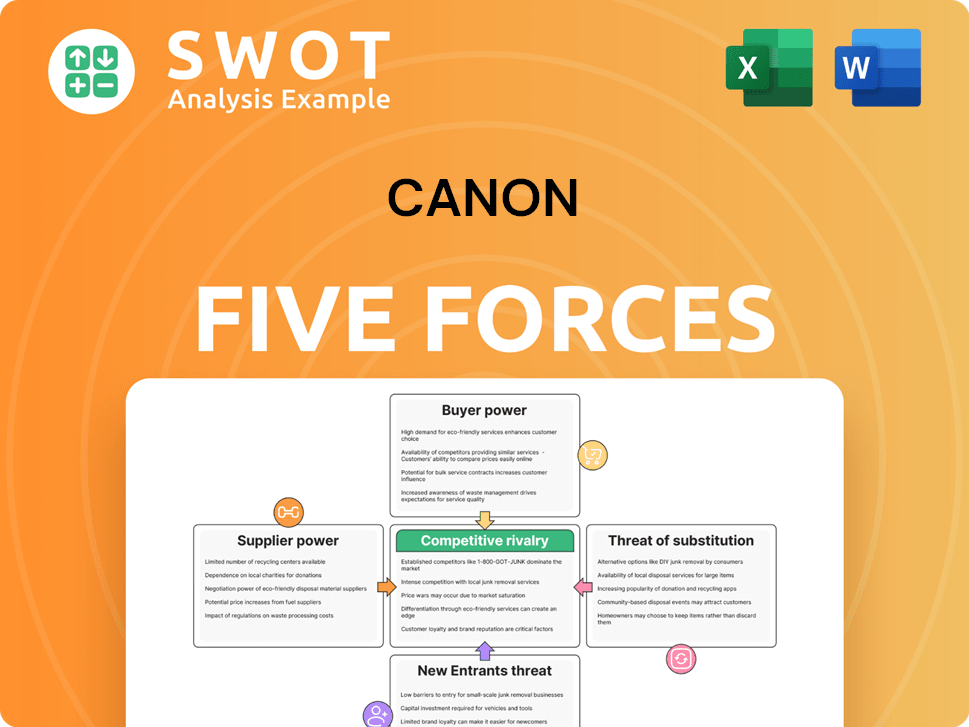

Canon Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canon Bundle

What is included in the product

Tailored exclusively for Canon, analyzing its position within its competitive landscape.

Quickly pinpoint vulnerabilities using a color-coded, at-a-glance pressure matrix.

Full Version Awaits

Canon Porter's Five Forces Analysis

This preview unveils Canon's Five Forces analysis; the very document you'll instantly receive upon purchase. It provides a comprehensive examination of competitive rivalry, supplier and buyer power, threat of substitutes, and new entrants. Expect a clear, ready-to-use assessment of Canon's industry position. This detailed analysis is fully formatted and ready for your immediate needs.

Porter's Five Forces Analysis Template

Canon faces intense competition, making profitability a challenge. Buyer power, due to consumer choices, impacts pricing. Suppliers, particularly tech component providers, exert influence. The threat of new entrants is moderate. The availability of substitute products, like smartphones, poses a risk. Understanding these forces is crucial.

Unlock key insights into Canon’s industry forces—from buyer power to substitute threats—and use this knowledge to inform strategy or investment decisions.

Suppliers Bargaining Power

Canon faces a challenge due to a concentrated supplier base for specialized electronic components. This dependence on a few key suppliers grants them significant pricing power. The market is dominated by a few major players, enabling them to dictate terms. For example, in 2024, a rise of 5-7% in component costs impacted margins.

Canon faces high switching costs when changing suppliers, especially for specialized components essential to its imaging and printing products. Re-engineering products for new components can cost millions of dollars. This financial burden significantly reduces Canon's ability to switch suppliers easily.

These costs include expenses for re-tooling and testing, affecting Canon's profitability. In 2024, Canon's R&D spending was roughly $3 billion, underscoring the investment required for product adaptation. Therefore, suppliers gain increased negotiation power.

