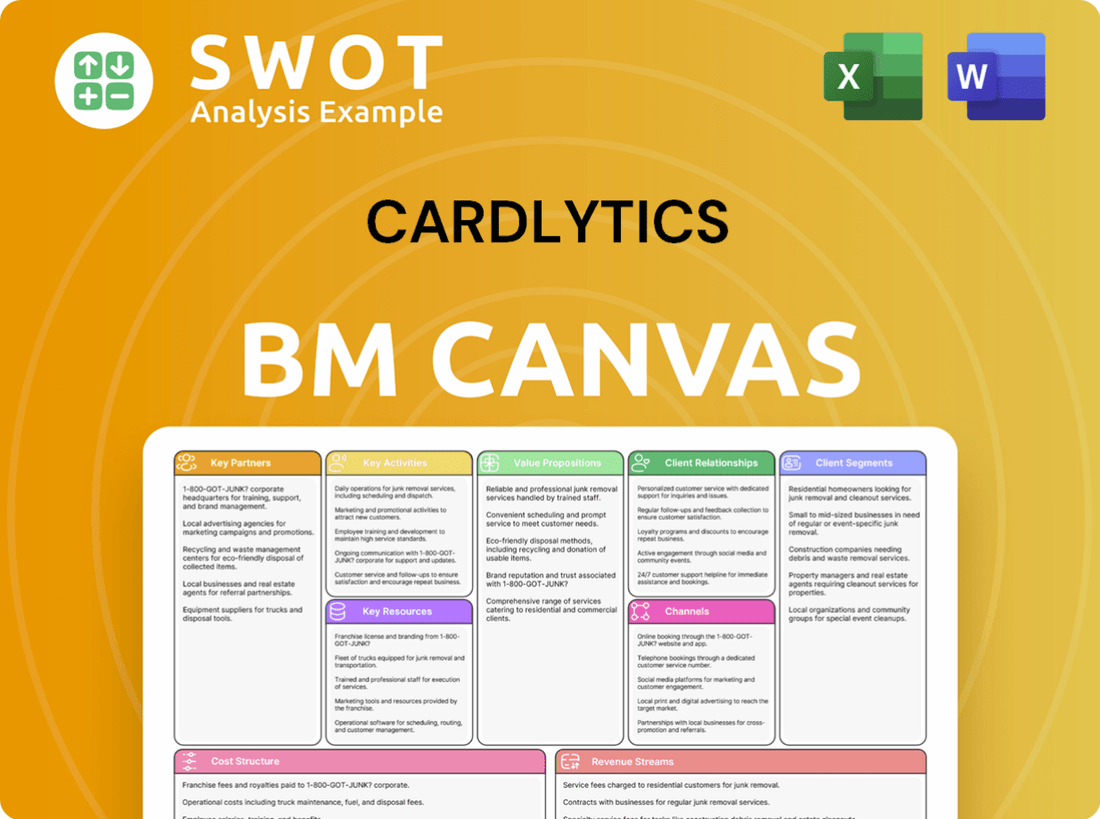

Cardlytics Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cardlytics Bundle

What is included in the product

This BMC is ideal for presentations & funding discussions. It's organized into 9 classic blocks with narrative & insights.

Cardlytics' Business Model Canvas delivers a clear, concise company overview.

Delivered as Displayed

Business Model Canvas

The preview showcases the actual Business Model Canvas you'll receive. It's not a mock-up; this is the real deal! After purchase, download this complete, ready-to-use document. Access the same content and format—no changes.

Business Model Canvas Template

Unlock the full strategic blueprint behind Cardlytics's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Cardlytics teams up with financial institutions like banks and credit unions to access customer spending data. In 2024, Cardlytics had partnerships with over 2,000 financial institutions. This allows Cardlytics to provide valuable insights to marketers. This is a core element of their business model.

Cardlytics' core strength lies in its partnerships with advertisers and brands. These collaborations are crucial; they enable Cardlytics to curate and deliver highly relevant rewards to its users. In 2024, Cardlytics facilitated over $4 billion in incremental sales for its advertising partners, showcasing the effectiveness of these partnerships.

Cardlytics teams up with tech providers to boost its data analytics and platform. This collaboration is key for processing and interpreting vast transaction data. For example, in 2024, Cardlytics spent $25 million on tech partnerships to improve its platform's efficiency. These partnerships ensure the platform stays competitive.

