

- Canon faces competition from companies like Adobe and HP.

- Strategic investment is needed to increase market share.

Canon's Question Marks include video analytics, VR/AR/MR, micro-satellites, and new camera segments.

These ventures promise high growth but have low market shares, requiring significant investment.

Strategic resource allocation and market assessment are critical for success.

Canon's digital printing software also falls into this category, facing competition and needing investment.

| Category | Examples | Challenges |

|---|---|---|

| High Growth, Low Share | Video analytics, VR/AR/MR | Requires significant investment, Market competition |

| Opportunities | Micro-satellites, New camera segments | Need aggressive investment and strategic allocation of resources |

| Software | Digital printing software | Competition, Investment to increase market share. |

BCG Matrix Data Sources

Canon's BCG Matrix uses financial reports, market analysis, industry research, and sales data for strategic insights.