Suppliers' forward integration poses a real threat, potentially turning them into Canon's rivals. This shift boosts their leverage in negotiations. Imagine a camera lens maker deciding to sell complete cameras. This can significantly change the balance of power. In 2024, such moves are increasingly common in tech. This impacts contract terms and pricing.

Long-Term Contracts

Canon utilizes long-term contracts with key suppliers to buffer against supplier bargaining power. These contracts, lasting multiple years, incorporate fixed pricing, which shields Canon from fluctuating component costs. This strategy reduces supplier leverage by ensuring a stable cost structure. For instance, in 2024, Canon's cost of revenue was approximately ¥3.5 trillion, and managing these costs is crucial.

- Fixed pricing agreements stabilize costs.

- Long-term contracts diminish supplier influence.

- Cost management is vital to profitability.

Outsourcing of Key Parts

In the electronics industry, outsourcing key parts is common. Suppliers gain power through essential contracts and potential future integration. Negotiations often hinge on these aspects. For example, Apple relies on suppliers like Foxconn. In 2024, Foxconn's revenue was around $226 billion, highlighting its supplier power.

- Horizontal integration leads to outsourced production.

- Key contracts boost supplier influence.

- Future integration is a negotiation factor.

- Foxconn's revenue in 2024: ~$226B.

Canon's suppliers, particularly for specialized parts, have considerable power due to their market dominance and the high switching costs Canon faces. Forward integration by suppliers, like lens makers selling complete cameras, intensifies this pressure, altering negotiation dynamics. However, Canon uses long-term contracts to manage these costs.

| Aspect | Impact | Example |

|---|---|---|

| Concentrated Supplier Base | Increased Pricing Power | Component cost rise of 5-7% in 2024 |

| High Switching Costs | Reduced Flexibility | R&D spending of $3B in 2024 |

| Forward Integration | Enhanced Leverage | Tech industry trends in 2024 |

Customers Bargaining Power

Customers wield significant power due to the wide array of imaging and optical product substitutes available. The market is crowded with competitors, intensifying buyer power. In 2024, the electronics sector saw over 50 major players, heightening price sensitivity among consumers. This saturation allows customers to easily switch brands, giving them leverage in negotiations.

Customers' price sensitivity is high, making them likely to switch. Canon must balance quality and competitive pricing. Buyers may shift due to price or quality concerns. In 2024, Canon's focus is on maintaining its market share amidst rivals like Sony. This requires constant price and quality assessments.

Canon benefits from robust brand loyalty, a key factor in mitigating customer bargaining power. Canon's established reputation fosters a customer base, but this loyalty isn't impenetrable. Competitor actions can erode this, as seen with Sony's 2024 market share gains. Innovation and quality are crucial for Canon to retain its customers; in 2024, Canon invested heavily in R&D to maintain its edge.

Easy Access to Information

Customers today wield significant power due to easy access to product information, prices, and alternatives. Online platforms and comparison tools empower buyers, allowing informed decisions. This shift enhances buyer bargaining power, especially in saturated markets with many product choices. For example, in 2024, e-commerce sales hit $11.15 trillion globally, highlighting buyer influence.

- Easy access to information empowers buyers.

- Online reviews and comparisons aid decision-making.

- Buyer power increases in saturated markets.

- E-commerce sales reflect buyer influence.

Switching Costs are Low

Customers of Canon products often face low switching costs, allowing them to easily shift to competitors like Sony or Nikon without major financial burdens. This ease of switching amplifies the bargaining power of buyers, compelling Canon to maintain competitive pricing and product quality. The availability of substitutes further strengthens this power dynamic. In 2024, the global camera market was valued at approximately $8.6 billion, with Canon and its rivals constantly vying for market share.

- Low switching costs give customers more leverage.

- Customers can easily opt for alternative brands.

- Canon must compete on price and quality.

- The camera market is highly competitive.