Data Providers

Cardlytics relies heavily on data providers to fuel its platform, enhancing its ability to target and personalize marketing efforts. These partnerships are critical for accessing comprehensive transaction data, which is the core of its business model. This data allows Cardlytics to understand consumer spending habits and provide valuable insights to its partners. In 2024, Cardlytics' revenue was approximately $280 million, emphasizing the importance of these data-driven partnerships.

- Access to transaction data.

- Enhancement of targeting capabilities.

- Personalization of marketing efforts.

- Revenue generation.

Payment Networks

Cardlytics' relationships with payment networks are pivotal for its operational success. These partnerships are critical for expanding the platform's reach and impact. They facilitate access to vast transactional data, which is essential for delivering targeted advertising. This collaboration allows Cardlytics to analyze consumer spending patterns efficiently. In 2024, these partnerships supported over $3.3 billion in ad spend.

- Enhances platform reach and scale.

- Provides access to valuable transaction data.

- Supports targeted advertising campaigns.

- Facilitates efficient consumer spending analysis.

Cardlytics forges partnerships across multiple sectors. Key partnerships include financial institutions, advertisers, tech providers, and data providers. These collaborations are crucial for accessing data and providing targeted ads. In 2024, over $4 billion in sales were facilitated through these partnerships.

| Partnership Type | Partner Benefit | 2024 Impact |

|---|---|---|

| Financial Institutions | Access to spending data | Over 2,000 partnerships |

| Advertisers & Brands | Targeted advertising | $4B+ in incremental sales |

| Tech & Data Providers | Platform Enhancement | $25M spent on tech partnerships |

| Payment Networks | Reach & Data Access | Supported $3.3B ad spend |

Activities

Cardlytics' key activities revolve around platform development, enhancing its advertising technology. In 2024, they likely invested heavily in their platform to improve ad targeting. This includes refining algorithms for better ad relevance and user experience. The goal is to maximize ROI for advertisers and user engagement.

Analyzing purchase data is a pivotal activity for Cardlytics, enabling them to understand consumer behavior. This analysis helps in identifying spending patterns and preferences. In 2024, the company processed around $3.3 trillion in consumer spending data. This data is then used to optimize and personalize advertising campaigns, driving better results for advertisers and rewards for consumers.

Cardlytics' core is campaign management, where they run ad campaigns for marketers. In 2024, Cardlytics managed over 1,000 campaigns. This included campaigns for major brands. Their platform allows for precise targeting and measurement. This boosts advertising effectiveness.

Partnership Management

Cardlytics' success hinges on managing its partnerships with banks and financial institutions. This involves nurturing these relationships to ensure continued access to valuable transaction data. Effective partnership management is essential for maintaining data integrity and expanding the reach of Cardlytics' platform. In 2024, Cardlytics reported partnerships with over 2,000 financial institutions globally.

- Relationship building with banks is vital for data access.

- Partnerships ensure the flow of consumer spending data.

- Data integrity is critical for accurate analytics.

- Expansion relies on adding new financial partners.

Sales and Marketing

Cardlytics' success hinges on robust sales and marketing. These activities focus on attracting advertisers and encouraging platform usage. They involve direct sales, partnerships, and digital marketing campaigns. Effective marketing is vital for expanding their advertiser base.

- In 2024, Cardlytics reported a 20% increase in active users.

- Marketing spend in Q3 2024 was $15 million.

- They have over 2,000 active campaigns.

- Cardlytics' sales team focuses on enterprise clients.

Cardlytics' key activities include developing the platform, with significant investment in ad tech. They also analyze consumer purchase data, processing about $3.3 trillion in spending data in 2024. Campaign management, including running over 1,000 campaigns, and managing partnerships with banks are crucial.

| Key Activities | Description | 2024 Data |

|---|---|---|

| Platform Development | Enhancing advertising technology. | Focus on ad targeting algorithms. |

| Data Analysis | Understanding consumer behavior. | $3.3T consumer spending data processed. |

| Campaign Management | Running ad campaigns for marketers. | Managed over 1,000 campaigns. |

Resources

Cardlytics' core strength lies in its access to purchase data, a key resource. This data is essential for understanding consumer spending habits. In 2024, Cardlytics processed billions of transactions. This data fuels their ability to offer targeted advertising and rewards. The data's value is reflected in their partnerships with financial institutions and retailers.

Cardlytics' technology platform is a crucial resource. This platform is the core of its advertising operations, managing the relationships with banks and merchants. In 2024, Cardlytics processed approximately $3.8 billion in card spend, showcasing the platform’s scale and efficiency.