Customer bargaining power in Canon's market is notably high due to the availability of substitutes and easy access to information. The competitive landscape, intensified by over 50 major players in 2024, heightens price sensitivity. Low switching costs, exemplified by easy brand shifts, further strengthen customer influence, impacting Canon's strategies.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Substitutes | High Availability | Numerous competitors like Sony, Nikon |

| Price Sensitivity | High | Electronics market: 50+ players |

| Switching Costs | Low | Camera market: $8.6 billion |

Rivalry Among Competitors

Canon faces fierce competition, notably from Sony, Nikon, HP Inc., and Ricoh. These rivals challenge Canon with competitive pricing and feature-rich products. The East Asian electronics market is saturated, intensifying rivalry. In 2024, Canon's market share battles these competitors. Intense competition impacts profitability and innovation.

Competitors constantly strive to differentiate their offerings with new features, intensifying market competition. Canon must continuously innovate to stand out, focusing on technology, quality, and performance. In 2024, Canon's R&D spending was approximately $3.2 billion, reflecting its commitment to innovation. This differentiation is crucial for Canon's market position.

Market saturation in the camera and printer industries is high, restricting growth and squeezing profits. This environment fuels intense competition, as businesses compete for market share. The global digital camera market was valued at $7.3 billion in 2023. Canon and its rivals face heightened rivalry due to product saturation worldwide.

Strong Competitor Presence

Canon faces intense competition, primarily from companies like Sony and Ricoh. These rivals offer diverse product lines, increasing competitive pressure. Canon's 2019 annual revenue was $32.96 billion, showcasing its market position.

- Sony and Ricoh are major competitors.

- Diversified product portfolios increase rivalry.

- Canon's 2019 revenue was $32.96B.

Focus on High-Margin Markets

The competitive rivalry in the camera industry intensifies as smartphone cameras improve, pushing companies like Canon to target high-margin markets. Canon, a leader in the DSLR market, focuses on advanced amateurs and professionals. This strategy allows Canon to maintain its position through technological differentiation and global presence. Canon leverages its global scale and local knowledge to cater to diverse market needs.

- Canon's revenue in 2024 was approximately $30.5 billion.

- The global digital camera market size was valued at $7.15 billion in 2023.

- Canon holds a significant market share in the professional camera segment.

- Canon invests heavily in R&D, spending over $3 billion annually.

Canon contends with intense rivalry from Sony, Nikon, and others. Competitors offer diverse products, increasing competition. Canon's 2024 revenue was approximately $30.5 billion.

| Rivalry Aspect | Details |

|---|---|

| Key Competitors | Sony, Nikon, HP Inc., Ricoh |

| 2023 Camera Market Size | $7.15 billion |

| Canon 2024 Revenue | ~$30.5 billion |

SSubstitutes Threaten

Mobile cameras represent a substantial threat to Canon. The rapid advancement in smartphone camera technology has begun to erode Canon's market share. In 2024, smartphone camera sales saw a 7% increase, directly impacting dedicated camera sales. Canon must innovate beyond traditional cameras to stay competitive.

Rapid technological advancements pose a significant threat. The imaging sector sees swift obsolescence of existing products. Smartphones with advanced cameras have diminished demand for traditional digital cameras. Canon faces real threats from rapid electronic innovation. In 2024, smartphone camera sales reached $80 billion globally, impacting dedicated camera sales.

Alternative printing solutions pose a significant threat to Canon. Cloud storage and digital document systems are reducing the demand for physical prints. The shift towards digital formats is accelerated by mobile technology, including advanced smartphone cameras. In 2024, the global digital printing market was valued at $26.9 billion, highlighting the ongoing competition.

Software Substitutes

Software substitutes pose a significant threat to hardware manufacturers like Canon. Image editing software has lessened the need for professional cameras. The fast evolution of technology, including improved mobile cameras, further intensifies this threat. This shift impacts Canon's market share and revenue streams. In 2024, the global digital camera market was valued at approximately $7.8 billion, with smartphones capturing a larger share of the photography market.

- Rise of image editing software impacting camera sales.