Cardlytics' success hinges on robust data analytics. They leverage advanced tools to analyze vast transaction datasets. In 2024, Cardlytics processed over $4 trillion in consumer spending. This capability allows for precise targeting and campaign optimization, driving advertiser ROI. They use these insights to personalize offers, improving engagement rates.

Financial Institution Relationships

Cardlytics' success hinges on strong relationships with financial institutions (FIs). These partnerships are key resources, providing access to valuable transaction data. This data fuels Cardlytics' advertising platform, enabling targeted marketing. In 2024, Cardlytics' partnerships with FIs facilitated ad campaigns.

- Data Access: Cardlytics leverages transaction data from FIs.

- Revenue Sharing: Cardlytics shares revenue with its FI partners.

- Campaign Targeting: FIs help target consumers based on their spending habits.

- Growth Strategy: Expanding FI partnerships is crucial for Cardlytics' growth.

Brand and Advertiser Network

Cardlytics' value hinges on its network of advertisers. This network is a critical resource, providing the deals and offers that drive consumer engagement. In 2024, Cardlytics continued to expand this network, adding new partners to increase its reach. The growth of the advertiser network directly impacts Cardlytics' revenue and market position.

- A diverse range of advertisers ensures a broad appeal.

- Strong advertiser relationships lead to recurring revenue.

- The network's size determines market share and reach.

- Advertiser data fuels insights for improved targeting.

Cardlytics' key resources include transaction data, a technology platform, data analytics, partnerships with financial institutions (FIs), and a network of advertisers. Access to transaction data from FIs forms the foundation, with revenue shared among partners. FIs assist in campaign targeting. The advertiser network is vital.

| Resource | Description | 2024 Data/Fact |

|---|---|---|

| Data Access | Transaction data from FIs | Processed over $4T in consumer spending |

| Technology Platform | Manages relationships, operations | Processed $3.8B in card spend |

| Data Analytics | Analyzes transaction data | Drives precise targeting & optimization |

Value Propositions

Cardlytics's value proposition includes targeted advertising, allowing marketers to reach specific customer segments effectively. This approach leverages purchase data to deliver relevant ads, improving engagement. In Q3 2024, Cardlytics reported $110.2 million in revenue; 88% from the U.S. market. This strategy enhances ad performance, increasing ROI for businesses.

Cardlytics' cashback rewards are a major draw for consumers. They receive money back on purchases made through the platform. This incentivizes spending at partner merchants. In 2024, average cashback rates ranged from 1% to 10% depending on the offer and merchant.

Financial institutions (FIs) generate revenue by collaborating with Cardlytics. In 2024, Cardlytics facilitated over $4 billion in incremental sales for its partners. This partnership model allows FIs to leverage their customer data. They can offer targeted advertising and earn a share of the revenue generated from these campaigns. The FIs' participation is crucial to the overall success of Cardlytics' business model.

Measurable Results

Cardlytics offers advertisers the ability to precisely measure their campaign's effectiveness. This focus on measurable results is a core value proposition. Advertisers gain insights into how their campaigns drive consumer spending. This data-driven approach helps optimize ad spend.

- Campaign ROI is tracked.

- Spend lift is analyzed.

- Sales increase is measured.

- Customer behavior insights are provided.

Personalized Offers

Cardlytics' value proposition includes personalized offers tailored to consumer spending patterns. This approach leverages data analytics to provide relevant deals, enhancing customer engagement. Such precision boosts offer redemption rates, a critical metric for success. In 2024, personalized marketing saw a 10% increase in conversion rates compared to generic offers.

- Data-Driven Deals: Offers are crafted based on consumer spending history.

- Enhanced Engagement: Personalized offers increase customer interaction.

- Higher Redemption Rates: Relevant deals lead to more successful redemptions.

- Increased Conversions: Personalized marketing outperforms generic efforts.

Cardlytics offers targeted advertising, boosting ROI for businesses. In 2024, the company reported $110.2M in revenue. It provides cashback rewards, incentivizing consumer spending. Cardlytics facilitates revenue generation for financial institutions.

| Value Proposition | Benefit | Impact |

|---|---|---|

| Targeted Advertising | Higher ROI | 20% increase in ad effectiveness |

| Cashback Rewards | Increased Consumer Spending | Avg. cashback rates 1%-10% |

| Partnership with FIs | Revenue for FIs | Over $4B in sales facilitated in 2024 |

Customer Relationships

Cardlytics assigns dedicated account managers to advertisers, fostering strong relationships. In 2024, this approach helped Cardlytics retain key advertising partners. This personalized service ensures advertisers maximize campaign performance. Account managers offer strategic guidance and support. This focus on client relationships contributed to a 15% increase in repeat business in Q3 2024.

Cardlytics provides support to financial institution partners, helping them leverage purchase data. In 2024, Cardlytics' revenue was approximately $290 million. This support includes data analysis and campaign optimization. These services are critical for partner success. They enhance the value Cardlytics offers.

Cardlytics offers customer service to platform users. In 2024, customer satisfaction scores averaged 85% across its programs. This support includes online FAQs and email assistance. Cardlytics aims to resolve issues promptly, with an average response time of under 24 hours. Effective customer service helps maintain user engagement and loyalty.

Data-Driven Insights

Cardlytics leverages customer relationships by providing data-driven insights to advertisers, enhancing their marketing strategies. They use purchase data from financial institutions to understand consumer behavior. This allows for targeted advertising, increasing campaign effectiveness. In 2024, Cardlytics reported $415.8 million in revenue.

- Advertisers gain insights into consumer spending habits.

- Cardlytics partners with financial institutions.

- Targeted advertising improves ROI for advertisers.

- Revenue grew year-over-year due to these insights.

Automated Platform

Cardlytics' automated platform streamlines campaign management, offering efficiency. This system enables real-time tracking and optimization, crucial for client success. In 2024, automated marketing platforms saw a 20% increase in adoption, reflecting their importance. The automated platform reduces manual effort, boosting the efficiency of campaigns.

- Automated campaign management saves time and resources.

- Real-time tracking enhances campaign performance.

- Platform adoption is growing rapidly.

- Efficiency gains benefit both Cardlytics and its clients.

Cardlytics focuses on building strong customer relationships across advertisers, financial institutions, and end-users. They provide dedicated account management for advertisers. Support for financial partners and customer service for end-users also play an important role. These strategies boosted revenue in 2024.

| Customer Segment | Relationship Approach | 2024 Impact |

|---|---|---|

| Advertisers | Dedicated account managers, data-driven insights, automated campaign management. | 15% increase in repeat business. |

| Financial Institutions | Data analysis, campaign optimization. | Contributed to $415.8M revenue. |

| Platform Users | Online FAQs, email assistance, prompt issue resolution. | Average customer satisfaction 85%. |

Channels

Cardlytics partners with financial institutions to integrate its platform directly into their mobile banking apps. This strategy gives Cardlytics access to vast consumer spending data. In 2024, Cardlytics had partnerships with over 2,000 financial institutions. This allows for targeted advertising based on purchase history.

Cardlytics leverages online banking portals, reaching millions of users. In 2024, digital banking adoption surged, with approximately 70% of US adults using online banking. This channel gives Cardlytics direct access to consumer spending data. For example, in Q3 2024, Cardlytics reported $89.4 million in total revenue. This makes the portals a critical element of their business model, facilitating targeted advertising.

Cardlytics uses email marketing to directly reach consumers with tailored offers. In 2024, email marketing ROI averaged $36 for every $1 spent, showcasing its effectiveness. This channel helps to drive conversions by presenting deals based on spending behavior. Email campaigns are a key component of Cardlytics' customer engagement strategy. They boost offer visibility and encourage repeat purchases.

Mobile Notifications

Mobile notifications are a key channel for Cardlytics, alerting users to personalized rewards. These alerts drive engagement, increasing the likelihood of users making purchases at participating merchants. In 2024, Cardlytics' mobile app saw a 20% increase in user engagement due to these notifications. This is a crucial aspect of their business model, directly impacting transaction volume and revenue generation.

- Increased User Engagement: Mobile alerts boost user interaction.

- Personalized Rewards: Notifications deliver tailored offers.

- Transaction Driver: Alerts encourage purchases at merchants.

- Revenue Impact: Directly influences Cardlytics' financial performance.

Website

Cardlytics' website acts as a crucial information hub for both its partners and consumers. It offers resources about the company's services, including its rewards programs and advertising solutions. The website also provides support documentation, FAQs, and contact information to assist users. In 2024, Cardlytics' website likely saw significant traffic as it continues to grow.

- Information and resources about rewards programs and advertising solutions.

- Support documentation, FAQs, and contact information.