- Rapid innovation in mobile camera technology.

- Impact on Canon's market share and revenue.

- 2024 digital camera market valued at $7.8 billion.

Customer Adaptability

Customer adaptability significantly impacts Canon, as alternatives constantly emerge. Customers might switch to competitors offering similar products or better deals. Adjacent competitors, even outside the core market, can lure customers, intensifying the pressure. Rapid tech innovation, like advanced mobile cameras, poses a real threat.

- Smartphone camera sales in 2024 are projected to reach $80 billion, impacting dedicated camera sales.

- Canon's revenue in 2023 was approximately $30.5 billion, highlighting the need to defend market share.

- The global digital camera market was valued at $6.8 billion in 2023, showing the shrinking market.

- Mobile phone camera technology has improved significantly, with some models now offering up to 200MP sensors.

Substitutes like mobile cameras and software pose a threat. Innovation and customer adaptability drive shifts, impacting Canon's revenue. The digital camera market, valued at $7.8 billion in 2024, faces pressure from smartphones. Canon must adapt to stay competitive.

| Threat | Impact | 2024 Data |

|---|---|---|

| Smartphone Cameras | Erosion of market share | $80B sales |

| Image Editing Software | Reduced demand for professional cameras | $7.8B digital camera market |

| Digital Printing Alternatives | Diminished demand for prints | $26.9B digital printing market |

Entrants Threaten

High capital requirements pose a significant barrier to new entrants in the electronics sector. Canon, with its established brand and resources, benefits from this. A new competitor needs substantial investment to establish manufacturing, R&D, and marketing. In 2024, the cost to launch a competitive electronics brand could easily exceed $100 million, hindering new players.

Canon's established brand loyalty poses a significant barrier to new entrants. This strong reputation built over decades makes it challenging for startups to gain market share. Canon cultivates loyalty through consistent innovation and quality. The company's customer retention rate is very high.

Canon, as an established player, enjoys economies of scale, a significant barrier for new entrants. Achieving similar scale is tough in the imaging industry, where Canon operates. This advantage stems from lower per-unit costs due to high production volumes. For example, Canon's annual revenue in 2024 was around $30 billion, reflecting its scale. This scale allows Canon to compete aggressively on price, making it harder for new businesses to enter and survive.

Technological Expertise

The electronics sector demands significant technological know-how, creating a hurdle for newcomers. Canon faces threats from swift tech advancements, including mobile camera improvements. These innovations constantly reshape the market, pressuring established firms. The rise of advanced smartphone cameras, for example, directly challenges Canon's market share in the camera industry.

- Canon's revenue from digital cameras in 2023 was approximately $2.5 billion.

- The global smartphone camera market is projected to reach $79.2 billion by 2028.

- New entrants with superior mobile camera technology can quickly capture market share.

- Canon's R&D spending in 2024 is around $3 billion.

Distribution Channels

Distribution channels pose a significant barrier for new entrants. Established companies often possess extensive distribution networks, making it difficult for newcomers to compete directly. Accessing and building these channels requires substantial investment and time. To overcome this, new entrants might need to offer a unique product or service. This could involve innovative features or a completely new business model.

- Logistics costs can be a major factor, with shipping expenses potentially impacting profitability.

- In 2024, companies like Amazon have a significant advantage due to their established e-commerce and logistics networks, making it hard for new firms to compete.

- New entrants may use partnerships or niche markets to gain access to distribution.

New electronics businesses face substantial entry barriers. High capital needs and established brand loyalty make it hard to compete. Canon's economies of scale and tech expertise add further hurdles.

| Barrier | Impact | Example |

|---|---|---|

| Capital | High costs to start | $100M+ for a new brand |

| Brand Loyalty | Existing market share | Canon's established brand |

| Economies of Scale | Lower per-unit costs | Canon's $30B revenue |

Porter's Five Forces Analysis Data Sources

Our analysis leverages company filings, market share reports, industry studies, and financial data to build a precise assessment of Canon's competitive landscape.