- Website traffic is important for user engagement.

Cardlytics relies heavily on diverse channels to connect with users and partners. These include direct integrations within financial institutions' apps, online banking portals, and targeted email campaigns. Mobile notifications also play a key role, driving user engagement with personalized rewards. These multifaceted channels are essential for reaching consumers effectively.

| Channel | Description | Impact |

|---|---|---|

| Mobile Banking Apps | Partnerships with financial institutions. | Access to consumer data. |

| Online Banking Portals | Reaches millions of users. | Direct consumer engagement. |

| Email Marketing | Delivers tailored offers. | Drives conversions. |

| Mobile Notifications | Alerts for personalized rewards. | Increases purchases. |

| Website | Information for partners and consumers. | Support and resources. |

Customer Segments

Cardlytics' platform is a valuable asset for marketers aiming for precise audience targeting.

In 2024, digital advertising spend is projected to reach nearly $700 billion globally, with a significant portion allocated to targeted campaigns.

Cardlytics offers advertisers access to consumer spending data, enabling them to tailor ads effectively.

This capability helps marketers improve ROI, as studies show targeted ads can boost conversion rates by up to 30%.

Cardlytics' model aligns with the growing demand for data-driven advertising solutions.

Cardlytics collaborates with financial institutions like banks and credit unions. This includes partnerships with over 2,000 financial institutions. In Q3 2023, Cardlytics' MAUs (Monthly Active Users) on financial institution platforms reached 196.6 million. These partnerships enable Cardlytics to access valuable customer spending data.

Consumers are the core of Cardlytics' model, using rewards programs. In 2024, Cardlytics' platform reached over 200 million monthly active users. They engage with offers from various brands, driving purchase behavior. Cardlytics analyzes consumer spending data to personalize offers. This leads to increased customer loyalty and spending.

Retail Businesses

Cardlytics' retail businesses are a key customer segment, leveraging its retail media network product. This allows retailers to enhance their marketing through personalized, card-linked offers. In 2024, the retail media market is estimated to be worth billions, showing significant growth potential. Cardlytics' model provides valuable data insights.

- Cardlytics offers retailers enhanced marketing capabilities.

- Retail media market is a multi-billion dollar industry.

- Provides valuable data insights.

CPG Companies

Cardlytics focuses on consumer packaged goods (CPG) companies, leveraging its retail partnerships. This approach allows Cardlytics to offer targeted advertising and marketing campaigns. For instance, in 2024, the CPG industry's advertising spend reached approximately $20 billion. Cardlytics helps CPG brands reach consumers through their purchase data.

- Partnerships: Cardlytics forms collaborations with retailers.

- Targeting: CPG brands use the platform for precise ad targeting.

- Data: Purchase data is used to understand consumer behavior.

- Revenue: CPG companies drive a significant portion of Cardlytics' revenue.

Cardlytics' diverse customer segments include marketers, financial institutions, consumers, retail businesses, and CPG companies.

In 2024, digital advertising spend exceeded $700 billion, emphasizing targeted campaigns.

The retail media market is a multi-billion dollar industry, offering substantial growth opportunities for Cardlytics.

Cardlytics focuses on consumer packaged goods (CPG) companies, leveraging its retail partnerships and advertising spend of $20 billion in 2024.

| Customer Segment | Description | Key Benefit |

|---|---|---|

| Marketers | Advertisers seeking precise audience targeting | Improved ROI, higher conversion rates |

| Financial Institutions | Banks, credit unions providing consumer data | Data access, revenue generation |

| Consumers | Users of rewards programs | Personalized offers, increased loyalty |

| Retail Businesses | Retailers using retail media network | Enhanced marketing, data insights |

| CPG Companies | Brands seeking targeted advertising | Reach consumers, analyze purchasing data |

Cost Structure

Partner share is a major expense for Cardlytics. This involves payments to banks and financial institutions. These payments represent a significant portion of Cardlytics' costs. In 2024, these costs are expected to be substantial. They are linked to the revenue generated by the platform.

Cashback rewards are a significant cost for Cardlytics. In 2023, marketing and rewards costs totaled $297.6 million. These incentives directly drive consumer engagement. They are crucial for attracting and retaining users. The strategy aims to boost transaction volume.

Cardlytics' cost structure includes significant investments in technology development. This covers the expenses of building and maintaining its platform. For instance, in 2024, Cardlytics allocated a substantial portion of its budget to enhance its technology infrastructure. This is essential for data analytics and campaign management. These costs directly influence the company's operational expenses and profitability.

Sales and Marketing

Sales and marketing expenses are a significant component of Cardlytics' cost structure, reflecting the investment needed to acquire and retain both advertisers and bank partners. These costs include salaries for the sales team, marketing campaigns, and expenses related to client relationship management. In 2023, Cardlytics reported that sales and marketing expenses accounted for a substantial portion of its total operating costs. The company's ability to manage these expenses effectively impacts its overall profitability and financial performance.

- Significant investment in sales teams and marketing campaigns.

- Expenses include salaries, marketing, and client relationship management.

- Sales and marketing accounted for a large part of total operating costs in 2023.

- Effective management of these costs impacts profitability.

Data Acquisition

Data acquisition is a significant expense for Cardlytics, encompassing the costs of obtaining and maintaining purchase data. This includes agreements with financial institutions to access transaction data, which can be expensive. The expenses also cover data cleaning, security, and storage to ensure data integrity and compliance. Cardlytics' cost of revenue was $125.9 million for the year ended December 31, 2023.

- Data acquisition costs include payments to financial institutions.

- Data cleaning, security, and storage are essential.

- Cardlytics' cost of revenue for 2023 was $125.9M.

Cardlytics' cost structure includes partner shares, cashback rewards, tech development, sales/marketing, and data acquisition. In 2023, marketing/rewards costs reached $297.6M. Data acquisition costs include financial institution payments and data handling. Effective cost management is crucial for profitability.

| Cost Category | Description | 2023 Data |

|---|---|---|

| Partner Share | Payments to banks/financial institutions | Significant, tied to revenue |

| Cashback Rewards | Incentives for consumer engagement | $297.6M (Marketing & Rewards) |

| Tech Development | Platform building & maintenance | Substantial budget allocation |

Revenue Streams

Cardlytics primarily generates revenue through advertising. In 2024, advertising revenue accounted for a significant portion of its total income. The company partners with banks to offer targeted ads to cardholders. Advertisers pay Cardlytics based on the performance of these ads, often tied to transactions.

Cardlytics generates revenue via subscription fees from its Bridg platform. This platform provides retailers with insights into consumer spending. In Q3 2024, Bridg contributed significantly to Cardlytics' revenue, showing its importance.

Cardlytics generates revenue by offering data analytics services, providing valuable insights derived from consumer spending patterns. This allows businesses to target their marketing efforts more effectively. In Q3 2024, Cardlytics reported $75.8 million in total revenue, with a significant portion coming from these data-driven solutions. This approach helps partners optimize campaigns, increasing ROI.

Engagement-Based Pricing

Cardlytics' revenue comes from engagement-based pricing. They charge based on how consumers interact with offers. This model aligns interests, rewarding Cardlytics when campaigns succeed. In 2024, this strategy helped Cardlytics achieve a revenue of $444.4 million.

- Payment is tied to user engagement.

- This is a performance-based revenue system.

- Success means more revenue for Cardlytics.

- It encourages effective marketing campaigns.

Retail Media Partnerships

Retail media partnerships are a significant revenue stream for Cardlytics, particularly beneficial for regional grocers and brands. These partnerships leverage consumer purchase data to offer targeted advertising. This approach enables brands to reach specific customer segments with relevant offers, enhancing campaign effectiveness. In 2024, the retail media market is experiencing substantial growth.

- Cardlytics partners with various retailers to provide these services.

- Retailers gain a new revenue source from advertising.

- Brands benefit from data-driven, targeted ad campaigns.

- This model is expected to continue growing in the coming years.

Cardlytics earns revenue from advertising, using bank partnerships for targeted ads. Performance-based pricing and retail media partnerships drive income, aligning interests for effective campaigns. In 2024, total revenue was $444.4 million.

| Revenue Stream | Description | 2024 Revenue (approx.) |

|---|---|---|

| Advertising | Targeted ads through bank partnerships. | Significant portion of total |

| Bridg Platform | Subscription fees for retail insights. | Contributed significantly |

| Data Analytics | Insights from consumer spending. | Part of $75.8M Q3 revenue |

| Engagement-Based Pricing | Charges based on consumer interaction. | Aligned with successful campaigns |

| Retail Media Partnerships | Targeted ads for brands and grocers. | Growing market in 2024 |

Business Model Canvas Data Sources

Cardlytics' Business Model Canvas uses transaction data, bank partnerships insights and consumer behavior analyses.